To name just a few:

- The Western world has entered a phase of unlimited money printing on autopilot.

- Joe Biden will be the first president in modern history who has not explicitly stated a goal of reducing the national debt.

- The International Monetary Fund, “Davos Man” and the Financial Times are openly calling for a “Great Reset”.

An increasing number of investors are worried about a debasement of fiat currency, debt jubilees that will impoverish bond investors, and a one-off wealth tax that was last seen in Germany after the Second World War.

In times like these, the world’s oldest monetary metal seems like an apparent safe haven indeed. Putting 1% of your money in gold as an insurance policy seems like an increasingly wise bet, even if you have only minor worries about the factors mentioned above.

It’s no surprise that the price for the yellow metal has risen over these past few years. In July 2020, it breached the USD 2,000 mark for the first time. At a price of currently USD 1,907 per ounce, it’s not too far off its previous record. With “digital gold” (Bitcoin) already going wild because of fears over the world’s monetary system, it’s probably only a matter of time before gold reaches a new record high sometime in 2021.

The question is, how best to profit from it?

A relatively obscure, small part of the gold sector could yield some fantastic profits.

Junior mining stocks are a bombed-out asset class that has long been shunned by most investors. However, it could soon benefit from a change in market dynamics that you are unlikely to have read about anywhere else yet.

The significance of Warren Buffett becoming a gold mining convert

Interest rates are likely to remain low, which is why investors will continue to hunt for yield. Reprieve from ultra-low interest rates could come from sectors that may sound surprising because they have been out of favour for a long time. Energy, commodities, and large gold mines may become sought-after yield plays over the coming year. Many of these companies have strong cash flow prospects, but their stock prices do not yet reflect their ability to generate cash for shareholders.

One of the best indicators for what’s likely to happen is Warren Buffett.

Notably, Buffett is anything but a gold bug. He previously summed up his rather dim view of the world's obsession with gold by saying the following:

“It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Nevertheless, Buffett's investment holding, Berkshire Hathaway (ISIN US0846707026), recently scooped up USD 500m worth of shares of Barrick Gold (ISIN CA0679011084), the world’s largest gold mining company.

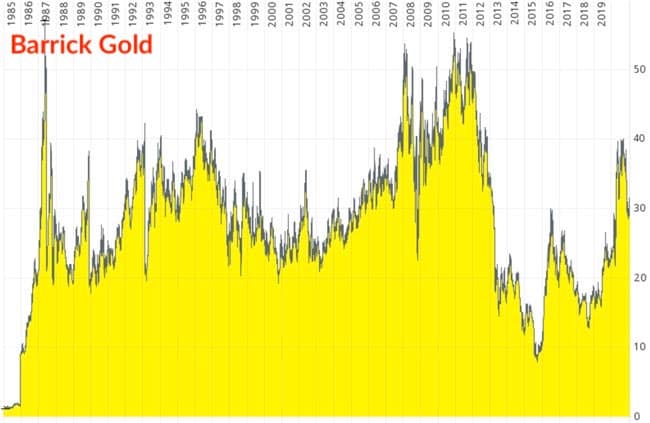

The stock price of Barrick Gold has not gone anywhere since 1986. That’s 34 years without shareholders making money (although the stock has fluctuated wildly during these years).

Why would the world’s most famous investor put money into an investment that has been a lame duck for decades?

Buffett will have bought it for the same reason he has always bought investments in the past.

Free cash flow!

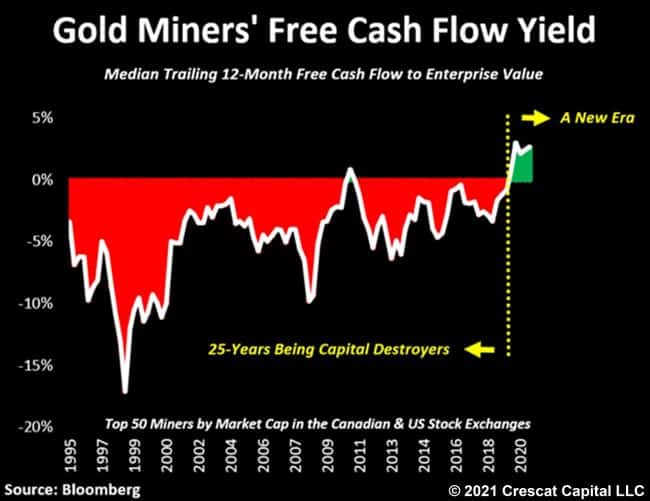

For the first time in a generation, the world’s largest gold mining companies have a positive free cash flow yield.

This fact is so remarkable that it cannot be overstated. Since 1995, the gold mining sector as a whole hasn't yielded any cash for its backers. Low gold prices, excessive costs and ongoing expensive investments in further gold exploration have turned gold mining into a sector that destroyed shareholder value.

Notably, Buffett invested in a large gold mining company rather than physical gold.

He is after the cash flow. Needless to say, if the gold price keeps rising, so will the cash flow of mining companies. The production costs stay the same, after all.

The company that Buffett has invested in has one major problem to resolve, though.

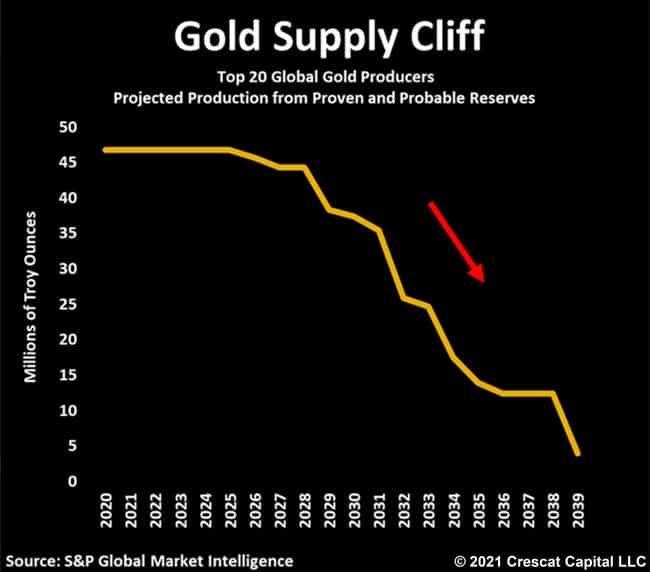

Unless it finds a way to increase its reserves in the ground, the party will not last. The world’s largest mining companies are running out of gold to mine.

Here is what you need to know about this essential aspect, and how it will inevitably lead to growing interest in small gold exploration companies.

The coming gold supply cliff

Companies that are mining natural resources need to explore for new resources continuously, else they eventually run out of reserves.

The decade-long underinvestment in finding new gold resources has started to catch up with the industry. The top 20 gold producers have kept mining their existing reserves without investing enough in replacing them. From the mid-2020s onwards, the world’s largest gold mining companies will see their reserve figures fall off a cliff. These companies face going out of business because they won’t have any more gold reserves left to mine, as this chart by Crescat Capital shows.

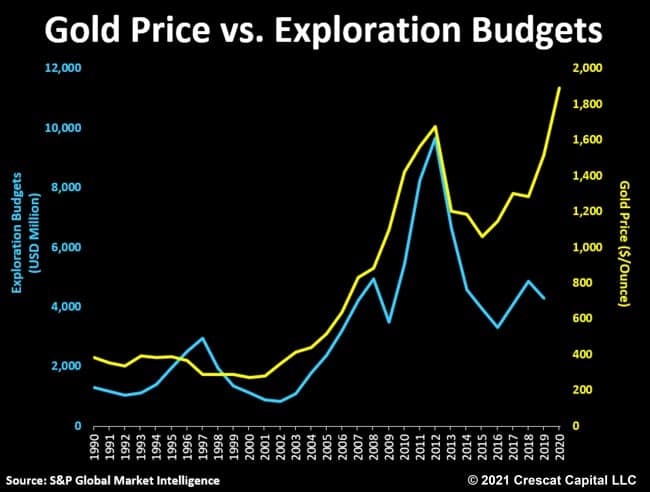

The gold price has been rising since 2014, but that did not lead to an immediate uptick in investment for finding new reserves. The market was slow to catch up. At a time when the stocks of Apple, Facebook and Google provided stunning returns, the idea of investing money in gold exploration simply didn’t appeal to the investing public. The sector was ignored, and any gold exploration company still in business had to work double hard to raise additional funds to survive and keep exploring. The trend towards so-called ESG investing also didn’t favour the idea of putting money into ripping gold out of the earth, which further hindered investment.

The result?

There has been a remarkable, eight-year divergence between the gold price (rising) and gold exploration budgets (stagnant on a low level).

Large gold mining companies would usually invest in either exploration or (more likely) buying up small exploration companies once they have struck a rich vein. Over the past decade, however, the large gold mining companies have been reluctant to invest in either. That’s why they are now facing a gold reserve cliff, and also produce a positive free cash flow yield for the first time since 1995.

The good news is, ample cash flow can be used to resolve problems.

Large mining companies simply need to go back to doing what they have done historically, i.e. buy up smaller exploration companies once they have discovered significant, verifiable gold reserves.

Enter, the coming bidding wars for successful gold exploration companies – which the market is now starting to wake up to.

Big companies will soon start buying up smaller exploration companies

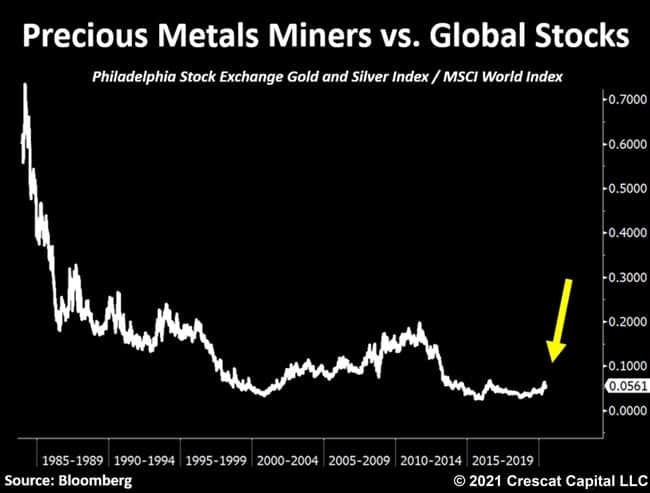

Gold mining stocks entered a persistent bear market that started in 2012 and lasted into 2019. Had you invested in the more speculative junior mining companies (= those that are still looking for or producing gold on a small scale), you probably would have lost 80% or 90% of your money over the past eight years.

2020 brought a reversal. Many junior mining stocks rallied, even though they had long been considered the gold sector’s spiffy end and too toxic for anyone to touch. Quite a few of these smaller companies have already seen their stock price multiply from their low points. They generally remain far off their highs from a decade ago, though.

As just one example of money, check out the short- and long-term charts of Eloro Resources (ISIN CA2899003008), a Canadian company hunting for gold in South America.

Over the past nine months, its stock is up 1,000%.

Though if you check back to its long-term performance, it is still 95% lower than its historical record high.

You could find countless such examples in all sorts of variations - or at least charts for those companies that haven't gone bankrupt. The past decade has seen small gold mining companies and explorers keel over in large numbers because investors weren’t willing to subsidise their ongoing losses anymore.

Add the different factors we just looked at together, and you’ve got the following constellation:

- A rising gold price, with more to come thanks to “Quantitative Easing Forever”.

- Large mining companies are running out of reserves to mine, but they are flush with cash.

- Gold exploration companies are still trading near record-low valuations.

It’s not difficult to see what will come next.

As a very worthwhile January 2021 presentation put together by Crescat Capital concludes:

“The majors will be flush with cash to buy the deeply undervalued juniors for their much-needed mineral resources.”

Record-low valuations, on the one hand, and buyers with plenty of cash and a strategic need to buy on the other hand.

That’s what I call an exciting investment opportunity to dig into!

But it gets even better than that.

A potential wall of investor money hitting a tiny sector

Once a sector has gone through a depression-style downturn, the subsequent recovery is usually all the more potent.

Commodity markets are famous for being highly cyclical. It’s feast or famine.

The reason why there could soon be a feast for shareholders of gold exploration companies will become clear if you consider the following facts. I am not a gold bug either, but I can spot an industry with great metrics:

- Of all business sectors represented on the stock market, gold mining companies have the cleanest balance sheet, thanks to the seven-year bear market they had to endure. When gold fell from USD 1,920 to USD 1,050 per ounce, financial discipline was restored throughout the sector and the survivors emerged with lean operations. What debt they do have was often provided not by banks, but by private equity companies that were happy to lend against future cash flow. Financing provided by private equity is less fickle than bank lending. It’s now a rock-solid sector to invest in.

- Apple Inc. alone is worth three times as much as the entire precious metal industry (gold, silver and others). Put another way, even if a relatively small number of investors start to redirect some of their money towards gold mining stocks, it’ll lead to violent reactions. Gold may yet see something similar to Bitcoin recently. All the world’s outstanding Bitcoin are currently worth USD 0.7tr (based on a price of USD 41,000), whereas the gold available on the investment market is worth around USD 2.5tr. The entire existing gold available for investment purposes is only worth a tad more than Apple, which has a market cap of USD 2.2tr.

- The sector of small gold producers and exploration companies is still trading 50% off its peak from ten years ago. In other words, it’s still early into the new cycle. Some gold exploration stocks are trading at a quarter or a third of the price they’d fetch if a large gold mining company made a bid for them. Buying at a low price remains the best way to minimise risks and maximise your chance for a good payoff.

Once the world starts to warm up to gold again, the resulting new cycle could go further and higher than we’d currently expect. Do keep in mind that gold is the world’s best-known and most-loved metal. It is the world’s #1 monetary metal, its role as an insurance policy against crisis has been established for thousands of years, and it is among the most supply-constrained resources on the planet. It doesn’t have the built-in finite supply of Bitcoin, but it’s difficult to procure in large amounts, and it takes years to ramp up supply. Each year, the stock of available gold above ground increases by only 1% to 2%.

Bitcoin has already reached USD 41,000 because investors the world over are worrying about the endless printing of fiat currency. This trend is probably driven by a remarkable number of young(er) investors who worry about their long-term financial fate. Among other reasons to invest in Bitcoin, there is the aspect of buying an insurance policy.

Gold is unlikely to ever catch up with the pace of Bitcoin, but it doesn’t even need to rise that fast to produce stellar returns for the investors of mining companies. If the gold production of a mining company has a break-even point of USD 800 per ounce, then an increase in gold price from currently USD 1,900 to USD 3,000 doubles the profit margin of that mine. Gold mining stocks are gold investments with built-in leverage. There are historical, long-term statistics about gold mining stocks outperforming the gold price during bull markets. For example, in the current gold bull market which started in 2015, gold mining stocks have so far increased 182%, which is more than double the 78% increase of the gold price itself.

If you buy at a bombed-out price that does not even reflect the real underlying value of the proven reserves, the stock effectively has a double-leverage built into it:

- First, it needs to catch up with its higher intrinsic value.

- If the gold price keeps rising, its intrinsic value will go up further.

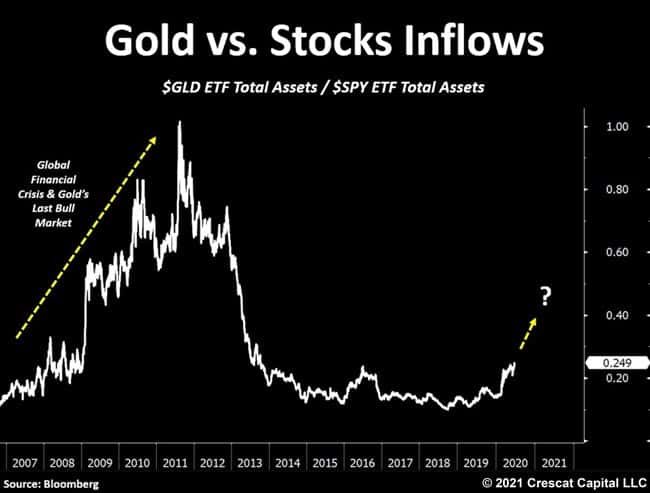

There are plenty of advantageous fundamental factors about the gold and gold mining market, and the increasing doubts about the long-term viability of fiat currency are now making investors pay more attention to them again. Last year, the inflows of investor money into gold already started to rise. However, they did not even get anywhere near the level of investor interest that we've seen during the 2008 financial crisis – at least not yet.

Let’s also be clear, however, that investing in gold is a polarising affair. There is also a lot of ideology attached to gold, ranging from a general distrust in the political establishment (which I am firmly signed up to) to beliefs that the world is governed by a secret cabal run by the Rothschilds (when in reality it’s definitely the lizard people!). It’s undoubtedly an emotive subject.

However, what cannot be argued with are figures about reserves, cash flow, and growing inflows from investors. For investor interest to continue to grow, it may only take a further increase in prices combined with a handful of high-profile investors joining Warren Buffett by placing bets on gold. Buffett’s investment in Barrick Gold has already made other investors dig around the long-forgotten sector. Whereas Buffett preferred a large mining company, other investors will pursue different parts of the gold investment sector, depending on what they deem fits their investment goals.

Needless to say, I have also done some digging – no pun intended.

To multiply your money, check out junior mining stocks that are M&A targets

On the one hand, it would be easy to follow Buffett’s lead and invest in Barrick Gold. That’d be a bet on cash flow, first and foremost. Buffett likes cash flow yield, and he has spotted a company that is undervalued relative to the amount of cash that it will likely generate over the coming years.

However, I find these large-caps relatively dull compared to the opportunities offered among gold exploration companies.

I like to benefit from situations where large, cash-rich companies are forced to issue takeover bids for smaller companies. Large gold mining companies will be under increasing pressure to demonstrate to investors that they are not going to run out of reserves in the latter part of the 2020s or early-2030s. Historically, the answer to dwindling reserves has been to purchase gold exploration companies once they have struck significant, verifiable gold reserves.

Combine the vast financial firepower of the world’s largest gold mining companies with bombed-out valuations of junior mining stocks, and you are onto something that could multiply your investment in a relatively short time. A rising gold price will then merely be a bonus.

Tempting as these fundamentals are, it needs to be said clearly that junior mining stocks are an opaque and risky sector.

Most gold explorers end up finding nothing, or their finds are not sufficiently large to ever warrant entering production.

Never mind the rampant fraud that the industry is known for. As the old joke goes, a gold exploration project is a hole in the ground with a fraudster next to it.

Usually, I am rather reluctant to dip my toes into this sector.

But there is always a case that warrants an exception.

I have filtered out an outstanding junior mining stock

There is one junior mining company that I have been following for over 12 years.

Because of a couple of factors specific to this one company, I believe it’s one to invest in. Put another way, it’s a company that I am comfortable sticking my name to.

Its stock could probably go up by 200% over the coming 12 to 18 months, or more if the gold price keeps rising.

It’s easy to trade because it’s listed on one of the world’s largest stock markets.

It does, however, have limited trading liquidity. It’s not an absolute minnow of a company, but I wouldn’t want to feature it too broadly because that could create a bottleneck effect in the market.

Which is why this opportunity - my very first report about a gold-related investment opportunity - is reserved for my Lifetime Members. Lifetime Members are just a small set of my readers, and thus the perfect audience for companies that have less trading liquidity.

If you want to secure receiving the report the minute it's released (pencilled in for next week!), I recommend you sign up now if you haven't already (or upgrade your existing Annual Membership and have unused Membership fees deducted from the price).

I may well end up preparing an extensive report about gold for my regular Members. It’s something that I am currently mulling over. Plus, there'll be more reporting about the opportunities in the gold sector in my Weekly Dispatches this year.

For now, though, next week's report will be the best opportunity that I can offer you. It's yours for the taking!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

There's more to my Lifetime Membership...

Next week's report is just one of 4 additional investment opportunities (sourced from small- and mid-caps) that are shared exclusively with Lifetime Members every year.

It's an interesting group to be in, and I've got plenty of good stuff coming its way in 2021!

Lifetime Memberships are USD 999 – one/off. One payment, that's it.