Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Brexit special: a list of potential British takeover targets

Since August 2020 alone, there have been 15 announced and possible bids for listed UK companies. In total, these bids amounted to over GBP 25bn (USD 33bn) being offered to shareholders of these companies. The targets even included one member of the FTSE-100 index and six companies from the FTSE-350, besides a number of small AIM-listed companies.

All that happened during a time when many pundits saw Britain at a standstill because of the uncertainty over Brexit.

I had written previously that this was going to happen, and it didn’t take much to figure out that such a development was going to take place eventually. Britain’s stock market had become so undervalued that it was just a matter of time before private equity investors and industrial buyers would make use of rock-bottom prices.

By some measures, the British stock market had become the cheapest it had been in thirty years.

Crucially, the low valuations wouldn’t just make for an increased number in bids, but also juicy bid premiums. Investors who picked up the right stocks at the time could reap massive gains literally overnight, because of the nature of bids. Just check out the following recent cases.

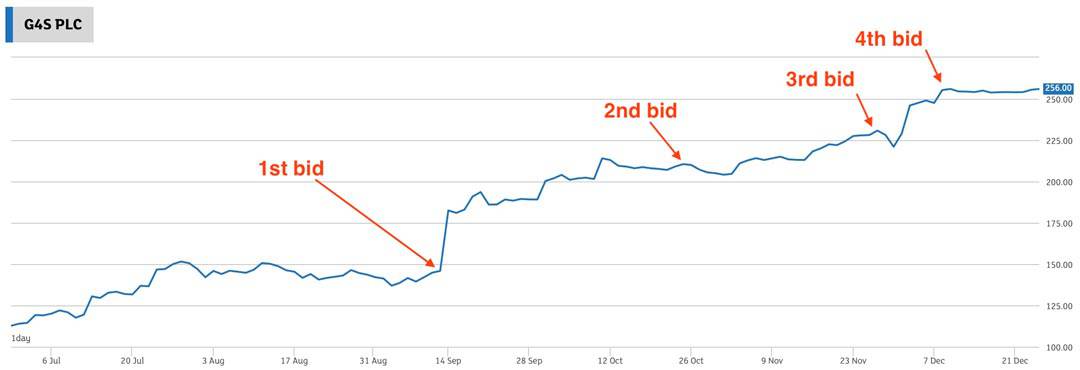

G4S (ISIN GB00B01FLG62) is the world’s largest security company. It runs prisons and detention centres for asylum seekers, and provides guards for embassies. In September 2020, G4S's Canadian competitor, GardaWorld, launched an unsolicited offer for the company, only to be outbid by long-standing US rival, Allied Universal. Following a rancorous takeover battle, shareholders received a cash bid that was 68% higher than the pre-battle share price. This wasn’t small fry, but a USD 5bn takeover!

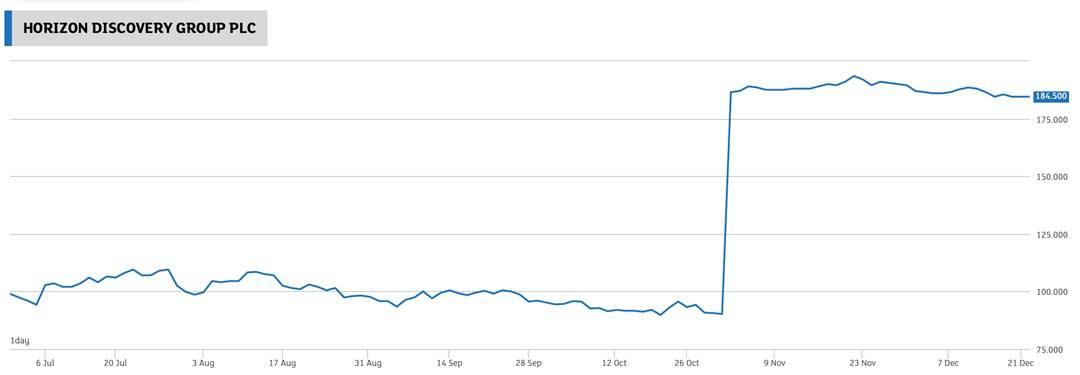

Horizon Discovery (ISIN GB00BK8FL363), a gene-editing company, was snapped up for GBP 296m (USD 383m) by the US diagnostics giant, PerkinElmer (ISIN US7140461093). Shareholders were 103% better off for it.

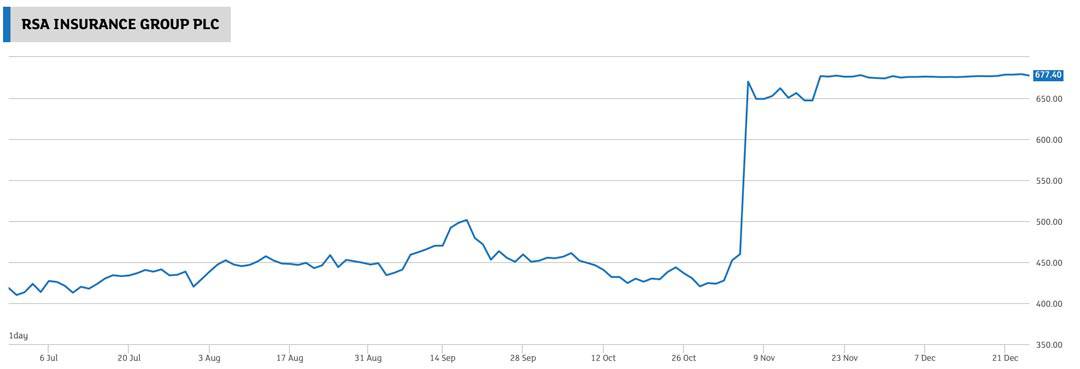

RSA Insurance Group (ISIN GB00BKKMKR23), a multinational insurer, received a GBP 7.2bn (USD 9.5bn) bid from a Danish-Canadian insurance consortium. RSA shareholders got 50% richer overnight.

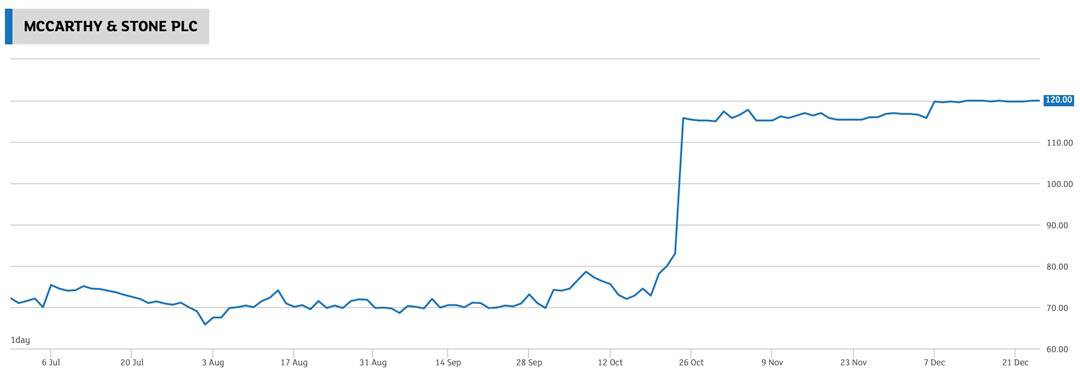

McCarthy & Stone (ISIN GB00BYNVD082), the UK’s leading developer of retirement homes, just changed ownership for GBP 650m (USD 859m). Lone Star, the private equity firm, made a bid that was 62% higher than the share price before the offer was revealed.

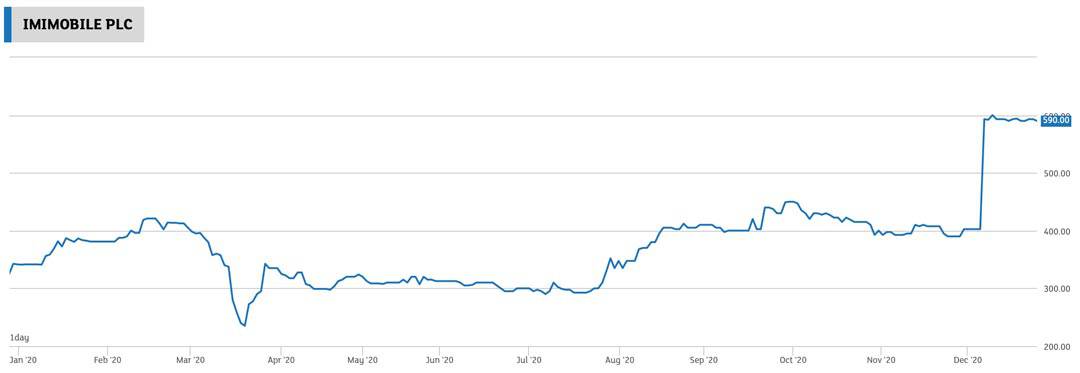

imimobile (ISIN GB00BLBP4Y22), a software company for cloud-based communication, got taken out by Cisco Systems (ISIN US17275R1023), the American technology conglomerate. The GBP 500m (USD 660m) bid made shareholders of the British company 50% better off in the space of 24 hours.

Just as everyone was heading off on the Christmas holidays did Codemasters (ISIN GB00BFWZ2G72) become the focus of a bidding war. Codemasters is one of the oldest video game developers in the UK. Its US rival, Take-Two Interactive (ISIN US8740541094), had offered GBP 759m (USD 973m) for the company in early November 2020. On 14 December 2020, the California-based game maker, Electronic Arts (ISIN US2855121099), made a higher offer. Both bidders are now widely expected to battle it out.

Takeover battles are once again making headlines across the British media.

The list goes on and on

Just to make the point clear once more. What’s unusual is not just the amount of M&A activity, but the premiums paid to shareholders. Because share price valuations in Britain are so low, the premiums come out much higher than under normal circumstances. Usually, bids for large companies with liquid trading would more likely be 20% to 30%. Most recently, the premiums often came out between 50% to 100%.

Researching M&A opportunities in Britain has been a lucrative field for those who focussed on finding these potential bid situations before they happen. Not that many did. Most people were misled by media headlines about Britain being in some kind of paralysis because of pending Brexit negotiations, or they feared that frogs would rain from the sky on the day Britain left behind the risky political experiment that is the European Union.

Is more such M&A action on the horizon?

You bet.

Valuations remain low, Britain has one of Europe's most open capital markets, and there is now at least some kind of agreement between Britain and the EU.

Over the coming months, it should pay off to invest a bit of time into research about British takeover targets.

Here are some names to get you started

Knowing how many of my readers are doing their own research, I wanted to provide you with a few leads to get you going.

The following ideas are not based on in-depth research. They are pointers towards companies that might be interesting to look at with regards to potential bids. Please don’t mistake this list as me saying there will definitely be bids for those companies. I am merely giving you a starting point to do your own research and draw your own conclusions.

Since there are 2,000 publicly-listed companies in the UK, filtering out two dozen names that could be worth checking seemed like a useful service Undervalued-Shares.com could provide.

Britain has always been home to large fund and wealth managers, and they escaped the pandemic relatively unscathed due to rising asset values around the world. One company that could end up in the crosshairs of global M&A is Jupiter Fund Management (ISIN GB00B53P2009), a GBP 1.6bn (USD 2.1bn) company with GBP 56bn (USD 74bn) of client assets under management.

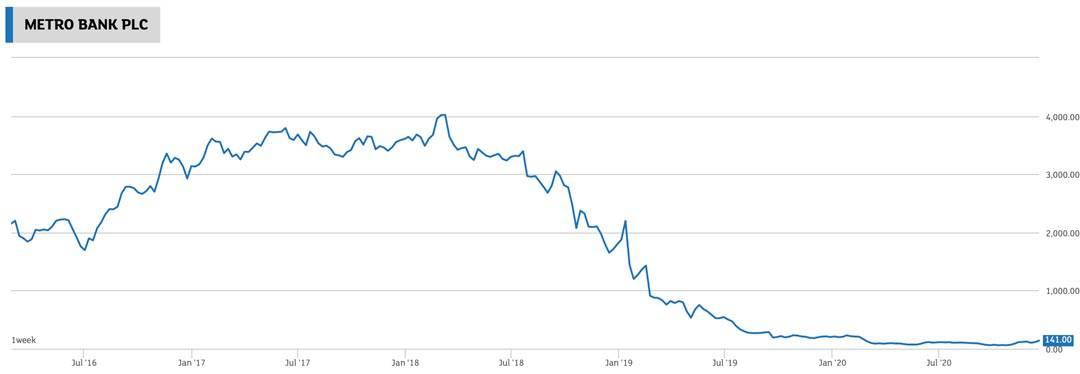

Metro Bank (ISIN GB00BZ6STL67) is one of the UK’s so-called “challenger banks” that tried to take on the local banking establishment through a better service offering for consumers. It ended up challenged rather than challenging, and its share is now down 97%. A larger bank could snap it up, solve its funding issues, and build on the company’s undoubted strength in brand recognition and branch network coverage.

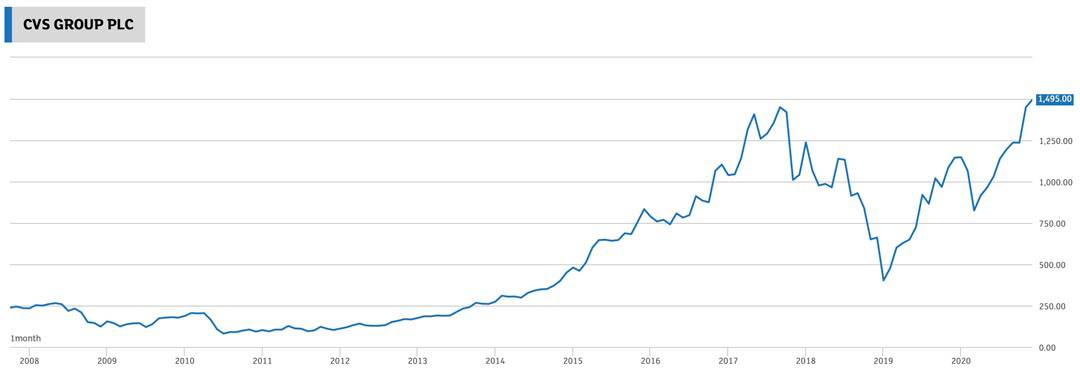

Britain is a global leader in life sciences, and there has been a recent flurry of bidding for British healthcare and life sciences companies. These are often held privately, which is why they make fewer headlines. The largest such deal was the acquisition of VelosBio by Merck for a price of USD 2.75bn. There are others that could yet fall prey to a bid and which you can invest into through the stock market. Advanced Medical Solutions (ISIN GB0004536594) is a medtech company that could make for a re-run of the 2019 acquisition of Britain’s medtech player, BTG, by Boston Bioscience. CVS Group (ISIN GB00B2863827) is a leading player in the veterinary business, which has seen a lot of consolidation-based M&A driven by both industrial buyers and private equity. Its stock could be about to break through its former record high (see chart below). Medica (ISIN GB00BYV24996) has a 40% domestic market share in outsourced radiology, but it lacks growth capital and access to new technology. An acquirer could combine it with a specialist for artificial intelligence, thus giving the company a new lease of life. Sensyne Health (ISIN GB00BYV3J755) operates inpatient data and digital healthcare applications – a hot sector given everything that has happened recently. While such companies trade at sky-high valuations in the US, Sensyne has a rather depressed share price, trading 40% below its 2018 peak.

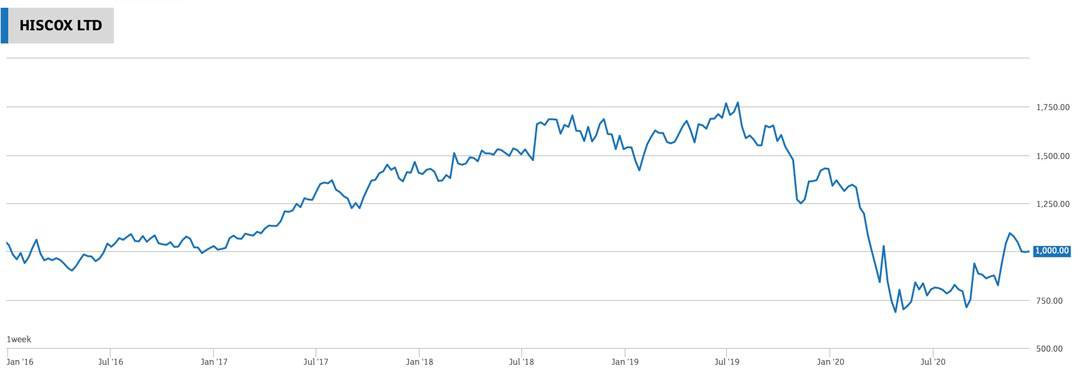

Insurance is another sector where the UK has long had many competitive advantages, and the bid for RSA Insurance Group should not have been the last takeover in the industry. Among the more interesting targets are speciality insurers that operate on the Lloyd’s platform. This platform has a 20% market share in the US speciality insurance market and could thus attract interest from US buyers in particular. Obvious targets in the sector would be Hiscox (ISIN BMG4593F1389), Beazley (ISIN GB00BYQ0JC66), and Lancashire Holding (ISIN BMG5361W1047).

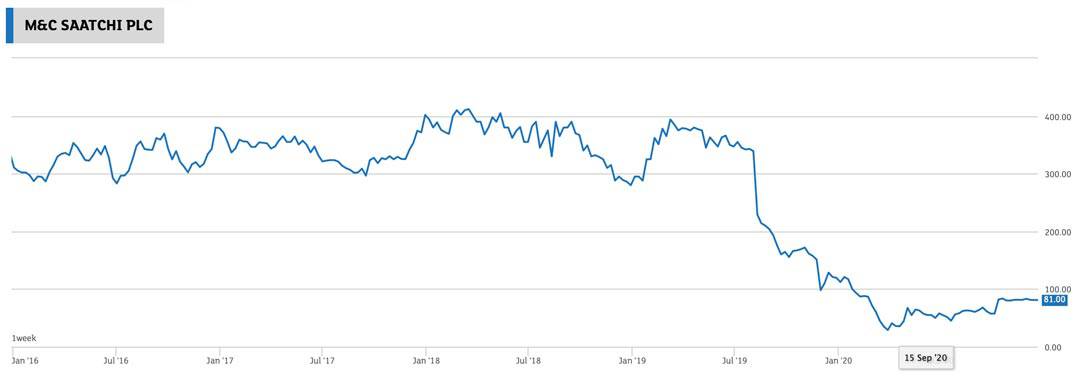

In the UK’s media sector, a whole raft of targets could fall victim to bidders. This could include situations where management teams decide to get backing from financiers and launch a management buyout. M&C Saatchi (ISIN GB00B01F7T14) is such a candidate, not the least because it could recover from some of its reputational issues a lot faster if it were taken private and able to operate outside of the public eye. Bloomsbury (ISIN GB0033147751) is an asset-rich, independent publisher with a lot of underutilised potential and a valuation that could make it vulnerable to a bid. Hyve Group (ISIN GB00BKP36R26) is an events business that has suffered mightily under the pandemic; however, it managed to carry out a fundraising that will ensure its survival. If you believe in a recovery of the conference and events business, then Hyve is a company to look at. Its bombed-out share price leaves it very vulnerable to an opportunistic bid by an industrial or financial buyer.

Among video game makers, Codemasters should not remain the only company to attract a bid. Large game developers are fighting over scarce human talent, and the sector is likely going to see more consolidation around the globe. Team17 (ISIN GB00BYVX2X20) and Frontier Developments (ISIN GB00BBT32N39) could go the same way as Codemasters, provided someone convinces their founders (who hold significant stakes) to back a bid.

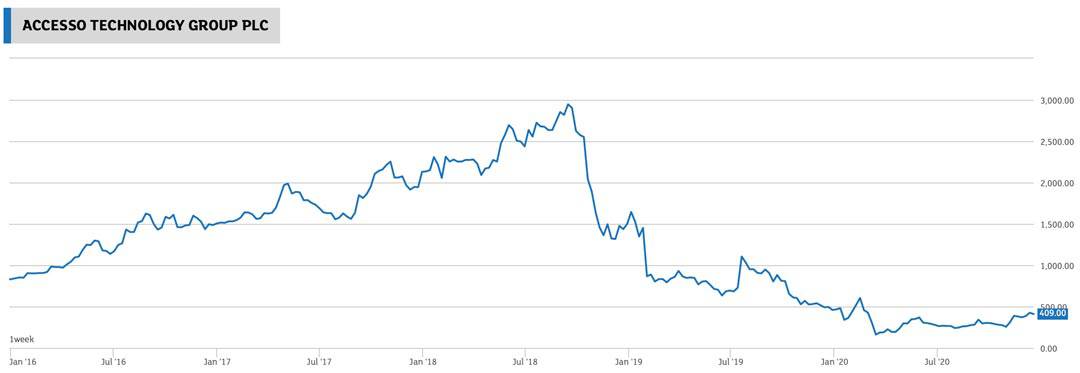

There are a number of high-likelihood targets among technology companies, too. AVEVA Group (ISIN GB00BBG9VN75), the Cambridge-based information technology group with a GBP 9bn (USD 11.9bn) market cap, is already 60%-owned by France’s Schneider SA. The company could well be taken private by its major shareholder. Accesso Technology Group (ISIN GB0001771426), which provides ticketing and guest experience solutions in over 1,000 venues around the world, recently invited bids following a number of approaches it had received. None of these negotiations has worked out, but the company declared that it was still open to a transaction. Finally, it's worth to keep an eye on dotdigital (ISIN GB00B3W40C23), which is much more likely to be prey than predator. The company works in marketing automation, a highly fragmented market that is due to see some consolidation.

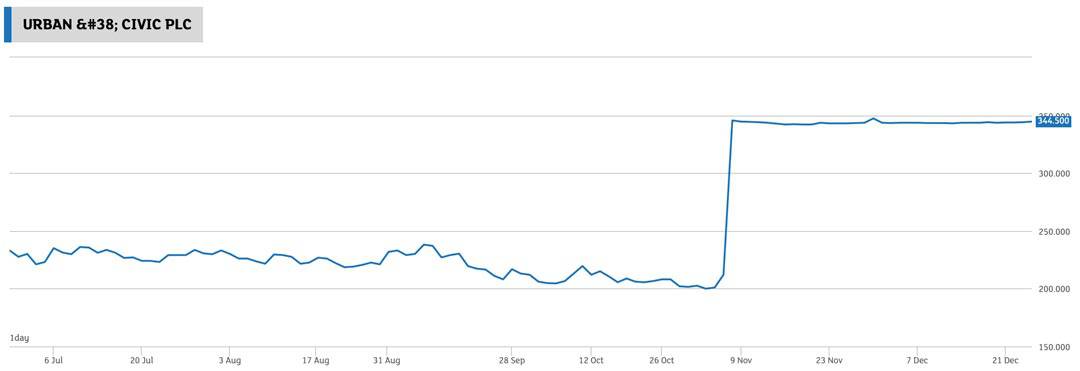

Prime real estate is a sector that I have strongly leaned towards for quite some time. In September 2019, I had introduced Undervalued-Shares.com Members to Capital & Counties (ISIN GB00B62G9D36). This holding company owns vast swathes of AAA real estate around Covent Garden, London's most famous tourist, shopping and entertainment district. I suspected that it would eventually be taken out by a sovereign wealth fund, given that it’s the kind of safe asset you could tuck away for the next few generations. Following initial indications that such a development would happen (the Saudis evaluated a bid), the coronavirus pandemic struck, and stocks in the real estate, retail, hospitality and leisure space plummeted. Capital & Counties was last trading at a >50% discount to its most recent published net asset value, even though it is solidly financed with a 75% equity and just 25% debt. How long can potential bidders resist? The recent example of Urban & Civic (ISIN GB00BKT04W07) could show the way towards a recovery of the share price. Wellcome Trust, the GBP 30bn endowment trust, launched a bid for Urban & Civic that recognised the net asset value as the benchmark on which to base the offer price. The stock of Urban & Civic shot up by 72%, and its discount to net asset value disappeared overnight. Is Capital & Counties next? There certainly is a lot of international interest in prime real estate in Britain. The UK market for real estate holdings has recently seen KKR, the US private equity group, build a 5.4% stake in Great Portland Estates (ISIN GB00BF5H9P87). Brookfields, the Canadian private equity giant, has built a 9% stake in British Land (ISIN GB0001367019), arguably one of the bellwethers among British real estate holdings. A smaller, more specialised real estate holding is RDI REIT (ISIN IM00BH3JLY32), which trades over 40% below its net asset value because hotels and serviced offices are out of favour for now. Starwood, the hotel group, purchased a 29% stake in the company in June 2020. Will a full-blown bid come next? The stock price is currently trading lower than the GBp 95 per share that Starwood was happy to pay for its initial stake. Such are the opportunities in the UK market right now!

Ready-made research on 3 British takeover opportunities

As said earlier, the ideas listed out above are just that – ideas that warrant further research by those who want to do some truffle-hunting on the UK market. I have taken a lot of inspiration from an even longer list published by the British brokerage firm, Peel Hunt. There is a lot to discover on the London Stock Exchange if you are willing to put in the hours and do research yourself.

However, there are three opportunities that I have researched to a higher degree. Undervalued-Shares.com Members will have come across them already, as they've all been featured in in-depth research reports that are part of their annual Membership package. Even so, I recommend you check back on them!

Capital & Counties is a company that is worth another look. My Members will find several updates about it in their account and another update is coming their way within the next few days.

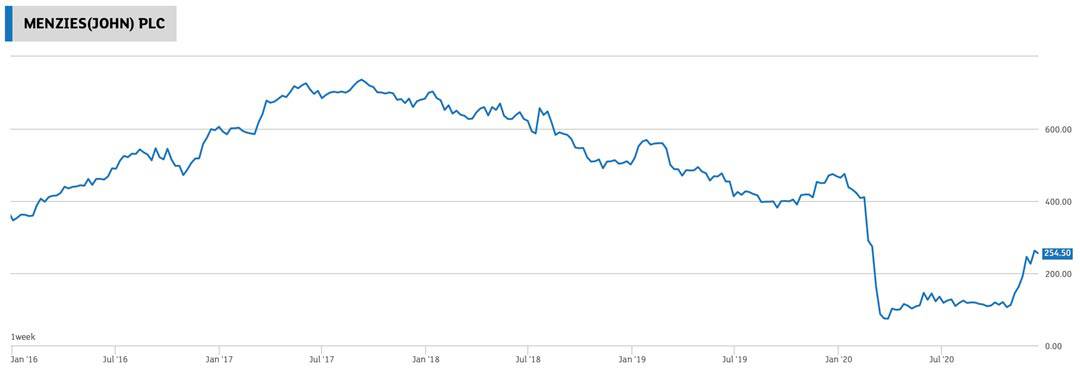

John Menzies (ISIN GB0005790059) is another case where I had the right idea but at the wrong time. The company is one of the world market leaders in servicing airlines at airports, and it should have already been taken out by a bid from private equity players. However, just as a bid appeared to be imminent, the pandemic brought aviation to a standstill, and Menzies' share price plummeted. As my Members already know from my 2 December 2020 update, now could be an even better prospect than ever for a bid. I’d expect a bidder to have to pay at least double its current share price – in line with what I said about the staggeringly high premiums paid for British companies right now.

Last but not least, I featured Just Eat Takeaway.com (ISIN NL0012015705) in a 43-page research report last week. The company is half British (Just Eat) and half Dutch (Takeaway.com). As I reveal exclusively in my report, there is a non-negligible chance that the company could receive a surprise hostile bid.

As these three examples show, checking out some of my older reports can be worthwhile (Undervalued-Shares.com Members automatically have access to my entire archive of reports).

Or, if you prefer, simply take inspiration from my free Weekly Dispatches. As this column shows, I deliver a lot of information that you’d be hard-pressed to find elsewhere. Or at least, I give it my best shot every week!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get 2021 off to a good start...

... with one of my most exclusive reports!

I'm hot on the heels of yet another promising investment idea. It's an opportunity too good not to share, but one that has less liquid trading - which is why it's reserved for my Lifetime Members only.

Do you want in?

It's as simple as signing up for an Undervalued-Shares.com Lifetime Membership.

Lifetime Memberships are USD 999 – one/off. One payment, that's it.

In return, you'll not only get my latest discovery. There's a lot more to it!