Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

SJM – time to dip into Macau?

SJM Holdings is the oldest casino company in Macau.

It embodies gambling in Macau in quite the same way as SBM does in Monte Carlo.

Since its peak in 2014, the stock is down 90%.

In fact, it's now back to the same level when it first went public in 2008. Both SJM and Macau have since advanced by leaps and bounds.

Will the stock of SJM ever return to its former glory?

SJM Holdings.

SJM's history in a nutshell

Analysing the future of SJM Holdings (ISIN HK0880043028, HK:880) necessarily involves a look at the company's past.

SJM Holdings was set up by the late Stanley Ho, Macau's most prominent entrepreneur who died in 2020 at age 98. Ho had experienced his wealthy Hong Kong father losing everything through an ill-fated investment in stocks, and he also witnessed the Japanese invading his native Hong Kong in 1941.

Ho then fled to nearby Macau, a tiny colony that the Portuguese had occupied for nearly five centuries. At the time, Macau was a remote, poor, dubious backwater that hosted refugees, spies, pirates, and fortune-seekers.

Ho made a fortune "trading" (smuggling), first with China and later with the UN-embargoed Korea.

Using his family's excellent connections, he eventually convinced the Hong Kong tycoon, Henry Fok, to financially back him in his plan to turn Macau into a haven for gamblers. In 1961, Ho was granted the sole license to operate casinos in Macau. Details of both his winning such a lucrative monopoly and his subsequent operating the casino are murky; the early version of the casino was allegedly used to launder money and circumvent currency controls. In any case, the operation turned Ho into one of Asia's richest men.

The late Stanley Ho in his early 90s (2013).

Ho fathered at least 16 children from four wives, which eventually made for complicated family relations. In the early 2010s, the battle over succession and fortune erupted in full public view when former wives #2 and #3 ganged up against current wife #4 to fight over directorship posts for their children and ownership of the family holding.

When all this took place, Ho had already been ill and frail for a long time. As the Financial Times reported in its obituary, the family drama gained a tragic-comical dimension when "depending on which wife's home he happened to be in at the time, Ho was pushed around in a wheelchair for the TV cameras and made conflicting statements about what his intentions had been."

One year before his death in 2020, the family affairs were brought in order. Ho's daughter, Pansy Ho, and the family foundation of his original backer, Henry Fok, teamed up to take control of the central family holding. The privately-held Sociedade de Turismo e Diversões de Macau SA is the controlling shareholder of Hong Kong-listed SJM Holdings, which in turn owns the gambling subsidiary, Sociedade de Jogos de Macau ("SJM"). Filings made with the stock exchange at the time indicated that several important members of the Ho and Fok families had agreed to pull on the same rope to advance the company.

Source: Financial Times, 11 July 2019.

The day the end of the family conflict was announced, the share price reacted with an 11% jump to HKD 8.

Today, it's down at HKD 2.50.

This compares to HKD 25 in 2014.

Given Macau's stellar growth over the past two decades, why hasn't the share price of SJM done better?

A complex jurisdiction with a mixed performance

Macau has been operating under a new gambling regime for two decades. On the surface, it has done extremely well.

As part of complicated political negotiations involving the territory's legal status as Special Economic Zone of China, Ho's family relinquished its casino monopoly in 2002. Instead, new licenses were granted to three operators – SJM, the American gambling entrepreneur Steve Wynn, and Hong Kong's Galaxy Entertainment Group (ISIN HK0027032686, HK:27).

Macau flourished under the new regime. Further casino operators were let into the fold before too long, and a construction boom briefly made Macau the world's fastest growing economy with an annual GDP growth as high as 25%.

I had a tiny bit of on-the-ground involvement in the early phase of the boom, as the director of a newly-created residential property fund for Macau in the mid-2000s. Using a listing on London's AIM, the fund raised money from City institutions and built a USD 300m residential property portfolio.

One of my vivid memories of the time are widely-followed statistics about Macau quickly catching up with Las Vegas. The American gambling destination had long been the world's biggest, but it proved no match for the might of the Chinese gambler. It only took Macau until 2006 to surpass Las Vegas' gambling revenue.

By 2013, Macau had grown to an astonishing 4x the gambling revenue of Las Vegas.

This particular metric is somewhat misleading, though, because of several factors:

- The revenue wasn't based on per capita, and China has five times as many people as the US.

- Gambling preferences in China are very different from those in Las Vegas, which influences with which game revenue is achieved and how profitable each dollar of revenue is for the operators.

- Las Vegas has become much more of a family and event destination and generates over half of its revenue from hotel rooms, food, beverages, tickets and the like. Macau, on the other hand, is still predominantly about gambling, with only a third of its revenue deriving from other activities. Precise figures vary depending on which source you trust, but it's clear that Las Vegas and Macau are two different kettle of fish altogether.

Such details make superficial comparisons between Macau, Las Vegas and other successful Asian gambling destinations difficult at best, and possibly useless even.

Anyone delving into the finer details of Macau's gambling industry will encounter complexity and nuance. This makes it more difficult to analyse potential opportunities in the space, but it could also make for information asymmetries and an opportunity to gain an edge over other investors.

From a high-level perspective, important developments in Macau since 2010 include:

- Mainland China's ongoing crackdown against corruption. Surprise, surprise – the level of corruption did have an influence on the level of gambling in Macau. In 2013, the Macau gambling industry generated USD 45bn of gambling revenue, with USD 77bn expected by 2017. Instead, revenue in 2023 was USD just 22bn. The Macau gambling sector never fully recovered from China's crackdown on corruption, nor did the share prices of Macau casino operators. Macau gambling companies have been in a ten-year bear market.

- China's long and hard crackdown on travelling and public gatherings during the pandemic. Unsurprisingly, Macau was hit hard by these decisions.

- The end of the initial concessions for casino operators in 2022. During the years leading up to the expiry date, investors feared the casino companies would not be able to extend their license, or only on unfavourable terms.

Never mind China's ongoing general issues with its stock market. Of late, many have considered the Chinese market "uninvestible" (see article linked to below). Hong Kong shares have fallen back so far that they are now trading lower than in 1997 when the territory returned to Chinese sovereignty. Macau gambling stocks are stuck in a much wider market rout.

Source: Financial Times, 6 February 2024.

Where does that leave SJM?

With the family issues put to rest and the casino concessions extended thanks to a 2022 agreement between Macau and all existing operators, is SJM stock now a generational buying opportunity? After all, gambling is the business where the house always wins and gaming companies with a rich heritage attract crowds, right?

After spending a day reading up on the subject, I conclude: "maybe".

Even when leaving aside the general issues experienced by Chinese stocks, the entire situation has several worrying issues:

- The latest extension to the concessions is for a mere ten years, compared to 20 years for the initial concessions granted in the early 2000s. SJM (and its competitors) are already two years into this period, and 2032 isn't all that far off. The signal sent by the government is that all of these companies may be living on borrowed time. Elsewhere in the world, such extensions would normally be for a 25-year period.

- Eager to turn Macau into the kind of place that Las Vegas has become, the Chinese government required all concession holders to invest significantly into non-gambling attractions. SJM is a case in point. The company plans to invest MOP 14bn (MOP = Macanese pataca; USD 1.7bn) over the next ten years. Of that, MOP 12bn (USD 1.5bn) are earmarked for non-gambling attractions. As Pansy Ho told the media: "Non-gaming investments are not a problem, there's huge market potential." However, many wonder if she made the statement because of orders from Beijing.

- During the pandemic, all Macau casino operators had to take on additional debt to sustain themselves. Since China reopened, SJM's deleveraging trajectory was running at a slower pace than those of its peers. The company has been struggling with excess staffing and a slow ramp-up of its newly-built, USD 5bn Grand Lisboa Palace Resort.

SJM's Grand Lisboa Palace Resort in Macau (image by maryeung / Shutterstock.com).

On the positive side:

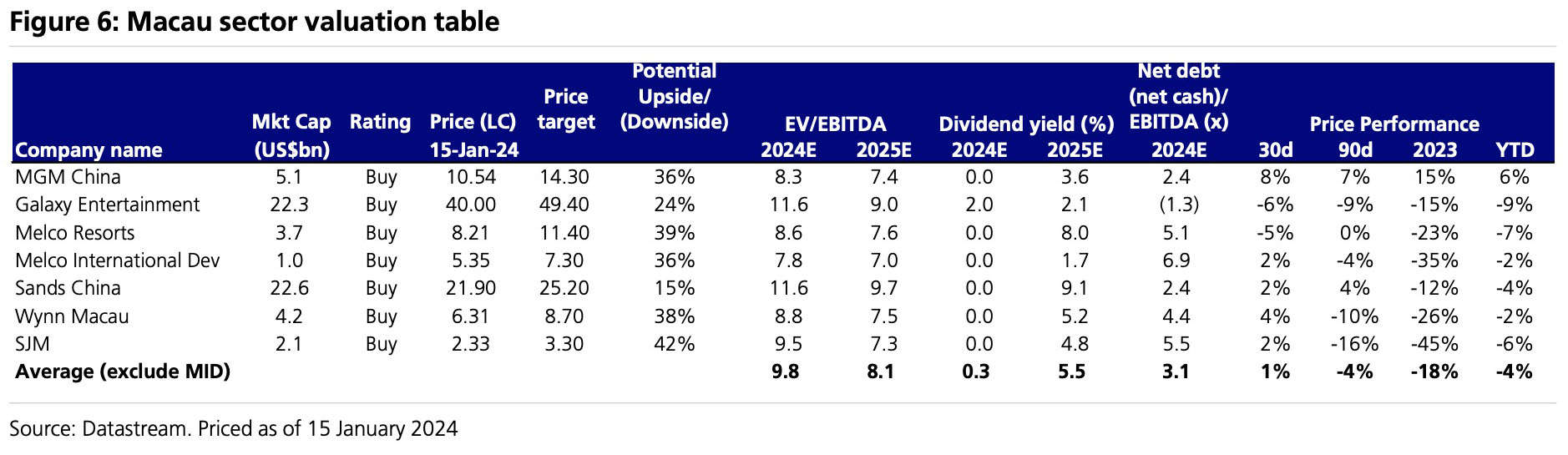

- Pre-pandemic, Macau casino stocks were trading at EV/EBITDA multiples between 15-25. Today, these multiples have come down to a range of 7-10 based on 2025 estimates. With a ≈7.5x EV/EBITDA multiple, SJM is trading nearer the lower end of this range, and it is projected to throw off a 5% dividend yield. You could argue that the bad news is already priced in.

Source: UBS, 17 January 2024 (click on image to enlarge).

- In 2024, gaming revenue from mass market gamblers should reach 105% the level of 2019. Revenue from VIP gamblers has a long way to recover, but it also indicates a lot of room for improvement without even having to surpass previous visitor figures.

- In January 2024, Fitch Ratings altered its credit outlook for SJM from "negative" to "stable", because of its expectations that the company is going to turn free cash flow positive in 2024.

Is there a chance of a surprise to the positive?

My verdict is: "I don't know, but I want to find out!"

As my blogger colleague Michael Fritzell of Asian Century Stocks wrote in an outstanding report on Macau in July 2021: "Casinos can be highly profitable businesses. After they reach maturity, many of them enjoy operating margins above 30% and return on equity above 20%."

The Grand Lisboa Palace Resort swallowed up huge investment, but it also has considerable potential to generate long-term growth. After all, it's still only a comparatively small 2% of the Chinese population who can afford a proper weekend in a hotel in Macau.

Maybe – and that is a maybe – Macau and SJM will eventually surprise on the upside again.

Pearl River Delta research trip

Given how low Chinese stocks have fallen, I am eager to learn if they are a value trap or a buying opportunity.

China is a complex country, and I'd love to analyse its stocks with the help of some local input. In late April 2024, I'll be visiting Hong Kong, Macau and the Pearl River Delta region.

I don't have an itinerary yet, but I want to experience Macau as a product, meet local friends from my network to quiz them, and maybe even set up meetings with some locally listed companies.

Given my 20-year fascination with Monaco's SBM, I'm particularly keen to learn more about SJM as its Macau equivalent. Now that China may offer one of the world's largest selections of undervalued shares, I need to take a good look around, including at the other well-known Macau casino stocks, such as Sands China (ISIN KYG7800X1079, HK:1928), Wynn Macau (ISIN KYG981491007, HK:1128), and MGM China (ISIN KYG607441022, HK:2282).

No doubt, Hong Kong will have a plethora of other interesting small-, mid- and large-caps to dive into.

If you are based in Hong Kong or Macau, and willing to meet for a coffee, do drop me a line!

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: