SIX' CEO: "We've had a look at it, but it's not our cup of tea."

Following this news, I pulled forward a plan to write about the company.

Now may be, in fact, the perfect time to look at its stock!

It's an asymmetric opportunity, i.e. one with seemingly limited downside and fairly large upside.

Source: Reuters, 28 March 2024.

What's Allfunds about?

In case you have never heard of Allfunds Group (ISIN GB00BNTJ3546, Euronext: ALLFG), you are not alone.

Even though it has a EUR 4bn market cap and administers an impressive USD 1,400bn of client assets, it's not a company that the investing public would ordinarily have heard about.

As a B2B platform, Allfunds primarily connects businesses rather than deal with individual investors. The platform works as an interface between financial institutions that purchase funds on behalf of their customers, and financial institutions that create, manage or distribute these funds.

Amidst the various counterparties of such transactions, an awful lot of technical aspects need managing. Allfunds has spent over two decades building services around execution, data provision, and analytics. It operates a software as a service (SaaS) platform that helps its clients automate services, maximise transactional efficiency, minimise the risk of operational errors, and reduce costs.

Unless you work in the fund management industry, it'll be difficult to grasp the full scope of services that Allfunds provides. This complexity und opacity greatly work to the company's benefit, though: the more complex and fragmented the fund industry, the greater the need and demand for Allfunds' services.

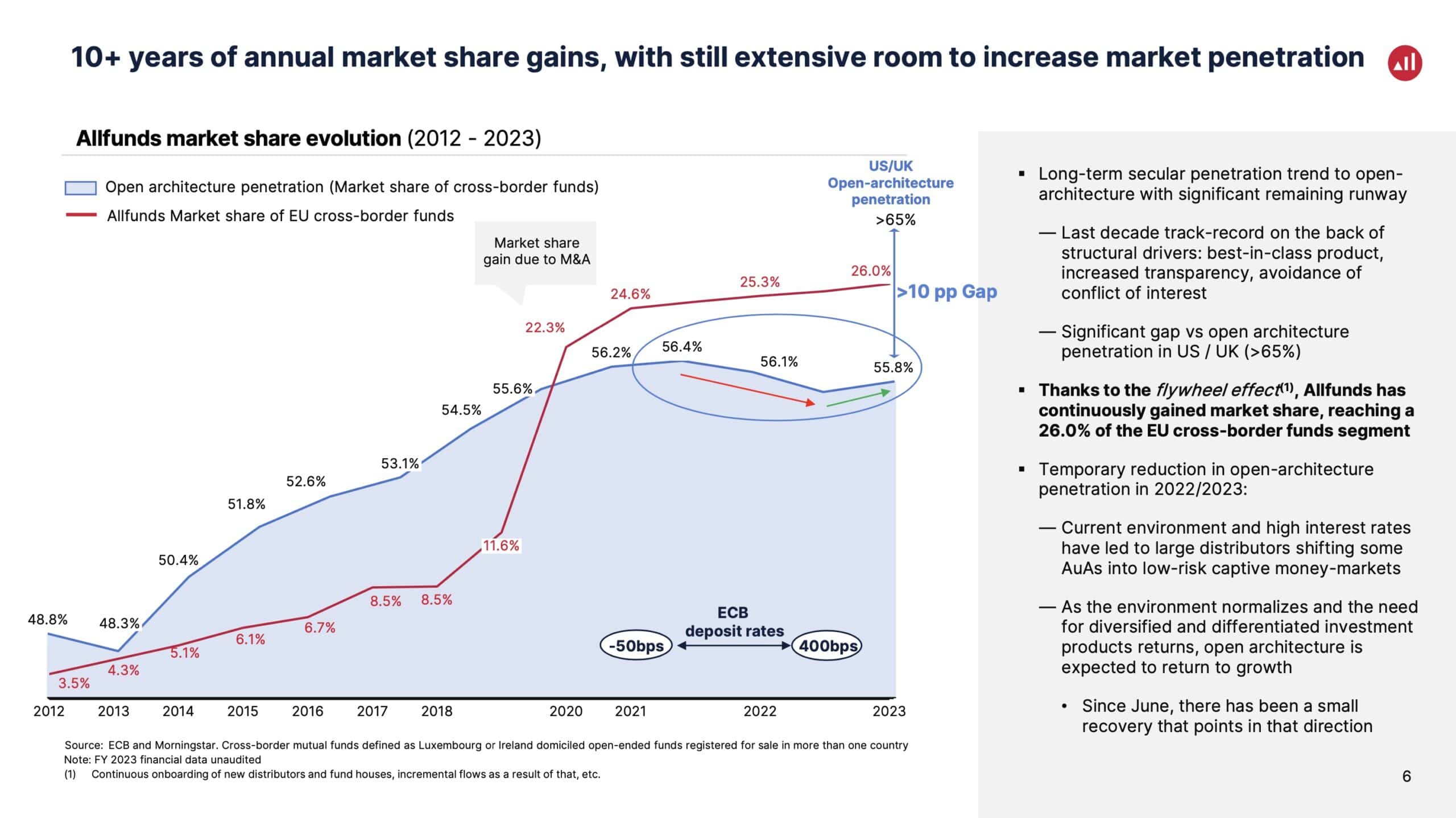

Source: Allfunds, 2023 results presentation (click image to enlarge).

Most recently, the company had 3,000 fund groups as clients, and growing. It is the world's leading B2B wealth tech platform, and while founded in Spain, it is now registered in the UK. Its founder, Juan Alcaraz, has remained CEO to this day.

Since 2021, Allfunds is a public company. Its former majority owner, private equity firm Hellman & Friedman, listed Allfunds on the Euronext exchange in Brussels. Several large institutions used the IPO to cash out some of the shares they held.

The IPO was the largest going public of a financial services firm in Europe that year and resulted in a market cap of EUR 7bn. With a placement price of EUR 11.50, the IPO came out at the higher end of the placement range of EUR 10-12 per share. Several of the world's top investment banks were involved with the IPO, and the placement was oversubscribed several times. At the time, it was a big success story, and a rare tech success "Made in Europe".

The stock reached EUR 18 that same year, but it has since fallen back to just EUR 6.60.

It's the low share price that makes this stock so worthwhile to look at right now.

Not only is it 43% below the IPO price, but it's also significantly below the EUR 8.75 per share that a hostile bidder was prepared to offer just a year ago.

Allfunds.

Aborted hostile takeover

In February 2023, Euronext (ISIN NL0006294274, Euronext:ENX) went public with plans for a hostile takeover of Allfunds.

Ironically, the exchange that Allfunds had listed on just two years earlier now wanted to buy the company. On the day of the announcement, Allfunds' stock price rallied 29% to EUR 9.45, i.e. well above the prospective EUR 8.75 that were offered as a combination of EUR 5.69 in cash and 0.04059 Euronext shares. The market expected that Euronext would be improving its bid, or that a competing bidder would emerge – or both!

Neither happened, though.

Allfunds' management categorically stated that it did not deem the bid sufficient. Euronext eventually deserted the attempt, and no other bidder emerged.

The stock subsequently fell as low as EUR 4.80 in October 2023.

A combination of rising interest rates, repeated stock overhang from existing shareholders, and lack of familiarity with the firm's business model conspired to keep continued pressure on the stock.

Bid speculation returned in January 2024, when Reuters reported:

"Swiss stock market operator SIX Group is considering a bid for fund distribution company Allfunds, according to two sources with knowledge of the situation."

By early March 2024, speculation surrounding Allfunds helped its stock price get back above EUR 7. However, it got knocked back to its current level when on 28 March 2024, SIX issued an official denial that it was looking to acquire the firm.

Allfunds, the potential bride that no suitor wants to get serious about?

Hardly.

A bid is likely to happen eventually, and investors will probably be rewarded handsomely for having a bit of patience.

"The Amazon of fund distribution"

Much as Allfunds' business model is difficult to understand, it offers tremendous attraction for a particular type of buyer.

Allfunds operates a platform that combines:

- An asset-light model with high cash flow.

- An incredible client retention rate of almost 100%.

- A strong balance sheet that is close to showing net cash.

Combine that with several secular trends:

- Fee compression in the fund management sector, forcing managers to cut costs.

- Ever-growing regulatory burdens, which you can best manage using technology.

- Pressure to operate at scale, which you can only do with a truly global platform.

Allfunds occasionally gets dubbed "the Amazon of fund distribution", and much as this is an overused comparison, there is a lot of truth to it. It'd be next to impossible for someone else to build a similar platform from scratch today.

Source: Allfunds, 2023 results presentation (click image to enlarge).

Anyone making the effort to read through Allfunds' recent publications will find all sorts of impressive factoids, such as 40% of all new clients originating in Asia. Who would have expected that from a financial services provider that originated in Spain?

Source: Allfunds, 2023 results presentation (click on image to enlarge).

Allfunds is now at a stage where it's experiencing the famous flywheel effect. Its business won't grow in a straight line, and it's inevitably somewhat exposed to everything that is going on in the world. However, it's highly likely that in five, ten and 20 years, this will be a bigger, more profitable company by far.

Before too long, a particular kind of bidder should come back and make a realistic offer.

Repeated M&A noise

It's not surprising that it was Euronext which had a go at taking over Allfunds.

Exchanges run similarly scalable, asset-light platforms. Many have significant excess cash to put to use, and they want to stay within their circle of competence and buy comparable businesses. In recent years, Euronext has bought several market infrastructure companies, including a sovereign debt trading venue and a clearing house.

Similar to that, the London Stock Exchange nowadays makes just 4% of its revenue from fees on trading stocks. Instead, it's now one of the world's leading financial data groups. This was further spurred by its 2019 takeover of Refinitiv, a rival to Bloomberg that the exchange paid USD 27bn for.

The entire idea of purchasing a capital-light business that benefits from secular growth trends, with a high percentage of recurring revenue and growing economies of scale is something that appeals to every other private equity company. When Reuters published the rumours about Allfunds in January 2024, it also reported:

"Funds including Advent, Brookfield, CVC and KKR have shown an interest, two people familiar with the process said."

It's clear that the market does not really appreciate what Allfunds has to offer. When a global firm like Euronext dangles a EUR 8.75 offer in front of investors, only for the stock to fall back to EUR 6.60, it's evident that Allfunds does not appeal to public market investors.

The issue does *not* seem to be that Allfunds' management was against a bid altogether. As Reuters reported:

"Amsterdam-listed Allfunds is working with Goldman Sachs and Citigroup on a strategic review that could lead to a sale and has also attracted interest from private equity firms, two other people with knowledge of the situation said."

There is likely a sense of realism in Allfunds' corporate headquarter. Hellman & Friedman together with BNP Paris control 46% of the shares. These are financial institutions that will accept an attractive offer when it's made. Allfunds is on the block by virtue of being controlled by fickle financial investors. Everyone knows that it's a potential target, and it's merely about the price.

Management will maximise the price

Allfunds is another firm that was featured at annual value investor conference Value Spain (see also last week's Weekly Dispatch about Denmark's Ørsted). Julio Utrera, senior analyst at SouthEastern Asset Management in London, presented the case to the audience.

Utrera believed that "as a fallen-angel with shares having corrected -50% since Allfunds's IPO in 2021, … the market is underappreciating the durable growth fundamentals and cash generation of the business today."

"Founder/CEO Juan Alcaraz is well aligned with minority shareholders, incentivised by the share price, and a proven solid capital-allocator by launching the 2023's buyback."

Pointing towards the current valuation of 11x EV/EBITDA, Utrera believes "the intrinsic valuation offers >50% upside from current levels."

What's needed now is a willing bidder to step in.

Given Euronext's approach for EUR 8.75 per share and management's reluctance to even entertain a discussion at that level, I'd say it's more likely than not that bid-focussed hedge funds will disclose positions in Allfunds before too long. After all, this is an asymmetric situation, if ever there was one.

From its current level and given the entire circumstances, it seems unlikely the stock will fall much below EUR 6 again.

Just as much, a bid upside of 50% in a company with a EUR 4bn market cap and plenty of trading liquidity is the right combination for large US and European funds to get interested. At some point, all the stars will eventually align.

Allfunds' life as a public company will then have proven short-lived. Those who bought in the IPO will have lost out, as is often the case with stocks bought in IPOs. Going public placements are a mechanism designed to allow existing owners to cash out at the highest possible price – it's usually the opposite of paying a good price for an asset.

However, for investors who stepped in when the stock was down and out, the future scenario is much brighter. This is not an exciting business model or one that would be easy to understand, but that's part of what makes this stock so interesting. Allfunds simply lends itself to a takeover by private equity or a growth-hungry exchange.

Hot off the press: new in-depth research report

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report – out this week for Lifetime Members only – has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Hot off the press: new in-depth research report

Western Europe has many industry-leading mid-cap companies that are hardly known among investors.

The company featured in my latest research report – out this week for Lifetime Members only – has a 50% market share in its industry in Europe, is trading at just 5x EBITDA, and has started to grow by 30-40% p.a. in a major overseas market.

Few analysts or fund managers follow the stock – but they should!

The company's CEO and COO have been given a strong financial incentive to at least double the share price by mid-2026.

It looks likely that they will succeed.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: