Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

UK takeover targets – ideas to fuel your research

In 2022, the UK widened its lead as Europe's top destination for financial investors.

The country landed 76 projects that involved foreign direct investment in its financial services sector. This compares to 45 for France and 31 for both Germany and Spain. It means the UK secured 26% of all European FDI projects in financial services.

Brexit, high taxes, a decline of the City of London – anyone?

Despite the never-ending criticising headlines, the UK remains a magnet for investment.

How is that possible, and how can private investors benefit?

Bid mania continues

The seeming contradiction of a country's prospects constantly getting hammered in the media but thriving nevertheless is one that I already explored in some detail in my Weekly Dispatch "USA – the unstoppable juggernaut?".

It's entirely possible for a country to be simultaneously in decline in many ways but also on the rise in others – and with a net positive overall. As an extreme example, take South Africa. The headlines coming out of this country haven't been pretty for longer than I can remember. Yet, there are many South African entrepreneurs with thriving self-made enterprises. No matter how bad a country's situation, there will be entrepreneurs (and companies) with the ability to succeed in any conditions. Keep in mind that within Europe, there is probably no other country that hoovers up more entrepreneurial talent than the UK!

In the UK, this entire subject has been visible through the large number of bids for publicly listed companies over the past few years. Undervalued-Shares.com must sound a bit like a broken record in this regard (check past articles here, here, here, and here), but it's been a trend that few others have been writing about. Thanks to the UK's open capital market and low stock market valuations, there have not only been a large number of bids, but ones that often came with outsize bid premia, often in the range of 50-100% compared to the 30-40% usually found elsewhere.

Case in point, last week's rumoured approach of Amazon (ISIN US0231351067, Nasdaq:AMZN) to buy Ocado (ISIN GB00B3MBS747, UK:OCDO), the online grocery retailer. With a market cap of GBP 4bn, Ocado is anything but a small-cap. As The Times suggested, Amazon had hired Goldman Sachs and J.P. Morgan to make a bid that was 85% above the recent share price. For a widely-followed mid-cap company like Ocado, this is an almost outrageously large bid premium. It's all down to the UK's low market valuation. When a bidder decides to have a go at a company, they will need to offer somewhere nearer a private market valuation for the bid to have a chance to succeed – and that's where value then gets unlocked for public market investors. The stock of Ocado has come back down and may be worth a closer look. "Phantom billionaire" investor Nick Roditi, previously fund manager at Soros Fund Management, continues to hold a 14.5% stake in Ocado.

Source: The Times, 23 June 2023.

Another recent case which already crossed the finishing line is that of Dechra Pharmaceuticals (ISIN GB0009633180, UK:DPH), a GBP 4.5bn veterinary products maker which received a 44% premium bid from Swedish private equity firm EQT. Again, such large premia for companies of this size are unusual.

The UK stock market's strong leaning towards old economy companies and stocks that would fit into the value basket is not a bad thing for a market that is wide open for bids and attracts deep pools of capital. Take the case of Lookers (ISIN GB00B17MMZ46, UK:LOOK), one of the country's best-known car dealerships. The company has just been through a tumultuous period where it not only had to deal with the pandemic, but also with global supply chain snarl-ups, rampant inflation, and an accounting scandal followed by the exit of three senior executives. Still, a Canadian car dealer felt compelled to make a bid with a 35% premium compared to the most recent share price.

Lookers.

It all begs the question, will there be more of it and where might bidders strike next?

Cases to keep an eye on

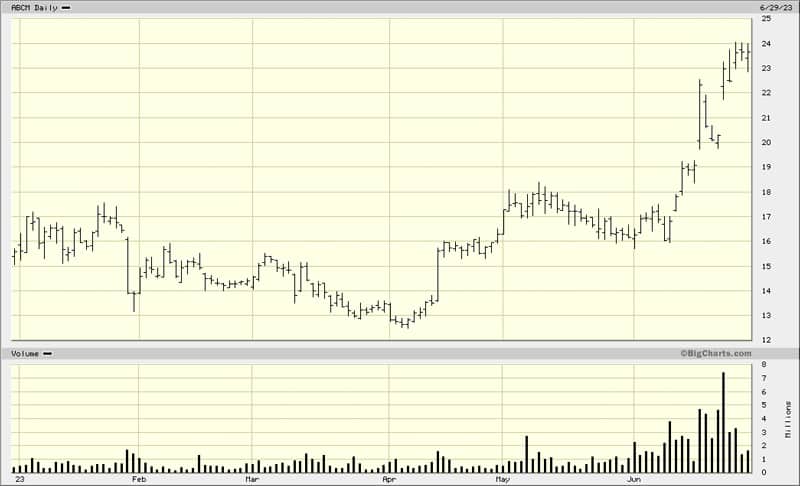

One obvious case will be that of Abcam (ISIN US0003802040, Nasdaq:ABCM), a leading supplier of protein research tools to life scientists. The situation of the company is a bit peculiar, because the stock is now listed in the US even though the firm originally floated in London and is headquartered in Britain's Cambridge. Abcam had to learn the hard way that listing in the US is no panacea when it comes to getting your valuation up. Its founder and large shareholder, Jonathan Milner, has started to campaign for the firm to be sold. For outside shareholders, these developments have already been a boon, but there is probably more to come now that 58-year-old Milner is working overtime to cash one last big cheque from selling his life's work.

Abcam.

For a more controversial and complex case but one with potentially very high upside, you could delve into ASOS (ISIN GB0030927254, UK:ASC). The company started selling clothes worn by TV stars ("As Seen On Screen") two decades ago, and it has subsequently grown into one of the UK's largest fashion retailers. Its shares have lost well over 90% over the past two years, though, as the company's costs surged just as shoppers returned to the high street after the pandemic. ASOS even had to secure an emergency funding package, which is how the Danish retail billionaire, Anders Holch Povlsen, got to control an increased stake of 26%.

ASOS was put on bid alert last December already, when rumours emerged of a GBP 1bn approach from Trendyol, a Turkish company that is backed by the Chinese internet giant Alibaba (ISIN US01609W1027, NYSE:BABA). In 2021, Trendyol had raised USD 330m from Alibaba and USD 1.5bn from investors such as SoftBank and the Qatar Investment Authority, which the firm is now wanting to put to use. According to rumours at the time, the Turks were preparing a bid between GBP 10 and GBP 12 per share. Driven by rampant speculation, the share price quickly doubled from GBP 5 to GBP 10.

It's now below GBP 4 again, because of the company's persistent problems and because a bid hasn't emerged yet. However, the low share price could tempt bidders to enter the fray again. British retail tycoon Mike Ashley indirectly controls a 7.4% stake through Fraser Group, which has a successful history of buying up failing brands such as Gieves & Hawkes and I Saw It First. Any potential bidder will have to come to an agreement with the Danish shareholder, who so far has been reluctant to sell but may be open to build a consortium to take ASOS private.

ASOS.

One of the slow-burning but promising short-term takeover cases on the London Stock Exchange is that of Condor Gold (ISIN GB00B8225591, UK:CNR). The company officially confirmed in late 2022 that it was looking for a strategic buyer, with a bid anticipated to come in by spring 2023. However, the process has taken longer than expected, and the stock has recently drifted back down. Condor Gold shareholders should look to the example of Cardinal, a West African gold explorer where a similar situation unfolded. Against the backdrop of a rather lacklustre situation, Cardinal stock was trading at 25 cents in March 2020, when bid interest emerged for its high-quality gold assets. As sometimes happens in such situations, competitive tension between several bidders led to a series of bids – first 45.775 cents, then 60 cents, 66 cents, 70 cents, 90 cents, 100 cents, 105 cents, 107.5 cents, and the deal getting closed at 110 cents (even though someone else then tried to enter the fray with 120 cents). I continue to believe that the Gordian knot at Condor Gold will be cut through before too long because of the large gap between the company's market cap and the intrinsic value of the firm's Nicaraguan gold assets (Undervalued-Shares.com Lifetime Members have access to a whole treasure trove of information on Condor Gold).

Are you lacking the time to get your head around individual cases of British stocks? Benefitting from the UK market could be simpler, still. After all, it is among the cheapest in the world right now, as a report issued earlier this week pointed out once again.

Opportunities across the British market

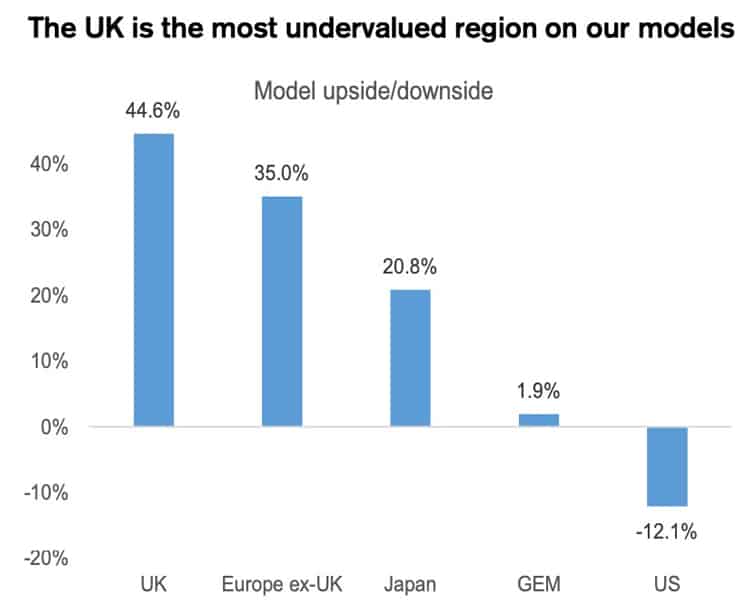

In its high-level view of the British market, Credit Suisse just came to the interesting conclusion that "the UK is the most undervalued region on our models".

Source: Credit Suisse, 28 June 2023.

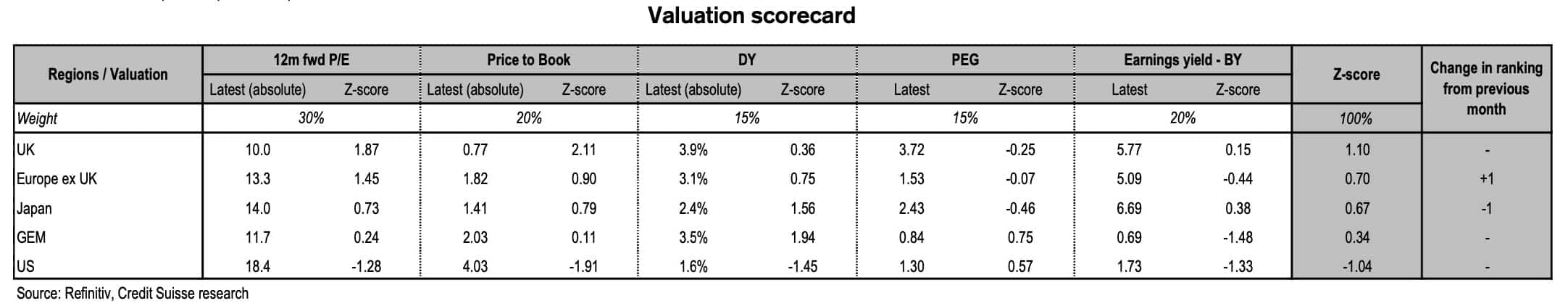

For those interested in more granular detail, here is the valuation scorecard that Credit Suisse applied to derive at this conclusion (click to enlarge for a higher resolution).

Source: Credit Suisse, 28 June 2023.

There are quite a few surprising aspects to the UK economy. E.g., today only 28% of UK homes are owned with a mortgage, compared to 40% in the 1980s. And only 18% of mortgages are adjustable rate. Who knew?

The Bank of England might want to see the country enter a recession, as it needs a slowdown to deal with pesky inflation caused by rising wages. Wage growth needs to fall to 3% from 7.5% to get inflation back on target, where Britain is currently under more pressure than many other European countries. The prospect of an imminent recession means domestically-focussed British companies are not particularly interesting when viewed as a whole (exceptions always apply).

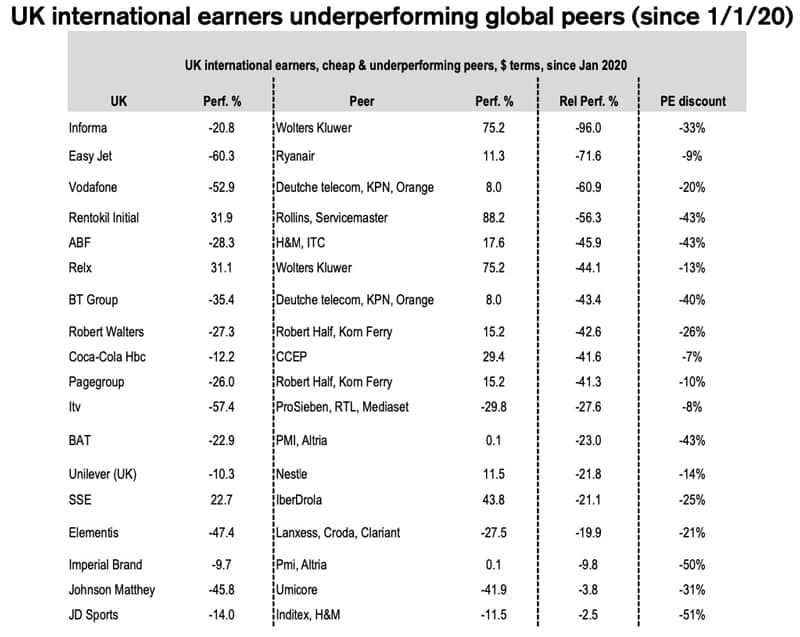

However, 80% of the sales generated by FTSE 100 companies are international, i.e. export-derived. The UK's leading index is primarily an indicator for a group of global companies, and these stocks are currently trading with a massive discount compared to their peers.

Source: Credit Suisse, 28 June 2023.

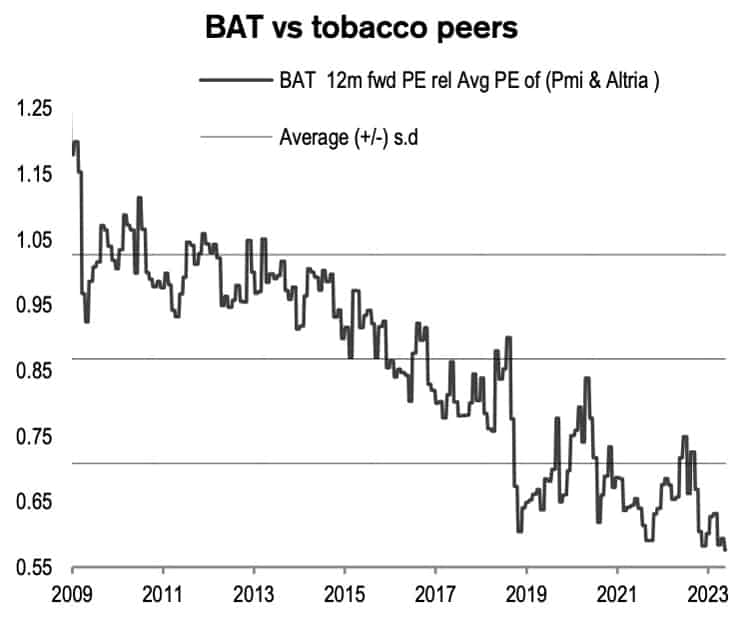

Take British American Tobacco (ISIN GB0002875804, BATS) as an example. While cigarettes are a truly global market, the company's stock trades way below that of its peers. Leaving aside the variations to its strategy in vaping and other alternative ways of nicotine consumption, why wouldn't an investor holding other cigarette stocks consider switching their investment to British American Tobacco, for the sake of the dividend yield? There is a valuation gap that begs to be closed in the long run.

Source: Credit Suisse, 28 June 2023.

Whether you should delve into this list of names to do your own research or invest is also very much a question of whether you believe in value or growth to outperform. If you want to take a cautious stance and bet that value will be the place to be over the coming years (with "value" being both abnormally cheap and very oversold), then the UK is a place where you should have exposure.

You could simply buy multiple UK names that look abnormally cheap versus peers and have underperformed, such as JD Sports, Imperial Brands, BAT, Unilever, ABF, Relx, or Informa. Or you could simply look out for a fund that is available in your country and which is tied to the FTSE 100, of which there exist many.

Either way, many opportunities still beckon in the UK, and Undervalued-Shares.com will continue to report about them.

The latest on Russian ADRs/GDRs (German-language video)

What's the current outlook for owners of Russian ADRs and GDRs, as well as for major companies with assets in Russia?

Dr. Marc Liebscher of SdK Schutzgemeinschaft der Kapitalanleger e.V. and I give a rundown of the latest developments.

The latest on Russian ADRs/GDRs (German-language video)

What's the current outlook for owners of Russian ADRs and GDRs, as well as for major companies with assets in Russia?

Dr. Marc Liebscher of SdK Schutzgemeinschaft der Kapitalanleger e.V. and I give a rundown of the latest developments.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: