If you wanted to disprove the efficient market hypothesis, look no further than Marshall Group plc, also known as "Marshall of Cambridge". It's a case study for markets being slow to recognise a new situation – so slow, in fact, that you can still take financial advantage of it.

The 113-year-old Marshall family group has long had a diverse set of operative companies, ranging from car dealerships to aircraft servicing and recruitment. Its most interesting asset – by far – has long been ignored by the market: 900 acres (364 hectares) of land on the outskirts of Cambridge. While plans for the site's redevelopment have progressed for years, the market still values the land bank at zero.

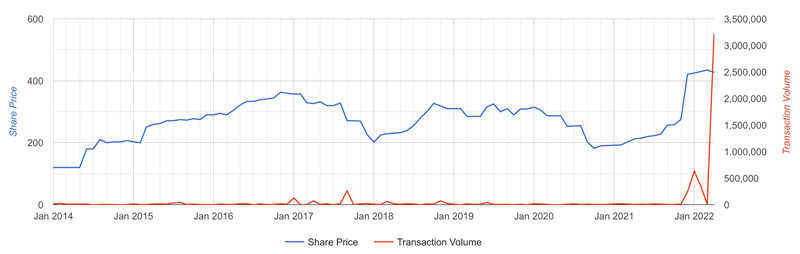

Based on my local intel about recent block trades worth millions, the stock could finally be about to break free.

The Marshall Group airport and industrial site in Cambridge.

A diverse, successful family holding

Marshall Group is a family-owned holding company with annual revenue in 2020 of GBP 2.5bn. Despite its formidable size, it was never listed on a stock market.

However, its stock does change hands occasionally on a privately organised market. James Sharp & Co., a stock brokerage firm located in Bury near Manchester, provides quotations to buy and sell. You just register your interest and get an email alert when a line of stock becomes available. Given the contortions required to trade the stock, few investors have paid any attention.

The more visible part of the Marshall family empire was a subsidiary, Marshall Motor Holdings, whose stock was listed on the London Stock Exchange. Marshall Motor Holdings is one of the UK's largest car dealer networks, with 162 dealerships representing 26 brands across the UK. Marshall Group held a controlling 64.41% stake.

In November 2021, the spokesperson of Marshall Group stated that they'd be willing to sell their stake in Marshall Motor Holdings if a suitable offer was made. Two weeks later, the company behind WeBuyAnyCar made a GBP 325m takeover offer backed by a British private equity company. Marshall Group swiftly accepted and received GBP 202m at the end of May 2022. The group went from having GBP 40m of net debt to being awash with cash.

Source: BBC, 6 December 2021.

When news of the sale of Marshall Motor Holdings broke, the share price of Marshall Group swiftly climbed 55%, from 275 pence to 425 pence, in spite of overall quite weak markets at the time. The brutal sell-off in equity markets during the past few weeks didn't do the stock any harm either, and it continues to trade just below its all-time high of 430 pence. Why the relative strength?

On the surface of it, investors must have simply been pleased with the overall direction of the company. During 2021, Marshall Group sold four business units which didn't just yield attractive prices, but they also helped to give the diversified holding more focus:

- Aeropeople, a recruitment agency in the aerospace sector, was sold for GBP 1.8m in April 2021. The company was too small to warrant a presence within such a large group.

- Martlet Capital, an early-stage investment vehicle, was sold for GBP 11m at a time when venture capital was the hottest show in town. In retrospective, the sale couldn't have been better timed.

- A small housing development in East Cambridge, dubbed Land North of Cherry Hinton, went for GBP 34.5m.

The remaining group is now focussed on three divisions:

- Marshall Aerospace and Defence Group (MADG). This core division specialises in servicing one particular military transport plane, the Lockheed Martin C-130 Hercules, which is utilised by 70 nations around the world. The division also produces shelter solutions used in humanitarian, defence, and security operations. Last but not least, it has a small division for producing complex, low-volume components for ships, submarines, and aircraft. Going forward, this division will contribute ≈82% of sales of the remaining group.

- Marshall Fleet Solutions (MFS). As the UK's largest independent specialist for servicing commercial vehicles, MFS will contribute a further ≈16% of the group's revenues. The division keeps 200 engineers on stand-by in 13 locations across the UK, which allows it to offer a 24/365 emergency service for all sorts of commercial vehicles.

- Marshall Group Property (MGP). With 2% of annual group revenues, this division appears to be the minnow within the company's portfolio. However, it's MGP that has the greatest hidden potential and could propel the stock price forward during the remainder of the year.

Farmland turned prime real estate

An incident over 100 years ago resulted in Marshall Group owning 900 acres of land that sit within 3-5 kilometres (2-3 miles) of Cambridge's city centre.

The company was originally set up to provide chauffeur-driven cars. When the mechanics it employed to repair the cars helped an airship after a nearby emergency landing in 1912, the company's founder, David Marshall, spotted an opportunity in the emerging aviation industry. He subsequently acquired a nearby farm and initially used the land to operate a flying school and a basic airfield. Later, the company developed a fully-fledged airport, which became famous for training 20,000 air crew that participated in the Battle of Britain in 1940.

Over the decades, what had been a farm on the outskirts of a sleepy university city became prime land on the edge of a growing and wealthy tech and education hub. The land also benefitted from the gradual tightening of British planning laws. Like many cities in Britain, Cambridge is surrounded by a green belt where development is not permitted. The city is visibly bursting at its seams, and space for further development is scarce. This makes an industrial zone that is located between an existing residential area and the greenbelt a prime target for redevelopment.

In a way, the situation experienced by Marshall Group is not entirely different from that of the Duke of Westminster whose family acquired 300 acres of farmland on the outskirts of London in 1677. Today, the two areas are known as Mayfair and Belgravia.

It long seemed a waste for Marshall Group to utilise such well-located land for a little-used commercial airport and industrial facilities. Hence, in October 2019, the company submitted a planning application to move its aerospace operation out of Cambridge to an airport in Cranfield in Bedfordshire. If everything goes according to plan, the land currently used for the airport will become available for redevelopment. All of this started to happen at a time when the local authorities began to consider the Greater Cambridge Local Plan, an initiative to find space to develop 49,000 new homes in and around Cambridge. Cambridge was identified as having one of the least affordable housing markets in the UK, which is why taking pressure off the housing market has become a key priority for local politics.

Out of the 690 sites that were considered for the scheme, only 19 made it into the final round. Work on getting these plans firmed up and approved is ongoing, but it's widely acknowledged that the site owned by Marshall Group is one of the most obvious ones to consider for redevelopment. It's large enough to make a real difference to the housing market, it's located close enough to the city's centre to be highly attractive for residents and companies alike, and closing down a commercial airport that offers little benefit to the local population is a vote winner in more ways than one. For holiday getaways, residents of Cambridge tend to use London's Stansted or Luton, both of which are within easy reach.

Source: Cambridge News, 5 October 2021.

The redevelopment of the airport site could start in 2030 and see an initial 2,850 houses built by 2041. Longer term, the site has space for 12,000 homes and about 5m square feet of commercial space. This is a multi-decade project and difficult to grasp in terms of its size and potential pay-off. However, it starts to make a lot of sense once you put today's value of land in Cambridge in relationship to Marshall Group's current market cap.

An irrationally low valuation

With 64.48m outstanding shares and a share price of 425 pence, Marshall Group has a market cap of GBP 274m (ignoring small differences between different share classes). Net cash following the recent receipt of cash for Marshall Motor Holdings is probably GBP 160m, so the company has an enterprise value of about GBP 114m. The MADG division alone will probably generate EBIT of ≈GBP 15-20m p.a. in a normal (non-pandemic) year, meaning the company is trading at 5-7 times the EBIT of its largest division. Put in somewhat simplified terms, you pay a moderate price for the existing businesses and the land bank is essentially thrown in for free.

It begs the question, what might the land be worth?

The most reliable source of land prices is a data set published by the UK government. Using input from the Land Registry, it shows values for each of the country's districts or boroughs. While an acre of residential development land in the South of England is generally worth around GBP 1m, in and near Cambridge, it can be worth GBP 2.5m per acre.

Marshall Group has already started to redevelop some of the land it owns with residential housing. It has yet to receive the final go-ahead for the airport site's redevelopment, there'll be costs for clearing the site, and the future value of any project is lower when interest rates rise. However, even the recent sale of some slightly less attractive development land in a nearby location yielded GBP 0.5m per acre. If you extrapolated that value to the remainder of the land bank, Marshall Group's site would already be worth around GBP 450m. This estimate is probably too low given the average value of land in the region, but staying on the conservative side makes for a good baseline to work with. Real estate prices in Cambridge are also likely to continue to rise while the company works to free up the site. Cambridge has long been the UK's answer to Silicon Valley, and it's gained a reputation as the fastest-growing economy within the UK.

In essence, the land could turn out to be several times Marshall Group's current enterprise value. As of yet, the market effectively values it at zero.

How can that be?

This opportunity has existed mostly off the radar, primarily because Marshall Group stock has been difficult to trade.

Until recently, members of the Marshall family owned 76.3% of the shares, with the remaining 23.7% in free float. You'd usually only see the occasional trade of 5,000 to 25,000 shares, and you need to have an account with James Sharp & Co. to participate in the firm's private marketplace. Stocks that are difficult to trade generally trade at lower valuations.

Such low valuations persist until something leads to a re-rating. If recent market activity is anything to go by, Marshall Group may be approaching the point where its stock is about to undergo this kind of transformation.

We've recently seen a number of very large block trades go through, all around the 425 pence level: several trades between GBP 400,000 and GBP 2.5m, and even one of GBP 12m. Who felt compelled to hover up such large numbers of an otherwise illiquid stock? The buyer will be aware that such a position would be impossible to sell under normal circumstances. What led to these trades?

Trading near its all-time high.

Following the jump in share price after the sale of Marshall Motor Holdings, a number of Marshall family members are said to have offered up stock for sale. As ever, after a few generations of family ownership, some heirs do like to cash in to pursue their own interests. (A similar situation led to the eventual sale of John Menzies plc, a situation that Undervalued-Shares.com Members are well familiar with.)

The death of Sir Michael Marshall in 2019 could have been a game changer. His son, Robert Marshall, had been group CEO but subsequently stepped down and is now focussing on venture capital investments in Cambridge. Another family member was appointed to the board in 2020 when Robert left, but has subsequently resigned to concentrate on his own business interests. For the first time in the company's history, there is currently no Marshall member of the board.

When family tradition is taken out of the equation and managers with purely financial incentives take over, it usually means that everything is put up for discussion. Big changes could soon take place at Marshall Group – and may have started already, given the developments described above.

What's the direction of travel?

Right now, there is a whole range of possibilities:

- Marshall Group could simply use its enormous cash hoard to pay a special dividend. The company doesn't just have GBP 160m of net cash, it also has an unused credit facility of GBP 75m.

- The company could further reduce its portfolio of subsidiaries and focus on the aerospace and defence business. The entire Western world currently has a renewed interest in defence companies, and American firms have already gobbled up several market-leading British defence companies. A focussed aerospace and defence subsidiary could probably be sold quite easily, either to private equity or a strategic buyer from the sector. Marshall Group's most important services relate to an American product, and the firm is even licensed to produce parts on behalf of Lockheed Martin (ISIN US5398301094, NYSE:LOM). This makes it a natural fit for acquirers from the US or even Lockheed Martin itself.

- The airport site could be spun off into a separate company and floated on the stock market, where it would probably attract a lot of attention as a specialist real estate play on Cambridge. It could raise capital for the long-term development of the site and generate additional value by handling the developing all by itself.

- Several of these possibilities could be combined with each other, starting with a special dividend, a spin-off of the real estate, and a flotation or sale of the defence business.

It's all in the realm of speculation right now, but it would explain some of the recent block trades.

Who were the buyers of these large blocks of shares? According to local rumours, the endowment fund of Cambridge University is one likely candidate. It would certainly have the financial firepower to make a bid for some or even all of the site. If anything, as a larger shareholder in the group, the university would probably get first picking at upcoming real estate sales and rentals. Seeing its investment increase in value along the way would be thrown in for good measure. As Cambridge's largest real estate owner with some land purchases going back hundreds of years, the university will know a thing or two about the value of property in the region.

Be that as it may, the stock of Marshall Group does appear to be a bargain right now. It comes with the catch that you need some tenacity to build a position, and then probably stick to it for a few years to see its full value realised. There is also a risk that the site's redevelopment is not going to go ahead for some reason. It's a low risk given Cambridge's need for housing, but it's not zero given the strange twists that local politics can take.

Overall, this stock appears to be the rare case of an investment that is relatively safe but comes with the chance of making several times your money. Provided, of course, you manage to get hold of some stock – this series is labelled "microcaps" for a reason.

In a few years, if there is an IPO of a Cambridge real estate company on the London Stock Exchange, remember where you read about it first!

Blog series: Forgotten microcaps

There's more to "Forgotten microcaps" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Death care: a crisis-resistant industry

The death care industry benefits from the only absolute certainty that we all have to live with: sooner or later, everyone becomes a customer.

Which is why – at a time when tech, software and Internet investments have gone out of fashion – death care could prove a crisis-resistant industry.

I picked one company in this sector whose stock price is currently too low by a factor of 2-3, at least.

The remainder of 2022 should bring not one or two, but three catalysts for a re-rating of the stock. If the company recovers as expected, the current stock price would be akin to a price/earnings ratio of 4, if not even lower.

Death care: a crisis-resistant industry

The death care industry benefits from the only absolute certainty that we all have to live with: sooner or later, everyone becomes a customer.

Which is why – at a time when tech, software and Internet investments have gone out of fashion – death care could prove a crisis-resistant industry.

I picked one company in this sector whose stock price is currently too low by a factor of 2-3, at least.

The remainder of 2022 should bring not one or two, but three catalysts for a re-rating of the stock. If the company recovers as expected, the current stock price would be akin to a price/earnings ratio of 4, if not even lower.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: