UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

Allocating to Europe (part 3): Britain

"What's going on in the UK right now should be of note to many."

Goldman Sachs said it best; we are witnessing a spectacular phenomenon.

In public takeovers, the bidder usually offers a premium of 20, 30 or maybe 50%.

Recent bid premia for British companies, however, have been far higher.

KKR's bid for Spectris (ISIN GB0003308607, UK:SXS), for example, yielded a >100% premium.

And Spectris isn't a thinly traded micro-cap. It's a GBP 4bn (USD 5bn) company, selling market-leading high-tech instruments around the world.

Many such opportunities can currently be found across the British market.

Spectris.

Takeover bids galore

What Goldman Sachs pointed out in a recent client email is something that Undervalued-Shares.com readers have been aware of for years.

Britain is a target-rich environment for takeover bids, and bid premia are higher than elsewhere in Europe (check previous here, here, here, and here).

Oftentimes, American money is the driving force. US investors know and like Britain, and they appreciate the low valuations at which some of Britain's leading companies are trading. Take Learning Technologies Group, for example. In August 2024, Undervalued-Shares.com flagged it as a potential "forced takeover candidate" due to unique a set of unique circumstances that made a sale highly likely. Just a month later, the company's shareholders received an all-cash offer from US private equity firm General Atlantic.

The stocks of British banks have also done exceedingly well, mirroring the trend seen across much of Europe. Blue-chip names like Barclays (ISIN GB0031348658, UK:BARC), NatWest Group (ISIN GB00BM8PJY71, UK:NWG) and Lloyds Banking (ISIN GB0008706128, UK:LLOY) are all up by a multiple over the past five years and will have paid high dividend yields along the way.

FTSE 350 Banks Index.

British bank stocks have already had a strong run, and their shares are no longer amazingly cheap.

Which other sectors could achieve similar gains?

1. Oil and gas companies

In last week's article about stocks in the Mediterranean region, I described how investors multiplied their money by investing in European banks at a time when they were truly unloved.

What's today's equivalent of those unloved European bank stocks?

British oil and gas stocks might qualify.

Not exactly market darlings elsewhere, energy stocks are particularly "out" in Britain. The Labour government appointed Ed Milliband as Energy Secretary – an outspoken critic of fossil fuels.

Britain currently has a 78% (!) tax on profit from oil and gas, compared to other businesses in the country paying only 40%.

Energy matters. Data from over 100 countries shows a strong positive correlation between energy capacity, economic productivity, and living standards. In 2005, the UK's per capita energy use was 50% of the US level, and living standards were pretty decent. By 2022, the UK's energy per capita had fallen to just 38% of the US level. Is it any surprise, then, that in March 2025, the National Institute of Economic and Social Research (Niesr) reported that "Britain is no longer a rich country"? There is always a political angle to such reports – but it only takes a walk around London to ascertain that Britain is not doing that well.

For now, the Labour government remains firmly opposed to domestic fossil fuels.

These policies have made Kistos Holdings (ISIN GB00BP7NQJ77, UK:KIST) one of the market's energy sector bargains. As reported in January 2025, the stock could recover by a multiple if or when British energy policies change.

Kistos Holdings.

When might we see such policy changes? I believe the situation needs to get worse first before it becomes better.

However, it will change eventually. If the US boomed in 2026 and left Europe falling behind ever further, it could lead to the long overdue rethink of European policies. Eventually, the electorate will have had it.

Love him or hate him, but Nigel Farage currently has the lowest betting odds for becoming Britain's next Prime Minister. His Reform UK party has promised the energy sector "a 'day one' assault on net zero policies that includes reversing restrictions on new oil and gas exploration."

Source: Financial Times, 23 May 2025.

In such a case, it'd be interesting to also look at firms such as Serica Energy (ISIN GB00B0CY5V57, UK:SQZ), Harbour Energy (ISIN GB00BMBVGQ36, UK:HBR), Energean (ISIN GB00BG12Y042, UK:ENOG), Jersey Oil & Gas (ISIN GB00BYN5YK77, UK:JOG), Tullow Oil (ISIN GB0001500809, UK:TLW), and Reabold (ISIN GB00B95L0551, UK:RBD).

Some of these companies are now priced for doomsday. For someone with a three-to-five-year investment horizon, British oil and gas stocks are worth keeping an eye on. Politics will eventually provide the value catalyst for these stocks.

2. Housebuilders

The stocks of British housebuilders have been cheap for as long as I can recall.

They've always had a semi-religious following, with many famous value investors publicly beating the drum for them.

So far, it all came to nothing. The sector always stayed cheap.

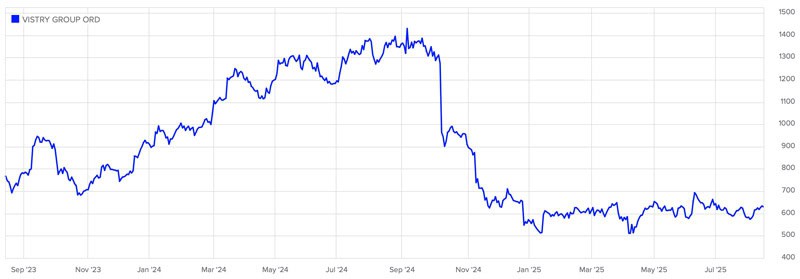

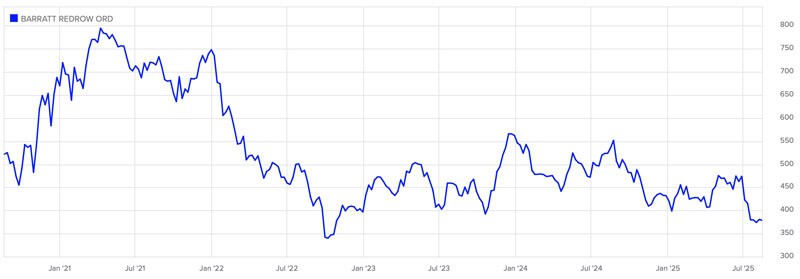

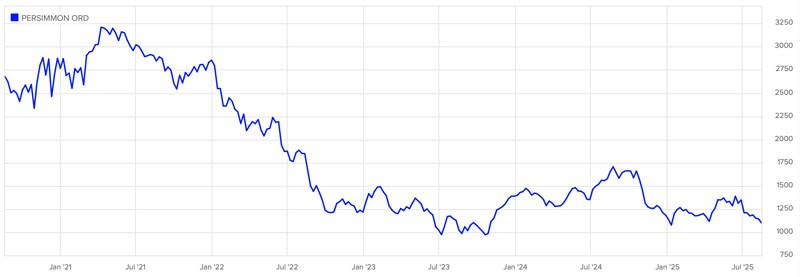

Worse still, most of Britain's leading housebuilders had their stocks crushed over the past 12 months.

There is blood in the street, and it's the blood of those who thought this sector was cheap.

Behold the charts of the following leading housebuilders.

Vistry Group.

Barratt Redrow.

Persimmon.

Taylor Wimpey.

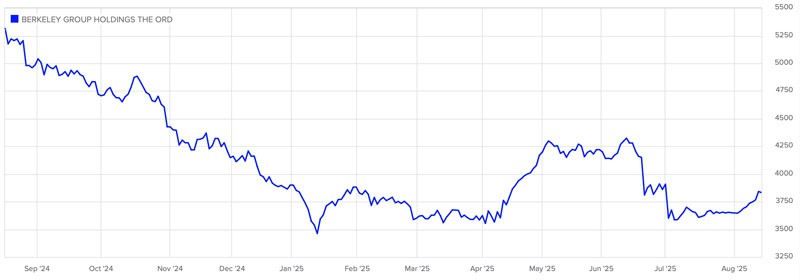

Berkeley Group.

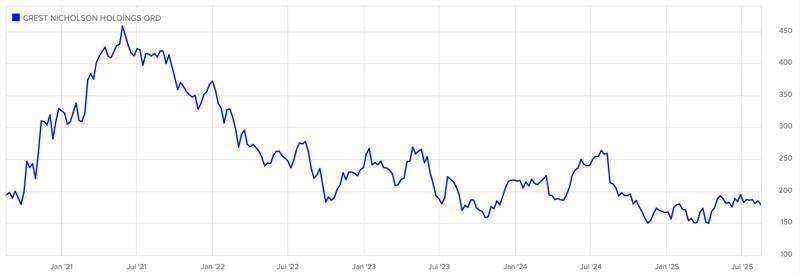

Crest Nicholson Holdings.

Has this sector hit rock-bottom yet?

I wouldn't necessarily believe that's the case, yet.

Yet Britain is in desperate need of more housing. The social housing waiting list has reached a record 1.3m people, and around 170,000 children are currently living in temporary accommodation. Meanwhile, every day more people stream into the country – a trend few expect to change under the current government.

At some stage, this will prompt voters to demand change at the ballot box. Policy changes are all that's needed, as already highlighted in a comprehensive report published in 2015: "Redefining Density – Making the best use of London's land to build more and better homes". The report pointed out that London is less densely developed than cities like Paris and Madrid. Without too much ado, London could add a further 1.4m houses. That's not even counting the space that exists in other parts of the country.

If (or when) voters cause a rethink of development policies, it'd be down to capital-rich housebuilders to make it all happen.

Given how low valuations have fallen, will private equity be tempted to pick up some of these companies on the cheap by making a bid for them when they are truly out of favour?

The charts above showed the bellwethers of the sector, i.e. Barratt Redrow (ISIN GB0000811801, UK:BTRW), Bellway (ISIN GB0000904986, UK:BWY), Berkeley Group (ISIN GB00BP0RGD03, UK:BKG), Crest Nicholson (ISIN GB00B8VZXT93, UK:CRST), Persimmon (ISIN GB0006825383; UK:PSN), Taylor Wimpey (ISIN GB0008782301, TW.), and Vistry Group (ISIN GB0001859296, UK:VTY).

Some of these housebuilders have strong balance sheets, and are well positioned to make it to the other side of this dark period of Britain's economy. Once there, the field of competitors will likely have thinned out given the ongoing consolidation of the sector. Fewer companies could then share a growing business, with less competitive pressure on margins.

In five or ten years, folks might be rubbing their eyes at just how cheaply these quality companies once traded. Haven't we just seen something similar with British (and European) banks?

3. Special situations

As highlighted in the introductory article of this series, Europe's equity markets are not as grazed over as those in the US. Analyst coverage is lighter, and news travels more slowly – especially for companies whose investment case lies outside the normal spectrum and therefore require a bit more work to assess.

The British market offers tons of such "special situations". If I had to focus my entire reporting on just one country, it would be Britain – ensuring I'd never run out of overlooked opportunities to write about.

Take Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH) as an example. When I covered the stock in an in-depth research report back in October 2022, it was trading BELOW the company's likely cash reserves. Rockhopper Exploration has since advanced monetising an arbitration award and developing its oil and gas fields in the Falkland Islands. As a British Overseas Territory, the Falklands were never tied to Britain's energy policies, and they could pursue the energy wealth of their offshore waters. Rockhopper Exploration stock is now up 450% and likely has further to run, due to an Israeli energy conglomerate reportedly preparing a bid.

Rockhopper Exploration.

How many analysts were following Rockhopper Exploration when its Falkland Islands assets were practically given away? Similar situations exist in the British market at any given time.

Stock markets don't always reflect a nation's economy or politics, and within difficulties lie opportunities. Europe may not be the most economically agile continent, but for well-informed equity investors, it could be the most attractive right now.

Out now: Buying growth at value prices

2025 is shaping up to be a breakout year for European stock markets.

Behind the headlines, smart investors are quietly building positions in overlooked European companies with global reach, strong fundamentals, and compelling valuations.

The latest Undervalued Shares report – out this week – uncovers one such hidden gem.

If ever there was a good opportunity to buy growth at value prices, this is it – and opportunities like this don't stay quiet for long.

Out now: Buying growth at value prices

2025 is shaping up to be a breakout year for European stock markets.

Behind the headlines, smart investors are quietly building positions in overlooked European companies with global reach, strong fundamentals, and compelling valuations.

The latest Undervalued Shares report – out this week – uncovers one such hidden gem.

If ever there was a good opportunity to buy growth at value prices, this is it – and opportunities like this don't stay quiet for long.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: