Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Asana – the world’s largest ever insider purchases

It's not often that you see a CEO carry out insider buys in the tens of millions.

The CEO of American software firm Asana has hovered up shares worth a lot more: USD 166m, last year alone.

Once you factor in prior years, his insider buys amount to well over USD 1bn – most likely the largest ever stretch of purchases made by a corporate insider.

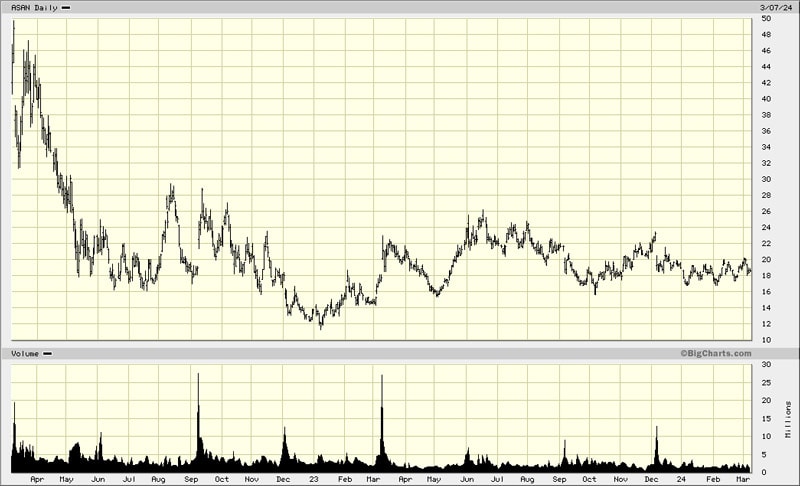

The company's CEO has made ample use of the stock's weakness since the cooling of the "work from home" hype. The stock is currently down 88% since its 2021 peak, even though the company's product has been showing solid growth and holds much promise for the future.

Are these insider buys a sign that now is a good time to build a position?

Asana.

Pay attention to backdoor listings

My ears perk whenever I find a company that came to market using a non-conventional way of listing.

Asana (ISIN US04342Y1047, NYSE:ASAN) is one such case. The company went public through a so-called direct public listing, a rare form of going public in which no new shares are created. Instead, only existing, outstanding shares are sold with no underwriters involved.

Apart from Asana, I am aware of only three other notable companies with such a direct public listing in recent years: Spotify, Slack, and Palantir Technologies.

Why do I take an interest in such companies?

When a company is quietly admitted to trading, fewer investors keep the stock on their radar. These direct public offerings can lead you towards real gems. I know one investor who landed his first 100-bagger thanks to a software company that did a direct public listing.

Asana is not a secret-secret company, due to its high-profile founders and its globally successful product. With a USD 4bn market cap, some analysts are already following it.

However, a sleugh of insider purchases were made last year, and the company is going to release an earnings report on 11 March 2024.

The mission to make work more efficient

Asana was set up by two prominent former Facebook employees: Dustin Moskovitz, co-founder and first CTO, and Justin Rosenstein, the engineering lead. Moskovitz held more shares of Facebook than anyone but Mark Zuckerberg himself.

As Facebook grew from a nimble start-up, the firm's early employees witnessed how it became much more of a typical large corporation. Both Moskovitz and Rosenstein allegedly became fed up with the amount of inefficient, annoying task management their team members had to do.

Large corporations typically comprise an endless number of everyday workplace struggles that keep employees from focusing on their actual work:

- Endless (and often unproductive) meetings.

- Lack of access to vital information.

- Duplication of work.

As Rosenstein once said: "When I ask people how much time they spend not doing their job – time spent on 'work-about-work' or phone calls or e-mails – people regularly tell me 60%, or even 90%."

Moskovitz and Rosenstein decided to leave Facebook to focus on creating a software that would make collaboration and communication more efficient. They wanted to reimagine communication in the workplace and link together email, data, and project updates. In effect, they envisioned a software that would become the "team brain", enabling teams to work better, smarter, and more cohesively.

Using their network and reputation in Silicon Valley, the duo quickly secured an initial USD 1.2m of angel funding before raising a further USD 9m Series A funding the same year. Three years and a successful public product launch later, they raised USD 28m Series B funding based on a valuation of USD 280m. Further details are laid out in Nira Blog's epic article "Asana's Rise to a $1.5 Billion Valuation".

Asana was off to the races, and it's grown impressively since then. It now provides a platform that helps teams orchestrate work, from daily tasks to cross-functional strategic initiatives, and tries to eliminate the need for constant meetings, email updates, and memos. This platform is currently used by about 140,000 customers that paid USD 547m in subscription charges in 2022/23. While notable clients include Airbnb and UBER, 40% of Asana's paying customers reside outside of the US, and there are millions of free users around the world.

Taking the middle road of offering both a freemium and an enterprise version was one of the key ingredients for Asana's success. "A guide to Asana, the workplace management tool that helps streamline communication across teams" by Business Insider explains more about the product and what it offers. Alternatively, watch Asana's brief introductory video linked to below.

Source: "What is Asana?" (corporate video).

The success of its first decade of operating culminated in Asana's direct public listing on the New York Stock Exchange in September 2020. This was the ideal moment for going public, given the prevalent remote working hype at the time. The stock debuted at a price of USD 27, only to climb to USD 142 just a year later. At its peak, the company was worth USD 30bn.

How times change!

A short three years later, the hype about "WFH" has been replaced by a new sense of realism about humans having to come together in real life to coordinate work, build relationships, and close sales. Additionally, large US tech companies had to lay off significant numbers of staff for the first time, and rising interest rates have led to multiple contraction among software companies.

Asana stock is currently down 88% from its peak.

Still, Moskovitz keeps loading up with insider purchases.

Why does he do so? Should you load up as well?

The truth about the insider purchases

Moskovitz owns 1% of Facebook, which regularly makes him pop up in rich lists with an estimated net worth of currently USD 25bn.

His Facebook wealth enabled him to become a massive buyer of Asana stock. Moskovitz last made headlines in October 2023 when he purchased 2.7m shares at prices of around USD 18 for a total investment of USD 48m. Up to that point, his purchases in 2023 alone amounted to 8.5m shares worth USD 166m, which made for an average price of USD 19.5 per share.

Insider buying, especially by a founder or CEO, is usually a bullish signal: smart money believes that a stock is undervalued. Given that Asana stock is currently trading slightly below Moskovitz' average purchase price of these transactions, should you rush out and buy the share?

Following insider purchases is an imperfect science, and one that comes with its own set of pitfalls.

Moskovitz had already purchased stock worth USD 1.02bn in 2021 and 2022. At the time, he paid an average price of USD 64, i.e. well over three times the current price. From that perspective, you could even argue that Moskovitz is a counter-indicator. His positive bias towards his own firm made him waste a record amount of cash on purchasing shares that he could have bought for a third of the price a year later.

This particular case of large-scale insider purchases demonstrates how important it is to not view these purchases in isolation, but to consider them within the broader context.

Like many other Silicon Valley companies, Asana heavily depends on compensating staff with stock. Over time, this leads to significant dilution of the share. It also means that a company has a strong interest in projecting optimism or its share price, as otherwise it might see key staff defecting to other firms.

One can argue that Moskovitz has been doing these purchases to keep his company's stock-based compensation plan attractive. His public persona (and possibly ego) will now be tied up in Asana's success. Given his enormous Facebook wealth, Moskovitz can afford to waste a billion (or two, or three) on buying back Asana stock for reasons other than making a good short-term investment.

When you spot large-scale insider buying, always keep in mind there may be reasons that are not immediately apparent from the outside. In the case of Asana, this could be a combination of Moskovitz' ego and the company's compensation plan – at least, to some extent. Had you followed Moskovitz' massive insider purchases in 2021 or early 2022, your investment would currently be down by two-thirds.

Moskovitz may have done these purchases despite multiple worries about the company's (and stock's) short-term performance.

E.g., much as Moskovitz and Rosenstein are celebrated entrepreneurs, they are not the only smart people out there. The market has recently become more conscientious of the fact that there is no shortage of competitors in the space. Market leader Atlassian (ISIN US0494681010, Nasdaq:TEAM) is several times larger than Asana, and there is stiff competition from Israel's Monday.com (ISIN IL0011762130, Nasdaq:MNDY) and Slack, the platform that was taken over by Salesforce (ISIN US79466L3024, NYSE:CRM).

This sector of the software industry is currently predicted to grow at about 15% p.a. over the next few years. That's decent growth, but a massive slowdown compared to the years of the pandemic lockdowns. Also, growth investors tend to only get excited once a company or an industry achieves 20% annual growth. Add to it the fact that Asana is still losing money, even though it's already been operating for over a decade.

With all that in mind, it's easier to appreciate why the market hasn't gotten overly excited about Moskovitz' large-scale insider buys.

Not all is lost, though.

After two years of going sideways and forming a bottom, there are also good reasons for keeping the stock on your watch list.

Asana.

A story that will come good eventually

Asana is one of the highest-margin software companies in the market. It has pro forma gross margins in the range of 90%, which means that as the company grows larger, 90 cents out of each dollar of incremental revenue will flow through to the bottom line. While the company isn't profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably once it has become larger.

The question is, when will Asana become big enough for that to have an effect on its stock price?

In 2021, the market overestimated the company's growth potential. Right now, it may well be underestimating its potential. During this period of lower expectations, it's worth taking a closer look at factors that could eventually catalyse a recovery of the stock.

Asana's reporting include a few noteworthy yet hidden gems of information:

Large companies that have already purchased the Asana software for some of their team members are extending its use to more users within their firm. Put another way, existing customers are satisfied and happy to buy more. Asana customers that contribute over USD 100,000 of annual revenue reportedly have a so-called net revenue retention rate of over 100%.

Asana's large enterprise customers have 80m employees, but only 3m of them have been put on a subscription of the Asana software yet. There is significant growth potential by having the software spread deeper into the staff of Asana's existing clients, never mind winning new clients.

The workplace issues that Asana's software addresses exist in nearly unlimited quantity, which makes me believe that the adoption of such software around the world will only grow further. All the more so since Asana (and its competitors) are developing ever more tools that are worth looking at, such as those powered by AI.

Here is a serious question – who can afford not to have such software to manage their teams? Researching this article has made me realise that such project management software has matured to a point where almost every team, in every industry, could benefit from using it.

Sooner or later, this should see Asana grow to a size where it breaks even – ahead of producing huge amounts of profit from each incremental dollar of revenue.

Which leads back to the same question, when to jump in?

The stock is not at the right level – yet!

Over the last five years, Asana has grown its revenue more than sevenfold, representing a 66% compound annual growth rate.

For its fiscal year 2025 (= the year ending in January 2025), Wall Street analysts currently estimate revenue growth to USD 725m, representing 12% year-on-year growth – a notable slowdown compared to prior years.

Asana has about USD 450m of net cash, leaving it with an enterprise value of USD 3.6bn. With a current share price of USD 18.50, the company is trading at 5x revenue.

As a rule of thumb, a US-based software company with a combination of 15% revenue growth, 20% long-term net margins, and a 1.5x price/earnings to growth ratio should normally be trading at about 4.5x revenue. Based on the current set of metrics, Asana stock remains slightly too high to qualify as a true bargain. It looks like Moskovitz was buying way too early when he picked up stock in 2022.

However, if the company managed to get back to 20% revenue growth and generated 30% net margins over the long term, it would deserve a valuation closer to 9x revenue. That's far from an unrealistic prospect once Asana leaves the current lull behind and achieves better economies of scale.

The kind of software that Asana is offering should stay in a secular growth trend, with Asana bound to remain in the top five of companies globally who offer this kind of service.

Moskovitz has vowed to not take the company private, and he would be unlikely to sell even if there was an offer on the table.

I'll keep this stock on my watch list, in case any general market turbulence ever makes it fall a lot further. The product is convincing, and it's a company that genuinely enhances its customers' lives. Along the way, it should eventually make heaps of money, once it has reached critical mass.

I doubt that Asana stock will be back to its all-time highs any time soon, but it's an interesting growth play nonetheless.

While I wait for things to advance, I may well be testing its product. If it improves my worklife, too, then researching this potential investment will have already been worth my while. Move over Slack, here come the test drive of Asana…

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: