If you study the history of financial markets, you eventually realise that there is hardly anything new under the sun.

Or as Jamie Catherwood likes to put it: "We have been here before."

The 20-something has created a blog that looks at exciting parts of financial history and puts them in the context of what's happening in financial markets today. The name of his blog, Investor Amnesia, is a reference to investors forgetting lessons from the past and making the same mistakes over and over again. Instead of merely looking back at relatively recent events, Jamie travels back in history hundreds of years.

To the best of my knowledge, no comparable blog exists.

Here are seven reasons why I have started to look forward to its lengthy "Sunday Reads" emails.

1. A genuinely useful tool

Even if history isn't your cup of tea, do not underestimate its value. If you want to become a successful investor, you need to have a thorough understanding of what has happened in the past.

You only need to follow Investor Amnesia for a few issues to discover how valuable Jamie's approach is. Changes in technology driving rampant speculation, the oil market undergoing extreme volatility, entire asset classes surging before being wiped out almost overnight – it's all happened before, and multiple times!

E.g., did you think that today's low interest rates and Quantitative Easing were new phenomena?

Think again. Back in the 1800s, the British government carried out similar measures, albeit through different mechanisms. Today, it's pension funds that are desperately chasing yields. Back then, it was Britain's leisure class who lived off their bond investments. Different era, same problems.

Just like today, the low interest rates of that era spawned an entirely new industry of financial services companies that promised to help investors generate a higher income.

As (almost) always in financial market history, it didn't end well. You can read all about it Jamie's article "The Yield Of An Empire".

Reflecting and studying the past is a valuable activity that will help you make sense of our world today.

2. An extremely passionate author

Jamie's writing is eclectic, and the variety of his sources mind-boggling.

In the olden (pre-Internet) days, I would have imagined him to be an older guy with a house full of books. As Jamie disclosed in one article, his work greatly benefits from online archives that nowadays make historical material more easily accessible.

You would expect someone to be genuinely passionate if they call themselves "The Finance History Guy" on Twitter.

What's more, Jamie is very clearly gifted. His explaining the present through the lens of the past has already made him a bit of a media phenomenon: on Bloomberg TV, Jamie explored the origin of modern-day passive investing in medieval Italy, while on RealVision, he put the coronavirus crisis in historical context. All that before (presumably) hitting the age of 30.

It's always best to stick to authors who genuinely love what they do.

3. Focus on the bigger picture

I myself am more of a big picture person than someone who would get lost in details. I am interested in the overall direction of travel, first and foremost. My focus is to know where the world will be in three, five or ten years.

Investor Amnesia takes important pieces of news and analyses them with an eye to the bigger picture, e.g. by looking at the commonalities of the San Francisco earthquake in 1906 and the 2020 coronavirus pandemic.

This kind of content feeds nicely into my approach to analysing investments.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

4. Book recommendations

Inevitably, one or the other book that Jamie refers to in his writing will be of interest to me.

His blog is a source for books that you had no idea even existed, and which you can often easily buy through out-of-print book shops such as AbeBooks (which beats putting more money in Jeff Bezos' pockets).

5. Anecdotes for your arsenal

Us finance people tend to be way too serious and intense, and we should all become better at lightening things up a bit.

I love picking up the odd anecdote and geeky historical reference that I can sprinkle into dinner conversations and pub evenings.

Who'd have known that most everything we thought we knew about "Tulip Mania" was wrong? The famous descriptions of people going bankrupt from trading tulips or drowning themselves in canals were all based off satirical pamphlets that exaggerated the events of the mania on purpose. There has been a global misunderstanding of what happened because Charles Mackay misrepresented facts in his widely known 1841 book "Extraordinary Popular Delusions and the Madness of Crowds". Who'd have known?

I also loved learning about "windhandel", the Dutch word for "trading air". It led right over to a section that describes rather vividly how Dutch stockbrokers sold overvalued securities to a speculative mob during an investment bubble in the 1720s. One engraving from the era shows "customers snatching stock certificates from the streams of gas blasting out of the brokers’ posteriors – a fitting metaphor for investments that ended up too foul to touch."

Back then it was Dutch stockbrokers, and today it's investment banks from Wall Street. What has changed?

6. Engaging Twitter feed

Jamie's Twitter feed has attracted over 25,000 followers by now, and there is a lot of interesting engagement among his followers.

If you prefer Twitter to emails, check it out.

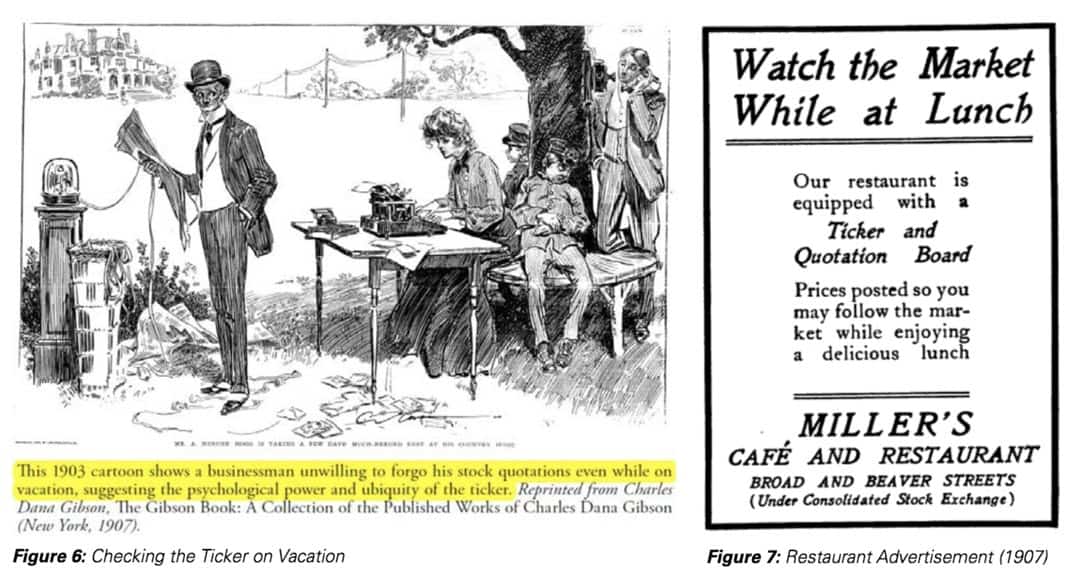

Think smartphone addiction is something new? Think again!

7. Events

Jamie works as a Client Portfolio Associate at O’Shaughnessy Asset Management in Washington, DC. His work seems to allow him to organise the occasional get-together of like-minded people. Events have already taken place in Los Angeles, Chicago, Philadelphia, New York, Toronto, Atlanta, and Washington, DC.

Events are great fun to attend as a guest, but a bitch to organise and virtually impossible to earn money from. I appreciate anyone who puts himself (or herself) out there by making an effort to bring like-minded people together. If I ever end up in the right location at the right time, I'll be sure to attend myself.

The next generation of globally known talking heads

I have long been going on that the world of finance urgently needs a new generation of bloggers, writers and media personalities.

Much as we all love them dearly, the Jim Rogers, Marc Fabers and James Grants of this world are all getting a bit tired. Other long-standing favourites have already retired, such as the inimitable Harry D. Schultz (who spends his late nineties in Monaco).

It doesn't take much to imagine Jamie Catherwood turning himself into the globally known Finance History Guy. He might just become part of finance history himself.

I think (and hope) that we'll see a lot more of him.

Besides checking out his blog, I also recommend this insightful interview with him.

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year