Isaac Schwartz started an investment fund at age 24, after convincing a legendary fund manager to back his idea of investing in one particular, exotic, out-of-favour country.

He has been a global, unconstrained, value-focused portfolio manager ever since. Known for drilling very deep into companies before making concentrated, long-term investments, Isaac's career now spans two decades.

Isaac and I recently sat down in New York for a coffee. Early into our conversation, I realised just how useful some of his insights would be for Undervalued-Shares.com readers.

The following is a transcript of our two-hour conversation.

Isaac Schwartz.

Swen Lorenz: You started managing a fund at age 24. By anyone's standard, that is an unusually young age at which to start a fund, all the more so in the highly competitive fund management industry of New York. How did you pull that off?

Isaac Schwartz: It helped a great deal that I had one specific, unusual investment theme that I was very excited about.

In 2005, I became very interested in Southeast Asia in general, and Thailand in particular.

The markets of Southeast Asia had already doubled, from their post-Asian financial crisis lows of 1999-2000, but almost a decade on they were still 60, 70 or 80% below their bubble highs from 1995-97.

Have you read anything from Richard Koo? He is a really good writer, and he has been the Chief Economist at Nomura since 1997. It was Koo who coined the expression of a "balance sheet recession". He was originally talking about Japan, but the idea applies elsewhere, too. When a leveraged economy hits a financial crisis, the companies go into something of a permanent debt pay down mode.

At that time, Thailand had been in a debt pay down mode for the better part of a decade. Their economy was once again doing fine.

I wasn't some Southeast Asian economist, but if you just did stock screening in 2004 and 2005, you noticed that Thailand had a plethora of companies that were selling at single-digit price/earnings multiples, even though they had clean balance sheets and were paying dividends.

These findings were what, ultimately, led me to launching a fund at a young age. I was excited about this theme, and so was a value investor and fund manager to whom I presented the theme, Bob Robotti of Robotti Advisors.

We decided to call it the "Global Fund" because the idea was to keep looking for opportunities in less efficient markets. Initially, though, despite the "global" in its name, the fund was very much focused on Southeast Asia. At the beginning, more than half the investments were in Thailand alone.

SL: Bob Robotti barely needs an introduction given that he is an industry legend. Without his support, you couldn't have set up a fund at such an early age. Cynics would say that you simply were double lucky. You were born and raised in New York City, and you must have had a family member introduce you to Bob – or some such lucky coincidence. Right?

IS: Not at all. It was my writing that gave me access to Bob.

In 2002, while studying at Wharton's undergraduate business school, I worked for Schiff's Insurance Observer, a journal that published investigative research on the property casualty and annuity insurance industries.

David Schiff was for the property casualty insurance industry in North America what Jim Grant and Grant's Interest Rate Observer has been for credit markets. Schiff's newsletter ceased publication many years ago, but it was a must-read at the time. Schiff had a big circle of investors to speak to. I landed a job as his assistant.

David would host a conference at the New York Athletic Club each year, and there would be a very interesting assortment of people from the insurance industry. Bob Robotti was an investor in insurance stocks, and he was also one of David's subscribers. That's how I met him. I started working as an intern analyst for Bob, and started looking for undervalued stock ideas. When I found Thailand, Bob was intrigued and put some money from his fund into Thai shares I had identified, but he didn't necessarily want to refocus his own fund. Together, we created a new entity, and I have been working with him ever since.

SL: I am a lifelong proponent of writing. Putting your thoughts down on paper and publishing them has all sorts of benefits. You meet interesting people, and interesting people come your way. It sounds like you made use of that, too.

IS: Yes, there's a lot of value to writing and putting yourself out there.

Just as an example, Hank Greenberg, the legendary CEO of American International Group, spoke at David's conference not once, but twice.

Jack Byrne, who ran Geico for Buffett and then later was the head of White Mountains Insurance, was among the speakers.

By being part of a small publishing operation, I got to meet people who fuelled my interest in value investing, insurance stocks, and other themes. It even got me to have a one-to-one conversation with Charlie Munger once!

SL: Really, how so?

IS: This was over 20 years ago. Charlie Munger had made some public comments about the workers compensation insurance market, and David asked me to follow up with him.

Charlie was in LA, and when I called him from New York, it was seven or eight in the morning on the West Coast. That's before his assistant was in the office, so he answered his own phone.

I had a chat with him about the comments he had made at a conference comparing the California and Texas workers comp insurance markets, and he commented on aspects such as regulation.

Everybody has a message that they want to get out. I wasn't a journalist per se, but people tend to have a lot of respect for quality publications, which Schiff's Insurance Observer definitely was. When I called Charlie, he opened up, and we wound up having a chat.

SL: Here is a curveball for you. It sounds amazing to have access to such inspiring role models and mentors at an early age, and to start your own fund when most folks would be keen to even just get an internship at a fund management firm like Robotti Advisors. However, is it really desirable to have such opportunities handed to you very early in life? In retrospect and with the benefit of hindsight, do you think that starting out so early gave you an advantage, or would you do it differently if you had to do it again?

IS: That's a thought-provoking question.

My fund started to sign up a broader investor base in 2007. In 2008, the financial crisis hit.

I experienced a real baptism of fire right at the start of my career as portfolio manager. To others, this period meant an early end of their career. To me, it provided a scenario that gave me the confidence that by sticking to your principles, you can deal with bad times that inevitably come along in markets.

I had a mentor who had been through such periods already. Very importantly, I had clients who were supportive. They were supportive also because I sought to maintain a high level of communication with them, and because they were sophisticated about investing.

The first two years when the fund had outside investors were a severely difficult time in markets. However, the big benefit I had was that I was able to focus on making sure that I owned the best stocks for when things would come back.

In summary, I wouldn't do anything differently. But it taught the value of having good mentors and making sure you have the right clients. When you start out early, that is super important.

SL: Let's speak about your fund. The Robotti Global Fund invests into "undervalued securities", which you source around the world. Describe your approach to investing in more detail and – importantly – help us understand what sets your fund apart.

IS: We have built a huge amount of domain expertise. We have more than a decade of history with all of our large positions. We know these companies very, very well.

In our stock selection, we stay away from very high financial or operating leverage. In other words, I want to take the risks in my stock selection, not in financial leverage.

Whereas the global approach gives us the flexibility to look far and wide for opportunities that fit our criteria, we are ultimately also very focused. Our approach of avoiding financial and operating leverage allows us to run a truly concentrated portfolio.

Crucially, for the stocks that we have a very high level of conviction of, we also have a very differentiated opinion from the market. The fund only invests in stocks where we have real domain expertise, and where I think we have a truly differentiated view as well as a very significant margin of safety.

SL: We crossed paths because a reader put us in touch over a stock that we both have an interest in. I published an in-depth research report about Ocado Group (ISIN GB00B3MBS747, UK:OCDO), the British automation specialist for grocery deliveries. Unbeknownst to me, this was the single-largest position in your portfolio, and you have been following the company since 2013. The controversial debate about Ocado is whether you can really call its stock "undervalued", given that the company has only been generating losses so far. I laid down my reasoning in my research report, but how does Ocado fit into *your* definition of undervalued stocks?

IS: Indeed, Ocado Group has been in our top three position for years.

At a base level, it's undervalued relative to its future cash flow. The valuation is the price you are paying for a set of discounted cash flows, and you have to probability weight and time weight these future cash flows.

Obviously, if a future cash flow came from the US government, then you are probability weighting it at 100%.

Ocado has clients like Morrisons supermarkets in the UK, Kroger in the US, and Aeon in Japan, all of which have financial strength. The probability of payment from them is extremely high.

In that case, the calculation is just based on the time weighting. The stock is currently trading at less than GBP 5. Ocado is undervalued because the discounted cash flows will be comfortably in excess of that.

SL: How can you be so confident about that?

IS: Once again, domain expertise is important.

I met with the company for the first time more than a decade ago, in early 2013.

Another mentor of mine – a client in the UK – had done work for Morrisons supermarkets as an outside professional. He held that company in extremely high regard.

When Morrisons signed a contract with Ocado in early 2013, he called me and said that we should go visit this new automation company. Morrisons wouldn't outsource a critical part of their business to a firm like Ocado unless they were an excellent company delivering good value. After all, Morrisons is a real operator in the British supermarket sector, and they are known to be both smart and cheap.

Ocado is now in the middle of a contracted building programme on behalf of about a dozen blue-chip supermarket companies around the world. These projects represent critical infrastructure for their customers, and Ocado is in a financial position to complete them.

Source: Ocado Group, must-watch three-minute video.

Unlike a B2C company, Ocado does not have to make assumptions about how a product's popularity will catch on. Instead, they are going to be running around 60 integrated facilities in ten countries. These contracts put Ocado in charge of managing a fixed amount of online selling capacity. The supermarket companies will have to worry about what sits on their shelves. Ocado gets paid for automating the process of getting these products to customers who ordered them online.

I have studied their clients pretty closely, and I did so for most markets that they are in. I looked the most closely in Canada, the US, England, Sweden, and also quite a bit in Asia-Pacific. What Ocado is providing to these clients under contract is a critical component of these companies' strategies for online.

SL: Which begs the question, how much grocery shopping will be done online? The pandemic led to widely inflated expectations in this regard, which in turn contributed to a collapse of Ocado's stock price once the lockdowns were over. With what we know now, what's your take on that question?

IS: There is a wide debate of how important online will become in groceries. Groceries is the final category of retailing that has to truly go online. In a sense, the debate isn't entirely different from those of ten or 20 years ago about how many people will be willing to buy books online, and whether consumers will ever buy clothes and shoes online given that they need to try them on.

Ocado is one of only a handful of companies that have done very innovative things to build a new, completely dedicated architecture for solving the problem of moving groceries to e-commerce. They have created a market where there used to be none.

Both McKinsey and Goldman Sachs have put out reports about the future of the online grocery industry. One of them said it would be 25% online, and the other one said it would be 30-33% by 2030. These figures are for the developed world, like the US.

This may be a pretty wide range, but compare that to before Covid when less than 4% of grocery shopping was done online.

The shift of groceries to online was happening slowly, but the online market share of groceries was always continuously growing. This was happening even though there weren't really good solutions available. The type of online selling that happened in groceries often involved using gig economy workers to pick items and pack bags, which is really just retrofitting existing infrastructure to turn it into online selling infrastructure. What Ocado is doing instead is to build dedicated online selling infrastructure.

Ocado's supermarket clients have hired the company to provide critical services that they believe they simply couldn't match with their existing infrastructure. The reason that these companies are pursuing innovative strategies like Ocado partnerships is that they have seen in other industries how online markets wound up being much more consolidated than offline markets.

I look at Ocado as completely de-risked venture capital. There is an existing business that is marching ahead. It's not whether the company will succeed, but on what scale.

You can ask questions about what the final margins will be, and it is not completely known yet. Although, there is a lot of evidence that there will be very strong margins, and there is also a lot of evidence that this will be less complicated to calculate. After all, Ocado is around a third of the way through building 60 facilities that will have USD 30bn in annual sales capacity, and they are already earning USD 500m in fees off what they are managing today.

I think it is very important that they have continued to increase the automation level in their newest facilities in North London. They now have a completely automated facility that involves automated packing, as I understand it. There have been some mentions in the trade publications about this.

There is also a lot of optionality that they will find other ways to grow their business. Recently, they signed their first contract outside of groceries, licensing their technology for pharmaceutical distribution in Canada. It will be interesting to see how this new business segment develops.

We just jumped around a little bit, but to summate I would look at it as something that doesn't really have comparable companies doing it. However, up to now, there is a kind of misinformation about what Ocado is doing. In their home market, their message has tired out a lot of people because of promises repeatedly made for years. E.g., as part of the IPO story in 2010, Ocado said they were going to serve other customers, but it wasn't until 2013 that they got another one. Then they were saying for years that they were going to go international, but it wasn't till late 2017 that they got one of those – four and a half years later.

It has been a slow rollout to date, but they are pushing ahead. Having followed them for over a decade, I do have a sense that they have good cost control, while they have continued revenue growth. I think that they have hit a tipping point where revenue growth is not going to be so consumed by cost.

The next 12-24 months will reveal some of the leverage to their business model. They already grew from supporting UK customers only, into a global business selling to multiple large grocers on four continents. Now, as they have built a base to support their much more complex business, we'll see how that intersects with the ongoing recurring fee revenue accumulation to affect the bottom line.

SL: Change of subject, another large position of yours is Spotify (ISIN LU1778762911, NYSE:SPOT). Everyone will be familiar with what they are doing. Why did it become a prominent position in your portfolio?

IS: Indeed, Spotify is another position that we have a high level of conviction for.

That is because the company has a very, very diverse base of customers spread all over the world. That's except for mainland China, but other than that they really are in every corner of the globe.

Spotify has a deep relationship with 600m people who use the app for around an hour a day. If you think of your own mobile phone usage, the idea of engaging with an app for an hour a day is remarkable. There are not too many apps that any person can engage with for that amount of time.

I look at Spotify's business as having a very high margin of safety because of the colossal amount of money that YouTube Music, Amazon Music or Apple Music would need to spend to acquire 600m sound listeners in 80 countries. The idea of an internet major just rebuilding through spending what Spotify already has is just completely impractical.

Spotify is serving these existing customers not just with an excellent product, but the offering has expanded over time.

Spotify.

SL: What I hadn't realised until chatting to you is that Spotify has done only a very small amount of share issuance since going public in 2018. I also found that noteworthy and relevant in the context of analysing other companies. Can you tell us a bit more about your view of this aspect?

IS: One thing that Spotify and Ocado have in common which I think is pretty cool is that they didn't grow up in Silicon Valley.

Spotify didn't have the Silicon Valley ecosystem or a SoftBank, and without those prongs to pull to just have money pouring into them, they were really disciplined where their capital went. They used their scarce capital to put it into creating long-term sustainable competitive advantages and having a differentiated product. It's not one of your typical Silicon Valley companies that just burn a lot of cash.

To be clear, Spotify did raise capital a few times when they were a private company, and tapping VCs. Of course, there has been some stock compensation, and they have done a few acquisitions where there was some stock included to align the interests of executives they brought in that way.

On the whole, though, they have reinvested their gross profit instead of raising capital, which I think is just evidence of a very disciplined approach. In keeping with that, the insiders and even early VCs have stayed in the company and retained their shares.

They haven't had a mindset of using their popularity and their standing as a hot service to raise money. At other companies, there would have been an incentive to spend that capital on stuff like marketing, because then you can show explosive growth. But such short-term thinking can be a slippery slope for companies.

Spotify did a direct listing IPO just under six years ago, and since then there has been extremely little share issuance.

Everything that their management has communicated for years has basically been: we see an enormous market that we want to participate in and find a way to lead. That is why they have gone into audio books, which is another thing that people listen to while they are in the car on commutes, and things like that. As they have grown, they have gone from music into podcasting into – finally – audio books. Audiobooks is another thing that people listen to while they are in the car on commutes, and Spotify saw a natural platform extension into providing that – something the industry was excited about, as it has basically evolved as a monopoly by Amazon Audible. Each successive area Spotify has entered, they have attacked with incredible vertical and horizontal integration. They created all sorts of technology that is optimised for that type of listening. They have special types of advertising marketplaces for podcast advertising, and they have developed searchability for sound files.

Spotify would already be showing a good level of profit today had they not continued to expand the things they are doing.

SL: Notably, Spotify is actually a Swedish company and legally speaking, it's domiciled in Luxembourg. Much as it's listed on the New York Stock Exchange, if it weren't for your global, unconstrained portfolio mandate, this one could have slipped through your fingers. This sort of open-minded, global approach leaves you open to criticism. If you are not specialised in a geography or a sector, you can be accused of being a jack of all trades and lacking focus. How do you counter that?

IS: I think the most important component of investing boils down to corporate governance. What are the motivations and incentives of the insiders? That determines a lot about how investments will work out.

You can tell a lot about an insider group and a board's motivations by seeing their track record, especially if it is a company that has been public for 10-20 years. You will have a lot of data about how shareholders were treated and how capital was handled.

So I do think that investment experiences are portable across sectors and geographies.

SL: Speaking of geography, one of the reasons why I have been enjoying our conversations so much is the fact that you are a truly global investor. You could be expected at any moment to tour a factory in Japan, speak with bankers in Kazakhstan, or quiz tech executives in the UK. How do you deal with the specific risks that exist outside of the US, e.g. in less developed markets?

IS: When I say that I am equally comfortable investing in Sweden, Kazakhstan, or Indonesia, then that's based on looking at each individual case based on factors such as capital discipline and other aspects of corporate governance.

Instead of ruling out investments in a specific geography or sector, I rule out investing in an IPO. I generally wouldn't want to invest in an IPO anywhere in the world. In an IPO, the interests of an insider and a control group are not aligned with those of outside, passive minority investors.

Whether we are investing in large-cap companies in the developed world or small-cap in emerging markets, alignment is something that we care greatly about.

SL: In your investor letters, you often refer to visiting your portfolio companies. You tour their factories or facilities to learn firsthand about their operations. You also have a history of travelling, to countries such as Thailand, Cambodia, Spain, Turkey, and even Iraq. In this day and age of the Internet, where everything is available at the click of a mouse, do you still see value in doing research on the ground?

IS: It's always valuable to sit down with people over a meal for an extended period of time and hear their perspective.

I think it is possible to do good research without travelling. But I also think you lose something if you are not sitting down with people face to face.

SL: You are also the chairman of the New Silk Road Forum, which brings people together once a year. Can you describe the event and why it is so valuable?

IS: The New Silk Road Forum is a community for people who are interested not just in global investing but also in culture and politics.

We started this community seven years ago in Kazakhstan. At that time, I had already been visiting the region for a number of years. At times, friends in the industry and other people would tag along.

I finally said, why don't we have a proper conference and bring together a bunch of interesting people every year? Over the last seven years, our group has met in Almaty, Kazakhstan; Baku, Azerbaijan; twice in Jackson Hole, Wyoming during the pandemic; and in Istanbul, Turkey, in 2023.

You will remember what I said earlier about everyone having a point of view that they want to put forward. The forum has been very successful and enjoyable because we have had some very interesting figures. Previous speakers at our forum included central bank governors, heads of large companies, and cabinet-level economic ministers. We've also sought to invite speakers with different points of view, from the arts and even religious worlds in a couple cases – those sorts of people can really help paint the sociological portrait of an economy, to give a richer perspective on economic opportunity.

Gathering such a group of people in a thought-provoking setting helps with learning about local, sometimes off-the-beaten-path opportunities and ideas.

Also, gathering someplace different demarcates that we are flexible global investors.

SL: Who can attend the forum?

IS: More than half of the participants are professional investors, but many are businesspeople or entrepreneurs from other fields. The most participants we have ever had at the conference was 52 attendees. A lot of people will come one or two times, then they'll skip a few years and eventually come back.

The conference has a website set up: www.newsilkroadforum.com.

If you go onto the website, there is a place to say that you'd like to learn more about it.

Participants of the New Silk Road Forum.

SL: Knowing how many of my readers are bookworms, do you have any all-time favourite book (or books) that you recommend to those with an interest in investing? Is there something that has particularly inspired you or guided your career?

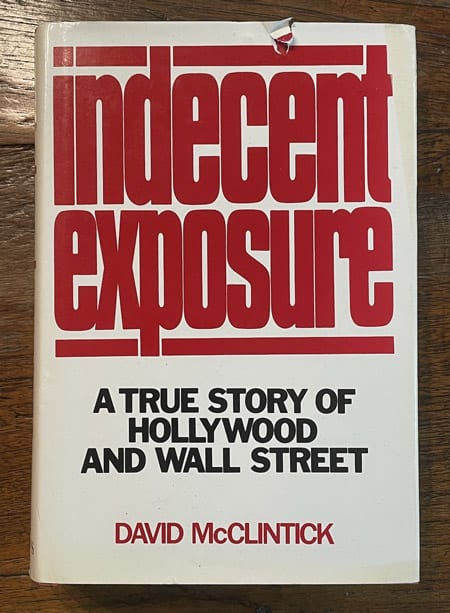

IS: One book that I really love is "Indecent Exposure: A True Story of Hollywood and Wall Street" by David McClintick. It was first published in 1982.

It's about the absolutely crazy series of events that unfolded during the power struggle for control of Columbia Pictures. It provides a very good perspective on the kind of politics that exist in the top echelons of most large corporations.

The reason I love this book so much is that it so clearly shows a case of a company where the board of directors, the management and the employees all had so many conflicts with each other and so little information about what the other ones were doing. It is really about how one of the most powerful brands in American cinema came undone and wound up getting sold to Coca Cola.

It is a good reminder that there are people behind investments, and crazy things happen.

SL: And finally, what do you like to spend a few hours on when you are not knee-deep in analysing companies? What else are you really passionate about?

IS: I love the theatre. I love going to plays, musical theatre, and the opera.

Theatres are a very interesting world. On the one hand, you have the opera that exists with grants from the government or from the National Endowment for the Arts, and it's a non-profit. Then at the opposite end of the spectrum, you have Broadway. It's also great, but Broadway is 100% for profit and doesn't get a single dollar of funding from anyone.

A non-profit theatre company that I really love in the city is Playwrights Horizons. It's where a lot of incredible great works from the 1980s, 90s and 2000s that wound up making it to Broadway were originally performed in some form.

I also really love the Irish Repertory Theatre. I am a little bit of a geek about English culture, and the "Irish Rep Theatre" in New York is pretty amazing in this regard.

SL: Isaac, many thanks for sharing your insights with Undervalued-Shares.com!

About Isaac Schwartz and the Robotti Global Fund: Isaac is an investor in global and emerging markets with a special focus in financial services, logistics and e-commerce, consumer products, and durable goods. He is a Portfolio Manager at Robotti & Company, an investment adviser managing USD 1bn in equity assets. Since 2007, Isaac has managed Robotti Global Fund LLC, which he has run from Singapore, Hong Kong, Istanbul, and now New York. He has invested extensively in Kazakhstan and Indonesia, as well as other CIS and Southeast Asian markets. In 2017, Isaac founded the New Silk Road community of more than a hundred professional investors who meet annually for an investing-ideas summit. Isaac has been a director of Menu Group, an online food delivery company in the UK, and Complete Start, a health food company in the U.S. He earned a B.S. in Economics from the Wharton School of the University of Pennsylvania.

Ocado: British high-street retailer turning international ecommerce specialist

"It's not whether the company will succeed, but on what scale."

Ocado has been in the Robotti Global Fund's top three position for years. Isaac Schwartz strongly feels that it is undervalued, and Undervalued Shares couldn't agree more.

What are the key triggers that could propel the relatively conservative stock over the next 12-18 months?

Undervalued Shares has done the groundwork for you.

Ocado: British high-street retailer turning international ecommerce specialist

"It's not whether the company will succeed, but on what scale."

Ocado has been in the Robotti Global Fund's top three position for years. Isaac Schwartz strongly feels that it is undervalued, and Undervalued Shares couldn't agree more.

What are the key triggers that could propel the relatively conservative stock over the next 12-18 months?

Undervalued Shares has done the groundwork for you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: