UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Allocating to Europe (part 2): The Mediterranean region

They used to be called "PIGS": Portugal, Italy, Greece, Spain.

During the mid-2010s, the derogatory term described the set of Southern European countries that seemed to forever suffer serious economic problems.

Fast-forward to 2025, and all four were among the world's top 10 best-performing markets:

- Greece +58.9% (#1)

- Spain +45.3% (#6)

- Portugal +40.92% (#9)

- Italy +37.7% (#10).

The US market only returned +7.3% during that period, leaving it a distant #36.

What are some of the factors that made these markets perform so well, and which opportunities exist in these countries right now?

Join me for a quick spin around Europe's Southern region.

Greece – back from the dead

The best returns are often achieved in markets that are unloved, provided you buy quality and stick with it for a few years.

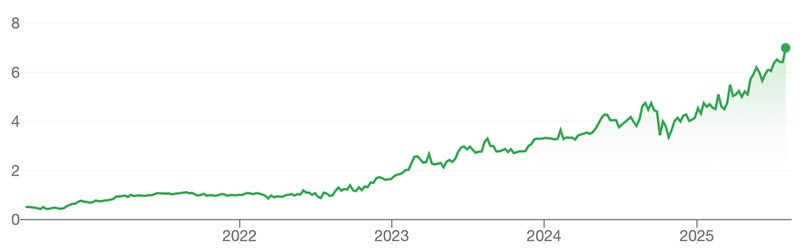

Undervalued-Shares.com waded into one of these markets in late 2022 when it reported on Bank of Cyprus Holding (ISIN IE00BD5B1Y92, GR:BOC). Cyprus had long been part of the club of Mediterranean countries that were perceived to be the worst places for investing. As it turned out, though, the stock was a stellar investment, up 500% since September 2022.

Bank of Cyprus Holding.

What had happened?

Like the rest of the region, Cyprus' deep economic crisis of the early 2010s prompted companies to get their act together and and policymakers to introduce sensible new policies. Such steps always take some time to take hold, but if you get in while things look bleak, the long-term returns can be stunning because your base is really low.

Much as I caught that wave in Cyprus, I missed making more of the opportunities in nearby Greece.

Who wouldn't remember the period when the country that had given birth to democracy was primarily known for bank bailouts, riots, and a sovereign credit rating that competed with bankrupt third world nations. Greece was the poster child for Western financial dysfunction. Many thought it would never come back.

When countries are written off entirely, you can often land incredible investment bargains. By 2015, the Athens Stock Exchange had shed over 80% of its former value. The Greek government then introduced a leaner, more disciplined financial framework. When evidence started to emerge that the Greeks were serious about implementing change, you should have started to accumulate high-quality Greek companies.

Dirt cheap valuations drove share prices to increase by stunning multiples. When Greek equities went from "bad" to "less bad", early investors made fortunes. The stock of Alpha Bank (ISIN GRS830003000, GR:ALPHA), for instance, is up 20x over the past ten years. You just needed the guts (and necessary information) to invest when it all looked hopeless.

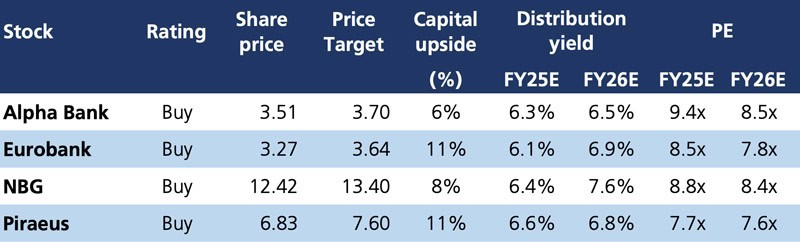

Interestingly, Greek banks are likely to remain a good investment even if you consider investing today.

Here is why.

As a result of the sovereign debt crisis, Greece temporarily stopped investing in its future. Over the subsequent 12 years, the country invested an average of 10% less than its European counterparts. Just to catch up with its backlog of investments, Greece now needs to invest 1.2x its GDP. The race to catch up has already begun, fostered by Southern Europe's newfound reputation as Europe's more dynamic part. Word has spread that Greece is now a good place to invest if you are looking to buy growth at value prices.

The best way to play this trend is through Greek bank stocks. Well capitalised to provide the loans needed for the country's investment drive, they could triple (!) their lending over the coming decade. This is all the more interesting once you factor in that the four leading Greek banks jointly control 90% of the Greek banking market. There is limited local competition which will make for attractive lending margins.

As to buying growth at value prices, the stocks of these four banks are currently trading at a price/earnings ratio of 7.7 – low in absolute terms and well below the European average of 8.4. These banks have strong balance sheets, they all pay dividend yields of >6% p.a., and they have stronger growth outlooks than banks elsewhere.

Source: UBS, 4 August 2025.

Over the next few years, the Greek market will likely continue its run – albeit with periods of consolidation and setbacks in between.

Spain – new tech and Latin American money

In 2010, Spain's youth unemployment rate stood at 46%. Swathes of newly built real estate sat unsold and empty. Spanish banks seemed trapped in a death spiral and reliant on bailouts. Most investors wouldn't have touched the basket case country with a bargepole.

Fast-forward to 2024, and The Economist dubbed Spain the best-performing rich economy in the world based on a broad set of metrics: "Overall economic growth and the pace of job creation are running faster than in America, which has been the envy of the rich world."

At times, it's real estate – not public equity – where the biggest money can be made. Had you picked up cheap property in Spain when it was for sale by desperate owners, you would have made a killing.

Countries reinvent themselves in different ways, and Spain did so on the back of its uniquely strong ties to South America. It's not just Miami that attracts millionaires (and billionaires) from Latin America, but also Madrid. As The Times reported:

"The wealthy central Salamanca district is now almost entirely colonised by Latin Americans. 'The best restaurants are all fully booked – if you want to get a reservation it's best to put on a Mexican accent,' said a Spanish businesswoman. 'They'll give you a table because Mexicans, like the Americans, leave huge tips.'"

In terms of high-fliers, Madrid's social scene now resembles London or Paris. As a result, some luxury properties in Madrid have risen in value by 5x since 2018 alone.

Just like in Greece, bank stocks were one way to play the country's recovery. Spanish bank stocks are up 45% this year alone, but they have now returned to trading at double-digit price/earnings ratios. They were cheap-cheap once and have now returned to normal valuations.

Given how much asset prices have risen in Spain, has this train already left the station? Are there still opportunities to invest?

Surprisingly, the country has an interesting tech sector. Attracted by sunshine, lifestyle, tax incentives, and special visa categories, a growing number of tech entrepreneurs have made Spain their home.

There is one Spanish tech outlier that is currently a laggard in terms of its stock's performance, and it may be worth taking a look at it for that reason.

Allfunds Group (ISIN GB00BNTJ3546, Euronext: ALLFG) is a European tech company you probably haven't heard of before, despite having a EUR 3.7bn market cap and administering an impressive USD 1,600bn of client assets. Although legally registered in the UK and listed on Euronext-Paris, it was founded in Spain by a Spanish entrepreneur and has its corporate headquarters in Madrid.

As a B2B platform, Allfunds primarily connects businesses rather than deal with individual investors. It acts as an interface between financial institutions that purchase funds on behalf of their customers and those that create, manage, or distribute these funds. Amid the various counterparties involved, many technical aspects need to be managed. Allfunds has spent over two decades building services around execution, data provision, and analytics. It operates a software as a service (SaaS) platform that helps its clients automate services, maximise transactional efficiency, minimise the risk of operational errors, and reduce costs.

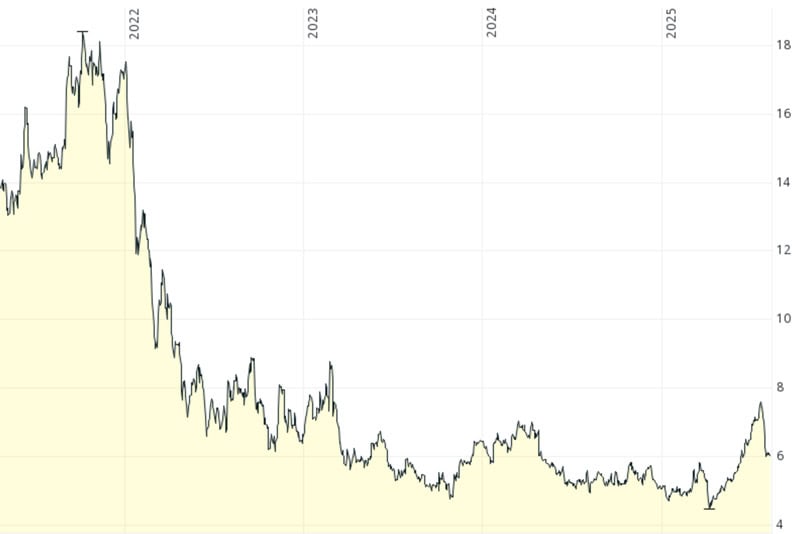

In 2021, Allfunds went public, with an IPO that was the largest financial services listing in Europe that year, briefly with a market cap of EUR 7bn. Shares were placed at EUR 11.50 and reached EUR 18 soon thereafter. They later dropped to EUR 4.50 and are currently trading at EUR 6. Allfunds has forever been the target of takeover speculation, though nothing has materialised so far.

I already wrote about Allfunds in March 2024, and I'd currently advise to take another look. The company has a tech-driven, scalable business model that is unique in Europe, and it comes with a low valuation. If you are looking for new ideas to research yourself, add Allfunds to your list.

Allfunds Group.

Italy – luxury with forever pricing power

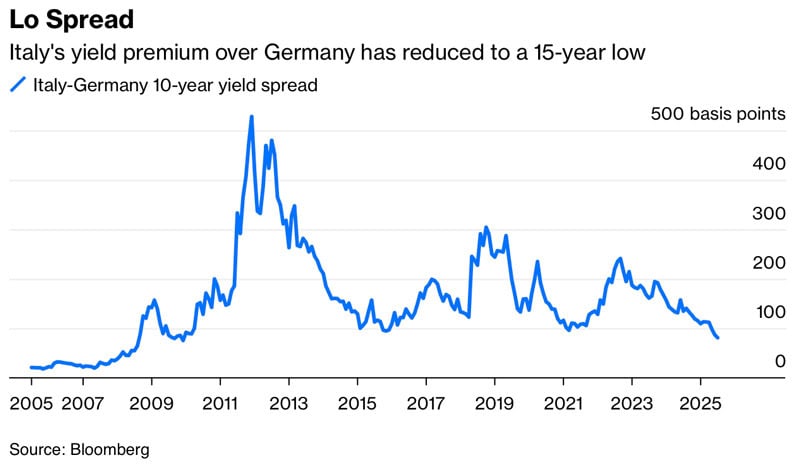

Besides Greece, Italy was another country infamous for fiscal instability and banks teetering on the brink of insolvency. At times, Italian bonds offered a 7% higher yield than German bonds, such were the doubts about the country's future.

Today, the yield spread is down to 0.8%, lower than that of France. Italian banks have left their dismal past behind and may even play a role in consolidating Europe's fragmented banking market.

Source: Bloomberg, 5 August 2025.

Undervalued-Shares.com was onto these changes early on – too early, to be precise.

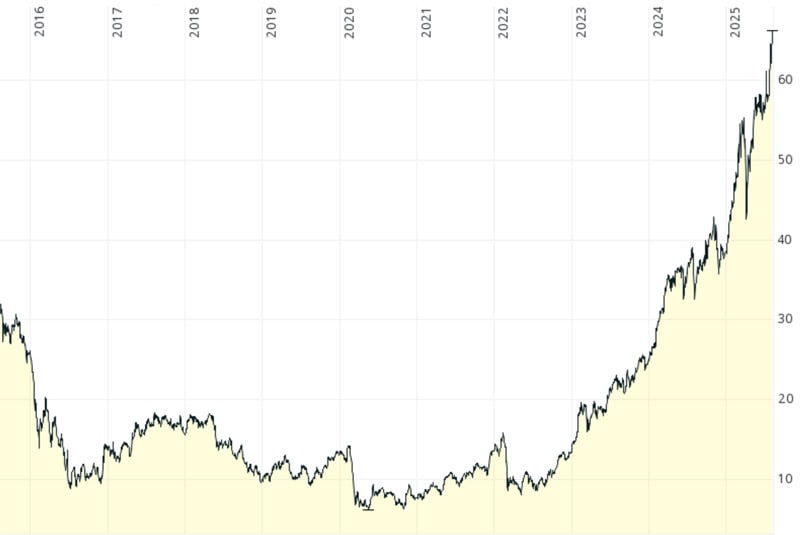

In 2019, an extensive research report was released on Unicredit (ISIN IT0005239360), when its share was trading at EUR 11.30. It is now at EUR 60 without even counting the dividends that the company has paid since. Sadly, I was impatient and bailed out too early.

Unicredit.

What else is worth looking at in Italy today?

If you are looking for new ideas, spend a bit of time going through Italy's luxury goods sector.

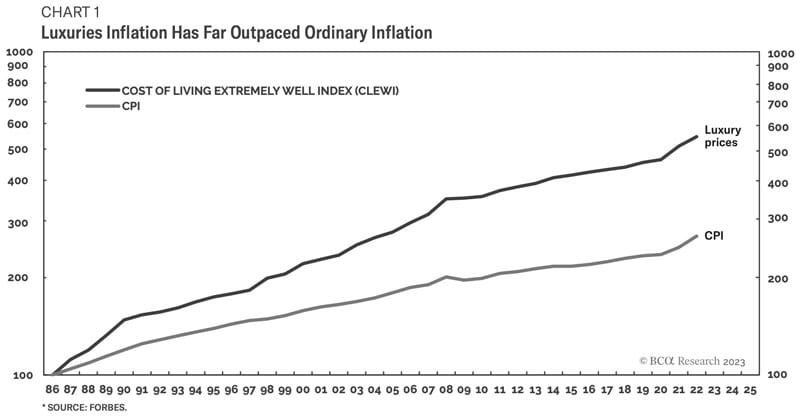

Few investors are aware, but no other industry or sector in the world (not even US tech) can keep up with the profit margins and pricing power of European luxury goods. Luxury goods prices rise faster than those of other consumer goods (see chart below), which further supports the strong profit margins of luxury goods companies.

Source: BCA Research, 30 April 2023.

Italy's stock market features luxury goods makers that are famous the world over, including Brunello Cucinelli (ISIN IT0004764699, IT:BC), Prada (ISIN IT0003874101, IT:PRP), and Moncler (ISIN IT0004965148, IT:MONC). However, a second tier of luxury goods makers exist that investors have not yet discovered: small and medium-sized family-owned businesses.

These smaller firms, which make up the bulk of Italy's luxury goods industry, struggle to compete with the superior marketing and services of conglomerates like LVMH (ISIN FR0000121014, PA:MOH), Kering (ISIN FR0000121485, PA:KER), and Richemont (ISIN CH0210483332, SWX:CFR). Realising they need to up their game, "Made in Italy" has started to get organised.

If you missed investing in LVMH in the 1980s or 1990s, you may now be given a second chance in Italy. Over the past few years, several entrepreneurs and private equity groups have set up new holding companies for Italian luxury brands. Buying smaller firms at low multiples and combining them to integrated groups should prove a winning formula. It's what made LVMH's Bernard Arnault one of the richest men in the world, and further fortunes will be made in bringing Italy's luxury sector together.

Source: Family Capital, 8 September 2022.

One possibility to play this theme is Dexelance (ISIN IT0005543480, IT:DEX), a roll-up acquisition company in Italy's high-end design and furniture market. This is a very fragmented market with a plethora of sub-scale companies, and also high margins and a 20-year compound annual growth rate of nearly 5% p.a.

Dexelance ("Design, Elegance, Excellence") was initially set up under the name "Italian Design Brands". As a testament to how slowly financial news travels in Europe (see my Weekly Dispatch from 25 July 2025), some stock data websites still list the company under its old name. The company was created by two highly regarded private equity professionals and has bought 12 other companies so far. The stock was listed in 2023 at EUR 11 and has since slipped to EUR 7. With a market cap of EUR 180m, it trades at 0.5x sales which seems undemanding.

Besides Dexelance, there are other small and medium sized Italian companies worth analysing in more detail. Among them, some future winners and outliers are waiting to be discovered.

Many might currently draw a big yawn from most investors, just like Bank of Cyprus, Unicredit, and Greek banks a few years ago. For superior returns, you need to invest when assets are unloved and largely ignored.

This concludes my rapid-fire tour of the Mediterranean, which only scratched the surface of what's available to investors. Hopefully, it will have shown you that Europe's Southern region offers PLENTY of worthwhile targets to research.

A few of them may pop up in the in-depth research reports that I publish for Undervalued-Shares.com Members and Lifetime Members – so watch this space!

Gold at record high – time to switch to gold mining stocks? (German-language video)

The price of gold is soaring – nearly doubling since 2022 – yet many gold mining stocks are still stuck in neutral. Why the disconnect?

Join my chat with Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. to discover what's driving gold's surge, why miners often lag behind, and what savvy investors should watch for when picking gold mining stocks.

Gold at record high – time to switch to gold mining stocks? (German-language video)

The price of gold is soaring – nearly doubling since 2022 – yet many gold mining stocks are still stuck in neutral. Why the disconnect?

Join my chat with Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. to discover what's driving gold's surge, why miners often lag behind, and what savvy investors should watch for when picking gold mining stocks.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: