Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

AppFolio – the future Microsoft for property managers?

Do you own real estate? If so, have you ever cursed having to deal with tenants, maintenance, invoicing, taxes, and other tedious admin work?

In which case you should check out AppFolio, a software company listed on Nasdaq.

Its promise is "to create a world where living in, investing in, owning, and managing real estate feels magical and effortless."

During the last two weeks, its stock soared nearly 40%.

The market seems to be waking up to the fact that AppFolio is a company worth keeping an eye on. That's true whether you are an investor or a potential user.

AppFolio

A long overdue software tool

As the saying goes, simple things are not necessarily easy to do.

Property management is something that is simple, in theory. However, it's far from easy to do.

Any rented property requires extensive dealings between the proprietor, the tenant, and a multitude of other stakeholders and service providers. Maintenance people need to be hired, instructed, paid for, and accounted for. There are taxes to take care of, often involving more than one government agency.

Real estate is a fairly convoluted business, and property management is a never-ending list of tasks and complications.

A typical property manager with 1,000 rental units would normally:

- Employ two or three full-time accountants.

- Collect rent from 1,000 individuals.

- Deal with 500 maintenance requests every month.

- Handle 25-30 tenants moving out, and another 25-30 tenants moving in.

Many property managers still handle these tasks with Excel sheets and manual data input.

AppFolio (ISIN US03783C1009, Nasdaq:APPF) has spent the last 18 years trying to create a better solution. The California-based company helps property managers to streamline tasks, enhance communication, and improve overall efficiency in managing rental properties.

Its software touches on every aspect of the property management business:

- Collecting rent.

- Scheduling maintenance calls.

- Delivering information to clients and stakeholders.

Think of it as AppFolio providing an operating system for property managers in the US. What Microsoft is for anyone with a computer, AppFolio wants to be for property managers.

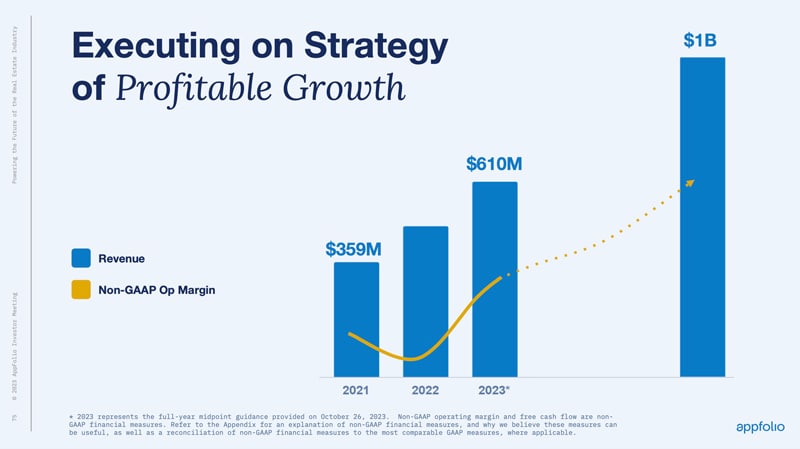

Source: AppFolio, 2023 Investor Meeting deck.

AppFolio's software also ends up in the hands of the tenants and other parties. It aims to be a coordination tool that significantly improves the experience for all parties involved by sending information back and forth.

Revenue is generated from a subscription-based model where fees vary by property type and contract duration. What this results in is the kind of business that you might want to be invested in.

Pricing power and low churn

Many fund managers and investors are looking for companies with demonstrable market power, i.e. companies where switching costs are quite high.

Once a property manager has put their portfolio onto AppFolio, switching to a different system becomes a major hassle and one-off expense. Switching to a different software also inevitably means losing some of their data. Unless they have reason to be truly unhappy, customers will stick to their chosen software. This is one of the reasons why the churn rate at AppFolio is currently less than 3% per year.

Such a set-up usually makes for a high percentage of recurring revenue combined with pricing power. It's the sort of combination that has turned other successful software companies into star performers and compounders.

Then add the sheer number of properties in the US and the as-yet relatively low market penetration of systems like AppFolio.

There are an estimated 79m managed properties in the US.

AppFolio believes that 27m of those fall right within its ideal target group.

So far, the company is rendering services to about 8m.

It has 20,000 property managers as clients, out of 300,000 nationwide – a market share of 6%.

Obviously, the room for growth is significant, even before you start to factor in AppFolio's X-factor.

Growth for years to come?

AppFolio reinvests its cashflow into research and development to provide new features and better services. Customers will gladly pay because these improvements drive their productivity and profitability. AppFolio's new tool "Realm-X", for example, uses AI to let users talk to AppFolio in regular language, thus helping with tasks such as getting reports or managing maintenance requests. If you report a leak in your rented apartment, the app will tell you when the service team will show up.

Driving more sales from existing customers is a very powerful value generator.

Right now, AppFolio generates about USD 73 of revenue per property unit and year. Among its best clients, this figure rises to USD 120. Among its worst clients, it's just USD 30. Evidently, there is a lot of room to grow revenue just from the existing client base.

Case in point, the latest annual results that AppFolio announced on 25 January 2024:

- Full year revenue in 2023 was up 31% to USD 620m.

- Revenue in 2024 is expected to be at least USD 755m, up another 21%.

Compare that to 2021 when AppFolio only had USD 359m of revenue. Within just four years, the company will have doubled its sales. That's 30% annual growth. With its services to property managers, AppFolio sits nicely at the intersection of the growing rental market, rising rents, and the never-ending pressure to reduce the costs of property management.

The company has already identified USD 1bn of sales as its next milestone target. It didn't commit to a specific year for reaching the target, but it may even be as early as 2025. Once it has hit this milestone, it will appear in rankings that only software companies with more than a billion dollars of revenue are included in.

Source: AppFolio, 2023 Investor Meeting deck.

AppFolio did all of that without requiring much external capital. The firm only raised USD 100m since its founding in 2006, USD 86m of which were raised as part of the IPO in 2015. Outside of that, AppFolio has been using its cash flow from existing customers to fund its growth. This is an extremely efficiently funded growth business.

During the past few years, AppFolio even set aside nearly USD 200m in cash reserves, and it remained debt free all along.

Among those who will be happy about this success story is IGSB, a private investment partnership based out of Santa Barbara. IGSB has a track record of investing in software companies since the 1970s, and it has accompanied AppFolio's growth path as a true long-term owner. One of IGSB's members, Maurice "Reece" Duca, controls 39% of the votes through shares that have ten times more voting rights.

An exceptional business for long-term investors?

AppFolio is currently running at about 20% operating margins. If it didn't invest so much into its growth and margins were calculated based on a steady state, margins would be about 40%.

The stock is currently trading at about 10x EV/Sales. Depending on your mindset and strategy, this may already be outrageously high, or it may well be entirely reasonable given current growth rates and the long-term perspective. If you were to run a peer group analysis, you'd find that this multiple places AppFolio in the middle of the valuation range of this sector.

Interestingly, AppFolio's two biggest competitors are both privately owned. RealPage is in the hands of Thomas Bravo, the private equity company specialised in software businesses, following a 2021 takeover bid for what was then a listed company. Yardi is still in the sole ownership of its founder, Anant Yardi. When it's difficult to get exposure to a business because the few dominant players in that industry prefer to keep it all to themselves, my ears perk up.

The stock has just experienced another leg up, and it's far from cheap by conventional standards. Also, as with any company, the entire investment thesis is not without its question marks. E.g., a significant percentage of AppFolio's recent revenue growth has been driven by upselling to existing clients and increasing prices. These two factors will likely hit a ceiling at some point.

AppFolio.

However, when would Microsoft stock ever have been conventionally cheap? If you keep compounding at a nice double-digit rate, short-term blemishes can't really stop a company like AppFolio from delivering superior returns. AppFolio may just be the kind of exceptional business that investors do want to own for the next ten years.

It's usually not very clever to buy just when a stock has popped following a record year. Stock market crises do occur and can drag down the entire market. The next time world markets are hit by a storm, AppFolio will be on my watchlist.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: