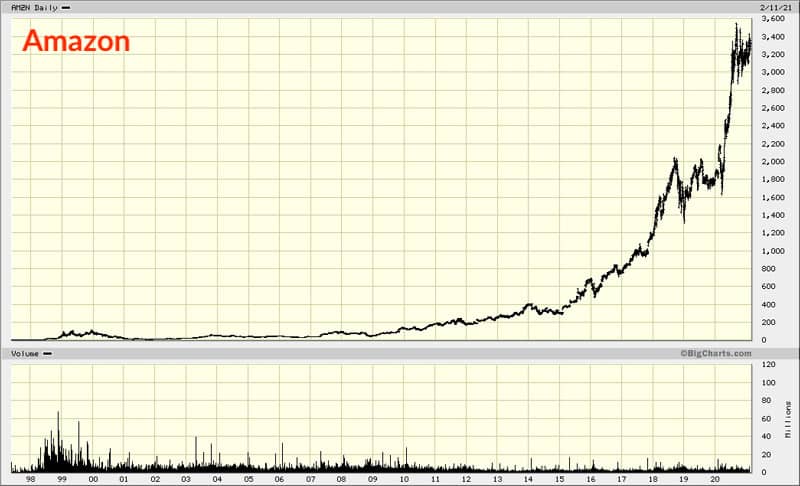

MercadoLibre (ISIN US58733R1023), the South American version of Amazon, is up five times since I featured it in a Weekly Dispatch in January 2019.

Ozon Holdings (ISIN US69269L1044), Amazon's Russian equivalent, has roughly doubled since it went public in November 2020. I previously wrote about the holding company that owns Ozon, SISTEMA (ISIN US48122U2042), whose stock price has also been propelled forward by Ozon's post-IPO performance.

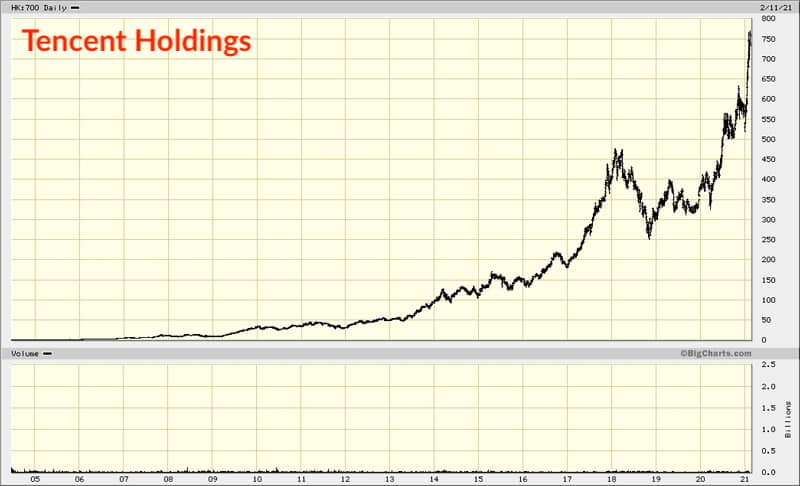

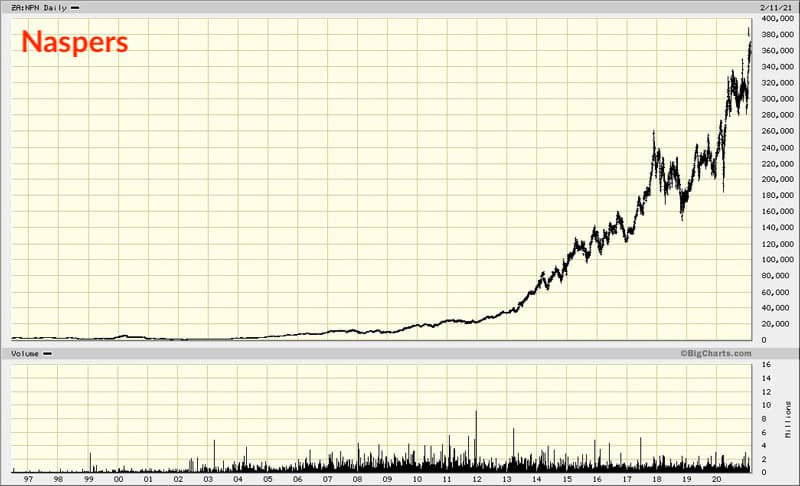

The grandest prize among non-US, Amazon-esque e-commerce companies was Tencent (ISIN KYG875721634), the Chinese online giant. In 2001, South African investment holding Naspers (ISIN ZAE000015889) invested USD 32m to take a 46.5% stake in the Chinese company. Its stake is now worth USD 300bn, or nearly 10,000 (!) times as much. In hindsight, an investment that will have looked crazy at the time wasn't so crazy after all.

Never mind the performance of Amazon (ISIN US0231351067) itself, up 1,200 times since its IPO in the 1990s, and up 26 times in the last decade alone.

Could another such success be in the making elsewhere?

Look no further than Iran.

For investors, the country may currently seem impossible to access. However, there is a route in to its fledgling e-commerce sector via a Swedish holding company that owns a substantial stake in Iran's Amazon equivalent (alongside several other e-commerce companies).

Amazingly, every single one of these portfolio companies is already earning money. That's just one of the surprise factors about investing in Iran.

Be warned, though, it's an illiquid, difficult-to-trade proposition that could see you entangled in international sanctions regulations (depending on your nationality and bank).

For most of my readers, today's Weekly Dispatch will be entertaining and insightful; however, I doubt more than a handful of you will be inclined to invest.

I did want to make sure, though, that one day I could say: "I told you so."

A primer on Iran's e-commerce potential

Iran isn't a country that immediately comes to mind when mentioning e-commerce and investing. It should, though, provided you can stomach the political aspects and the current difficulty in accessing the market.

In terms of population (83m), Iran is the second largest country in the Middle East and North Africa (MENA) region after Egypt (100m).

Its economy is also the second largest in the region with a GDP of USD 500bn, after Saudi Arabia's USD 800bn.

A youthful, educated population is one of Iran's key strengths. 65% of the country's population is younger than 35 years, and it has one of the highest literacy rates in the region.

Somewhat surprisingly, only 14% of Iran's economy is based on exploiting fossil energy. The country has the world's second largest gas reserves behind Russia, but it largely avoided the kind of dependency found elsewhere in the Middle East.

Needless to say, Iran currently has more than its fair share of political issues. Its rulers, the Mullahs, are problematic, to put it mildly.

The country is in the crosshairs of significant international sanctions, not just by the US but also by the European Union. Investing directly in Iran could get you into all sorts of trouble. Although for some, it'll be possible to invest without undue consequences – more about this later.

Given Iran's ambition to become a nuclear power, there is the ever-looming threat of military conflict with Israel.

There are probably a dozen other difficulties you'd have to list when describing the country.

However, just like anywhere else, Iranians are flocking to the web. It's a secular trend that has only been accelerated by the pandemic, and which won't be stopped by anything – not even the Mullahs.

Which is why Iran's growth potential for e-commerce is tremendous.

So far, only 2% of the country's retail shopping is conducted online. The current global average is about 18%, and countries like China (28%) and South Korea (28%) show where things may be going longer term.

Iran has a high urbanisation rate of 73%, compared to 33% in India and 75% in Germany. That makes it a relatively easy country to penetrate logistically, once you have established an operation.

With all that in mind, Iran's e-commerce sector is probably the closest thing you can find to the proverbial ground-floor opportunity among the world's significant-sized countries.

It's not a question of when it takes off, but of how to get in?

Let me tell you about the man who is making it happen. Having a bit of context about the key man's history is crucial for appreciating today's investment case.

The 500-bagger investor you have never heard of

Unless you are a long-standing reader of this website, you are unlikely to have heard of Per Brilioth before. However, you ought to know about him.

Brillioth was closely involved with the Swedish Lundin family, whose billion-dollar coups in investing in Russia formed part of my popular three-part series on "crisis investing". As a reminder, the Lundins invested in the Russian gas monopolist, Gazprom (ISIN US3682872078), when foreigners were not yet allowed to buy stock in the firm. The Lundin family's investment vehicles bought the Russian shares via Cyprus, which at the time was a grey-area loophole that made it possible to get into the Russian equity market under the radar. In those days, the media warned against using the Cyprus structure because it involved taking a few additional risks surrounding share ownership. The Lundins ignored all that and, over time, built a 1% stake in Gazprom. (You can read all about it in Adolf Lundin's biography. The hard-to-find book was already priced at up to USD 200 when I featured it a year ago, and it now costs around USD 1,000.)

Brilioth spearheaded these investments of the Lundin family using an investment vehicle called Vostok Gas.

Even for experienced pioneer market investors like the Lundins and Per Brilioth, not everything was plain sailing. Vostok Gas' holdings temporarily suffered under Russia's economic collapse in the late 1990s, and as a result matters took longer than expected. However, the setback was only temporary. The early-stage Russian investments have since turned into one of the greatest investment coups of living memory (if measured from trough to top).

When Russia went bankrupt in 1998, Vostok Gas' holdings temporarily decreased to a value of approximately USD 10m.

Today, these same holdings would be worth well over USD 5bn – up 500 times over two decades. The portfolio that Brilioth had assembled has done extraordinarily well. Not only did he get in early, but he also bought into Russian e-commerce companies before anyone else did.

Despite its name pointing towards fossil fuels, Vostok Gas didn't limit itself to gas. It also purchased stakes in Avito (Russia's answer to eBay and comparable to Craigslist) as well as Tinkoff (a consumer lending operation addressing the newly emerging Russian middle class). Gazprom was a good investment, but it was these early e-commerce investments that made Vostok Gas such a star performer.

Avito later gained some recognition among investors because of the advertising website's exceptional level of profitability. You can read a fascinating 2018 investment analysis written about Avito by Dylan Adelman, a New York-based analyst who gained notoriety at age 20 when he beat 400 applicants to win the "Ideas Contest" of the legendary SOHN conference.

As to the small lending operation that used to be Tinkoff, it is now publicly listed in London as TCS Holding (ISIN US87238U2033) with a market cap of GBP 7bn (USD 9.7bn).

Why is all that relevant to today's Weekly Dispatch?

Per Brilioth is the chairman of another Swedish holding company that is not only trying to emulate in Iran what Vostok Gas pulled off in Russia in the 1990s, but to do even better this time around.

Enter Pomegranate Investment AB (ISIN SE0006117511), an investment holding founded in Sweden in 2014.

Pomegranate Investment's sole focus are e-commerce investments in Iran, including...

Digikala, the Amazon of Iran

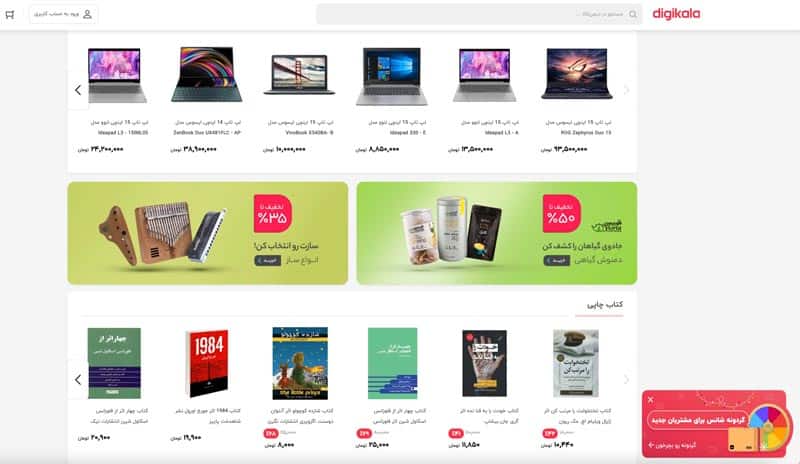

The ten-year-old company operates the second most popular website in Iran, right behind Google (based on Alexa figures). It offers a platform where 120,000 merchants have listed over 3m products.

Laptops, Orwell's 1984, and coffee – Digikala is an e-commerce website like anywhere else in the world.

During its last fiscal year that figures are currently available for, Digikala delivered 53m products to its customers. At last count, the company employed around 5,000 staff.

It also operates Digikala Fresh, a service to deliver 8,000 supermarket items. Within Tehran and Karaj, orders are fulfilled within three hours.

Given the size of the country's population, Digikala is still in its very early stages. Its market penetration rate is similar to that in Europe or the US in the late 1990s or early 2000s.

Because of the base effect, the company can claim an average annual growth of >100% over the past decade. The growth rate will slow down, but there is still vast space for expanding given that e-commerce so far makes up just 2% of Iran's retail market.

Also, competition is limited. Foreign companies find it challenging to access the Iranian market. By now, Digikala has had a head start in building fulfilment centres and other critical infrastructure. It seems safe to assume that the company will be able to leverage the domestic market's growth to its advantage; and quite possibly, achieve even higher profit margins than its international peers.

That's why Pomegranate Investment took a significant stake in Digikala, albeit indirectly. To deal with sanctions and other practical aspects, Pomegranate Investment holds its Iranian investments through another company, the aptly named International Holding Company ("IIIC"). Pomegranate Investment owns a 28.6% stake in IIIC, which in turn owns 30.2% of Digikala. This gives Pomegranate Investment a see-through stake in Digikala of 9.2%.

Digikala is the largest holding in Pomegranate Investment's EUR 120m (USD 145m) portfolio, but not the only one.

Covering the Iranian e-commerce space

A quarter of a century into the Internet revolution, it's apparent that countries need a range of e-commerce companies to fulfil basic needs.

Building on what has worked elsewhere, Pomegranate Investment and IIIC have invested in an entire stable of Iranian e-commerce companies:

- Komodaa is a social buy-and-sell platform, i.e. the equivalent of eBay.

- Alibaba/Tousha Group is the leading online travel agency in Iran.

- Sheypoor is Iran's second largest online classifieds company.

- Fidibo is an online platform for e-books, audiobooks, and e-readers in Farsi.

- Bahamta offers mobile peer-to-peer money transfers.

With its current portfolio, Pomegranate Investment covers a large part of the e-commerce opportunity of Iran.Brilioth even added a stake in an investment banking advisory firm. Through Griffon Capital, Pomegranate Investment will be able to facilitate transactions and mobilise other investors' funds.

Given the difficult circumstances under which all of this was created, Brilioth and his team have pulled off a stunning effort.

Interestingly, though, the stock market has not recognised it yet.

Right now, the stock is trading even below its published Net Asset Value (NAV). That is if you manage to buy it through your broker.

Plans got delayed, and the market forgot about it (for now)

Pomegranate Investment was initially funded through private placements, with strong backing from Brilioth and a host of other investors from Sweden who jointly provided about 50% of the initial capital. Other investors from the UK, Switzerland and across Europe joined in. Initially, the company raised EUR 80m (USD 100m) despite not being listed on a stock market. Every subscriber had to provide evidence they weren't a US person, to ensure the company complies with all sanctions-related regulations.

Pomegranate Investment wanted to pursue an IPO and get the privately-placed stocks listed on a regular market, but life got in the way. The international sanctions against Iran and several other factors kept the company from its earlier plan of listing on Sweden's primary stock market.

However, its stock is traded on the Swedish OTC market ("over the counter", an unregulated market). A local brokerage firm, Pareto Securities, provides quotations for buying and selling the stock, with prices published every other day.

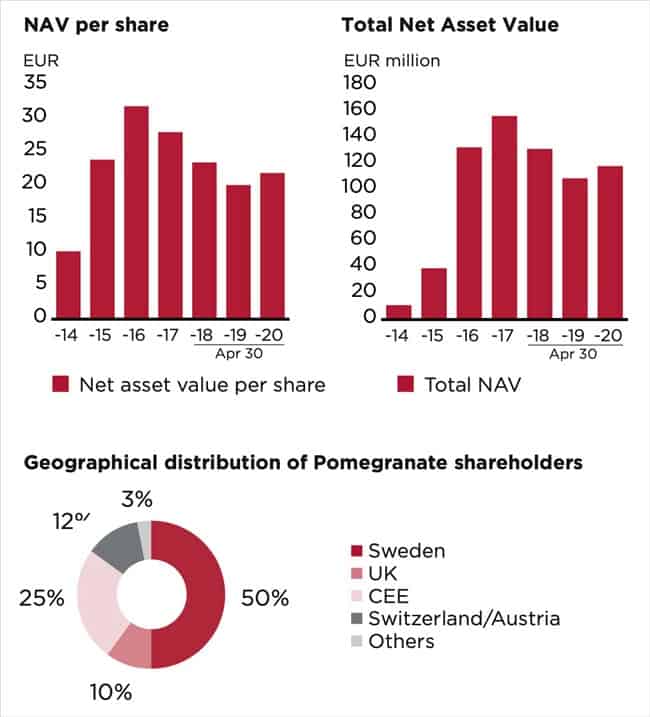

Between 2017 and 2020, the stock price fell from around EUR 30 (which was about its NAV at the time) to as low as EUR 5. The bid/offer prices were EUR 12 / EUR 14 when this Weekly Dispatch went to press.

Interestingly, Pomegranate Investment's latest published NAV was EUR 22.8 per share (31 October 2020), which is 1.6 times higher than its current ask price. For a highly prospective but challenging-to-access growth market like Iran, investors would often be willing to pay a premium to NAV to get exposure. Instead, it's currently a 39% discount to NAV.

Source: Pomegranate Investment's annual report 2019/2020.

It is difficult to work back from Pomegranate Investment's published accounts and figure out the current valuation of Digikala. By order of magnitude, it seems that Pomegranate Investment currently values its 9.2% stake in Digikala at around EUR 40m (USD 49m), which would give Digikala a market value of just about EUR 440m (USD 543m). Relative to the size of the addressable market and low market penetration, that would seem low.

Outside of not revealing the current value of each individual investment, Pomegranate Investment's annual report is surprisingly informative. If you ever wanted to do a quick fly-over of the Iranian e-commerce industry, I can recommend downloading it from the company's investor relations website.

The corporate governance issues are somewhat challenging to get your head around. E.g., Pomegranate Investment has much of its capital tied up in a company that it doesn't have majority control of (IIIC). I do not doubt that Brilioth & Co. will have a high degree of confidence in the overall structure since they reportedly have invested significant funds of their own. However, it shows that there are obstacles and challenges yet to be overcome before Pomegranate Investment becomes a normal investment proposition. In some ways, it is similar to investing in domestic Gazprom shares via Cyprus in the mid-1990s. It is not for the faint-hearted.

A significant step towards a normalisation would be an IPO of Digikala in Iran. Reportedly, that is in the cards. A listing of Digikala on the Teheran Stock Exchange would make it much easier to put a reliable value on Pomegranate Investment's portfolio. Depending on developments in the political arena, it could even pave the way for an eventual share distribution straight to shareholders as a dividend in kind – which is what Vostok Nafta did at the time with Gazprom shares. Such a possibility seems far-off right now, but the same was the case in 2001 when Naspers gave a USD 32m cheque to Ma Huateng.

A lot can go wrong. If it goes right, though, the upside is enormous.

How high could this baby fly?

For once, the sky seems genuinely the limit for this investment. Given the overall constellation in Iran, the e-commerce sector could grow by a factor of ten just to catch up with comparable countries. The market leaders would probably grow their size by even more than that and achieve outrageous levels of earnings growth due to the combination of economies of scale AND lack of foreign competitors. Add to it that right now, valuations are low and the stock price of Pomegranate Investment represents another discount. Just look at Ozon, which is only the fourth largest e-commerce company in Russia, but now valued at USD 12bn.

From here onwards, Pomegranate Investment really could be Brilioth's next 10, 50 or 100-bagger. It's impossible to come up with a precise figure. It's easy to sense, though, that Brilioth has assembled this company to pull off another major coup.

A ground-floor opportunity if ever there was one – but it requires work

There are multiple issues with this investment which you need to be aware of.

Pomegranate Investment currently has 5.4m shares outstanding and a market cap of just EUR 70m based on its last traded price of EUR 13. That's a tiny market cap. Much of the stock is with long-term investors, and trading is thin.

Then again, trading does occur, and investors who are not looking to dump millions into the company stand a chance of succeeding. Since January 2019, 450,000 shares have changed hands at prices between EUR 6 and EUR 14. That's about EUR 200,000 worth of shares traded every month. There could also be quite a significant overhang of supply from investors who have sat on this investment for years and who might be tempted to sell as soon as the share price sees some action.

The stock is only traded on the Swedish OTC market through a Swedish broker, Pareto Securities. Most of my readers will find it impossible to invest for this reason alone. However, Swedish residents (and I have a few of them among my readers!) can easily trade the stock through their Swedish broker, i.e. they don't usually need to have an account with Pareto Securities. Citizens from other EU countries usually have to open a custody account with Pareto Securities (contact [email protected] for details). I suspect some brokers in Malta or Israel can trade the stock, and some Swiss banks that don't have exposure to the US may trade in Iran-related securities. I would welcome feedback from readers if anyone stumbles across workable solutions (which I would later add to this article if permitted to do so).

American and Canadian citizens can forget about this investment entirely given the current US sanctions.

And in any case, anyone considering to invest should read the sanctions-related section on the website of Pomegranate Investment and speak to their professional advisors to ensure they are not accidentally falling afoul of regulations.

As you can see, mere technicalities make this a challenging investment to be part of.

Then throw in the extreme volatility of the Iranian stock market. In February 2020, the New York Times reported: "Iran's Economy Is Bleak. Its Stock Market Is Soaring." In May 2020, the Economist followed suit: "Why Iran has the world's best-performing stockmarket". The market's volatility is extreme, though. Fast-forward to January 2021, and the headlines had changed to "Iranians Lose Savings In Stock Market, Threaten Riots". Iran is not for the faint-hearted.

Have I mentioned extreme currency fluctuations yet? Iran has just introduced a 1 MILLION Rial note, which sounds grand but would barely buy you a cappuccino in London these days. Zimbabwe is saying hello!

Never mind the legitimate question and concern whether anyone should invest in Iran while the current regime is in power. This article is not an endorsement for or against investing in Iran at this time. That's for everyone to decide for themselves. Yours truly is but a humble chronicler.

That all said, it's an unusual and exciting proposition if you look at it purely from an investment perspective.

Quite probably, it's about as exciting as buying Gazprom shares through Cyprus in the mid-1990s. This time, though, you can go via Sweden rather than Cyprus. Difficult as it is, it seems a lot easier and safer in comparison.

Pioneer-country investing doesn't come easy.

However, as the examples of the Lundins and Brilioth show, the early bird may end up catching the worm.

A question to my readers

Occasionally, I come across investment opportunities that are quite clever but a bit extreme.

These tend to come with an extraordinarily large upside but are also laden with practical difficulties.

The feedback I get when writing about such opportunities is off the charts. Many private investors would like to put some money into them, even if it involves a lack of liquidity or a higher cost for managing them. After all, who wouldn't want to at least get a decent shot at landing a 100, 500 or 1,000-bagger once in their lifetime? The common problem is, many of these investments cannot easily be bought and sold through your mom-and-pop brokerage firm.

Which makes me wonder, should someone launch an investment fund to provide easier access to such opportunities?

I was discussing the idea of "YOLO Funds" with a friend from New York recently. My friend came up with the term "You Only Live Once" fund to describe a vehicle that aims for the stars and carries a suitable risk disclaimer on its packaging.

Such a fund could:

- Focus on investment propositions that are extreme but clever.

- Seek out investments that most people would find difficult to manage themselves.

- Be global in its outlook and entirely opportunistic in its choice of asset classes.

E.g., it could buy:

- Equities in pioneer markets that are emerging from dictatorships.

- Real estate in post-hurricane disaster zones.

- Crypto-innovations while they are stilled viewed with scepticism.

- Precious metals that require physical storage.

Its sole focus would be to make as much money as possible from a diversified portfolio of outstanding investment opportunities. Just plain old maximising of investment returns and a level of ambition that takes a few pages out of Elon Musk's rulebook (or tears up the rulebook of conventional fund management altogether).

Its returns would probably have a very low correlation to major global indices.

I am not aware of anyone having come up with a better name yet for such a fund. Maybe by floating it on the web I am creating a new fund genre. "YOLO fund" sounds good to me, though others may have yet better ideas for a new genre.

Why am I putting this out there?

I also see my role as occasionally having to paint the art of the impossible. Excessive regulation and insane wokery are currently pushing everything (and everyone) into a form of global homogeneity. If I don't push a few boundaries on here (and feedback from you strongly indicates that this is what you want), few others will.

Working triple-hard on generating original, off-the-beaten-path investment ideas would be an essential feature of such a fund. Sharing its ideas with the public (once invested) could even go towards educating a new generation of investors about how to best cut their own path instead of just following the herd. Maybe there is a reality TV series to be done about managing such a fund?

Is this something investors would be interested in? Or does it already exist?

I wanted to put the question out there for your feedback This last section of today's article is market research, please don't read too much into it.

Love letters, hate mail, and undated fund subscriptions forms (just kidding) are all equally appreciated.

Please email me on [email protected] to let me know your thoughts.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Yet another pioneer market investment...

... awaits in the gold sector.

There's a lot of pent-up demand for M&A in this sector, and now is the time to find the right candidates for those looming takeover bids.

I've dug out one such candidate for you - a junior mining stock that has spent over a decade exploring, developing and de-risking a gold field.

Even if no bid occurs for the company, you will have bought a cash-generating mining operation at a bargain price - not to be sniffed at either, since it'll spit out dividends.

My most recent report - exclusively available to Undervalued-Shares.com Lifetime Members - has all the details.