In its five years as a public company, Germany's Northern Data has seen its fair share of hype, controversy, setbacks, and triumphs.

Of late, it has been relatively quiet around the company. Right now, not a single analyst is covering the stock.

The lack of analyst and media attention hasn't held back a remarkable recovery, though. Since the beginning of this year, the stock has quietly crept up over 300%. It's an actively traded stock, with EUR 1-2m in turnover a day.

Northern Data has now invited investors and the financial community to a double-event in Frankfurt on 2 November 2023. In the afternoon, it promises to reveal more details about figures and plans around its groundbreaking partnership with NVIDIA, which has been announced in September, followed by an evening event for customers.

Will a new hype involving the theme of Artificial Intelligence propel the stock further?

Northern Data.

An insider purchase got my attention

Northern Data (ISIN DE000A0SMU87, Xetra:NB2) isn't an easy company to understand.

I do understand stock market logic, though.

When I read that Northern Data's CEO recently invested an additional EUR 37m of his personal money into his company's stock, I pricked up my ears.

This was a substantial additional commitment by someone who is on the inside and to my knowledge doesn't have any significant other assets. This is quite a large "all-in" move.

Was I missing out because I had not previously paid attention?

The stock's performance year-to-date would indicate as much. Like many others, I had only ever paid attention to the headlines surrounding this company – which were juicy. I had never bothered to look at the underlying fundamental details, though.

Following the CEO's transaction, I've spent half a day digging deeper into the company – or, at least, I've tried to.

Anyone who tries to get into the details of this company faces quite a challenge.

On the negative side, you'll have to overcome:

- A business model rooted in complex, ever-changing industries and surrounded by buzzwords.

- Past reports about missed projections, delayed audits, a short-seller attack, and even an anonymous complaint to German regulator BaFin about misguiding communications.

- A history of corporate transactions and acquisitions that require a Sherlock Holmes-type analytical mind to deconstruct and evaluate the finer details of.

On the plus side, you'll find:

- A CEO who got flack for a daring but potentially foresightful decision, and who may now stand to experience his "I told you so" moment.

- Resurging revenues, eventually two clean audits, short sellers proven wrong, and a general attorney who folded the complaint flagged to BaFin at the very first hurdle.

- Successful anchor investors who repeatedly caught emerging trends before others did and turned themselves into billionaires.

As ever, bulls and bears are in a tug of war over this particular stock.

Eager to learn something new, I've spent a bit of time trying to wrap my head around a business model which piqued my interest because of the potentially revolutionary changes currently going on in the world.

The rise of AI

Artificial Intelligence (AI) is one of the great debates of the year. Investors can approach it from many potential angles.

One angle that always made sense to me was that the world was going to need ever more computing power.

Case in point, NVIDIA (ISIN US67066G1040, Nasdaq:NVDA). Not only is its stock up nearly fourfold over the past 12 months, but the company has now joined the exclusive club of companies that are worth over a trillion dollars.

In case you've spent the last months living under a rock, NVIDIA produces high-performance computer chips needed for the data-intense calculations underlying AI-related work. The American firm produces so-called graphics processing units (GPUs), i.e. computer chips that were originally designed to accelerate real-time 3D graphics applications, such as computer games. Because of their immense computational capability, GPUs have become a tool to support the work of their cousin, central processing units (CPUs). In essence, GPUs are needed to help speed up the work of CPUs to solve some of the world's most difficult computing problems. Based on NVIDIA's description, these GPUs are the world's first computer chip designed for so-called generative AI, i.e. AI systems that can quickly create humanlike text, images, and other content.

Such "H100" GPUs come with 80bn (!) transistors. Each chip costs between USD 32,000-42,000, which gives NVIDIA a profit margin of around 1,000% (not a typo). One day earlier this year, NVIDIA gained USD 184bn in market value because of the success of its H100 product.

NVIDIA was once a company known to benefit from the boom in gaming and crypto mining, but it is now seen as a chief beneficiary of AI. AI applications simply require fantastic computational power, which is where NVIDIA's expertise is ahead of the competition.

NVIDIA produces chips and sells them on to users, rather than putting the chips to use itself.

One such user, and on a gargantuan scale, is Northern Data. On 21 September 2023, Northern Data announced that it had been awarded Elite Partnership with NVIDIA as one of their largest customers. There are just 15 Elite Partners globally.

For the German company, this represents a change to its business model, although one that is probably evolutionary rather than revolutionary.

Contrarian, bold moves to build computing power

Northern Data went public in October 2018 as Northern Bitcoin. As the name indicates, at the time it was a play on operating Bitcoin farms.

The company invested in buying large numbers of computer chips and other hardware in order to build data processing centres. These centres consist of thousands of computers that churn data all day (and night) to mine new Bitcoins. In essence, Northern Bitcoin invested into chips and energy, and it derived income from subsequently creating (and then selling) Bitcoin.

Following the pandemic lockdowns, several severe stock market cycles and what seems like the beginning of an altogether new technology cycle, the company now operates under a different name and with a widened approach to business. Northern Data aims to be THE operator of high-performance-computing (HPC) data centres in Europe. And in fact, Bitcoin mining was the first-ever large-scale HPC application.

Going forward, Northern Data will use the computing power of its data centres not only for mining Bitcoin but also to offer outsourced computing services to companies that require computing capacity for their work in AI-related fields. It reportedly takes at least USD 250m worth of computer equipment to do serious generative AI work, and many companies will only find it viable to rent computing capacity rather than creating their own high-performance computing operation.

Offering computing power to others is a business model where the company does benefit from its past.

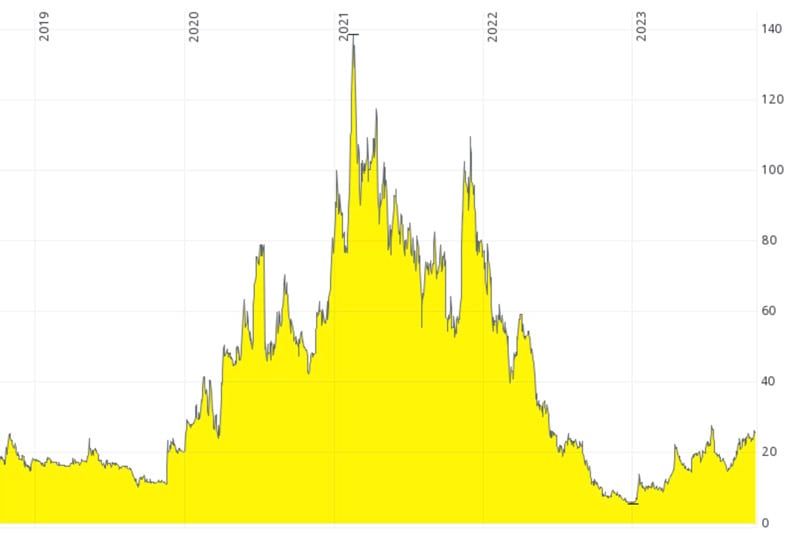

In 2020, prices for chips temporarily collapsed because of the lockdowns and the resulting crash of financial markets and economies. Northern Data's CEO, Aroosh Thillainathan, made a bold contrarian move by ploughing nearly EUR 400m of cash into purchasing computer chips – a massive bet which sparked the stock's subsequent rise when Bitcoin prices rallied and Bitcoin mining became highly profitable. At its peak in early 2021, Northern Data was worth over EUR 2bn.

And Thillainathan did not just buy ASICs chips – which are required for Bitcoin mining – but also NVIDIA GPUs. For the first three years, Northern Data used those GPUs to mine ETH, another cryptocurrency.

In 2022, the company's focus on Bitcoin and ETH mining worked against it. When energy prices spiralled due to the war in Ukraine, and Bitcoin and ETH prices fell, margins in mining also plunged, with many miners no longer breaking even. Worse still, in autumn 2022, the European Union considered a Bitcoin mining ban in order to preserve precious energy during the winter months. Also in autumn 2022, ETH changed its protocol and switched – as it had been anticipated for several years – from "proof of work" (mining) to "proof of stake", another validation mechanism. So that revenue stream ended suddenly.

On the surface of it, it looked like Northern Data could be done for altogether. The stock dropped from EUR 142 to as low as EUR 6.

Notwithstanding these threats and fluctuations, the company continued to up its ambitions in high-performance computing. Northern Data's leadership bet was based on two assumptions:

- Bitcoin is a valuable asset which will stand the test of time and in the long term rise back to levels or beyond that make Bitcoin mining highly profitable again.

- The fully paid data centres full of NVIDIA GPUs could be used for the coming AI boom.

This was not an easy message to communicate to markets at a time when there was a glut of chips.

What the company also had to deal with was a series of failings, allegations, and accusations.

Repeated allegations

In December 2021, Germany's financial regulator BaFin criticised Northern Data based on anonymous complaints and an online smear campaign for alleged violations in its reporting to financial markets.

Even before all this happened, Northern Data had already come under pressure for failing to file its audited 2020 accounts on time. Sign-off from its auditors, KPMG, was months overdue.

In March 2022, a 38-page report published by NINGI Research listed out a long list of alleged failings and misdeeds and concluded that "Northern Data is bankrupt".

On the surface of it, the circumstances did not look good for Northern Data.

What happened next, though?

The state attorney and BaFin ceased their investigation. Northern Data's name was cleared, and all allegations were discharged as baseless, because they did not even reach the first threshold required for such a matter to be taken forward by the authorities.

For 2020, the company eventually received an unqualified audit report.

In terms of its operative performance, in 2021 the company's revenue soared by 1,058% to EUR 189.9m and achieved EBITDA of EUR 320.1m. And the company got an unqualified audit report again. Late again, but unqualified.

As to the company's alleged bankruptcy, 18 months have passed since this assumption. Northern Data is still trading, and it also managed to get almost EUR 100m of additional cash from institutional investors over the course of several share issuances in the first and second quarter of 2023. The stock is up over 300% since the beginning of this year.

In summary, Northern Data has performed much better than the headlines of the previous two years would have made one expect.

What's more, the company has carried out a major acquisition which it arranged with a major partner.

Teaming up with Tether

Because of the strong demand for computing power for use in AI, the H100 computer chip produced by NVIDIA has become one of the world's hottest commodities. It has also become a national priority the world over, since it also powers critical research carried out by nation states.

In September 2023, USD 86bn stable coin Tether managed to purchase 10,000 H100 chips worth USD 420m for delivery in the foreseeable future. Tether then sold its special purpose vehicle called Damoon, which owns those chips, to Northern Data against issuance of new Northern Data shares. "To da moon", get it? Tether got the newly issued shares at EUR 18.35 per share.

As the companies point out, these chips were effectively passed on to Northern Data at their original cash purchase price, as if Northern Data had purchased them directly.

NVIDIA's capacity to produce H100 chips currently stands at about 550,000 per year. Through the transaction, Northern Data secured about 2% of the annual global supply of these sought-after chips, which is no small feat. In comparison, the UK government only managed to secure 5,000 such chips, and the Saudis got hold of an allocation of 3,000.

As the Financial Times reported in an extensive feature about NVIDIA on 26 May 2023:

"Elon Musk, who has bought thousands of Nvidia chips for his new AI start-up X.ai, said at a Wall Street Journal event this week that at present the GPUs (graphics processing units) 'are considerably harder to get than drugs'."

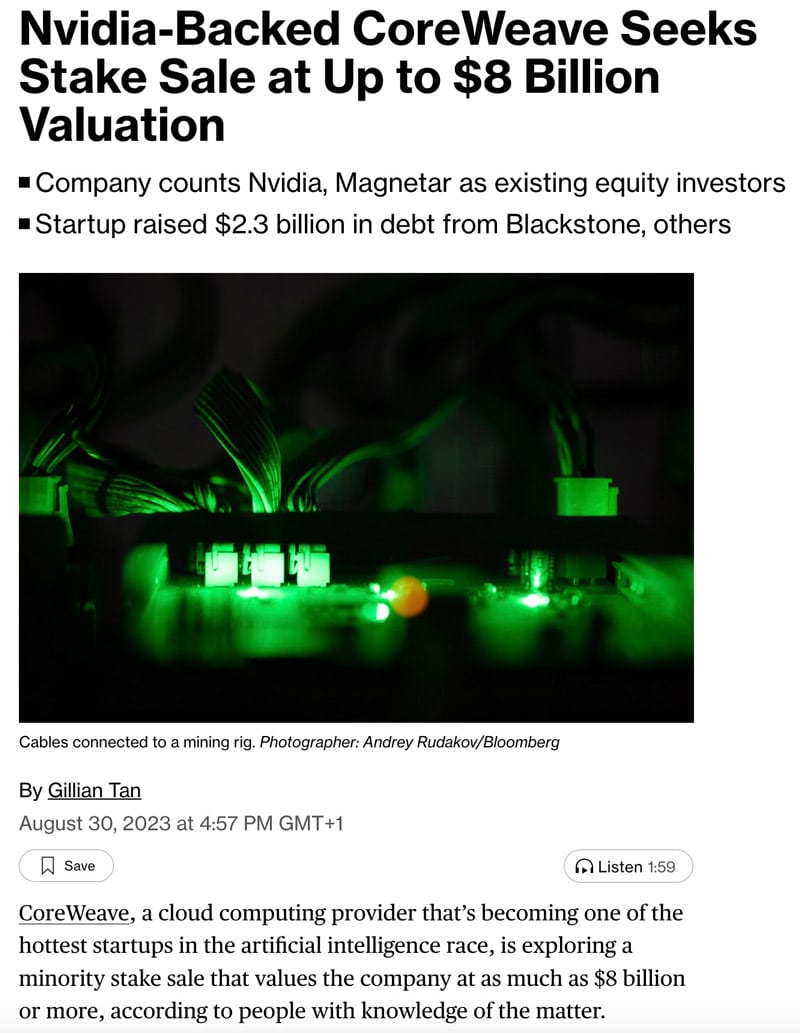

Northern Data has secured access to these chips and now plans to follow in the footsteps of other Bitcoin miners such as Coreweave. The US-based company pivoted from mining cryptocurrency to powering AI computation, enabling it to tap investors for USD 421m in equity and USD 2.3bn in debt. There are serious investors out there who view this particular pivot as power move, and similar changes have already taken place at other miners including Hive, Crusoe, and Hut 8.

Source: Bloomberg, 23 August 2023.

It seems like an unlikely equity story to emerge from Germany, but Northern Data may just have managed to position itself for the leading position in this market in Europe.

If the company delivers on the plans as they currently stand, it will become the leading provider of this type of high-performance computing in Europe. As a European company, Northern Data will benefit from a range of factors that are particular to the continent's market and its local customers, such as:

- EU firms not being allowed to send critical data outside the EU.

- EU countries wanting to build national competence centres for AI at universities, and pouring money into securing the necessary computing power.

- European corporate clients with so-called ESG policies being keen on buying computing power that is powered by so-called renewable energy, which Northern Data does, in particular, in its Swedish operation.

Let's look at the numbers: the rental price per hour for one GPU currently stands around EUR 3-4. You can make your own assumptions as to how many hours Northern Data will sell per year, and if those rental prices will rather go up or down going forward. Let's take 90% usage and the mid number of EUR 3.50 per hour. In this case, the newly acquired H100 alone will make approximately EUR 280 million revenues per year. In addition, Northern Data has its "old" GPU hardware out of the ETH mining days, namely NVIDIA A100 and A6000 GPUs.

Notably, Northern Data is not abandoning Bitcoin mining at all. In fact, now with Tether as one if its anchor shareholders, the company wants to double down on this revenue stream as well. At the moment, about 170 Bitcoin are produced each month, creating EUR 5.5m revenues per month. Northern Data just announced a USD 150m purchase of the latest ASICs miners, which – at current levels of hash rate etc. and once fully deployed – could bring monthly Bitcoin production up to approximately 500-600, which would equal around EUR 190-220m at current Bitcoin prices (back to 2021 levels).

Now throw into the mix the opinion of some experts that Bitcoin could soon surpass EUR 100,000 per Bitcoin, once the long-awaited ETFs are approved, and Bitcoin Mining, bundled in Northern Data's subsidiary Peak Mining, could potentially be a massive value contributor.

It does all sound rather tempting.

So where is the catch?

MUST-READ feature about NVIDIA and the H100 chip (source: Financial Times, 26 May 2023).

Asking questions to the people in charge

Had the UK not gotten battered by Storm Babet, I wouldn't have written this article.

A cancelled ferry back to Sark had me staying in London a day longer than expected. In came an invite for a small luncheon with the leadership of Northern Data, and I had the empty space in my diary to accept at short notice.

Northern Data has Christian Angermayer among its larger shareholders, the 45-year-old London-based German tech and biotech billionaire who manages several billions through his firm, Apeiron Investment Group. Angermayer is the investor who Bloomberg once reported "finally got Bitcoin" after going on a psychedelic trip using mushrooms. He invited his network to a lunchtime conversation with the CEO and COO of Northern Data.

(Disclosure: I am on the board of investment funds related to Apeiron. My position is that of independent director, and I have no economic ties to Apeiron or Northern Data.)

Having long been curious about Northern Data, I wanted to use the opportunity to speak to the CEO about his additional EUR 37m investment in the company he leads.

The investment, as Thillainathan confirmed to me when speaking across the table, was simply a high-conviction move, after Northern Data became one of just 15 global "Elite partners" of NVIDIA.

The status as key partner and the insider purchase are both significant developments, no doubt. Also, having a major player like Tether own a ≈20% stake should lead to a change in how Northern Data is perceived.

Did I walk away with a firm opinion on Northern Data, and the prospects of its stock?

Much depends on your view of the people involved, the underlying theme, and also whether you look at it as fundamental investor or momentum player.

Analysing company and industry

Judging the prospects of Northern Data requires judging several layers of separate, complex subject matters.

Is AI here to stay, and will it become the kind of serious industry that some predict? Even that is controversially discussed, with some saying the AI hype will fizzle out.

My most memorable moment of the group conversation was when I asked the company's COO, Rosanne Kincaid-Smith, if and how she believed AI would touch her life on a day-to-day basis. In retrospect, I wish I had recorded her reply. It was the best mini-pitch for AI as an investment theme I've ever heard, and the call to action I needed to finally get myself clued up about the subject.

Northern Data itself remains incredibly difficult to get your head around. While the business model is easy to understand once someone explains it to you in person (or reads this article!), just as with any other business, there are a million variables that require judgment. E.g., building data centres doesn't just require NVIDIA GPUs but also a raft of other parts. What if a critical part was produced in Israel? This is actually the case, and whereas Northern Data had actually stockpiled enough of this particular part, it demonstrates the underlying risks of this business.

Never mind questions such as how to treat such assets from an accounting perspective. In this particular aspect, Northern Data will face scrutiny and doubt because of its past and the complexity of some of its transactions. This might be the reason why this year as well, the company is late again with its audited report for the past year.

This question not only affects Northern Data, though. An article by The Information recognised that "several upstart cloud providers – as well as the big guns like Amazon Web Services – are buying as many chips as they can so they can rent them out to AI developers", but also pointed out uncertainty about the lifespan of these chips and how this affects calculations involving the returns for investors. A chip that promises considerable income from renting out its computing capacity today may get replaced by new technology faster than is currently envisioned.

If my perception about how the Northern Data story will likely land with an investor audience is right, it's possible that an upcoming bigger event will prove a catalyst for the stock to move up further or even experience a re-rating altogether.

The upcoming Investors Day

On 2 November 2023, Northern Data will host a combined investor conference and evening event in Frankfurt, Germany's financial capital.

During the day, the company will try to convince investors and analysts that it has moved on from its past issues and release more details and numbers about its growth plans. During the evening, it will host a glamorous party under the motto "Reimagine, Revolutionize, Accelerate", and reveal new branding for its different divisions.

Will the event send the stock "to da moon", once again?

I don't know either, but I bet we'll soon get a third-party analysis of it all.

A short-term catalyst?

The fast-moving underlying transactions with which Northern Data was built of late are complex but not impenetrable. A casual observer will struggle to piece it all together, but a professional with access to executives will be able to judge the finer details.

To do such work, investment banks employ analysts. Northern Data used to be covered by analysts, and the company probably aims to get such coverage again in the foreseeable future. Given its past and its aimed-for future, it only takes common sense to assume as much. And because the research of most banks – although independent with regards to content – is often driven by anticipation of future business with the company, Northern Data with its potentially soaring revenues and earnings becomes an interesting client again for many local but also global banks.

As a stock that is listed in the lightly-regulated M:ACCESS market of the Munich Stock Exchange, getting a reputable bank to cover the stock seems all the more necessary. It'd certainly beat buying advertorial interview space in an investment magazine, which Northern Data did earlier this year and which led to criticism and derision on chat boards.

Northern Data stock once gained 29% in a single day when it finally secured its overdue audit, and it soared over 130% in two weeks around the time it released surprisingly strong 2022 figures.

Will it do a similar leap if or when it secures new analyst coverage?

Given the hype that has started to push up valuations for similar firms in the US, it'd be interesting to see a peer group analysis that sets the market cap of Northern Data in relation to the valuation of similar firms. The company's fully diluted share capital after the Tether transaction will be 53.5m shares, which will give it a EUR 1.4bn market cap based on the current share price. I wouldn't be surprised if there was room to up that further, purely based on the higher valuations recently paid for stakes in other firms.

If I am right, the stock could become an interesting momentum play.

I once wrote an entire article why being right is not enough to succeed in investing. To be successful in stock market investing, you have to be right AND outside the consensus. This is a little-understood quirk of the stock market.

Undervalued-Shares.com doesn't issue financial advice, and my one-legged research operation wouldn't have sufficient capacity to dismantle a complex investment case such as Northern Data in detail.

What this website can offer, though, is access to my gut instinct and speculator's mind.

I have a sense that next week's event could be interesting to watch. It may yet lead to an uptake of the stock's conventional coverage, which could make this stock a short-term momentum play at the very least.

As ever, do your own research – and don't take any of my views and opinions as anything other than an inspiration and starting point for doing your own homework.

One of the world's best (and cheapest) oil and gas stocks

My latest research report features one of the cheapest large-cap stocks in the world.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

One of the world's best (and cheapest) oil and gas stocks

My latest research report features one of the cheapest large-cap stocks in the world.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: