Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Big Technologies – betting on illegal immigration

Image by Ceri Breeze / Shutterstock.com

Illegal immigration is a growth industry.

Human traffickers, NGOs, politicians, and bureaucracies – many benefit financially.

Big Technologies PLC could be one of the biggest and most direct beneficiaries.

The London-listed firm has a GBP 370m (USD 470m) market cap, and it may gain attention for its innovative use of technology in managing deportation-related issues.

Source: The Guardian, 17 January 2024.

A subject of our times

Illegal immigration is a growth industry that is difficult to define.

Reliable numbers are not just notoriously difficult to obtain, but also consistently disputed by the various players across the political spectrum.

For some, it's clear as day that many Western countries are in the midst of a border crisis.

Others beg to differ, or at least try to introduce different terms to redefine the phenomenon.

What used to be called an "illegal immigrant" is nowadays often described as an "undocumented immigrant" or simply "migrant". In the ongoing immigrant nomenclature debate, even the concept of an "American without papers" has been floated.

Next on the horizon is the "climate refugee". The World Economic Forum predicts that by 2050, 1.2bn people will have been displaced due to climate-related issues.

Source: Yahoo! News, 10 December 2015.

Today's Weekly Dispatch works on the assumption that large movements of people across borders, without involving conventional visa applications, will not just continue but probably grow yet further.

The question is, if illegal immigration based on traditional definitions will growth further, how can you benefit from its economic and financial ramifications?

Considering to invest in London-listed Big Technologies PLC may be one way to gain exposure.

A female-led success story

Big Technologies describes itself as a "supplier of innovative products and services to the remote personal monitoring industry."

The company produces what is commonly known as ankle tags.

Ankle tags are electronic devices that are affixed to a person. Electronic tagging can be used in combination with global positioning systems (GPS) or radio frequency technology, and it is used to monitor that person's movements.

Ankle tags were first developed in the 1980s, but it's taken the market a while to embrace them. One entrepreneur who anticipated their growth and succeeded in developing a next-generation type of ankle tag is Britain's Sara Murray. She is CEO and major shareholder of what is now listed as Big Technologies PLC (ISIN GB00BN2TR932, UK:BIG).

In the early 2000s, Murray spent three years designing a wearable tag to replace previous generations of the device. Leaving behind the 1980s design and limited functionalities, she created an ankle tag that was smaller, more robust, more accurate, and easier to charge than competitors' products.

Branded "Buddi", her firm's ankle tag became one of the world's leading products in the space, and Big Technologies one of the leading companies globally (including the #1 provider of such solutions in its home country).

Source: Big Technologies PLC, Annual Report and Accounts 2022.

While Murray initially wanted to develop a product for use in elder care and monitoring the safety of children, Buddi was particularly embraced by law enforcement agencies. Of late, these agencies – which need to keep track of people but have run out of space in detention centres – made up 98% of Big Technologies' revenue.

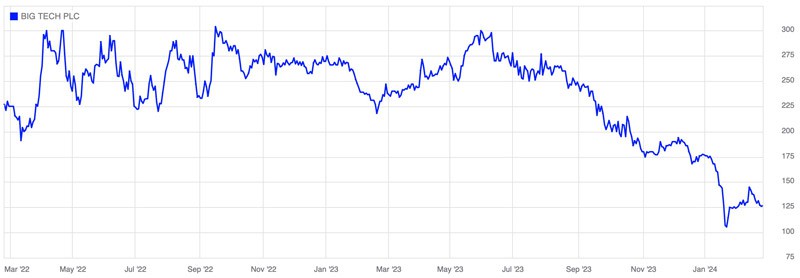

In 2021, Murray took Big Technologies public. The company raised GBP 200m from investors, and the share surged 50% on the first day of trading. Placed at 200 pence, it soon traded as high as 363 ence. At its peak, Big Technologies had a market cap of GBP 1bn (USD 1.25bn).

The share price has since come back down to 126 pence – way below its initial placement price.

What happened, and may now be a good time to get in?

Big Technologies.

Recurring revenue – and 'captive' customers

One of Big Technologies' attractions lies in its Software as a Service (SaaS) type revenue model.

Tags are provided via a subscription contract comprising daily or monthly fees. Law enforcement agencies typically sign multi-year contracts, sometimes spanning up to 12 years. During the two years prior to its IPO, Big Technologies consistently achieved EBITDA margins averaging 50 per cent and strong cash flow, and its stock initially benefited from the market's perception that the company had excellent long-term revenue visibility.

However, the past year has shown that even Big Technologies has its challenges.

In early 2024, the stock tumbled 26% in a single day when a contract for prisoner tagging in Colombia came to an end. The company's plan for conquering the massive US market also required higher upfront costs than anticipated.

Big Technologies warned investors that 2024 revenue was likely to fall back to the GBP 50m level achieved in 2022 already, and that margins would be under pressure.

For 2025, however, the company is already predicting a return to growth.

A new theme could also reignite the stock: the growing debate about illegal immigration, and how to manage it.

Searching for non-consensus investment themes

Of late, the idea of investing in illegal immigration-related themes – which Undervalued-Shares.com had pioneered in 2022 with a research report on British outsourcing specialist Serco Group (ISIN GB0007973794, UK:SRP) – has started to pop up elsewhere.

E.g., one eagle-eyed Undervalued-Shares.com reader pointed out this X thread by Ram Ahluwalia, CEO of Lumida, a SEC-registered investment advisor for alternative investments:

"Non-Consensus:

Can you bet on massive Illegal Immigration?

Yes. UBER stock.

A high number of migrants drives revenue increases AND keep wage pressure low for UBER."

The August 2022 report on Serco Group (recently tipped in the British media as a takeover target).

Given the election campaigns in several key countries across the world, the subject of illegal immigration is likely to stay at the forefront of public debate, with a few unexpected twists and turns. E.g., Germany recently saw the (predictable) return of the subject of potential large-scale deportations of illegal immigrants. Dubbed "remigration", the re-emergence of the subject caused an explosion of consternation among media commentators and large-scale demonstrations across multiple cities.

It's little-known that similar plans were once proposed by the great European statesman, Helmut Kohl, in the early 1980s. As we had learned in 2013 from declassified British documents, Kohl was also the German leader who had ""sought to deport half of Germany's Turkish population in four years because they could not all be assimilated." Kohl's involvement in the subject of remigration had not stood in his way. When Kohl died in 2017, the President of the European Parliament described him as "a great European, a great statesman, a political giant who combined the ability to listen to the concerns of ordinary people with a gift for articulating a vision for the future."

In politics, old themes always return – sooner or later, and often repackaged or relabelled.

Europe's political establishment, in the face of growing immigration figures and pressure from its voting population, could eventually turn to measures that are both old and new. Mass-tagging of illegal immigrants had been proposed as far back as 2005, when a Norwegian party made the case.

It may now return, and Big Technologies could benefit. The company doesn't just have the required technology, but also a track record of initial contracts.

Mainstream politics going Trumpian on illegal migrants

Big Technologies' government contracts include one for tagging illegal immigrants facing deportation. Rolled out in January 2022, this contract gained some unexpected political support. Even though it was a measure introduced by a Tory government, Labour leader Sir Keir Starmer also said that "there are 'particular cases' where he would support tracking asylum seekers with electronic tags."

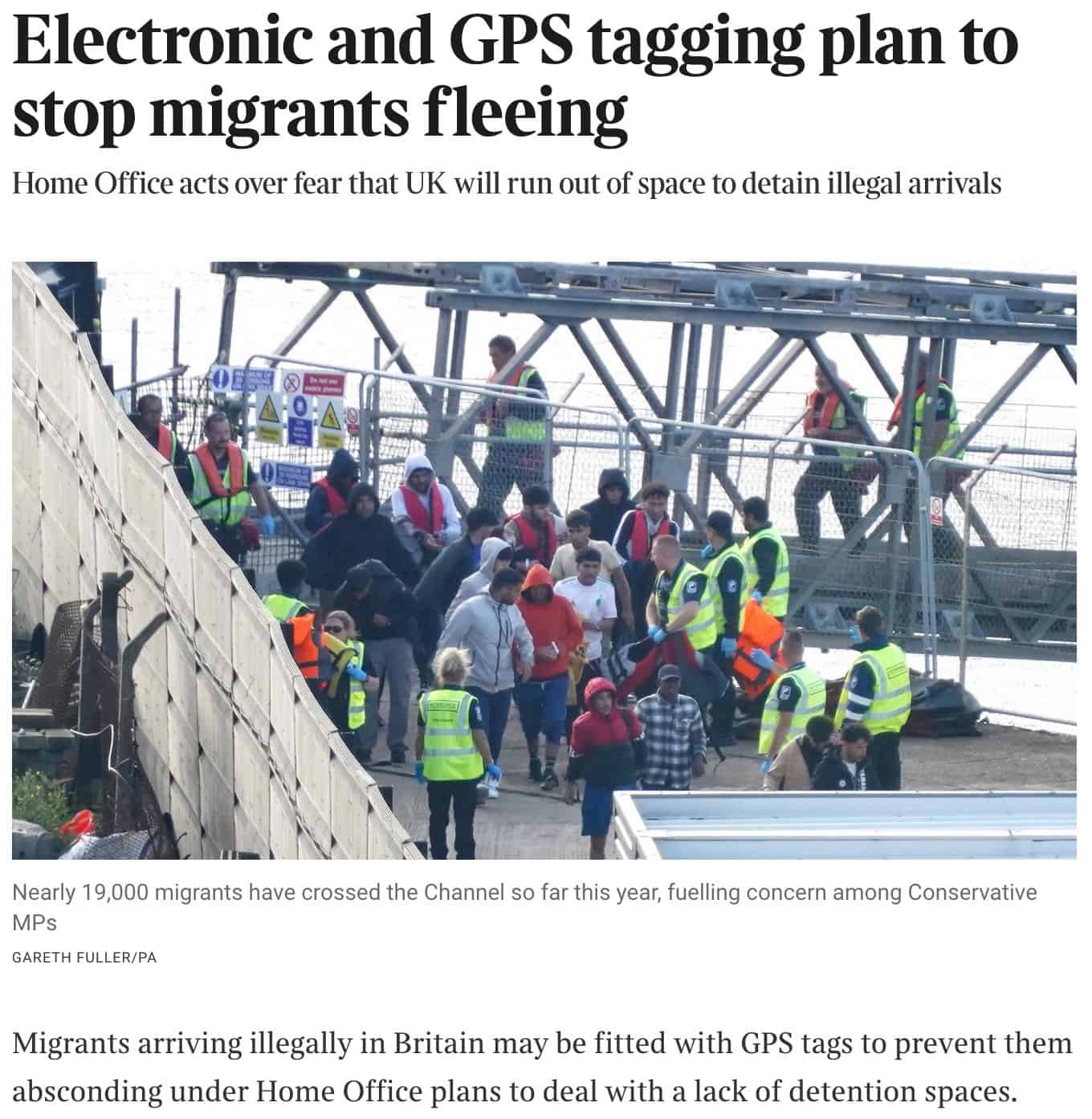

The subject gained prominence in August 2023, when UK newspapers such as The Times reported:

"Migrants arriving illegally in Britain may be fitted with GPS tags to prevent them absconding under Home Office plans to deal with a lack of detention spaces.

The government has a new legal duty to detain and remove migrants who come to the UK illegally. However, the immigration detention estate can hold only 2,500 people. Officials have been asked to find alternative ways of ensuring that thousands of migrants who arrive illegally but cannot be detained do not abscond.

…

The Illegal Migration Act, which got royal assent last month, created a duty on the home secretary to detain illegal migrants on arrival, pending their removal."

Source: The Times, 27 August 2023.

There is a notable uptick in the idea of using electronic tagging in the sector.

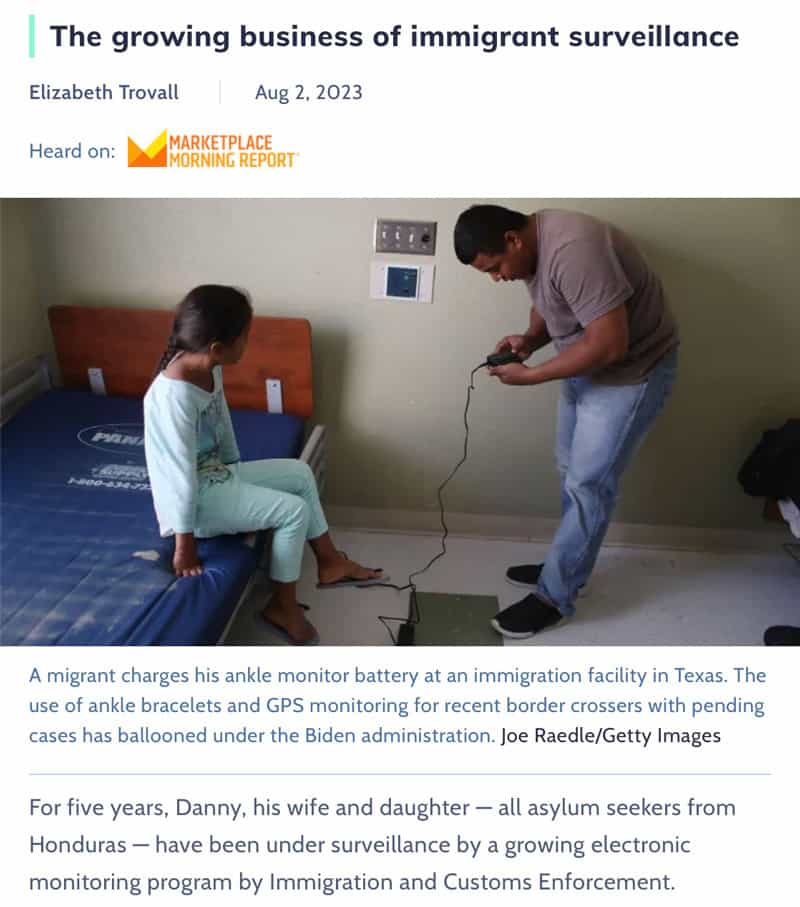

Under the current US president, "the use of ankle bracelets and GPS monitoring for recent border crossers with pending cases has ballooned. … An ICE electronic monitoring program has more than doubled in size under the Biden administration, according to Syracuse University TRAC data."

Source: Marketplace, 2 August 2023.

The Biden administration has put particular emphasis on "ankle monitors on migrants with children – and speeding up deportations", as The Wall Street Journal reported on 31 August 2023.

More could come, now that "Joe Biden considers bypassing Congress with Trump-style border plan", as reported just a few days ago.

The use of ankle trackers for managing issues stemming from illegal immigration was also discussed in Australia in November 2023.

We may yet see a sea change in how illegal immigration is managed. For investors, the challenge is to find non-consensus ideas that will eventually become the consensus. Being ahead of the crowd – even when facing headwinds and criticism – is what investing is all about. Think defence stocks pre-February 2022.

"Buddi" at the heart of the industry

Ankle-tagging illegal immigrants could be an as-yet little-noticed but lucrative growth industry.

As the Marketplace article quoted above put it:

"The high dollar contracts to run monitoring programs, like the one with ICE, have become a lucrative source of business for private prison companies that are otherwise seeing their industry decline."

Big Technologies may offer a more direct way to get exposure to the investment theme than private prison companies, though, whose business remains mostly geared towards conventional incarceration.

If political support for such measures continues to grow as it has in recent years, Big Technologies could experience the emergence of an entire new target market for its tags.

Privacy International, an NGO dedicated to documenting issues surrounding governments and corporations using technology, described in a May 2023 report that Big Technologies was one of the companies "at the heart of the UK's GPS tagging system" involving illegal immigrants:

"In May 2022, the Ministry of Justice contracted with Buddi Limited for the provision of 'Non-Fitted Devices' ('NFDs') at a cost of £6,020,000 (for May 2022 to December 2023). NFDs were also known in earlier policy documents and DPIAs as 'smartwatches', when the plan was to roll out wristband-like devices with biometric facial recognition. The latest Immigration bail guidance, however, refers to a device that 'fits in the palm of the hand - in addition to recording trail data, it can take fingerprints and will give a sound and vibrate alert to notify the person that their biometrics must be submitted - the device reads the fingerprint and compares this to the fingerprint captured when the device was issued - although the device is not fitted to the person, they are required to carry the device with them - requests for fingerprints are made on a random basis several times throughout the day to verify that the device is being carried as required - this requirement must be included within the person’s bail conditions'."

In a November 2022 report, Privacy International had even called Buddi "immigration enforcement's favourite tracking buddy".

Does that make Big Technologies the ultimate bet for anyone looking to build a portfolio that gives exposure to illegal immigration as a growth sector?

Challenges and opportunities for 'Buddi'

There are manifold issues and risks related to the idea that Buddi may be a beneficiary of measures aimed at managing illegal immigration.

To name just a few:

- Albanians who entered the UK illegally have boasted on TikTok that it took them just a few moments to get rid of their ankle tags – mockingly dubbed "British Rolexes" by human trafficking gangs. The tags proved no match to its Albanians wearers, who subsequently disappeared into Britain's vast irregular economy. A pair of kitchen scissors was enough to do the job.

Source: Daily Telegraph, 28 August 2023.

- Some politicians have criticised the use of ankle tags to manage illegal immigration as inefficient, and not more than a "gimmick".

- Privacy International and other organisations point towards previous government analysis that tagging is not just inefficient but also creates side effects such as mental health issues, which then may cause further costs to the government.

Just as some seek to relabel illegal immigrants as undocumented migrants or climate refugees so are proponents of ankle tags trying to class them as "behaviour transmitters".

The investment industry has recently seen how such battles over nomenclature and appearances can easily turn. E.g., while the defence industry was long shunned by investors who adhered to so-called ESG regulations, it quickly got rerated following the war in Ukraine, and stocks in the sector have been a highflyer ever since.

Source: Financial Times, 4 March 2022.

Big Technologies makes a visible effort to not publish too much celebratory information about its success; it does not even have a conventional investor presentation on its website. For the single-best overview of the company and its strengths, investors need to turn to the 2021 IPO prospectus, which contains a useful executive summary on page 17 as well as a lot of sectoral background information.

A recent legal tussle that broke out between a group of pre-IPO investors and Sara Murray put further pressure on the stock. The merits of the case, which accuses Murray of using offshore structures to abuse the rights of her pre-IPO investors, is impossible to judge for outsiders. Big Technologies has issued a stern rebuke of the accusations.

Waiting for the March 2024 update – with insider buys along the way

Is the stock undervalued right now, and could it gain on the back of illegal immigration as an investment theme?

Don't rule it out just yet.

With a female founder and CEO, an impactful corporate motto "Making society safer", and applications that also extend to elder care and child safety, there is a lot that investors could like if the zeitgeist swings Big Technologies' way. Add to that the company's recurring revenue and cash flow, all the more so once the business is fully back on track and potentially successful in expanding into markets like the US.

Big Technologies last issued a trading statement on 19 January 2024. Following its warning over additional costs in the US and declining margins, the next update is now scheduled during the company's full-year results announcement on 26 March 2024.

In the meantime, some insiders seem to think that the stock represents a good buy on the current level:

- Big Technologies' CFO, Darren Morris, recently upped his stake by a total of 20,000 shares at prices of around 120 pence. He now holds a total of 400,000 shares.

- Sara Murray purchased 300,000 additional shares at an average price of 106.5 pence. She now holds a total of 73.4m shares, or just above 25% of the company's share capital. It's a small additional purchase relative to her existing stake, but a significant insider purchase given that it will have cost her GBP 300,000.

- Ernström Kapital, a Swedish investment company that focuses on "niche companies that want to grow in … sustainability, innovation and digitalization", upped its stake from 8.29% to 9.15%.

Is Big Technologies a buy, and should you get in before the company gets its recent issues under control?

These investors seem to think so.

I'd be inclined to wait for the next trading update. Usually, once a growth company has hit some bumps, it takes longer than expected for things to turn around.

Still, these recent purchases by well-informed investors should be enough of an indication that Big Technologies is worth keeping an eye on.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: