Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Hunting for investment bargains on the Silk Road (part 3)

- Why Central Asia's most populous nation is currently undergoing rapid political and economic changes (part 1);

- What these kinds of "frontier markets" can offer to investors who are looking for superior investment returns (part 2).

During my recent trip to Uzbekistan, I sat down with politicians, bankers and entrepreneurs of privately-owned companies. I also met a few students, some of whom had already studied abroad, and others who were eager to go overseas temporarily and then come back to play a role in their home country's economic turnaround.

I participated in all these meetings because I wanted to get an understanding of how the country is likely to change over the coming years, and where risks, as well as opportunities, will lie.

Needless to say, a visit to the local stock exchange was also on my list!

All the more, as there are many more publicly listed companies Uzbekistan than you'd typically expect in such a newly emerging economy.

Why Uzbekistan already has 200 listed companies

During the early 1990s, Uzbekistan briefly flirted with economic reforms.

Formerly state-owned companies issued privatisation vouchers, which gave ordinary Uzbekis a stake in the country's economy. Its late President and de-facto dictator, Islam Karimov, subsequently stopped these privatisation efforts. But the Tashkent Stock Exchange stayed open throughout his entire reign, and the companies that were listed back in these days are still traded.

Here are some of the vital statistics I managed to gather locally:

- 200 listed companies.

- A combined market capitalisation of approximately $3bn.

- Shares worth about $300m are in free-float, and they are widely held by 600,000 to 800,000 Uzbekis.

To put this into perspective, all 200 publicly listed Uzbek companies combined (!) are currently worth about as much as the medium-sized British retail chain, WH Smith.

Obviously, this is currently a tiny market by anyone's standard.

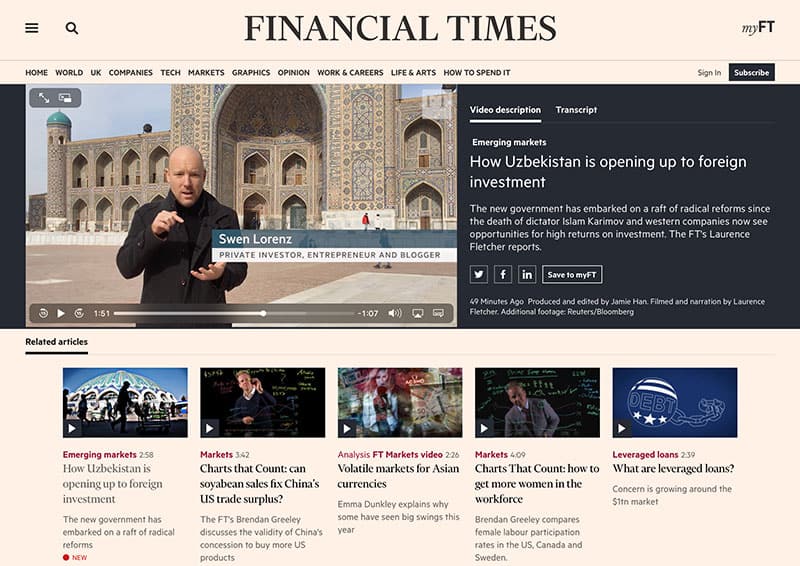

Last word on Uzbekistan: A fun 3-min video from the Financial Times

The Financial Times published this 3min video on 8 March 2019, and your author happens to be in it. Recommended watching for a first-hand impression of the country. You can also read a feature-article about the subject written by the FT’s @Laurence Fletcher.

It's also – for now – an extremely illiquid market. A good trading day sees shares worth $50,000 changing hands. Often, that average is heavily influenced by larger block trades rather than a large number of individual trades. However, there are also some local investors making smaller trades, and there is a small industry of brokerage firms servicing them.

As I described in my previous two articles, Uzbekistan is in the very early stages of development. The "stock market" is currently more of an organised private equity market than a stock exchange in the conventional sense.

Nonetheless, it offers some opportunities already, and more will arise in the coming years:

- Once the planned reform of capital market laws has been implemented, locally listed companies will have to adhere to stricter transparency regulations, and newly available information about these companies will generate more interest and stimulate trading. Buying shares off Uzbekis who have held them for nearly 30 years without much of a return and who won't have much of an idea about their value could be an extraordinary one-off opportunity! E.g., the country's largest coal company is currently only trading at 10% of its book value, as far as my initial (superficial) research was able to ascertain. I am sure there are plenty of bargains to be uncovered.

- Banks make up one of the largest sectors of the Tashkent Stock Exchange. Of the country's 29 banks, 13 are controlled by the government. As Atabek Nazirov, the director of the Uzbekistan Capital Market Agency, told me: "Our goal is to decrease the share of the government in banking." The current thinking is that with one single exception, all of these banks will be fully privatised eventually. There'll probably be sales of government-owned shares in banks, and share issues aimed at raising additional capital for these banks. In other sectors, too, there are companies that are already listed and which are considering to raise more funds by issuing additional shares. I heard of cement companies and mining companies contemplating such steps. These can turn out to be opportunities to buy into high-growth companies at low valuations.

- Given the current scarcity of capital in Uzbekistan, when the first few of the anticipated 50 IPOs take place, they will probably be attractively priced. Another opportunity to potentially make a quick gain.

Though you may ask, what good is that if your bank and broker won't let you trade on the Tashkent Stock Exchange?

There will soon be an easy way out of this conundrum.

Uzbek opportunities that anyone can access – and a forthcoming Uzbek fund

London is the world's most international financial market, which is why it's no surprise that there are already two Uzbekistan-related investments listed on the London Stock Exchange.

Since December last year, investors with an interest in bonds can trade Uzbek government bonds on the London Stock Exchange. The country launched a $10m bond denominated in the national currency, Sum. Shortly after that, another Sum-denominated bond raised an additional $10m. These were tiny placements and trading is bound to remain illiquid; never mind the 14% inflation rate the Sum is currently suffering on an annual basis. But if anything, the bond prospectus issued for the placement makes for some insightful background reading about the country.

This initial issue of "Samarkand bonds" prepared the ground for the $1bn Eurobond issue that Uzbekistan placed in mid-February. The bond issue is said to have carried a coupon of 4.75% for a five-year duration and a 5.375% yield for ten-year notes. They are both listed on the London Stock Exchange and can be traded relatively easily.

The choice available to investors interested in Uzbekistan is now bound to increase further. E.g., companies from other countries will develop a stronger presence which you can use to gain indirect exposure to Uzbekistan. International mining companies, in particular, are bound to enter into deals to develop some of the country's massive natural resources. Though admittedly, their Uzbekistan business interests will only make up a part of their activities and these shares won't qualify as a pure play on Uzbekistan.

If you'd like to get pure, diversified exposure to everything that Uzbekistan has to offer, you'll soon be able to have someone else take care of the heavy lifting for you.

Sturgeon Capital, a Silk Road-focused frontier market specialist based in London, is preparing the launch of a publicly listed investment fund for Uzbek investments. It will be free to opportunistically pursue what its management considers to be the country's best available investments and create a portfolio that spreads out risk across different sectors, asset classes, and geographic regions. The fund will likely make investments in private equity opportunities, publicly listed companies, start-ups, and financing deals.

Best of all, this fund will be listed on the specialist fund section of the London Stock Exchange. Anyone who can trade on the LSE will be able to easily buy and sell this fund, with relatively small amounts of money.

I have a feeling that there'll be considerable demand for this fund from the large Uzbek diaspora, i.e., from Uzbekis living abroad and looking for ways to invest in the economic changes of their former home country without actually having to move back.

Here is an advance heads-up: The team of Sturgeon Capital, who organised the trip to Uzbekistan, aim to launch this fund before the middle of this year. If you are interested in receiving more information about it, check their website or email them on [email protected].

Obviously, there isn't much information yet about the specific investments that the fund will hold during its initial phase, because its legal documentation has not yet been finalised and the fund's launch is a few months down the road. I am giving you this information as a heads-up about an upcoming opportunity, and one that will be managed by a team that I have come to know as deeply knowledgeable about the Uzbek opportunity. The firm's Chief Investment Officer first went to the country a decade ago, and has built a deep understanding of the country and a terrific local network to find and subsequently manage Uzbek investments.

Sturgeon Capital has already made some investments in Uzbekistan for privately held investment vehicles of clients. This, in turn, has made them a known factor in Uzbekistan. When new deals arise in Uzbekistan, Sturgeon usually gets approached.

Unless you fancy opening a local brokerage account in Uzbekistan and travelling to the country to research its existing publicly listed companies (which you may well do, I am happy to share contact details), you could do far worse than outsource the entire affair to an experienced fund manager.

Nothing beats researching opportunities by going places

As the old traveller quote goes: "Don't listen to what they say. Go see."

This wasn't the first time I've researched a frontier market. I have long had a liking for checking out these kinds of opportunities by getting a first-hand impression.

My first such trip took place in 1994, when I took a night train from Germany's Nuremberg to Prague in the Czech Republic, to visit the country's biggest publicly listed software company at the time, PVT.

The company turned out to be ridiculously undervalued. If my memory serves me right, it was trading at a p/e of 2 or 3, and much of its market capitalisation was covered by its vast cash reserves. What I do remember for sure, is that I did make a bit of a killing on PVT shares. I was the first ever foreign analyst to visit the country and the CFO was willing to sit down with me and talk me through the company's details. Walking the proverbial extra mile paid off nicely.

In subsequent years, I've dug out publicly listed opportunities in places like Russia, Macau, and Egypt. Not all of them worked out, but some did, and some even did so spectacularly.

Most recently, I reported on a "secret" South Korean share that gives investors exposure to North Korea, and its share price is now up very nicely. It gained 65% in four months but has recently come back off a bit; an update will be forthcoming soon.

Additionally, these experiences have helped me developed a gut feeling for countries that are set to do well.

Uzbekistan, for all its shortcomings and challenges, now ranks among the top emerging countries I have on my list. Which, it seems, is a realisation that others are currently coming to as well:

- The Eurobond issue I mentioned above was over-subscribed by a factor of 17, and the Financial Times started to report about the country in more detail.

- BNE IntelliNews reported of a "flood of foreign companies coming to Uzbekistan to implement projects."

- News agency Azernews wrote that "Uzbekistan may join World Trade Organization in 2 years."

As I explained in the second part of this article, you really want to be among the early adopters of such opportunities. When "hot money" flows in because foreign speculators have realised they are missing out on something, you will want to be on the selling side and take your profits off the table. Right now, Uzbekistan is still a ground-floor opportunity for pioneer investors. But these things change quickly, and in two years the country is likely to have made another leap forward.

Last but not least, a great place to visit!

You could also, of course, add the country to your personal bucket list of travel destinations.

Samarkand is bound to join the list of the world's most visited wonders.

I have no doubt that in ten years' time, paying a visit to Registan Square will rank as desirable as visiting the Egyptian pyramids, Angkor Wat in Cambodia or Peru's Machu Picchu.

Right now, Registan can still be enjoyed without massive crowds, especially if you travel outside of the main visitor season (Spring and Autumn). Climbing up one of the minarets of the Madrasas costs an extra EUR 2 (!) and requires both strong legs as well as an ability to cope with vertigo-inducing staircases. Though these may well one day end up getting closed to the public, because of crowds, security, and the building's fragility. It's a stunning birds-eye view of an incredible set of architecture!

In pleasure travelling as well as in investing, the early bird tends to catch the juiciest worms.

Which is why I think in a few years, investors could well look back in envy to anyone who used the clues provided in 2019 to make use of the ground-floor opportunity that Uzbekistan currently seems to offer.

Blog series: Hunting for investment bargains on the Silk Road

There's more to "Hunting for investment bargains on the Silk Road" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: I just released my latest in-depth report about what I consider to be the best equity opportunity in Germany - Porsche SE! Available for Members only so sign up now to get immediate access.