Image by kovop58 / Shutterstock.com

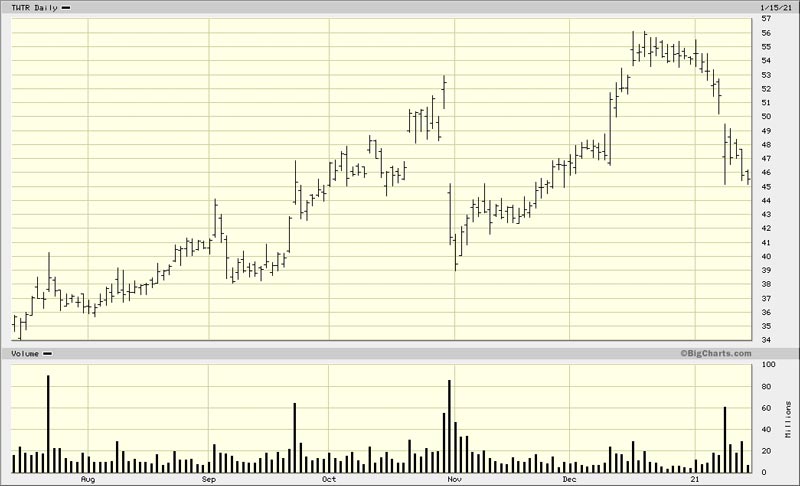

On 20 November 2020, I published an extensive report on Twitter.

In the report, I predicted:

"Could Twitter stock drop 5% to 10% if or when Trump's account gets deleted by Jack Dorsey? It probably could."

It was the most predictable move ever. Dorsey and the entire tech establishment had been gagging to ban Trump for the past four years.

I expected it to happen on 21 January, but it happened two weeks earlier, and the drop turned out to be 15%. What I didn't foresee were riots in the Capitol on 6 January, which made the move come earlier and cause bigger waves.

Still, it wasn't a surprise move. I had already predicted this was coming, and recommended Twitter stock regardless.

Where is the logic in that?

Politics aside and looking at it purely from a financial point of view, Trump's ban will turn out a good move for shareholders. In six months, it'll be evident to everyone. Here is why.

Censorship on Twitter is nothing new

In case you wonder, I am far from endorsing banning Trump (or anyone else, for that matter) from Twitter. I've been super-critical of web censorship since 2015, long before most people even had the issue on their radar.

Silicon Valley platforms started muffling certain voices and viewpoints as far back as five years.

They did it using the oldest trick from the playbook of politics and censorship. Start with widely disliked fringe groups to establish the policies and procedures. Then gradually widen their application.

The first cases to get thrown off the platform were folks who were widely disliked and a bit too edgy for most people – the Alex Jones' and Milo Yiannopoulos' of this world. After that, the catchment area was increased.

If you followed Twitter and other tech platforms over the past years, it was obvious that they were pursuing an ongoing effort to ban certain voices and narratives. Trump was the ultimate prize they sought to silence, but couldn't get to just yet. Instead, they gradually shadow-banned, demonetised and cancelled hundreds (if not thousands) of other significant content creators. Yes, there was a political angle to it. It has been totally obvious from the get-go.

You can find lots of issues with that. In its 2013 IPO document, Twitter pledged to enable "any voice to echo around the world instantly and unfiltered".

Never mind the US constitution's First Amendment, or trying to maximise your user numbers.

I have been so critical of these developments from so early on that I stopped or at least minimised using these platforms in 2017. My website doesn't have social media channels, and I mostly use DuckDuckGo instead of Google. Once censorship is allowed to start, it only ever expands. It wouldn't surprise me if criticism of central banks or praise of crypto assets got similarly banned one day. I never liked the idea of some kid from California having influence over what I can say to my audience.

Still, I don't see any of this standing in the way of Twitter – as a company and an investment – coming out ahead with this strategy. The company has already proven as much over the past years, even if few people realise that right now.

Here are three reasons why Twitter stock will be a lot higher in six to twelve months.

1. (Many) corporate advertisers will love it

Anyone claiming that Twitter is a trash platform or doesn't know what it's doing hasn't looked at the company's cash flow figures.

Twitter has had its issues, but it's currently on track to deliver an annualised cash flow of around USD 1bn. This isn't a dying business, but a cash cow.

Show me a Twitter critic, and I'll show you a company that has been growing the profitability of its online advertisement business by leaps and bounds.

During these past years of ever-increasing censorship and many large-scale users getting kicked off the platform, Twitter has gained advertising clients.

Right now, two-thirds of American companies with more than 100 employees use Twitter for advertising. Rightly or wrongly, many corporate advertisers appreciate the platform censoring certain voices.

Wait for Twitter to experience another increase in corporate advertising spending. Some decision-makers in "woke" corporate America are likely to increase their spending on Twitter's advertising products to signal their alignment with Twitter's political stance.

Given the company's economies of scale, much of that will go straight to the bottom line.

2. User numbers – lose some, win some

There will not even be a problem with a massive, sustained drop-off of users.

A few million Trump supporters left Twitter to join alternative platforms such as Parler or Gab.

The tech establishment has since managed to close down Parler (probably permanently). Gab currently has an estimated 10m to 20m users, or about 10% of Twitter's user base. It doesn't offer anywhere near the breadth of Twitter's content and global connectivity.

Also, don't forget that a significant percentage of the younger generation has proven leery of free speech and in favour of censoring content even if it just might hurt someone's feelings. For some, Twitter will have only become more attractive.

Lose a Trump supporter, win a liberal US college student?

With Parler closed down and Gab very limited in scope, I would even expect quite a few departed users to come back.

At the end of the day, what Twitter has done is similar to the strategy pursued by most media firms. Identify your target group and focus on keeping them happy.

The Guardian, the Daily Mail and The New York Times are so successful not because they focus on objectively reporting news, but because they cater to certain worldviews. Call them echo chambers of activist platforms – it's a business model that works.

Twitter remains the highly addictive, globally accepted social media platform that gives anyone access to world-leading experts and global leaders. From a technology point of view, what Twitter does is pretty trivial. Still, even bigger, better-established firms that tried to kill Twitter with technologically superior products have failed utterly.

Instead, Twitter gradually increased its cash flow and its base of advertising clients. The management's strategy is controversial, but it turned the company around since Dorsey took over the mess that his predecessor had left behind.

Speaking of management…

3. Dorsey can finally go

In my November 2020 report, I laid how and why Twitter's CEO, Jack Dorsey, is likely to be replaced in spring 2021.

Dorsey has achieved some great things during his second term as CEO of Twitter, but he is also a liability in many ways. It starts with the fact that he is the CEO of two major, publicly-listed companies. For a company facing the challenges and opportunities that Twitter has ahead of itself, you need a full-time CEO.

Elliott Management, the world's largest activist hedge fund with USD 30bn of client assets, purchased a USD 1bn stake in Twitter in early 2020 (at around the current price level).

Following their investment, Silver Lake Capital placed a USD 1bn investment in Twitter. Silver Lake is one of the world's most experienced private equity investors in the tech space.

Fun fact: the founder of Elliott Management, Paul Singer, is a major Republican donor and outspoken Trump supporter.

Would anyone think that Singer didn't see all of this coming, or that he wouldn't use his stake to interfere if he felt it was bad for Twitter's business?

His primary focus is to eventually replace Dorsey with someone who takes the company to the next level. The controversial Twitter CEO has now achieved the one account closure that he had been after for years, and he'll soon ride off into the sunset.

With a new CEO at the helm, Twitter will be starting to aggressively pursue a few new strands of income. Watch out for the launch of subscription-based add-on services, whose income will go straight to the bottom line.

I described all this in more detail in my report.

A blessing for anyone wanting to load up at low prices

Twitter stock is, obviously, a heavily politicised subject.

There'll be those who are angry with the company's policy, and they have my sympathy since I never supported the restriction of free speech.

Still, I can separate politics from investing.

If The Guardian was publicly-listed and a good investment, I'd buy it.

What Undervalued-Shares.com is interested in is finding opportunities for buying low and selling high.

Twitter is the cheapest major company among online advertising platforms, and it has massive growth potential over the coming years.

Two of the world's best investors have placed USD 1bn bets (!) on Twitter and joined the board to actively shape the company's strategy. I pay more attention to these two mega-investors' actions than to disgruntled users who should have seen all this coming (including Trump, who should have set up alternative channels years ago but disregarded any such advice).

Much more important than the closure of a few accounts is a legal deadline that Twitter shareholders have coming up shortly.

March 2021 will see the expiration of a standstill agreement between Elliott Management and its co-investor Silver Lake on the one hand, and Twitter on the other hand.

The market's focus will soon shift again because this deadline should see massive changes at Twitter.

Think change in leadership, pursuing a range of low-hanging fruit for further improving cash flow, and establishing a new investment narrative around Twitter stock.

E.g., Twitter is now home to the fast-growing "FinTwit" community where investors hang out. This is a large group of often high-net-worth individuals who are using the platform actively. Nothing much has been done yet to properly monetise this group. That will change, and it will have a significant effect on Twitter's earnings. It will also make for a story that excites equity investors.

With all that in mind, I stick to my guns regarding Twitter.

In a few months, the current bout of weakness should have turned out a good buying opportunity.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Missed my report on Twitter?

It's still yours for the taking! My original investment thesis remains valid, and there's probably never been a better time to load up on Twitter stock.

Follow me as I take a look behind the scenes, and uncover the vast growth potential of Twitter 2.0.