Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Investing in Africa (part 1): researching 8 countries in 11 days

In 2007, I was offered one of the most exciting assignments I've ever had:

- Research investments across sub-Saharan Africa.

- Free use of a private jet.

- Including introductions to the movers and shakers in politics and business.

How long did it take me to say "Yes"? About 0.1 seconds.

Despite the time that has passed since the trip, the observations and experiences that I've made are still relevant today. My journey provided me with a much deeper understanding of the challenges and opportunities of investing in the "Dark Continent".

As you'll see in this three-part series, this historical term for Africa is still very much accurate when describing its investment landscape, and that's where the opportunity lies.

Yours truly on tour in 2007.

Not my favourite continent, but…

Africa may well be the Marmite among continents: you either love it or hate it.

Over the past two decades, I have been to 15 of the 54 countries that make up the continent; including a few repeat visits. As such, I have probably seen more African countries than most people. However, I am far from a fan of Africa.

To be blunt, it's my least popular continent.

True, I have had amazing touristic experiences there:

- The Blue Train from Johannesburg to Cape Town is epically beautiful.

- The Victoria Falls in Zambia and Zimbabwe are one of the world's most spectacular places (and the Royal Livingstone Hotel is THE place to enjoy them or at least have a drink in the riverside bar).

- A seven-day horse riding trip through remote parts of the Cape region on retired racehorses – with just my then girlfriend and a guide – remains one of my best memories ever.

It can be spectacular to travel across Africa.

But there are some serious downsides:

- You haven't experienced a crime-ridden, violent society if you haven't spent some time in South Africa. It's as bad as they say, if not worse.

- Inter-country flight connections are a nightmare. Sometimes you have to fly from Africa to Europe and back, just to cross from one African country to another.

- Even today, some African countries feel like travelling back to medieval times when it comes to basic public infrastructure.

Now imagine doing business or placing investments in some of these countries. How do you feel about the following?

- Between 1950 and the early 2000s, more money was embezzled by corrupt officials in Nigeria alone than the amount of foreign aid sent to the entire African continent.

- Africa is "the new frontier in terrorism", with more terrorist organisations than anyone can keep count of.

- Together with Asia, Africa is where almost all epidemics start (even if China is getting more PR right now).

Doing business or investing in Africa comes with a health warning – literally!

However, it's also a place where extraordinary fortunes are created.

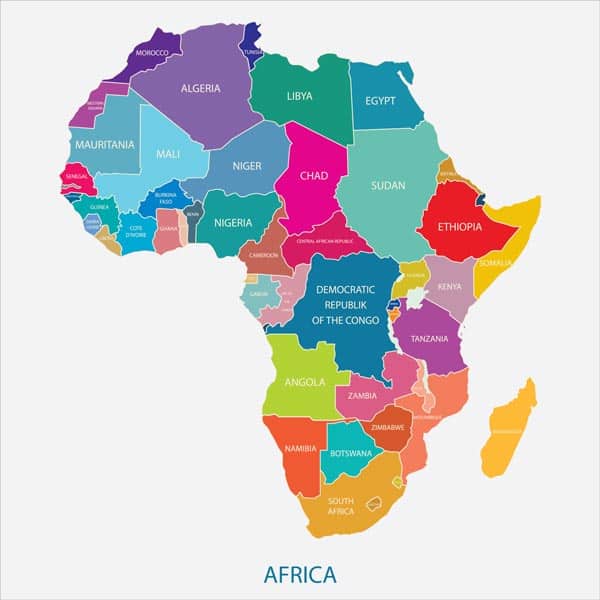

Hand on heart – could you place all 54 African countries on a map?

Africa's stock markets are "dark" (or maybe "grey")

I must sound like a broken record when I say that lack of transparency is an opportunity.

The more difficult it is to research a stock market or a particular company, the higher your chances of finding an overlooked gem.

My friend Tim Staermose from Hong Kong, who publishes a newsletter focussed on African investment opportunities, recently put it like this:

"Stock markets of developed countries, or even markets like China and India, are well researched and pored over by thousands of investors and analysts who think just like me. I don’t see that I have a whole lot of value to add. In Africa, on the other hand, it’s like stepping back in time. And, time spent doing research on the ground and knowing who to ask for information and where to get that information can actually still add real value…"

That was the case back in 2007, and it is still the case today (Tim has recently been fairly busy doing on-the-ground research in countries like Tanzania, which he also described in a Tim Price podcast that is available on his website).

In 2017, sub-Saharan Africa received less than 2% of the world's foreign direct investment despite representing 15% of the world's population. Foreign direct investment is not the same as money flowing into stock markets, but the figure is indicative of a persistent truth. When it comes to African stock markets, there is a similar lack of international interest. The idea of investing in Africa isn't to most peoples' taste – at least not yet.

Discarding Africa as an investment destination is an expensive mistake. I have already learned my lesson in this regard, and you should try to learn from it. That's what my 2007 trip has taught me, and I am determined not to make the same mistake again.

First, let me give you an idea how I go about researching such opportunities.

The necessary but manageable risk of researching on the ground

You probably think of me as an intrepid, fearless traveller who criss-crosses the world's most dangerous places, Indiana Jones-style.

Far from reality.

I do put careful thought into where I travel, and how I travel. I never take unnecessary, uninformed risks.

Over the years, I have learned that most people drastically overestimate some risks, and equally drastically underestimate other risks.

Among the risks that are widely overestimated are terrorism, kidnapping, and violent crime. You just need to avoid the hotspots and apply a bit of common sense.

The single most underestimated risk is that of dying in traffic. Even if you live in a Western country, traffic is one of the worst killers. In less developed nations, the risk of dying in a car goes through the roof. Bad roads, inexistent street lights, idiot drivers, no seat belts, overworked truck drivers – the list is long.

Or as I always say: "My biggest risk is taking a taxi from the airport to the hotel."

Outside of dying in traffic, the risks and problems when exploring frontier countries are relatively benign: catching diarrhoea from food, not having Internet access, or seeing your itinerary screwed up due to unreliable locals are about as bad as it gets.

That's been true for me even in most countries where you'd expect the situation to be a lot worse. During my 2007 trip, I ended up covering eight countries in just eleven days. One of them was Zimbabwe, which back then was already in an atrocious political, economic and social situation. Still, researching the Zimbabwe Stock Exchange as part of my trip was a doodle.

Little did I know, though, what I was in for in Nigeria (and Lagos in particular). The one trip in my life where I got the advance assessment genuinely wrong! It's worth highlighting this particular destination, not the least because it had such an interesting investment angle.

Lagos, Nigeria: welcome to hell!

It's not like I had arrived unprepared. Before setting off on my trip, I had read The New Yorker's seminal 2006 city profile of Lagos.

"The Megacity – Decoding the chaos of Lagos" remains a widely read article to this day. It characterises the city of then 15m in quite a vivid way.

I'll never forget when I first read that "only 0.4% of the inhabits have a toilet connected to a sewer system."

What about the other 14.94m people?

Yes, I did see people defecating in the street.

That just about summed up Lagos.

It was the most daunting, and at times outright frightening, place I had ever visited.

Arriving at Murtala Muhammed International Airport involved flying through an ominous layer of smog. Without any form of municipal garbage disposal, the trash produced by 15m tightly packed residents was simply piled high until someone set it alight. The smoking trash heaps across the city made for a Mad Max-style atmosphere (and explained the smog). Never mind the fact that at night, everything went pitch dark. Electric lighting was rather scarce at the time.

It did feel like a lawless place where as a seemingly wealthy foreigner you might just be killed and dumped into the next garbage heap. For once, I was glad having guards with machine guns outside my hotel.

That said, it would have made for some fantastic investment opportunities. You'll see as much from the two examples that I'll now tell you about.

Lagos' fire-based waste disposal system welcoming me on the way from the airport to the hotel.

Quick money – even from residential real estate

These were two of the main lessons that I've learned on the trip:

- Profit margins in Africa are spectacular.

- It all depends on getting things done (which is no small feat in Africa).

Case in point, the opportunity I found to invest in residential real estate.

Developing residential property was actually the anchor idea of the entire trip. The year before, I had helped found a residential property fund for Macau, then a fledgling gambling destination. My colleagues and I had managed to raise USD 150m from institutional investors in London, to purchase existing and finance new residential property in Macau. I was a director of the fund, and we subsequently built it up to a successful USD 300m property portfolio. Within two years or so, our investors were ahead about 70%. For a low-risk asset class such as residential real estate, that was a pretty darn good return. Everything was tax-free, since we ran it through a carefully constructed (and entirely legal) set of offshore companies.

Our idea was to do the same again for sub-Saharan Africa.

In Nigeria, I found the most insane circumstances for newly built residential real estate that I have seen in my lifetime:

- 50% annual rental yield.

- Before the tenant moved in, the rent for 24 months had to be paid in advance (the "key money").

These figures were for residential property of Western quality, aimed at expats and wealthy Nigerians.

Given what a mess Lagos was at the time, getting anything built to this level of quality was quite the challenge.

Still, it showed what level of wealth creation was possible.

A successful real estate investor could have quickly multiplied their fortune by building properties, getting the entire investment back on day one of the tenant moving in, and then building yet more. If you ever wondered how multi-billion fortunes are created, here's your answer.

One of the people who did make use of such ground-floor opportunities was Aliko Dangote.

The early days of Africa's richest man

When I visited Nigeria in 2007, Aliko Dangote had already become a well-known local tycoon worth about USD 2bn. That's from an initial investment of USD 3,000 in 1977 when, at age 21, he started trading agricultural products with money borrowed from his uncle. During the 1990s, Dangote switched from importing goods to producing them in Nigeria, a revolutionary move at the time which put a rocket under his net worth.

It turned out I had come across Dangote just before his career was about to truly take off. Seven years later, in 2014, Dangote had stormed the world's wealth rankings, making it into Forbes' top 50 wealthiest people with an estimated fortune of USD 25bn. His companies accounted for 20% of the market capitalisation of the Nigerian Stock Exchange. In 2013, the Financial Times honoured Dangote with an extensive, flattering profile.

How had he done it?

The answer is a simple product: cement. Nigeria's fast-growing population needed housing, and Dangote built the cement plants to provide the most basic construction material. Since I visited, Lagos' population has grown from 15m to now 21m. During the same period, the living standard has risen and a burgeoning middle class has demanded more residential space. Imagine how much cement was needed to accommodate all these people. Never mind the 165m (!) people in the rest of the country.

His company eventually went public on the Nigerian Stock Exchange. I should have been a part of it, because I had a meeting agreed with Dangote Group to discuss buying a pre-IPO stake in Dangote Cement (ISIN NGDANGCEM008). Dangote Cement has the highest profit margins of any dominant cement company anywhere in the world, and its returns on equity are world-class.

Sadly, though, the meeting never happened, for reasons that I only have myself to blame for. After 36h of struggling with the countless challenges of Lagos, I cut the visit short, cancelled all remaining meetings, and jetted on to the more civilised shores of Ghana.

Nigeria had gotten the better of me. For the first (and to this day, only) time in my life, I felt thoroughly unsafe in a country. Retreat seemed like the wisest option.

In retrospective, I probably missed a hell of an opportunity (no pun intended). Nigeria has grown by leaps and bounds since then, and investments in basic industries such as retail, construction, cell phone networks or banking could have done incredibly well. With fluctuations, of course. Nigeria has had some incredible boom times since then, but also a few busts. Given its dependency on oil revenue, much of that fate was tied to the ups and downs of the price for oil.

Aliko Dangote also has had his share of trials and tribulations. At last count, his net worth was back down at "only" USD 7bn.

Looking back at visiting Nigeria in 2007, I now rank it as one of the ground-floor opportunities that I could have gotten into but simply missed out on.

Which begs the question, where else in Africa can you nowadays find such ground-floor opportunities that are open to private investors?

Africa remains an opportunity

Since my African roundtrip, the continent has moved on impressively. Much as the Western media obsess about the rise of Asia, there is also a lot to be said about the incredible advances in parts of Africa. There is a large and growing middle class, and purely based on demographics, the continent is to grow yet more. Within the list of 54 countries, you have basket cases but also real outperformers.

The continent's stock markets have become more developed but remain underanalysed to this day. They are the dark boxes of the world of investing (or maybe "grey" – depending on which country you look at). For many African companies, you can't rely on Google or Bloomberg. You still need to physically travel there to get a clear picture of what's happening. Short of doing that, you need to know your way around some of the available backdoor routes into African markets – which do exist on international exchanges.

Over the past few weeks, I've pulled out my files on Africa and started to engage with friends who know a bit about these markets.

Lo and behold, there is a lot to be said in favour of paying more attention to opportunities in Africa. My interest is certainly piqued – again!

Next week, I'll show you why Africa is of growing interest to private investors. There'll be a lot of surprising facts! Needless to say, I am also looking for an opportunity that appears exciting right now and which anyone with a brokerage account can easily buy into (without having to place orders in Harare, Nairobi, or Luanda).

Stay tuned for more. It'll be an insightful trip, with no physical risks for yourself!

Blog series: Investing in Africa

There's more to "Investing in Africa" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year