Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The battle for ASOS – crunch time?

Online fashion retailer ASOS is bound to see corporate action soon.

It's a crisis-stricken company, but one with potentially tremendous strategic value to a swathe of potential bidders.

One retail billionaire has used the past 12 months to more than triple his stake, from 7.4% to now 26.26%.

Another retail billionaire already holds 27.1%.

A derring-do American hedge fund has accumulated 14% and could act as kingmaker.

This is a story that is going to make headlines sometime this year.

Today's Weekly Dispatch will put you ahead of the crowd and point you to a clever backdoor route to make money off it.

Michael "Mike" Ashely – retail billionaire and one of the main protagonists.

Once hyped like few other companies

There was a time when ASOS (ISIN GB0030927254, UK:ASC) was one of the rising stars of the British economy and the London stock market.

In the early 2000s, the company set out as a place where TV and movie fans could turn to find replicas of the outfits they'd seen on their screens. The acronym originally stood for "As Seen on Screen" and the company's "red carpet replicas" tapped into Britain's enduring obsession with celebrities.

While it got the firm off to a good start, it also led to an eventual expansion into other parts of the fashion market. "As Seen on Screen" was changed to "ASOS", and became an e-commerce store for so-called fast fashion in general.

The revised concept took the UK by storm. ASOS stock rallied from 14 pence in 2004 to a mind-boggling 6,960 in 2014 – a 500-fold increase.

The share price subsequently oscillated in a very broad range, trading as low as 1,200 pence during the March 2020 pandemic crash, only to recover to 5,600 pence during the e-commerce hype of 2021.

ASOS.

It is now trading around 350 pence, which is about as low as it has ever been in recent memory. The company has a market cap of GBP 420m compared to over GBP 30bn during its heydays. The peak valuation was equivalent to nearly 8x its annual revenues of then GBP 3.9bn.

It's not just the stock that has dropped dramatically, though, but the entire ASOS business.

The ever-elusive turnaround

During the e-commerce boom triggered by the pandemic lockdowns, ASOS overexpanded and lost its way:

- In 2023, the company showed a loss of GBP 300m, mostly due to writing down excess inventory. Fast fashion simply goes out of fashion – and often, fast!

- The company's brand-new warehouse in Lichfield, Staffordshire, was mothballed less than a year after opening.

- Amid its ongoing crisis, management seemingly wasn't able to keep its finger on the pulse. As a November 2023 opinion piece in The Guardian summarised: "Today, it is difficult to say exactly what Asos is and who it appeals to."

In October 2022, ASOS hired a new CEO, José Antonio Ramos Calamonte.

In his own words, Calamonte set out to:

- "Renew the commercial model and improve inventory management.

- Simplify and reduce the cost profile.

- Ensure a robust and flexible balance sheet.

- Reinforce the leadership team and refresh the culture."

The corporate talking points hit all the right buttons with analysts, and Calamonte's appointment made the share creep back up to 550 pence.

Today, it is once again near its five-year low of 325 pence, and it may soon reach new lows not seen since then late 2000s.

Following the latest company update, it's clear that Calamonte has a steeper hill to climb than anticipated. ASOS also admitted it would need at least until 2025 to return to sales growth and a positive pre-tax profit.

Still, the new CEO keeps his optimism. Calamonte claims ASOS had made "good progress", and after a year of cost-cutting and improving efficiencies he believes the company ended 2023 "a smaller, but inherently more profitable business". In 2024, Calamonte wants to focus on offloading old stock, and he plans to shift ASOS "back to being in fashion".

Empty corporate talking points?

The Retail Gazette, always one to follow for analysis of this industry, published its own view in November 2023: "How Asos plans to bring itself 'back into fashion' – and will it work?".

Well, will it?

If the share price is anything to go by, the market doesn't buy it.

Investors seem to fear that between now and the promised turnaround of 2025, cash might get tight. In May 2023, ASOS had to borrow a further GBP 275m and raise GBP 80m equity from shareholders. Given the latest trading updates, it looks like the company might need further cash. Why else would it explore a potential sale of its Topshop brand? Even though reported as a rumour by Sky News in October 2023, it probably has legs. ASOS had acquired Topshop in 2021 for then GBP 265m, and while a sale would solve a short-term financial problem for the company, it would send a terrible signal to ASOS shareholders. Selling off an asset when everyone knows you are desperate for cash will see potential buyers exploit your weakness.

Of course, there is an alternative path.

As it were, there is no shortage of retail billionaires with an interest in the company.

Povlsen versus Ashley

ASOS's largest shareholder with a 27.1% stake is Anders Holch Povlsen. The Danish entrepreneur owns Bestseller, a privately held, family-owned clothing and accessories company with almost 9,000 shops worldwide. Povlsen is estimated to be worth around USD 10bn, and is also the largest landowner in Scotland where he passionately pursues rewilding projects.

Anders Holch Povlsen – the other billionaire interested in ASOS.

Povlsen's stake in ASOS is unlikely to have made a positive contribution to his net worth yet. Povlsen had steadily increased the stake between 2010 and 2016, reaching 27.6% in 2016. It's likely that his average purchase price is way above the current share price. He would have been better off selling his stake during the firm's boom times.

The second-largest holder is Michael "Mike" Ashley, the British retail billionaire known for his success with Sports Direct. Ashley is worth nearly GBP 4bn, and he has a reputation for aggressively buying into crisis-ridden retailers, often using public markets to build stakes when he deems a share to be undervalued.

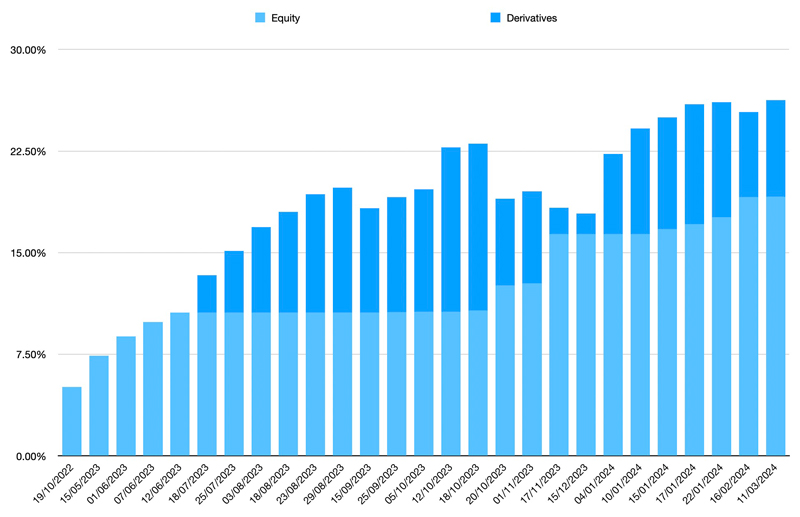

One of Ashley's quirks is that his holding company buys not just shares, but also uses derivatives to build stakes. E.g., Ashley likes to sell put options, which for regulatory purposes count towards the total percentage holding and need to be disclosed when above the disclosure thresholds. However, these combined disclosures for shares and derivatives are not always easy to follow.

Undervalued-Shares.com ventured where no one else has gone yet. Yours truly assembled the data of every single disclosure that Ashley's group has made for equity and derivative holdings in ASOS. As the chart below shows, Ashley has been on the prowl in not one but two ways. His group increased the percentage of shares it held (rather than derivatives), and it increased the absolute level of its stake in ASOS. Ashley's combined holding of shares and derivatives is currently above 26%, just a smidgen below Povlsen's holding (which consists purely of shares). Of Ashley's total, nearly 20% is now held through shares, compared to shares making up an 8% stake a year ago.

It's not inconceivable that Ashley's group will, before too long, catch up with Povlsen's stake.

Then, what?

A duel at dawn in the foggy forests that Povlsen planted to rewild the Scottish Highlands?

Hardly.

However, it's clear the two main characters will have to do SOMETHING about their stakes in ASOS.

Two billionaires in a tug of war – or a consortium?

Much has been written about the allegedly acronymous relationship between Povlsen and Ashley, and centred around a building in Edinburgh that both have an economic interest in.

Source: Retail Week, 26 January 2021.

Is Ashley really the nemesis of Povlsen or did the media hype it up?

I don't know, but I do know that there is an increasing need to act at ASOS.

As if the company wasn't already in enough trouble, it's recently also come under pressure from yet more competitors. New entrants such as Chinese disrupter Shein and second-hand clothes vendor Vinted are putting additional pressure on ASOS. And hot off the press, there is now a regulatory threat posed by countries that want to rein in fast fashion because of its environmental cost, including France. ASOS is now at serious risk of finding itself in a never-ending retreat.

Neither Povlsen nor Ashley would have to cut back their lifestyle if ASOS keeled over and went to zero. However, both will be keenly aware that ASOS remains a tremendous opportunity for the right retailer, and it'd be a shame to see it go to waste.

ASOS still has a staggering 23m active online customers. Many of them hail from a younger clientele, with money in their pockets and a desire to be a part of fast-moving fashion trends that they check out online.

Povlsen's group is privately held, and little is known about its strategy. Povlsen also owns a 10% stake in Germany's online fashion retailer Zalando (ISIN DE000ZAL1111, DE:ZAL), so he must have some kind of particular interest in this sector. Details are unknown, though, also because Povlsen is famously reclusive. For the Dane, a risk is that Ashley could eventually team up with Camelot Capital, a US hedge fund managed by a Briton, William Barker. Camelot controls 14% of the votes, and Barker will want to maximise the value of his stake.

For Ashley's company, the circumstances to his strategic interest are much clearer. It's been in the public domain for years that he aims for his company to expand into online markets.

The strategic value of ASOS

In October 2022, The Retail Gazette looked into why Mike Ashley will be keen on ASOS: "How Frasers Group is plotting an online empire"

"What is Frasers' gameplan? Is it planning to create an online empire?

Not an online empire but an omnichannel one, says retail consultant Graham Soult. 'When Frasers Group invests in these online brands, it does things with it in bricks and mortar too.'

Sources have suggested that Frasers could seek to use its stake in Asos to build a partnership which could involve selling each others' brands or sharing distribution.

Asos could be a vehicle for selling the labels already owned by the group and any future purchases made by Frasers. … There could also be scope to bring Asos to life in House of Fraser stores."

What does "omnichannel" mean? It's a reference to the ever-increasing integration of brick-and-mortar stores with e-commerce sites. Successful retailers use their stores as a delivery and return point for online orders, which is cheaper than using couriers or the mail, and it allows customers to combine picking up their parcels with checking out the latest products – to name just one advantage.

The absolute master at doing this is Britain's department store Next plc (ISIN GB0032089, UK:NXT). Undervalued-Shares.com published a research report about Next's strategy in November 2023, and the stock has since climbed to new highs.

Ashley is said to be keen on emulating Next's strategy. In fact, his group is so intent on expanding into e-commerce that it has hedged its bet in case ASOS remains out of reach.

Besides building a stake in ASOS, Ashley's company has amassed a 22% stake in Boohoo Group (ISIN JE00BG6L7297, UK:BOO), a fairly similar company but with a stronger focus on very young customers and cut-throat prices. Whereas ASOS has 23m active online customers, Boohoo has 17m. Boohoo's share price has also been smashed to pieces, and the company now has a market cap of just GBP 420m. The entire case is shockingly similar to that of ASOS.

Ashley is known to hedge his bets. When he tried to gain a foothold in Britain's electronics retail market, he built an 11% stake in Currys (ISIN GB00B4Y7R145, UK:CURY), and a 24.7% stake in AO World (ISIN GB00BJTNFH41, UK:AO), two high street competitors. Currys has recently become the target of competing takeover bids, which means Ashley's company is going to walk away from the investment with a tidy profit. In the meantime, it can engage further with AO World, where it has recently become the single-largest shareholder.

Britain's mainstream media regularly report about Ashley's exploits in M&A, and there are a couple of high-level talking points that British journalists seem to forever copy from each other:

- "Ashley has no strategy."

- "Ashley buys stakes based on his mood and whim."

- "Ashley's holding company doesn't know what to do with these acquisitions."

It's a ridiculous line of argument. Public perception and financial reality couldn't be further apart. After all, Ashley has built one of Europe's largest, most profitable retail companies and thus became Britain's 49thrichest man.

The good news is, if you play your cards right, there are now multiple opportunities for making a buck (or two) out of this entire melange.

ASOS stock – a buy?

The obvious question to ask is, will someone place a takeover bid for ASOS?

The company would very likely benefit from a single strong owner being in charge, radical changes implemented outside the public eye, and a strong balance sheet as well as retail expertise backing management.

Indeed, in early summer 2023, Turkey's e-commerce giant Trendyol was reportedly preparing a GBP 1bn bid for the company. Trendyol has the financial backing of China's Alibaba, among others. As the media reported at the time, "it is believed that the proposed deal would have valued Asos at between £10 and £12 a share."

Reportedly, the bid didn't happen because Povlsen wasn't inclined to sell.

This was nearly a year ago, and the situation has since evolved further. Given the combination of ongoing, severe problems at ASOS and Ashley's percentage stake gradually catching up, *something* is increasingly likely going to happen soon.

A bid is one realistic possibility. Many other shareholders would probably be only too happy if someone helped them to get an acceptable way out of their current misery.

How much is someone going to bid for ASOS in its current bad shape, and how will the large shareholders deal with it?

ASOS's market cap represents about 0.13x sales. Put another way, each active customer is currently valued at GBP 18. This seems like a relatively low price given prevalent customer acquisition prices, and indicates there is significant upside in a bid situation.

Then again, ASOS is a crisis-ridden company that may have to go to capital markets with its cap in hand. Shareholders could also face significant dilution from a potential emergency funding round. The stock may yet fall further.

Is this risk/reward ratio a good situation to walk into?

It's tempting in some ways, given the increasing pressure on shareholders to act and the resulting whiff of impending corporate action.

Could there even be a surprise? Povlsen and Ashley are in it for the money, and they could end up working together after all. Povlsen is richer, but if he took his stake to 27%, Ashley could sure talk with him on the same eye level. May Camelot's Barker, who sits on the board, act as a neutral go-between?

Somewhere in there is also the possibility of either party trying to buy out Camelot and taking their stake to 51%.

Also, a neutral third party could turn up and try its luck with a knock-out bid.

Plenty of possibilities, but it's not without risks, given ASOS's precarious state. As another old rule of investing says, don't buy into a takeover candidate if you aren't also so convinced of its fundamental prospects that you'd be happy to keep holding the stock.

In my view, for private investors watching this from the outside, there is a smarter route altogether.

A backdoor route for winning either way

Ashley's family holding is Frasers Group (ISIN GB00B1QH8P22, UK:FRAS), a British retail group that owns around 30 brands, most prominently Sports Direct. It operates ≈500 shops in the UK and ≈360 shops internationally, all complemented by e-commerce sites.

Thanks to the vast excess cash that the retail operation throws off on an ongoing basis, Frasers Group has become a kind of investment fund. Ashley is using the company's spare cash to buy and sell stakes in undervalued companies that fall within his range of expertise:

- He once snapped up a stake in his competitor, JD Sports (ISIN GB00BM8Q5M07, UK:JD), only to sell the shares for up to 11 times what he had paid when the company recovered from a crisis.

- During the pandemic, he built a stake in Germany's luxury fashion group, Hugo Boss (ISIN DE000A1PHFF7, DE:BOSS). When markets were reeling from stores being closed for months, Ashley bought stock hand over fist. He subsequently increased the stake to nearly 30% and used his leverage as large shareholder to negotiate an advantageous retail partnership with the Germans. He has recently been selling down, taking many millions of profit.

- His current dealings in Currys and AO World fall right into that category, and will likely see him come out on top as well.

Mike Ashley, a man without a strategy who places random punts on stocks?

As if.

In my view, Frasers Group is the smart backdoor route to benefitting from the consolidation that is currently taking place in Britain's (and Europe's) retail industry following the post-pandemic slowdown.

What if Ashley wins control over ASOS and/or forms a valuable strategic partnership?

What if Ashley does not win the battle but eventually sells his stake to a bidder?

For shareholders of Frasers Group, it's probably "heads he wins, tails you lose."

Ashley and his team are highly competent players in the British and European retail industry. Frasers Group, as the vehicle that Ashley owns 71% of, is currently one of the smartest asymmetric bets that you can find on the London Stock Exchange.

Why is it an asymmetric bet that combines low risk with large upside?

Instead of taking the risk of buying ASOS, you can simply latch onto Ashley and probably come out a winner either way.

It's the lateral thinking kind of way to approach what is likely to go down at ASOS in 2024.

I'd call it THE best way to place a bet on SOMEONE doing something with ASOS's valuable customer base.

And if that fails, there is also Boohoo Group… Which, obviously, has also got Frasers Group on its tail already.

The media likes to describe Ashley as an oaf. In reality, he is the Buffett-esque master of British retail. Ashley will likely come out atop either way, with shareholders of Frasers Group reaping the rewards. With that in mind, anyone who ever considered ASOS should probably check out Frasers Group instead.

Frasers Group: the Berkshire Hathaway of British retail

Hesitant to buy into ASOS? I'd sure be.

But check out Frasers Group instead!

The leading British retailer is currently one of the smartest asymmetric bets that you can find on the London Stock Exchange.

At its current level, the stock is trading at less than 5x EV/EBITDA. Its price/earnings ratio of 8 is 50% below the stock's own ten-year average, even though earnings per share will likely grow by 14% p.a. between 2024-2026.

On the current level, the highly cash-generative company is buying back stock.

Frasers Group: the Berkshire Hathaway of British retail

Hesitant to buy into ASOS? I'd sure be.

But check out Frasers Group instead!

The leading British retailer is currently one of the smartest asymmetric bets that you can find on the London Stock Exchange.

At its current level, the stock is trading at less than 5x EV/EBITDA. Its price/earnings ratio of 8 is 50% below the stock's own ten-year average, even though earnings per share will likely grow by 14% p.a. between 2024-2026.

On the current level, the highly cash-generative company is buying back stock.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: