The decision seemed mad in the eyes of friends and colleagues. The small island that I call home, Sark, had no coronavirus restrictions up to that point. No masks, no social distancing, and restaurants were open as usual. London, on the other hand, was destined to head into a renewed, even harder lockdown.

Why leave such an unspoilt paradise to fly into the eye of the storm?

Curiosity had gotten the better of me.

London is one of the world's leading financial centres. If you want to easily meet many movers and shakers in one place, London is one of your go-to destinations.

It's also the capital of "Brexit Britain", the only European country that decided to undergo the experiment of extricating itself from the European Union.

Last but not least, it's by far Western Europe's largest city. It matters through its sheer economic weight.

London is always worth a visit during normal times, and a fascinating place at this particular (and peculiar) point in time.

Various questions bounced around my head when I took the half-hour plane from Guernsey to the UK mainland:

- London's financial market is just as affected by the pandemic as all other financial centres. However, it also has a centuries-long history of shaking off crises and pursuing new, often surprising opportunities very quickly. Where would these new opportunities emerge this time?

- Year-end 2020 would be the definitive end of the Brexit transition period, and all the real-life consequences of Brexit were finally going to happen. How would that look like? Would flesh-eating bacteria rain from the sky on 1 January 2021? I did pack an umbrella, just in case.

- After eight months of repeated lockdowns and ongoing restrictions, London's population had grown weary, and some sectors of the economy were on the brink of running out of reserves. Would a new period of even tougher lockdowns push parts of the economy over the edge, and get people to revolt? If so, in what ways could it affect financial markets? Might there be valuable assets to be found among the ensuing wreckage?

Given my interest in unusual situations and crisis investing, how could I have resisted taking a firsthand look at it all? By going out into the real world to meet people and look at places, you pick up on new trends and exciting investments.

I decided to base myself in Central London for a full two months. Following last year's travel restrictions, I had barely tapped into my annual allowance of spending 89 days in the UK without becoming a tax resident – and I wanted to use those days before the end of the UK tax year in early April.

My Airbnb rental in Notting Hill was 50% off, given the current lack of tourists. Right now, no one can complain that visiting London was oh so expensive.

My temporary pad came with brilliant rooftop views to inspire my research and writing.

Indeed, what I've seen and experienced just had to be written down. So many of my own impressions were different from the mainstream media reporting that I felt a need to preserve some of my observations and conclusions for posterity.

It's just one man's observations, though, and as such, totally subjective and biased.

However, if others followed my example, it could all make for insightful reading for later generations. Future historians won't just get to read the history written by the victors, but a broad spectrum of records left behind by anyone who could put pen to paper (or send a tweet).

Checking the difference between media reporting and reality

Mainstream media reporting influences everything:

- Consumers' buying decisions.

- Votes filed in elections.

- Even the movement of stock prices, at least in the short term.

Over the past few years, I have been fascinated by how the reality projected by much of the mainstream media seems increasingly at odds with what I see happening around me.

During my time in London, nothing illustrated that better than the Covid-related reporting surrounding Hyde Park.

As a temporary resident of Notting Hill and with all gyms in the UK closed, I ended up going running in London's best-known park almost daily.

Additionally, I visited Hyde Park countless times to meet friends or hold business meetings while walking. Many others did the same, given the current lack of choices.

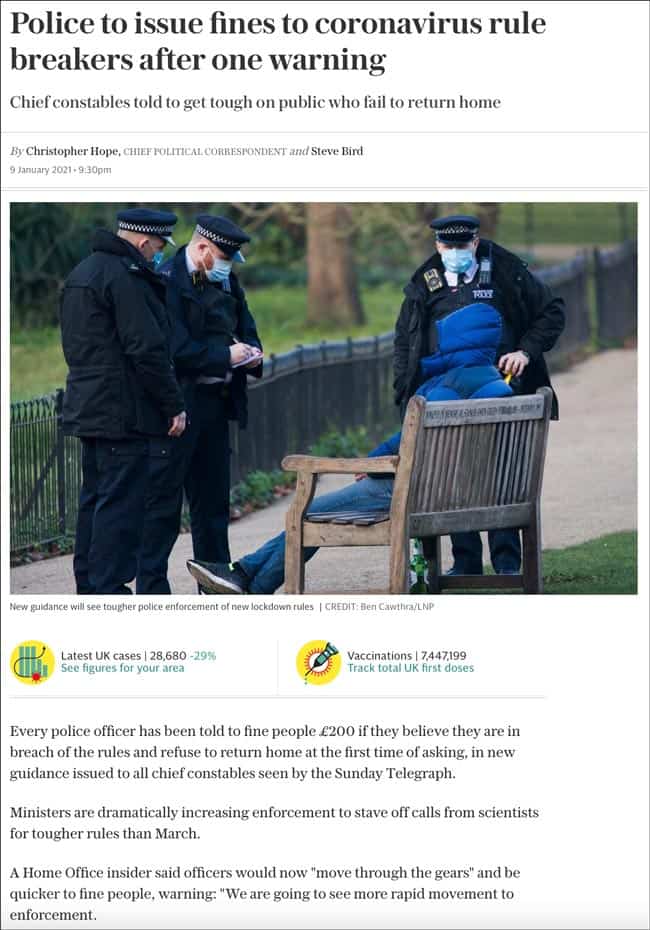

As one of London's central pandemic-era meeting point, Hyde Park was bound to be a focal point of media attention. Indeed, when restrictions were tightened yet again in early January, the media went into overdrive mode.

Park benches roped off. Police out in force. Fines handed out on the spot.

The reality on the ground?

Police have indeed had an unusually strong presence in Hyde Park ever since things got serious in early January.

However, they never seem to do anything. Despite massive crowds, large individual groups, and picnics on benches, they merely mill around (and, frankly, look a bit bored).

Was anyone scared by their presence? Not that I noticed.

ONE bench in Hyde Park was roped off. Upon closer inspection by yours truly, nothing seemed broken. Did someone actually rope off the bench for a photo opp? The mind boggles.

Bright vests and big letters, but no action – the "Covid Marshals" in Hyde Park.

On 16 January, amazing weather made Londoners come out in force, reminding me of the great wildebeest migration across the savanna. I spent several hours in Hyde Park that Saturday. Notably, the police vanished altogether. Had they been there, it would have been too obvious that they should have handed out fines en masse. I guess they wanted to spare themselves from looking a bit odd. Friends, too, asked me: "Hey, where are the coppers today?"

Not that you would have easily found out about this in the mainstream media. They kept publishing warnings of impending fines, and spewed endless headlines about restrictions and the alleged severe crackdown by the police,

Yet, several taxi drivers told me there was a silent agreement in place between the police and their trade: "Provided both the driver and passengers wear masks, the cops will never stop us. Never. If you want to get across town and not be questioned, just take a black taxi or an Uber."

I couldn't verify this statement. At least for me, taking a taxi never resulted in being asked about my legitimate reasons to be at the other end of town (for the record, I did have essential business meetings).

If such a silent agreement existed between the police and the taxi trade, would Westminster know about it? Could the government possibly not know about it given that law enforcement is part of its operations, and taxi trade one of the capital's most visible business sectors?

There was a lot that simply didn't stack up, or, at the very least, raised questions.

It does all have some real-life effects, though. The media managed to scare the living daylights out of my mum in Germany, who asked me about the "empty shelves in British supermarkets".

Empty shelves and a need for a 1948/49-style Berlin air bridge to keep the Brits from starving? (Germany's SPIEGEL magazine seriously started its article about British supermarket shelves with a reference to the air bridge of seven decades ago.)

I have been shopping across the entire range of Tesco, Sainsbury's, Waitrose, and Wholefoods, and experienced no such thing. A few days of some items missing did happen in some places, but the matter was blown out of proportion.

My mum calmed down after I told her that I had actually gained weight due to the masses of food and wine that inevitably get thrown at you when you are in London.

It's rather interesting, though, how the selection of reporting that the media serves up can lead to distorted views about the economy – which, by extension, is what interests us in terms of investments.

Surface-level reporting – and a more in-depth analysis of developments

The corporate media currently love a good headline about the retail apocalypse on Britain's high streets.

"Volcano erupts under the high street", read one article.

You can just about imagine lava flowing down Regent Street and devouring the shops in its paths.

Indeed, there is change afoot on British shopping streets. In between pandemic-related restrictions and a surge in online shopping, many shops and chains have toppled over. Walk down any major street, and you see lots of empty retail space.

I have now watched it happen firsthand, and some of it is heartbreaking.

My favourite bike shop in Notting Hill?

Evans Cycles at 106 Westbourne Grove was just opposite the Caffè Nero branch where I usually get my late-morning treat after a productive morning writing (including after finishing this missive). Often enough, I nipped into Evans Cycles to marvel at a few bikes or pick up some equipment. Sark not allowing cars and me not having a driving license, bicycle shops simply speak to me.

Suddenly – gone.

The fire sale wasn't even pre-announced. The morning after I spotted an "Everything must go" sign, workmen were clearing out the empty shelves. It was perfect fodder for the ongoing media reporting about the retail apocalypse. There is no denying, this was another empty shop on an already partially deserted shopping street. (In case you didn't know, Westbourne Grove is the throbbing heart of Notting Hill's community – the more famous Portobello Road is primarily for tourists.)

The underlying story is a bit different, though.

As I subsequently learned from industry contacts, Evans Cycles is already working to turn crisis into opportunity. The shop closure that I witnessed was not quite what I thought it was.

The chain had long had problems with generating sufficient income. Its previous management had leased stores in expensive locations, whose rents were impossible to earn back by selling bikes and fixing tires. Indeed, my local Evans Cycles was nestled between the kind of art galleries, high-end vegan restaurants and designer furniture stores that you'd expect to be in demand by the well-heeled clientele of Notting Hill. How a bicycle shop ever got into that location was a mystery.

Not all is lost, though.

The cycle shop chain was purchased by Mike Ashley, the British retail billionaire who has a knack for turning around troubled companies.

Ashley's strategy is to close down small shops in overpriced locations, and create bigger, experiential outlets elsewhere. Somewhat counter-intuitively given the current headlines, this includes city-centre locations, as the example of this upcoming multi-brand retail destination in Birmingham shows.

The death of the high street and everything moving over to Amazon? Not quite yet, and some entrepreneurs are good at spotting the opportunity early on. Mike Ashley will probably come out of this pandemic earning another fortune because the current circumstances enable him to carry out drastic changes in a short period. If Evans Cycle were a listed company, I'd take a closer look at it.

None of which is to say that e-commerce isn't going to flourish. I've also used my time in London to speak to a plethora of entrepreneurs. In amongst the stories that I picked up, I was fascinated to hear that the current effects on bricks-and-mortar retail are having a liberating effect on young brands.

As a new brand, you usually had to fight for space in high-quality retail locations to gain initial exposure to large audiences and build brand recognition. If no one knew you yet, it was obligatory to somehow get your brand into a Selfridges, a Wholefoods, or at least a high-end boutique shop on King's Road. These established bricks-and-mortar retail destinations had a stranglehold on young brands and could ask for outrageous financial conditions for the privilege of being in their physical space. You needed a lot of capital at your disposal to make it as a new brand.

With more shopping migrating online, smart young brands now have an opportunity to skip this expensive, tedious phase of brand building in established retail outlets. Instead, they can put all their focus on building an online community and maximising their digital engagement. Expensive deals aimed at getting exposure in shops? The world has – at least for now – moved on from that model.

Every time a long-established pattern is broken and the rulebooks of industries are thrown out the window, fortunes are made by those who recognise the signs of the times. In two or three years, we will read about the entrepreneurs who laid the foundation of their fortune during the pandemic, mainly through ignoring the established rules.

During my time in London, I've come across one such case which will make for a terrific investment opportunity. The company is not listed yet, and it will carry out a private placement. However, I am keeping my eyes out for listed companies that let you benefit from these seismic shifts in the world of retail. The pandemic will leave behind a lot of opportunities.

Indeed, I have already witnessed some of the first green shoots of this crisis happening right in front of my eyes.

A stone's throw away from the now empty Evans Cycle is another interesting case study. SUMI, at 157 Westbourne Grove, is a restaurant that opened in December 2020 - just a few days after the government ordered the closing of all restaurants. It's become the hip, busy meeting place of the neighbourhood on weekends.

How did they do it?

SUMI moved its food preparation to the centre of the restaurant space, where you would usually seat the patrons. It fitted its front with huge glass windows that it opens in the middle, similar in shape to a TV. The restaurant's kitchen has been turned into a display akin to a theatre stage or a reality TV cooking show. Anyone walking past will find it difficult not to stop for a moment and watch the kitchen staff's theatrics. And you will get hungry when doing so.

SUMI currently offers "Click and Collect" only, to adhere to restrictions. However, it's become a meeting place of sorts for the neighbourhood. People use the extended pavement to get there early and chat with neighbours and friends. The restaurant has installed benches for those waiting for their food. In amidst all that, patrons love watching their food getting prepared.

By now, word has spread across Notting Hill that SUMI is THE go-to place during the pandemic. Check out their Instagram account to see what you are missing out on. With fewer places to go to and no holidays to splurge on, many of my local friends have switched to spending more money on quality food and drinks. SUMI, I can report, is anything but a cheap option for take-away food. Still, it has worked around pandemic restrictions to get off to a flying start. Turn an obstacle into an opportunity, and use restrictions as the fuel that lights your fire – it's true entrepreneur style!

I have yet to see the coppers disperse the crowds gathering outside SUMI, even though police vans circle the road regularly.

Indeed, much of what's going on right now makes me wonder whether people aren't going to shove their leaders aside or even rise up in some fashion soon.

Are the 2020s gearing up to be a major turning point?

There are other local places that would have been even more interesting to report on, but I am not going to out them in an article. My writing could get them into trouble.

Based on my observations over the past four weeks, Notting Hill is a hotbed of civil disobedience.

Walk around at night and it's clear that dinner parties are happening everywhere.

Shops that one would deem "non-essential" put a box of cornflakes in the window, which suddenly makes them "essential" to be open. I am exaggerating slightly, but it's noteworthy how many shops of different varieties in Notting Hill are open despite the current restrictions.

Just the other day, I saw a boutique furniture shop elsewhere in Notting Hill throw caution in the wind and open its trade for the many passers-by on a sunny day. I guess if the threat of bankruptcy looms over you, having the cops turn up and close you down is no longer an overly daunting risk. When your life was ruined financially and you have nothing left to lose, you go all in.

Are we on the cusp of a movement towards masses of people simply not respecting the authorities anymore?

I have been following with curiosity a movement in Italy that aims to have restaurants simply reopen en masse. The idea is to open so many restaurants and get so many patrons in that the police couldn't arrest them all. The "IoApro" movement ("I am open") claims to have had 50,000 restaurants signed up. It's definitely a thing on Twitter (check out the hashtag #IoApro). What's the real situation on the ground, though?

It's hard to suss out. The British media didn't report about this development at all.

If I type "IoApro" into Google News, the seemingly intelligent auto-spell mechanism turns it into "iPad Pro" and sends me the way of Apple. Correcting the spelling or searching for "Italy restaurants resistance" did not yield a single English-language article on the first page of Google's search results.

RT did an article about it, but I was told that's all propaganda personally written by Vlad the Impaler.

I can't travel to Italy to check it out myself, because I am currently effectively imprisoned in the UK. Do I trust the mainstream media with its reporting or – equally if not even more important – its choice of subjects and what it chooses not to report about? Hell, no. Not anymore.

With a bit of effort, I found my way to the site of the Off-Guardian, a website operated by journalists that present themselves as wanting to offer an alternative to the mainstream media (and the name is a dig at The Guardian). The Off-Guardian reported on the Italian initiative, but I didn't find anything else – which makes it all the more interesting to keep following.

It's hard to know what to believe anymore, but one thing is for sure.

Scepticism towards anything and everything coming from politicians, the mainstream media, large corporations, government-related think tanks, and other members of the establishment will continue to grow. This issue could even become one of the defining developments of the 2020s.

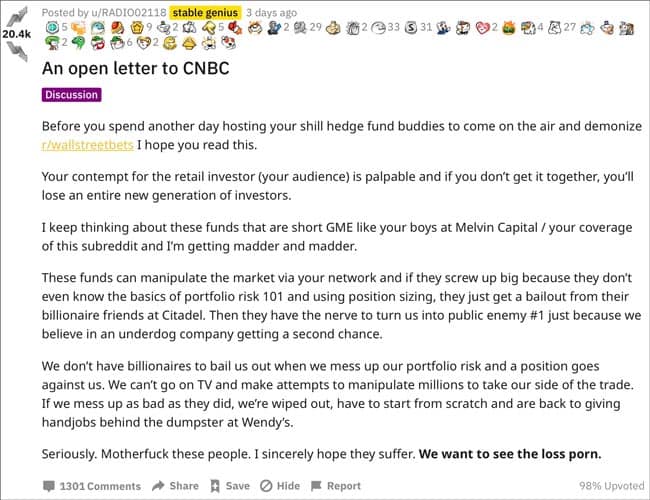

Look no further than this week's development involving the Reddit sub-group, WallStreetBets. This was probably the finance industry's no. 1 news story during the past days. In many ways, it's been a rising-up of the little guy against the establishment. The established players then worked to protect themselves, which they achieved by simply preventing private investors from placing further trades. These private investors did precisely the same thing that Wall Street has done for decades – yet they were closed down because they were good at it and cost the establishment a lot of money (billions, to be precise). They trusted one particular company – Robinhood – with its slogan of "democratising finance". Yet, when push came to shove, Robinhood sold them down the river to protect the big guys.

These events will have made millions of small-time investors wonder if the system is, indeed, rigged against them. The events of the past few days could be one of the defining moments in recent financial markets history.

It's certainly provided an outlet for a lot of people to voice their frustration over the establishment. Here is a telling, entertaining posting from Reddit, which I figured was worth preserving as a digital ephemera (hence me posting it using my Swiss server – in case Reddit gets banned and taken off the Internet by our digital overlords).

For an insightful analysis of the events, you could do worse than watch this video by The Duran, a channel created by two non-mainstream talking heads whose level-headed, long-form analysis I have loved listening to during the past few years.

I believe more such developments are just a matter of time, and their effects could be profound.

All of this is also going to have knock-on effects on investing. How you invest, what you invest in, and what new risks and opportunities you have to be aware of. Also, it will make it clear to ever-larger numbers of people that governments and other organisations don't have any power if a large enough number of people decide to take it away from them. The political, societal and economic changes resulting from such a development could be profound, and we may be lucky enough to witness them ourselves. I do expect developments along those lines to be among the defining trends of the 2020s.

The corporate/media/political establishment has been fighting back of late by banning all sorts of things. However, each time something gets banned, censored, closed down, demonetised or cancelled, their credibility sinks to a new low. These bans cost political capital, and make it ever more apparent how the system is stacked in favour of some and forever stacked against others. Despite the mixed outcomes of various recent political, economic, cultural and societal battles, how the war itself ends remains yet to be seen.

Choose your media diet accordingly

You need to keep yourself informed about these developments, to ensure you make the right decisions for your savings and financial future.

If you stick to the mainstream media, you only get a tightly controlled part of the "news". You need to inform and educate yourself using a variety of sources to get anywhere near the point of understanding what's going on out there. No one else will do this for you.

The good news is that there is an increase in grassroots reporting. The people who self-publish on the web do not depend on corporate advertisement, and their jobs don't rely on the increasing government support paid to ailing media outfits through a variety of covert or overt mechanisms. They have other failings and weaknesses, but such alternative sources should now be a daily part of your media diet. Don't consume news just from one kind of source but from a varied mixture of sources. Seek out opposing views. Just as you wouldn’t eat processed supermarket food all day and every day – you'd get sick if you did. You are what you eat, and your brain is shaped by what you read.

Experiencing these developments and changes in London, and seeing how this thinking is spreading among local friends made me want to write about it.

One email from a friend, who commented on the current "vaccine wars" between the UK and the EU, was a good example of the seismic shift in perception underway right now: "I was a Remainer, and am not looking forward to future airport queues, the risk of having my French and Italian cheeses confiscated, etc but boy am I glad we're out! The EU is a shit show."

Not everyone is experiencing such a change in perception, but the numbers I am seeing are noteworthy.

My tentative idea is that in one year, I'll write a follow-up to this Weekly Dispatch. Let's check back whether it has grown further by then, or if I have been misled by a Fata Morgana that existed only inside my little bubble.

In any case, London is certainly worth a trip, even (or especially!) during these strange times.

Coming up next week – more investment opportunities in Britain

I have already written extensively and repeatedly about the wave of lucrative takeovers on the London Stock Exchange.

As you can see from this article, my current stay in London is about exploring new ideas and opportunities. Undervalued-Shares.com focusses on listed equities that can be bought and sold on a stock exchange. Locating promising British stocks is the other focus of my trip.

I have come here at a time when there are encouraging signs about the vaccination progress in the UK. Think of vaccinations what you want (and I am somewhere in between both camps), the comparatively rapid advances in vaccinating millions of Britons is having an effect already. If only how the nation feels overall.

To use the words of Mark Wilson, managing director of Goldman Sachs and the author of a widely-read weekly client newsletter:

"I have a strong preference for UK over Europe – a trend which began to establish itself through Q4."

If Goldman Sachs sends its clients to an unexpected direction, then I certainly want to check out if there is more to it.

What are some of the surprise trends that could make the British stock market an outperformer in Europe?

Where do you find the most promising "reopening stocks" if Britain's vaccination drive turns into a success?

Will the current takeover mania continue and which companies could become the next target of a bid?

In next week's Weekly Dispatch, I'll take a closer look at all of this.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Interview: My global approach to investing in undervalued stocks

What sparked my initial interest in investing?

What are the key lessons that I've learned along the way - and how can others benefit from my own experience?

How do I go about finding those hidden gems that others haven't come across (yet)?

I just got grilled on all of the above! My exclusive interview with InvestorStory has the answers.