Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Blogs to watch (part 16): Bankless

Never before since the Second World War has there been such widespread worry about the value of money (or more precisely, the value of money potentially being impaired). There is a growing debate about the structural weaknesses inherent to so-called fiat currency, and how blockchain technology, decentralised banking and cryptocurrencies could radically change not just the financial industry but the entire monetary system.

What is it all about, why should you care, and what's the best way to learn more about it?

This blog review gives a few starting points to help you answer these questions.

The growing debate about the future of money

Until a few years ago, using the term "fiat currency" would have made people perceive you as a conspiracy theory nutcase.

How things have changed.

Suddenly, everyone seems to use fiat currency to describe the fragility of our monetary system. The term has entered the common language.

Fiat currency describes money that is backed by nothing more than a promise issued by a government, mostly through a government-owned central bank. The Latin term fiat indicates that it is money issued by order of the government, instead of money based on the scarcity value of a monetary precious metal such as gold. It's "paper money" as we know it, and it's the kind of money that central banks are currently printing by the trillions.

Of all the dollars in existence, 18% were printed in 2020 alone. A similar situation applies to the euro. Central bankers and politicians currently seem to live by the motto "A trillion here, a trillion there, what difference does it make?"

Thanks to Zimbabwe and Venezuela, everyone knows what it leads to if ever more money is printed. Politicians and central bankers claim that it's all different now because they are experts and know what they are doing. You know, Modern Monetary Theory (MMT) and all that jazz. Who trusts them, though? If they were trustworthy, responsible experts, why did their own systems allow them to run up record levels of debt in the first place? True experts would have delivered fiscal responsibility, instead of the orgy of debt that the world has experienced over the past 40 years. It's no surprise that investors and savers are starting to get worried about the long-term value of their savings.

Some even say the current stock market rally is the first sign of investors fleeing from fiat currency. If you believe there'll be a financial reset of some kind, what would you rather own – dollar notes or overpriced Microsoft stock? After a financial reset, Microsoft should still be around as a profitable company. The stock may be overvalued now, but as a shareholder of Microsoft, you are almost guaranteed not to end up as poor as a church mouse if the financial system is reset. Divesting fiat currency and buying productive or scarce assets at high prices are anything but irrational if you are worried about such scenarios.

This question has severe ramifications on stock market valuations. If liquidity is used to purchase real assets out of fear, then the valuation of the real assets you purchase matters a lot less than during normal times.

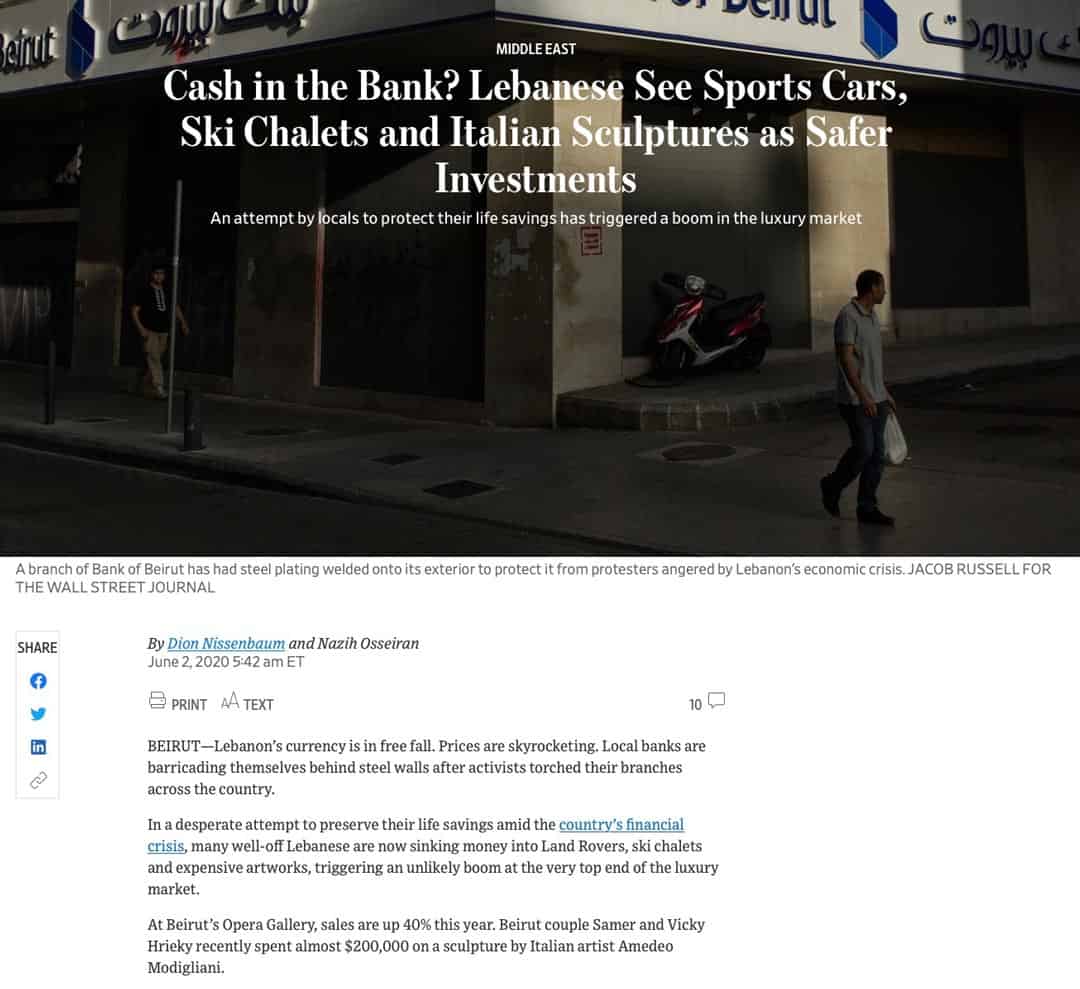

To read about a classic "melt-up boom", look no further than this June 2020 article from the Wall Street Journal.

Another alternative is, of course, to leave the current financial system altogether.

In the past, this meant buying physical gold and silver, the world's most well-established monetary metals.

Today, there is another potential alternative.

Cryptocurrencies, blockchain and decentralised finance are terms to describe one and the same phenomenon. It's about freeing your finances from the tight grip of central banks, governments, and the large corporations that are in cahoots with them – and instead, join a new financial system that is controlled by its community and which governments cannot manipulate.

That, in essence, is the premise of the growing "DeFi" movement, decentralised finance.

If you are as confused about decentralised finance as I am but eager to catch up, then today's featured blog will be for you.

A one-stop shop for education and investment inspiration

Whenever I use the term "blog" for the websites that I feature in my monthly "Blogs to watch", I do so in the broadest of ways.

Bankless is a blog, but it's also a course and a community.

It was set up on Substack, the popular platform form for content creators and newsletter writers.

I like it for the following reasons.

1. New concepts easily explained

When was the last time someone advised you to "regain your financial sovereignty by leaving behind the world of central banks"?

In the "open money system", no one requires banks anymore. They'll become as outdated as going to a travel agency to book a flight. Whether it's paying, saving, borrowing, lending, or investing – in the world of decentralised finance, you probably won't need an old-fashioned bank.

How exactly that could work, is something I have recently been eager to learn more about. Not the least as it's totally outside my comfort zone.

To get a flavour how Bankless explains such subjects, you should read their free article "DeFi will do to banks what the Internet did to newspapers".

Not that this would be the only article on the website, but it's one that I thought perfectly illustrates why it's worthwhile to follow the subject.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

2. Top-notch presentation

If or when I beef up the educational content on Undervalued-Shares.com, I'll use Bankless as one of my benchmarks.

The website's multiple authors are doing an outstanding job presenting their content. Their use of language, the visuals added to it, and the overall structure are exceptional. You can also choose between audio learning and reading.

You can check it all out by watching this nine-minute video.

3. Learn a bit each week

The content provided by Bankless is structured in a way that helps increase your knowledge every week, without overwhelming you.

You can see the structure and timing of their content using this link to "About us".

An investment opportunity like the Internet in the 1990s?

For most of us, so-called open finance is akin to the Wild West.

It appears exciting but also dangerous, and no one provides you with a map.

There could be excellent opportunities for investment. Some say that investing in decentralised finance is akin to buying Internet domains in the 1990s. Back then, a student bought porno.com for USD 4,200, sold it a week later for USD 42,000, only to watch it getting sold again for nearly USD 9m in 2015. That was after the owner had already earned USD 10m off the site by redirecting it to other websites. Over 18 years, the owner has made over 400 times his money.

You can strike gold in the Wild West if you are the first to discover a new vein. You can also lose your shirt if you don't know how to navigate the landscape.

Bankless is the best product I have found so far to help you to get your head around decentralised finance. It does require dedication and ongoing reading (or listening) because you get sent an email every day. It's a fairly extensive subject matter and one that evolves and grows with every day that passes. However, provided you have some interest in the subject, the content will quickly suck you into its vortex and make you read up even more than your recommended daily dose.

Parts of the website are for free, and the full course is an affordable USD 12 per month (about EUR 10).

If the dollar or the euro becomes worthless, you better spend them on your education quickly. That way, you will be prepared for what's waiting on the other side. It might help you to one day be rich in cryptoassets, and not have lost your savings through fiat currency.

A sneak preview of the massive content available to paying subscribers.

And in any case, this is a fun, exciting topic to delve into. I am amazed that the Bankless website hasn’t been discovered by hundreds of thousands of readers yet. It shows that we are still early into this trend, which makes it so worthwhile to educate yourself.

Porn.com, USD 42,000 and all that – the early bird catches the worm!

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Not convinced (yet)?

If decentralised finance isn't your thing, fair enough.

You can still escape the current financial system. Gold to the rescue!

There's a lot of pent-up demand for M&A in the gold sector, and now is the time to find the right candidates for those looming takeover bids.

My very latest report introduces you to one such candidate - a junior mining stock that has spent over a decade exploring, developing and de-risking a gold field.

Even if no bid occurs for the company, you will have bought a cash-generating mining operation at a bargain price – not to be sniffed at either, since it'll spit out dividends.

If you haven't checked out my report yet, I highly recommend you do so soon.