Image by aapsky / Shutterstock.com

Amazon isn’t going to eat the world. There’ll be plenty of local Amazons in countries that the American e-commerce giant didn't enter in time.

Some of these regional versions have been outstanding investments – such as MercadoLibre (ISIN US58733R1023), the South American poster child. Since my article “The South American success story that is seeking to rival Amazon” in January 2019, the stock is up 270%. MercadoLibre is an Argentinean company but decided to list its stock on the Nasdaq market.

Regular "Weekly Dispatches" readers will also know of Allegro (ISIN LU2237380790), the Polish e-commerce giant. It went public a few weeks ago and gained 60% on the first day of trading alone. The stock has gone up further since then and is now trading at twice its IPO price.

So, where next on the world map?

Russia! With 100m users, the country has Europe's largest internet market, and one of its leading e-commerce players is going public soon. Interestingly, it will list its shares on the Nasdaq market – a decision very much out of MercadoLibre's playbook!

Here is everything you need to know about this upcoming e-commerce IPO, including a backdoor route that lets you invest in the Russian firm before it goes public.

Anyone who can trade stocks on the London Stock Exchange can do it.

How so?

A short primer on Russian e-commerce

Russia and e-commerce may not be terms that are mentioned in the same sentence all that often – yet.

You’d be forgiven for being sceptical, given factors such as Russia’s vast distances. Doesn't the sheer size of the country makes parcel deliveries difficult and expensive?

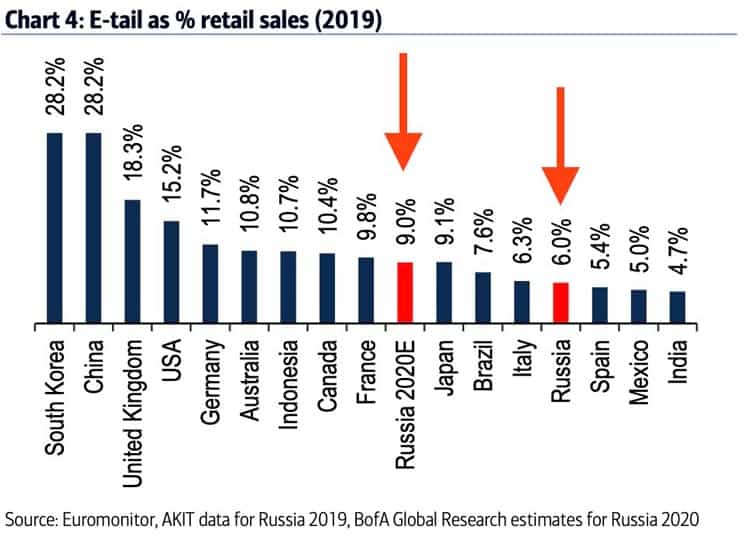

Indeed, Russia is lagging behind when it comes to e-commerce penetration. In 2019, only about 6% of Russian retail sales took place online. That was one third of the UK’s rate (18.3%), and one quarter the rate of China (28.2%). The world average is 19%, and the US comes in at just under 20%.

However, lower market penetration means more room to grow and the possibility of higher growth rates. In 2020, Russian e-commerce grew at an astonishing annual rate of 43%. In a seminal report about Russian e-commerce published in October 2020, Bank of America Securities estimated that 9% of the country’s retail revenues this year were made online.

Source: Bank of America Securities, 16 October 2020.

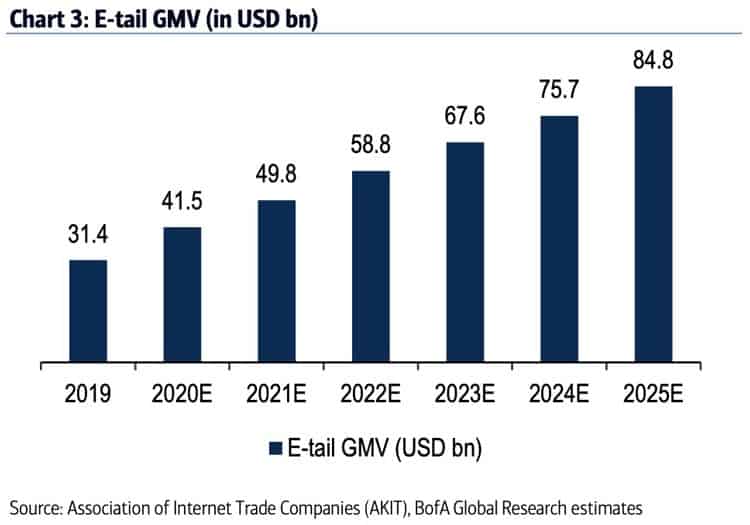

Between 2019 and 2025, the gross revenue earned by Russian e-tailers is estimated to increase nearly threefold, from USD 31.4bn to USD 84.8bn. These are chunky total amounts, and the annual growth rates are higher than in more mature markets.

Source: Bank of America Securities, 16 October 2020.

How and why is Russian catching up so fast?

The coronavirus pandemic is just one of the drivers for Russia’s fast-growing e-commerce sector.

Naturally, the country's nationwide lockdown did provide a boost for online shopping. According to Moscow-based research firm, National Agency of Financial Studies, an estimated 70% of Russians shopped online during the lockdown, half of whom (!) had never done so before. 25% of Russians who made their first-ever online purchase during April 2020 came back for at least one more online purchase, while 15% went on to make two or more such purchases.

Like everywhere else, Russians are increasingly discovering the convenience of online shopping.

Because of the patchy postal system, online shopping in Russia mostly means that customers "click and collect", i.e. they pick up their delivery in designated pick-up spots. However, even that could be changing. The country's leading e-commerce firms have been investing heavily in local and regional logistics centres.

As a result, sales in the vast hinterlands of Russia are growing rapidly. Novosibirsk, a city of 1.5m in Russia’s remote Siberia region, experienced a 300% growth in e-commerce sales during the second quarter of 2020.

And experiments with drones and self-driving vehicles may still be just that – experiments. Longer term, these new technologies could provide further fuel for the growth of the industry. Just like everywhere else in the world, geographical distances are shrinking because of technological advances.

Last but not least, Fintech firms are working on the issue of online payments. So far, electronic pre-payments for online deliveries remained at a relatively low 30% to 40%. A fast-growing industry of Fintech firms is working with banks and other financial services firms to enable easier online payment processing, micro-lending through the web, and faster onboarding of new clients.

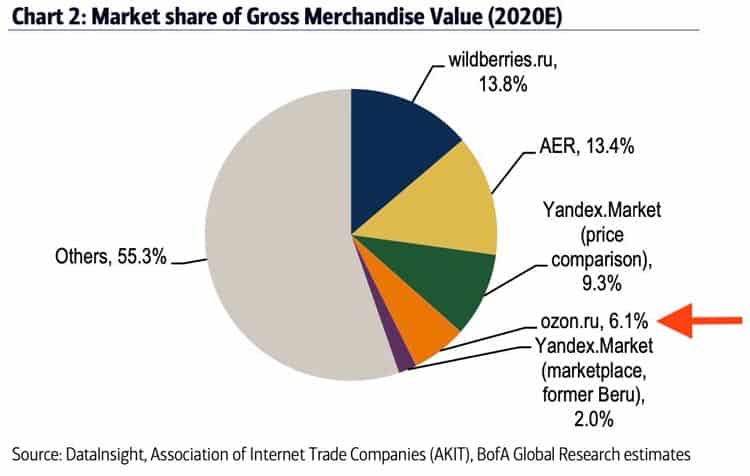

The writing is on the wall. During the next few years, Russians are going to shift more of their shopping to the Internet. Half of this fast-growing market is in the hands of four firms.

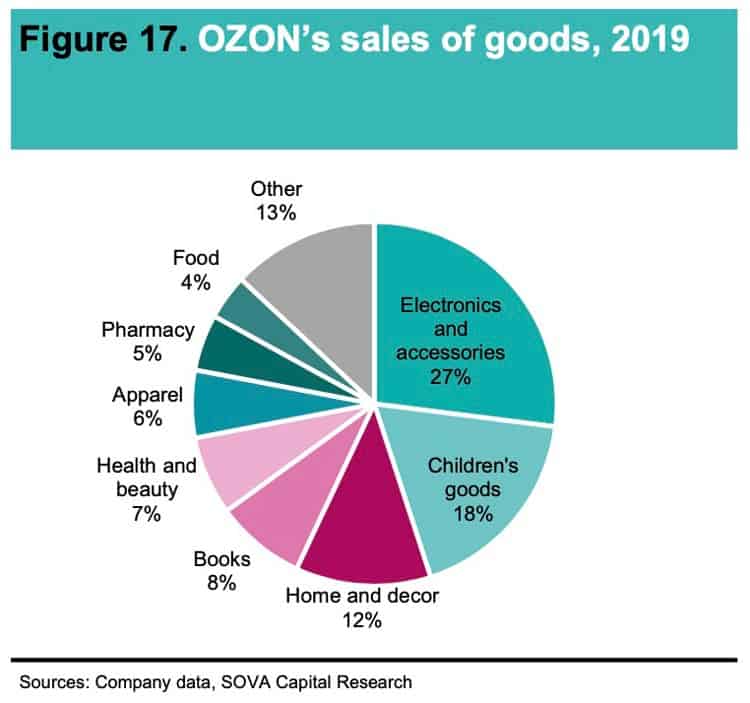

One of them is Ozon, which sells everything from white goods to children’s clothes.

Source: Bank of America Securities, 16 October 2020.

The crown jewel of the Sistema empire

With a national market share of 6.1%, Ozon is the smallest of the four market leaders. However, it's this smaller size which might enable the firm to achieve faster growth rates than its three bigger rivals, with national market shares ranging from 11.3% to 13.8%. Ozon also beats its competitors in some sectors of the market, such as Russian e-books where it has a 60% (!) market share through its LitRes subsidiary.

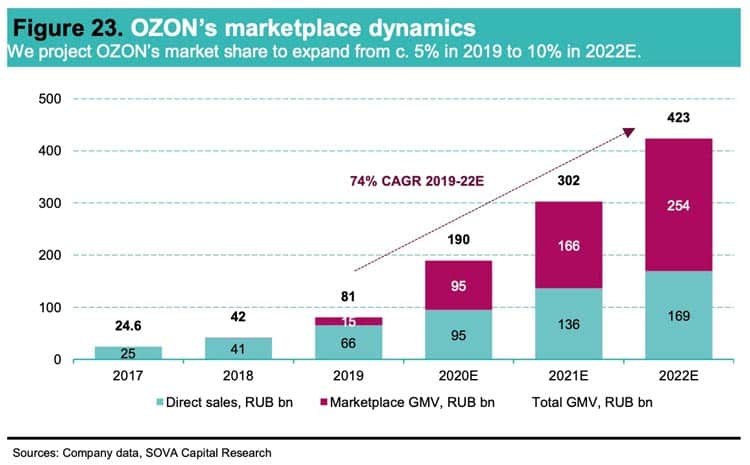

Source: Sova Capital, 15 October 2020.

The company strongly believes in investors wanting to gain exposure to the Russian e-commerce market. In early November 2020, it filed the documents necessary for preparing an IPO on the US market. This placement will be supported by Goldman Sachs, Morgan Stanley, Citigroup, UBS, Sberbank and VTB Capital.

So far, it’s only known for sure that Ozon wants to list American Depository Shares on the Nasdaq Global Select Market. Pricing terms haven’t been disclosed yet, but market sources estimate that the company wants to raise an additional USD 500m equity to fund its growth initiatives. It had already successfully raised USD 150m in April 2020through the issue of a convertible loan, parts of which were financed by existing shareholders as well as new investor Princeville Capital, a San Francisco-based venture-capital firm.

Ozon already stated that funds raised through an IPO would be used solely for financing growth initiatives. Some of the new funding will go towards building additional fulfilment hubs in important locations across Russia. Dividends are not on the horizon yet.

The focus on growth, growth and more growth should sit well with investors.

Source: Sova Capital, 15 October 2020.

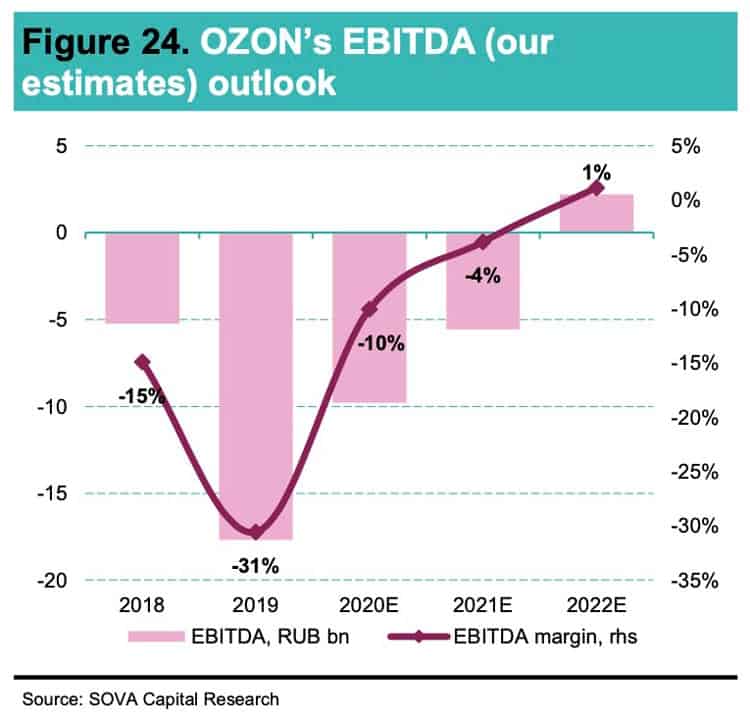

Source: Sova Capital, 15 October 2020.

Ozon’s growth prospects have already started to move the needle elsewhere. A 43% stake in Ozon is owned by Sistema (ISIN US48122U2042), a Russian conglomerate and investment holding that is listed on the London Stock Exchange.

Sistema experienced a rapid rise during the 2000s. When it went public in 2003, it was the largest IPO to come out of Russia up to that point. The listing turned its major shareholder, Vladimir Yevtushenkov, into a self-made billionaire whose fortune temporarily soared to the double-digit billions. However, in late 2014, the oligarch experienced some difficulties with the Russian authorities relating to suspected money laundering. Yevtushenkov temporarily landed in house arrest, which sent international investors fleeing. The share price of Sistema dropped from USD 30 to below USD 5.

Yevtushenkov was later cleared of all wrongdoing, but Sistema lost control of an oil company (Bashneft) and had to pay USD 1.5bn to settle a lawsuit with a state-controlled Russian oil conglomerate (Rosneft). My sources in Moscow tell me that Yevtushenkov hadn’t done anything wrong per se, but the Russian government was looking for ways to make up shortfalls in oil revenue and Yevtushenkov was simply a promising target for a financial shake-down. (Fun fact, the USD 1.5bn payment to Rosneft also helps to pay the salary of Gerhard Schroeder, Germany’s former Chancellor who is nowadays on the board of Rosneft.)

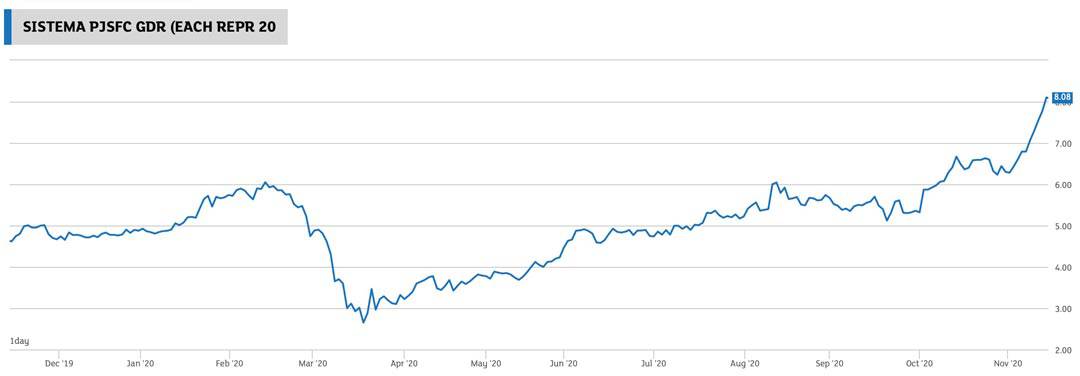

Following all this, investors decided it was wiser to stay clear of Sistema stock. In April 2019, the stock bottomed out at just USD 2.50, having lost over 90% of its value.

This all changed in 2020.

The stock has recovered to now USD 8 and was trading up 10% today (13 November). Since news broke of Ozon’s pending IPO plans, Sistema stock started to get back in fashion.

As the largest shareholder of Ozon, Sistema will benefit from the IPO. Sistema currently has a market cap of around USD 4bn. Ozon is estimated to be worth USD 3bn to USD 5bn following its IPO. The 43% stake in Ozon held by Sistema could cover a large part of Sistema’s market cap – and provide further uplift for Sistema’s stock price, even if you factor in the usual holding discount that is applied to investment conglomerates. Put another way, Sistema is currently a way to (indirectly) buy Ozon before the IPO, at a valuation that is likely below the IPO price.

Before it’s even happening, the upcoming Ozon IPO seems to have gotten Sistema back on the radar of international investors. The 2014/2015 affair involving Yevtushenkov seems far away, and Sistema’s prospects suddenly look like a tempting proposition.

Ozon is just one of 17 significant investments that Sistema holds.

Others include:

- MTS, Russia's largest mobile phone network. Its 50% stake in the company provides Sistema with a reliable cash cow.

- Medsi, Russia’s largest private healthcare chain with 48 medical facilities. Sistema owns 9% of the company and could use it to roll up the entire, highly fragmented Russian private healthcare market. Such a strategy could involve an eventual IPO of Medsi.

- Steppe, which maintains over 500,000 hectares of agricultural land in Russia. Sistema owns 85% of the company and thus indirectly ranks as the country’s sixth largest landowner. Alongside Steppe, Sistema owns 98% of Segezha, one of Russia’s most extensive forestry holdings.

Sistema is an investment holding that is very much geared towards the whims and instincts of its founder and largest shareholder, who likes to be seen as an opportunistic investor and entrepreneurial funder of ambitious ventures. During the past few years, the hotchpotch approach to investing across a seemingly random selection of industries was often held against the company. Right now, Sistema may be entering a period where this approach could once again be seen as an advantage. Yevtushenkov still has a talent for finding undervalued, underappreciated assets and increasing their value; and nowadays, he is supported by his son, Felix. Ozon's IPO will probably make Yevtushenkov’s name re-appear in the international media, as one of the country's astonishing turnaround cases – the comeback kid from Russia! Given that Yevtushenkov is 71 years of age and has a son who is actively involved in the business, we may also see a (perceived or real) generational change.

If the long-term chart is anything to go by, USD 10 should prove an important barrier for Sistema stock to break through.

Will Ozon’s IPO provide the catalyst for Sistema stock to finally roar back to life?

It might just work out like that.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Are you keen on “national online champions”?

I certainly am, which is why I've previously looked into several Internet and technology companies that are champions in their respective country or region (such as this one from Africa).

I've investigated another such champion for you, and am just putting the finishing touches to my findings.

Which means that *drumroll* my next research report will be out in a few days!

As always, this report will be reserved for Undervalued-Shares.com members – alongside all my previous reports (a veritable library of my best investment ideas).

If you aren't a Member yet, why not consider joining now?