Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

How to invest in frontier countries (part 1): Iran

Image by vanchai tan / Shutterstock.com

In February 2021, I wrote about the "Amazon of Iran", and how you can invest in it through a little-known listed Swedish company. The stock of the Swedish company, Pomegranate Investment (ISIN SE0006117511), has since risen by 53%, from EUR 13 to EUR 20. Still, it hasn't even reached its last published net asset value yet (EUR 22.80) and probably has further to run.

Admittedly, my article may have played its part, and according to some of my readers, there was precious little stock available to buy. Since Joe Biden came into office, the idea of investing in Iran has gained more interest. Indeed, the "Amazon of Iran" has become the most-read article on my blog this year.

Which makes sense, given that:

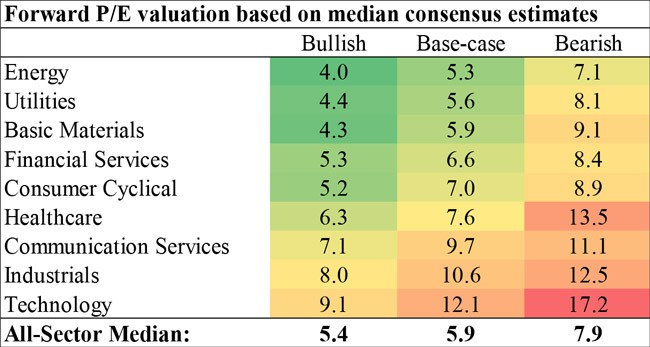

- Iran has one of the world's cheapest stock markets with a p/e of 4.

- It is one of the world's last "closed" countries, and it has a large, young population.

- The Biden administration is likely going to loosen economic sanctions.

Whatever your view of politics, Iran does look like an interesting investment opportunity, and now seems the right time to look at it in more detail.

The Economist described Iran as follows: "No market in the world has the same level of untapped potential." Could investing in Iran turn out to be a similar ground-floor opportunity like investing in Russia or China in the 1990s?

It probably could, but there is a significant hurdle you need to overcome.

Iranian stocks are, at least for now, notoriously difficult to access for investors. This is also part of the attraction, though. As soon as access becomes easier, you'll probably see the first uplift in stock prices and company valuations.

Right now, just 0.5% of Iran's equities are owned by foreigners. As soon as investing in Iran becomes politically, legally and logistically feasible, you'll have every large fund management company turn up on the doorstep of the Tehran stock exchange to get exposure to Iranian equity.

Needless to say, I'd like to be ahead of the curve, and give my readers the possibility of joining in.

I set out to investigate and found two more ways for getting investment exposure to Iran right now. It won't work for US citizens (sorry!), but it will work for citizens of most other countries. You do need to be a professional investor, but the hurdles to get in are entirely reasonable. Also, both ways can currently accommodate new investors, i.e. there isn't the same issue of lack of liquidity as in the case of Pomegranate Investment.

Here is everything you need to know about investing in Iran right now.

Why I like Iran: the less obvious reasons

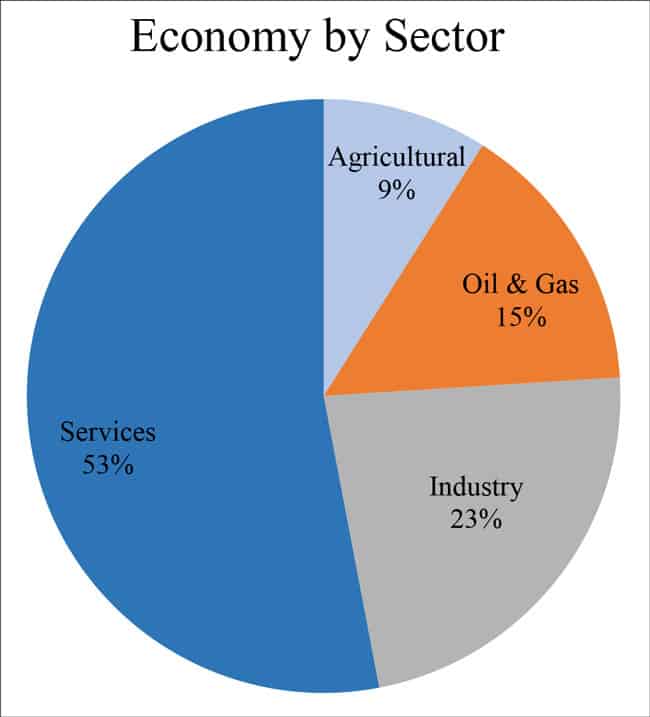

Whenever the media report about the economy of Iran, they almost always refer to the country's oil and gas reserves, first and foremost. Iran does have the world's second-largest gas reserves, outdone only by Russia and with similarly low production costs. Having these natural resources is great, without a doubt. However, the popular perception of Iran as a fossil fuel centric economy is actually way off. The energy sector only makes up 10% to 15% of the Iranian economy. In comparison, Saudi Arabia depends on energy for 45% of its GDP. As everyone knows, countries that are too dependent on natural resources often suffer from a general lack of dynamism in other sectors and all sorts of related problems.

If it was just for Iran having lots of oil and gas, I wouldn't find the country particularly exciting. You can find cheap energy opportunities in less troubled spots of the planet.

Once you start to look a bit more closely, you'll find that the economic opportunities in the country are much broader. The service sector makes up 53% of the economy, which is not too far off the 60% to 70% of highly developed European economies. Iran's economy benefits from the country's very high level of education, which it has had for decades already. Everyone I know who has ever travelled to Iran – including my late father – fed back that the country was much more developed than Westerners would generally expect following mostly negative media reporting of the past decades.

Speaking of travelling, I have long believed that one of the biggest opportunities in Iran must be the travel sector. Some of humanity's greatest historical treasures are located in Iran, such as the ancient cities of Persepolis and Bam, as well as the more recent wonders constructed in Isfahan. The country also has no less than 24 UNESCO World Heritage Sites within its borders, more than almost any other country in the world (and the same number as the US). I have a long-standing pet interest in World Heritage Sites, and I once managed to visit 41 of them in 12 months. Had Iran been open for conventional travel at the time, I would have seen many more that year.

Persepolis, the ancient capital city of the Achaemenid Empire.

The old square of Isfahan.

The ancient city of Bam.

"The tourism industry in Iran is actually really busy", an expert for Iran told me during a meeting in London. How come? Iranians like to travel domestically. They make use of surprising possibilities such as the world-class skiing you find just near Tehran on 4,000 metre-high slopes that have a longer season than Europe's Alps. Also, the country is open to visitors from the region and there are special factors such as religious travellers bringing lots of business.

Tehran has world-class skiing right on its doorstep.

Imagine, though, a few million Western and Asian visitors descending on Iran to marvel at its long-inaccessible ancient wonders. Prices for hotels and tour operators would go through the roof, and so would profit margins of the companies that operate them.

Iran isn't a country that has been bombed into the ground or is stuck in abject poverty. Its income per capita is just a bit below that of Brazil.

European and Americans tend to underestimate the country's location within a huge, and at least in parts, booming economic region. Counting the countries that Iran is close to and which are open for economic ties, Iran sits within an area with 550m consumers. In terms of headcount, the region is like a second Europe. Once you start to look at this in detail, you'll discover a few interesting relationships. E.g., Iraq and Afghanistan don't produce much, which is why they often rely on buying from Iranian companies (often using Western aid to pay for it). Several of these countries also speak a variation of Farsi, which makes business transactions easier. Outside of the immediate neighbourhood, countries such as China, South Korea and India are doing thriving business with Iran.

Source: Wikipedia.

You only need to check out the demographics of this region to find out why these are growth markets. The region does have deep, long-standing structural problems, but it also has a lot of eager, young consumers. As I always find in my travels to troubled countries, young people everywhere just want to buy consumer products, invest in real estate, and start a family. The demand created by hundreds of millions of young people who just want to enjoy life helps a lot to counter some of the more stupid political decisions found in many countries.

That's where Iran's undervalued companies come into play, although even this subject entails many nuances and hidden aspects. E.g., if it was just for the stock market trading at a p/e of 4, I wouldn't be interested at all. You can find similarly cheap companies in other, less difficult parts of the global financial markets.

The Iranian investment opportunity is so compelling because the profits of Iranian companies are currently artificially low. The sanctions that the country's economy has been under have led to a number of factors depressing profit margins and earnings:

- Companies have little certainty on anything. Whereas the West operates based on the concept of "just in time", Iranian companies operate on the basis of "just in case". They always keep extra inventory, leave additional time, and generally assume the worst – which inflates their operating costs and depresses profit margins.

- Iranian companies have to pay high interest rates, and they generally have limited financial connectivity. Transaction costs are very high. Again, this weighs on profit margins.

- Because of the sanctions and politics, Iranian companies that want to be successful in export markets generally have to compete through price.

Make any of these factors a bit less bad and you'll see earnings increase significantly just on the back of that. If you took away these difficulties, Iranian companies would probably trade at a p/e of 1 or 2. Leaving aside geopolitics for a moment, they are probably the proverbial investment no-brainer where you combine limited downside with tremendous upside. A website called "Undervalued Shares" can't NOT point out Iran as a country with interesting investment opportunities.

Source: Amtelon, May 2021.

Needless to say, the political and economic difficulties that Iran has suffered under for decades (!) won't go away overnight. However, these figures go to show how this market is a bit like a coiled spring. Whenever things take a turn for the better, the first upward move of the market could see prices increase to a multiple their current level. Markets such as the Tehran stock exchange can produce astonishing tinderbox reactions.

In Iran, everything is priced for war. If things move towards some kind of gradual normalisation, many of the country's companies are going to do extremely well.

And many companies there are, because the Iranian stock market is actually much bigger than you'd expect!

A decent-sized stock market

Iran's stock market consists of no less than 600 listed companies. The current market cap of the entire market is about USD 250bn and average daily trading amounts to a respectable USD 400m.

Out of those 600 companies, between 100 and 200 are not accessible to any foreign investment due to international sanctions.

Another 100 to 200 companies are simply not liquid enough to invest any amount of money worth mentioning.

That leaves between 200 and 400 companies that are worth looking at in more detail.

Someone who has done exactly that for the past seven years is Maciej Wojtal, a Polish-born fund manager who has worked for investment banks and hedge funds in Warsaw and London before setting up his own fund management firm.

In 2015, the deal struck between the Obama administration and Iran made Wojtal curious about the Iranian stock market. Not because he'd share any particular political view, but because he was interested in finding good investments for himself and his clients. "I started to research the Iranian market and couldn't believe there were actually 600 companies to choose from."

Not quite unlike yours truly would often do, Wojtal took a plane to Iran and went to investigate it further.

Fast-forward to 2021, and the 38-year old has become THE international expert on Iranian stocks. Along the way, he created a fund management company that operates out of Amsterdam, Tehran, and London – dubbed Amtelon, a name made up of the first letters of the cities the company is based in. In 2017, Wojtal launched Amtelon Capital as an investment fund that is focussed on publicly-listed Iranian equities and which is open to professional investors without ties to the US.

Wojtal's initial fundraising didn't work out well. While he was busy investigating the opportunity and creating his own fund management firm, Trump was elected president and the geopolitical situation changed. Wojtal had soft commitments from investors who wanted to put USD 20m into the Amtelon Capital fund, but he ended up having to start with a paltry USD 1m.

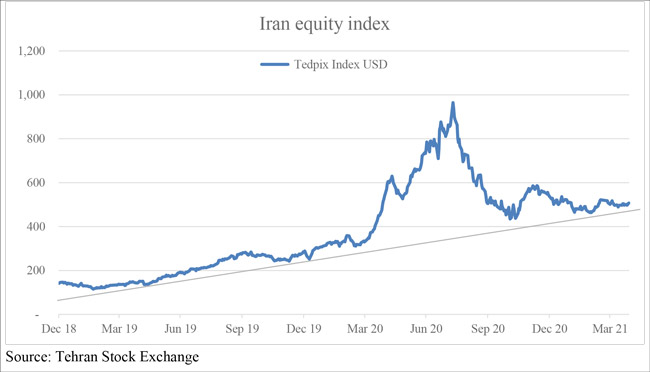

Still, he persevered and did rather well. Somewhat counter-intuitively, the Iranian stock market returned 150% in US dollar terms during the Trump administration and Wojtal has a track record of outperforming the broad market. During 2019, Wojtal earned his investors 170% in Euro terms and after all fees. That same year, the Iranian market "only" return 99% in dollar terms, although that made it the world's best-performing equity market. The market has since come off quite a bit, which was another reason why I wanted to write this article at this particular moment in time.

A good time to get in?

What does his fund get you access to?

Wojtal has an office with staff in Tehran, and usually travels there every other month. He describes the Tehran stock market in the way anyone old enough would remember pioneer markets during the 2000s and 1990s, and similar to Western Europe in the 1980s. Even by reading broker notes, you can already be ahead of the market. The Tehran stock market is intransparent, slow to react to news, and all the more interesting for that reason if you are a professional fund manager and investor.

Right now, foreigners have almost no presence in the Iranian stock market. That's what piqued my interest. Any additional influx of capital is going to drive up prices from their unusually low level.

And influx there currently is. Wojtal and I have mutual professional contacts and personal friends, and we met up for lunch in London as I wanted to pick his brain. As he told me: "In December 2020, my fund had 0% investment from Australians. Right now, Australians own 10% of the fund. I have been receiving interest from surprising places, such as Chile."

With currently approaching USD 20m in client funds, Amtelon's flagship Iran equity fund is still quite small. But that's the idea – get in before everyone else does. For those who do want to get in, Wojtal's fund is one of the few viable ways to do so, short of flying to Iran yourself to open a brokerage account and convincing your Western bank to wire some money to Tehran (good luck!).

The fund runs a fairly concentrated portfolio of 15 to 20 stocks. Oil and gas companies are not part of the portfolio because they are covered by the sanctions. The portfolio is focussed on manufacturing, exporters, and consumer-related industries. These are the industries where you can find companies that are experiencing tailwind even in the current economic environment, and they are also less political.

The EU-based fund has a minimum investment of EUR 100,000 (required by EU regulatory authorities), and it charges a 2% p.a. management fees besides a 20% management fee with a 0% hurdle rate. The notice period for investors is 90 days. New inflows into the fund are spread among a range of shares that have relatively liquid trading in Iran. That's why there is no major issue with getting funds invested, which makes this a more liquid route than the stock of Pomegranate Investment.

Wojtal has appeared on RealVision, on the cover page of The New York Times, and on the Meb Faber Show, among many others. He has built such a media presence and brand name for himself that I can see him single-handedly talking up the Iranian stock market once investing there becomes a bit easier and more popular. Wojtal's Twitter feed with pleasantly selective tweets gives an overview of what's happening in Iran, that being the only country his fund management focusses on. As Wojtal put it over our soft-shell crab and lamb lunch, he wants his firm to focus solely on the Iran opportunity and ensure he exploits the full scope and length of the opportunity for his investors. I have no doubt that he is fully committed to the idea.

Wojtal also has another product available, and it's one that I believe I am the first one to write about in its current shape.

Would you be interested in tech companies and venture capital in Iran?

If you are, there is an Amtelon-managed fund to get you access to that, too.

This is an investment for those who want to be truly ahead of the curve, and who are eager to aim for a moon shot by investing in Iranian tech and e-commerce IPO candidates before the rest of the world latches onto the idea.

High-tech and e-commerce IPO candidates in Iran

Wojtal loves talking to the media about his flagship fund for investing in the Tehran stock exchange. However, he also manages a second, smaller fund that focusses predominately on companies that have not yet gone public.

For those who are looking for mammoth upside and are willing to take a higher risk, this is a product to take a look at. It's similar to the concept of Pomegranate Investment. However, the issue with Pomegranate Investment has been that stock was hard to get hold of because there are few sellers following the changes in the US administration. This particular fund can receive investment right now, because it currently has unused capacity for deploying additional capital to its existing portfolio companies. And, as I said, no one else has reported about it in its current set-up. Those of my readers who are interested can currently go straight to the front of the queue, at least for now.

The Amtelon New Frontier fund has an eye on Iran's potential as an e-commerce destination:

- Iran is amongst the top ten countries globally for smartphone and Internet penetration. However, the market penetration of e-commerce companies is still at an early stage. Check back to my Weekly Dispatch about the Amazon of Iran.

- 65% of Iran's population are under the age of 35 and tech savvy. For that reason alone, the e-commerce sector in Iran will have only one way to go.

- The Iranian stock market currently actively promotes the IPOs of technology companies. A growing number of tech-related IPOs in Tehran is something that will likely go ahead even if international sanctions remain in place.

This second fund has been around for five years, and among its first investments was Swiss-Orient, a company that operates an online shopping and online payment system. When the fund first invested, Swiss-Orient was valued at USD 10m. In 2019, new investors came in on the basis of a valuation of USD 50m.

At the moment, the Amtelon New Frontier fund still carries its stake in Swiss-Orient based on a valuation of USD 50m. However, the e-commerce platform's transactions have recently gone through the roof – in line with similar developments seen elsewhere due to the pandemic, and combined with Iran's need to catch up. The company recently achieved gross merchandise value of USD 50m per month and its monthly growth rates were off the charts. It's highly likely the next valuation will be in the triple-digit millions.

Besides Pomegranate Investment, the Amtelon New Frontier fund is the only vehicle that I am aware of that allows Western investors to invest in privately-held Iranian tech companies. The fund also has some of its money invested in listed Iranian equities, but it will focus on the private space and venture capital when it comes to investing new fund inflows. Right now, investing in Iranian venture capital is particularly attractive because funding for these companies dried up when sanctions were re-instated. You can currently pick up great deals for investing in companies with well-known business models and strong management teams, and these companies often have very limited competition because foreign players cannot enter the market.

If you are interested in some of Swiss-Orient's platforms, you can download the presentation that I've obtained about ZoodMall and ZoodPay. For any further information about this fund, get in touch with Wojtal. Currently, the fund has about EUR 5m in client assets. This fund, too, has a minimum investment of EUR 100,000. It is required by the regulatory authorities and designed to ensure only experienced investors buy the product. Unlike with Pomegranate Investment, you won't experience issues with getting in – at least right now, and assuming you are not looking to deploy multi-millions overnight.

Which way to go – if at all?

I wrote this second feature on investing in Iran because of popular demand. I've also got the ambition to one day be able to point back to these articles, and add early reporting about Iran to my personal track record. I do think this is going to work out, one way or another. My article hopefully provides you with a more complete, deeper overview than what you tend to find in the occasional mainstream media article about the Iranian stock market.

Obviously, these investments are more difficult to invest in than equities listed on a Western stock market. That's the whole point. If it was easier already, you'd have to pay significantly higher valuations. The difficulty of it all is part of what makes it exciting.

There has been a lot of reporting recently on the political changes the Biden administration may bring, as far as the West's relationship with Iran is concerned. Everyone will have their view of politics, and judging any of that is not the goal of this article. I am interested, first and foremost, in turning a profit on the market. I doubt that Biden's new policy is wise. What I don't doubt, though, is that enough people will believe these are the right steps and money will flow into Iran for that reason alone.

Needless to say, these geopolitical gyrations are something you will have to keep in mind if you invest in Iran. My personal view is that, in the long run, economic development is hard to stop and prices will follow along. I am old enough to remember how investing in China in the 1990s was logistically difficult, commercially controversial, and politically risky. Had you gone ahead regardless of these difficulties, you'd now be very wealthy indeed – even though China still has a despicable regime in charge!

There is a strong case to be made for not supporting a regime like that of Iran by starving them of investment until another regime gets into power. The counter-argument is that by investing there, you'll help take the country into the 21st century which will lead to political change. You can pick your side, or simply focus on the investment aspect of it all.

In more practical terms, investors do need to keep in mind that pioneer markets such as Iran almost naturally experience extraordinary fluctuations. In 2019/2020, Iran became the world's best performing stock market, which was followed by a market crash not too long thereafter. You've got to be able to withstand such volatility, and ideally, use it to up your position during downturns.

Also, there is the important argument that investing in Iran gives you an asset that is definitely not correlated to world markets. At a time of sky-high valuations elsewhere in the world, using Iran as a way to diversify your portfolio is a smarter idea than may sound at first.

Everyone has to make up their mind about these risks and special factors, just as much as none of my Weekly Dispatches are ever investment advice of any form. Just for the avoidance of doubt, my blog has no commercial relationship with any of the funds (or any other company that I ever feature). I solely report about companies and managers that I believe are interesting and worthy taking a closer look at. Take this column as inspiration for your own research, reach out to Maciej Wojtal to learn more about the opportunity – or travel to Iran, as and when that becomes easier again.

Speaking of which, I'd be first in line for any investor trip to the country, and may even organise one sometime, given how much fun last year's reader trip to Poland was.

Persepolis, here I come! With dollars to spend on local tourism operators…

Blog series: How to invest in frontier countries

There's more to "How to invest in frontier countries" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Out tomorrow: the best of crisis investing (part 2)

Where else in the world but Argentina can you find top-quality assets at fire-sale prices? The country’s latest crisis makes for a huge opportunity, and now is the time to hunt down some of the world’s best investment bargains.

I’ve done some of the work for you, and am proud to present yet another Argentinean candidate which - at its current bombed-out price - offers limited downside and massive upside. Crisis investing at its best!

Even as a deep-value play, the stock should recover 100-300% over 1-2 years. It may even become a 10-bagger, longer term.

My latest report - out tomorrow, exclusively for Undervalued-Shares.com Lifetime Members - reveals all the details.

If you like buying the dollar for 10 pence, you will love this story!