Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Blogs to watch (part 23): Good Investing

Today's feature of another investing website is one that I am particularly excited about, but also a bit scared of.

I am excited because it's a truly outstanding investing website. Its content ties right in with what most of my readers are interested in, and it's 100% for free.

I am scared because some of you may leave Undervalued-Shares.com and migrate to Good Investing instead!

I've long considered Good Investing a secret that I'd rather keep. It's a place that I regularly go to for inspiration about stocks to feature in my in-depth research reports.

However, the idea behind "Blogs to watch" is to point you to the very best blogs and investing websites that I know of.

Secret no more, then! Tilman Versch's Good-Investing.net more than deserves a place in my blog series.

Here is why you will probably be interested in this website.

1. Extensive discussions of specific stock ideas

Good Investing occasionally features very detailed discussions of individual investment opportunities.

Take "Is Nintendo a multi-bagger?" as an example. There are not many people who can produce a 2h (!) video interview about a single stock and get people excited about it. Tilman Versch pulls it off.

The interview is absolutely outstanding in terms of the quality of the underlying stock analysis. It's so good, that I even considered writing one of my own reports about Nintendo (ISIN JP3756600007). However, this would have felt like plagiarism. I take great pride in primarily introducing you to stocks that are not discussed elsewhere, which is why I dropped the idea.

A few other examples of Tilman's interviews about specific stocks include:

"How does Spotify Stock become THE audio platform?"

"Why are you invested in Sea Limited and Carvana?"

Interviews about individual investment opportunities are relatively rare on Good Investing, but all the more worthwhile when a new one appears. Tilman recently told me that going forward, he'll pursue a focus on European companies.

2. Transcripts of interviews

Most videos on Good Investing - including the lengthy video interviews such as the 2h Nintendo discussion - are also available as high-quality transcripts.

Anyone who has ever tried to produce a transcript of a video will know just how much work it is, even if you outsource parts of the job.

Video transcripts are great if you can't or don't want to spend too much time on watching a video. Just skim through the written content to get the key points!

3. A thriving, curated community

The Good Investing Plus Community is the highest-quality investing-related community that I know of – bar none. It's a place where I, too, regularly go to for information, inspiration and to broaden my personal network.

There is a catch, though: you have to apply to become a community member. Tilman's approach is to protect the quality of the community by curating the audience. If you can convince him that you'll be a suitable, useful community member, you can join the community for free. (You don't need to be a member to access all the other content on Good Investing.)

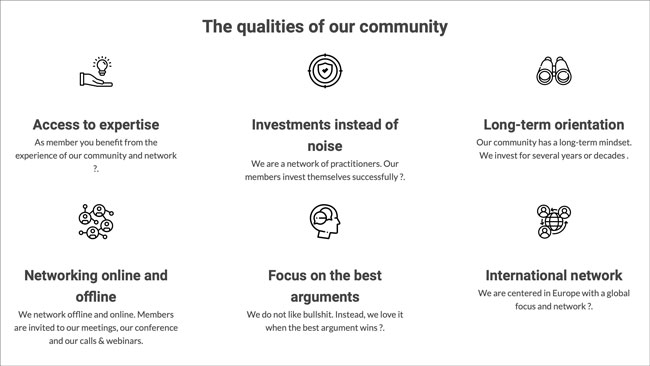

The Good Investing Plus Community does deliver what it promises on the website.

4. Lots of educational content

Good Investing is a place to learn and grow. Tilman makes it possible for you to learn from the best.

Whenever I use LinkedIn and look at the profile of a high-calibre, outstanding person in the investing industry, I notice that Tilman is already connected to them via his LinkedIn profile. He seems to know just about anyone who matters in the industry, and he gets them to do in-depth interview, mostly on how to improve your investing skills. Tilman's interview partners are the brightest minds of the industry, and quite often they are people you would otherwise probably never have heard about.

Recent examples include:

"Network intensively! An interview with Dennis Hong & Fred Liu"

"Do you want to start an investment business? Watch Guy Spier's advice"

"Edward Chang, how did you compound with 30%+ p.a. at Pledge Capital?"

Going forward, Good Investing aims to have an even stronger focus on outstanding investors, i.e. investors and fund managers with a proven track record of >15% p.a.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

5. A generous host who deserves everyone's support

A website such as Good Investing lives off the person who runs it. Most of the blogs and investing websites featured on "Blogs to watch" are operated by an individual.

Tilman is one of those people I'll always have time for, because he has also helped me in the past. Tilman is extremely good at being an active, approachable and helpful host of his community. When I recently asked him for advice on a question that I needed a few experts for, he generously and quickly provided me with more links to relevant people than I would have dared to ask for. I regularly see Tilman proactively connecting people in his community.

I made a voluntary contribution to Good Investing when Tilman relaunched it last year, which is one of the best ways to support him (via PayPal or Patreon).

If or when you use Good Investing and get benefits from it, you should also contemplate what you can give back. This doesn't need to be monetary. E.g., you could host a Good Investing meet-up in your city or region.

Plenty more to discover

You'll find Good Investing a real treasure trove of information.

For example, it also includes a list of "Good Investing Blogs". No doubt, if you made it this far into this article, you'll be curious which blogs Tilman recommends.

If you manage to become a member of the Good Investing Plus Community, you'll be able to register your interest for a group trip to the next shareholder meeting of Berkshire Hathaway (as I have done).

If you haven't come across Good Investing yet, you should check it now.

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get your hands on a real treasure

Fancy owning Russian reindeer leather from 1786?

It’s a material that is ultra-rare and a real treasure, with hardly any hides left in circulation. Luckily, you’ve got me, though - and my upcoming Special Edition book! Here’s your chance to own a unique piece of history.

Get your hands on a real treasure

Fancy owning Russian reindeer leather from 1786?

It’s a material that is ultra-rare and a real treasure, with hardly any hides left in circulation. Luckily, you’ve got me, though - and my upcoming Special Edition book! Here’s your chance to own a unique piece of history.