Tim Draper knows a thing (or two) about getting in ahead of the crowd.

He was the first Silicon Valley venture capitalist to invest in China in 2001. At the time, he negotiated the purchase of a 28% stake in Baidu (ISIN US0567521085). The company's valuation was a mere USD 32m. Today, it is worth USD 44bn – or 1,375 times as much. Speak of pioneering profits!

In 2014, Draper made headlines for investing USD 19m in 30,000 Bitcoins at a price of USD 633 each. He predicted the exotic asset to reach USD 10,000. Four years later, it peaked at just under USD 20,000.

Tim Draper is currently invested in popular, fast-growing companies such as Robinhood (stock trading app), Coinbase (digital currency exchange), and Carta (formerly eShares; equity management platform).

Trendspotting and successful investing seem to run in his family. His father, Bill Draper, was a backer of Skype, the Estonian communication app that became the first Eastern European unicorn. Skype was sold to eBay in 2005 for the princely sum of USD 4.1bn, with the Draper family pocketing 10%.

Tim Draper's latest big idea?

Investing in Eastern European tech companies – primarily in Poland!

Needless to say, when Tim Draper has a big new idea, it's worth taking a closer look. I'll start this overview with venture capital, before moving on to companies listed on the Warsaw Stock Exchange.

A clear indicator of things to come (from: Sifted, 4 March 2020).

Facts and figures about the Polish growth company sector

The announcement that Draper was moving in on Poland came during the days of the coronavirus crisis gathering pace. Most market participants will have missed it because they were busy with other stuff.

In early March 2020, Draper's venture capital firm teamed up with OTB Ventures, one of the best-known venture capital companies focussing on Central and Eastern Europe ("CEE"). In February 2020, OTB Ventures had launched a USD 100m fund for investing in early-stage technology companies across CEE, the largest such fund in the region to date.

As Tim Draper put it:

"Now is the perfect time to look into investing in Poland. The region has always had great technology, but now they are starting to connect it to the marketplace. Poland is a generation ahead of other countries in the region in understanding the market system."

A look at market figures does indicate that Poland is the natural hunting ground for growth opportunities in innovative industries.

A few days before I wrote this Weekly Dispatch, Dealroom.co and the Polish Development Fund Group published the "Polish and CEE tech ecosystem outlook", which put some meat onto the bones of Draper's claims.

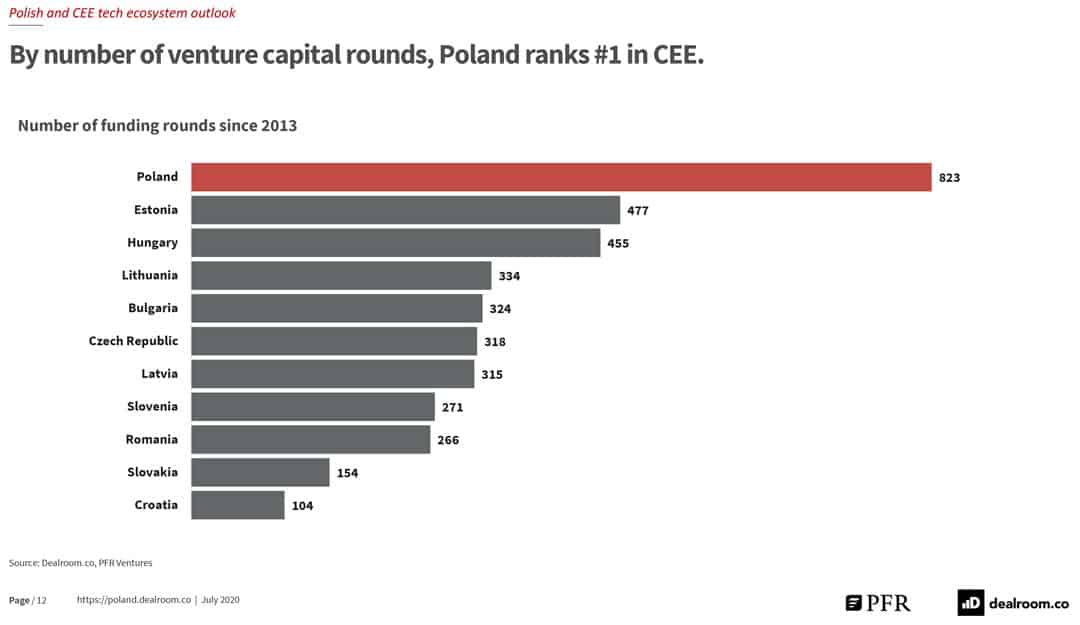

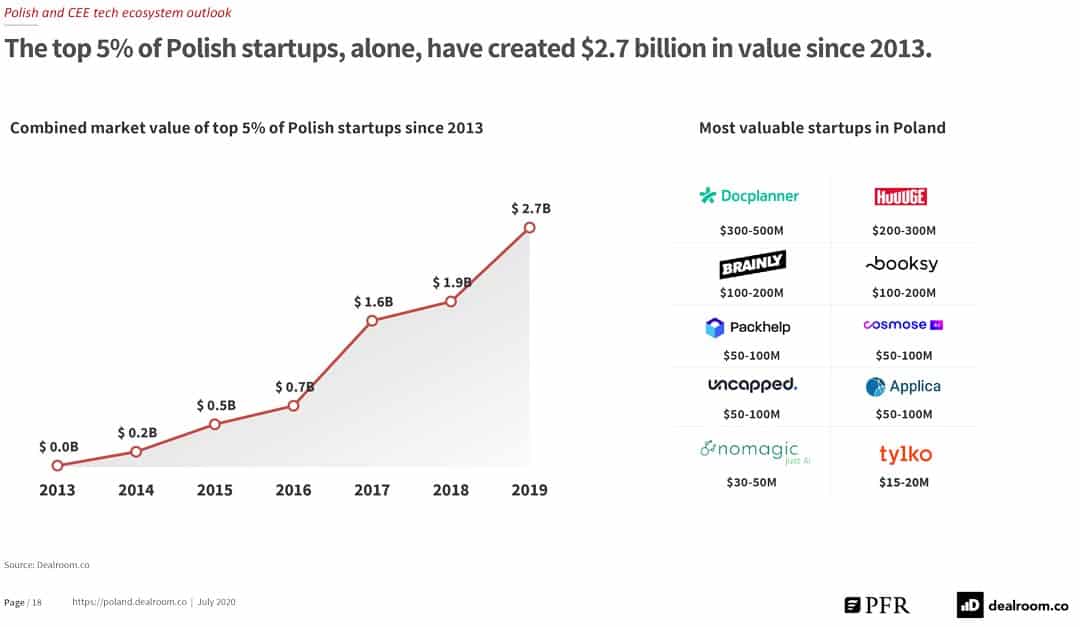

Based on the figures of the last seven years, Poland today is the CEE's #1 destination for venture capital rounds.

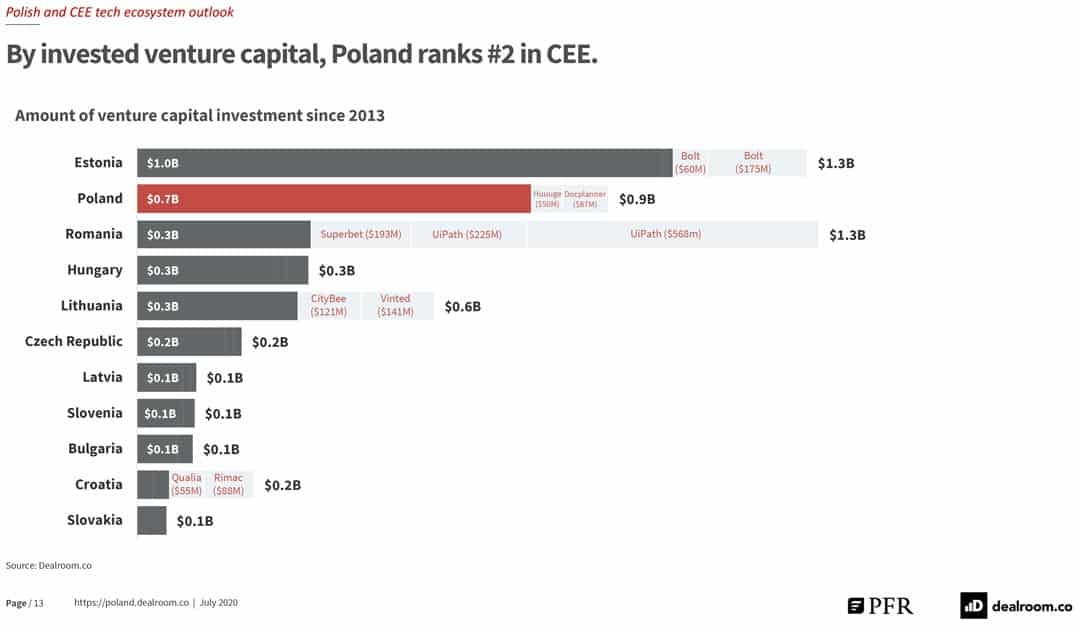

When measured by funds invested, Poland comes in #2 behind Estonia.

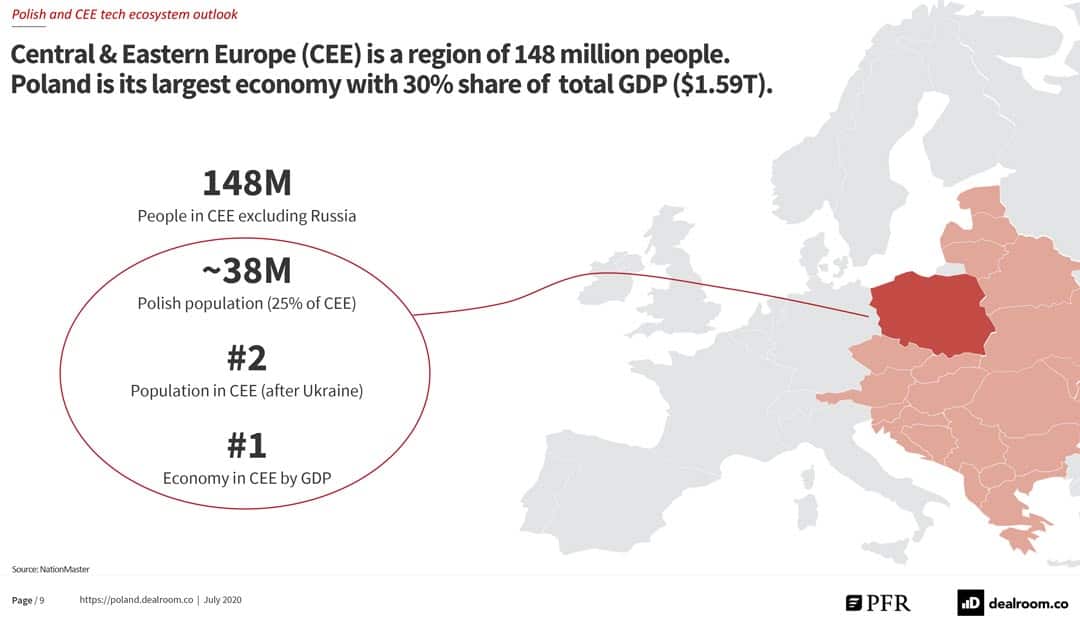

For those who know the former Eastern Bloc, these figures won't come as a surprise. As I already described in part 1 of this series, Poland is quite simply the biggest economy of the region – by a mile! Estonia got a head start in the early 2000s because of the mega success of Skype, but Poland is now zooming in on the leadership position.

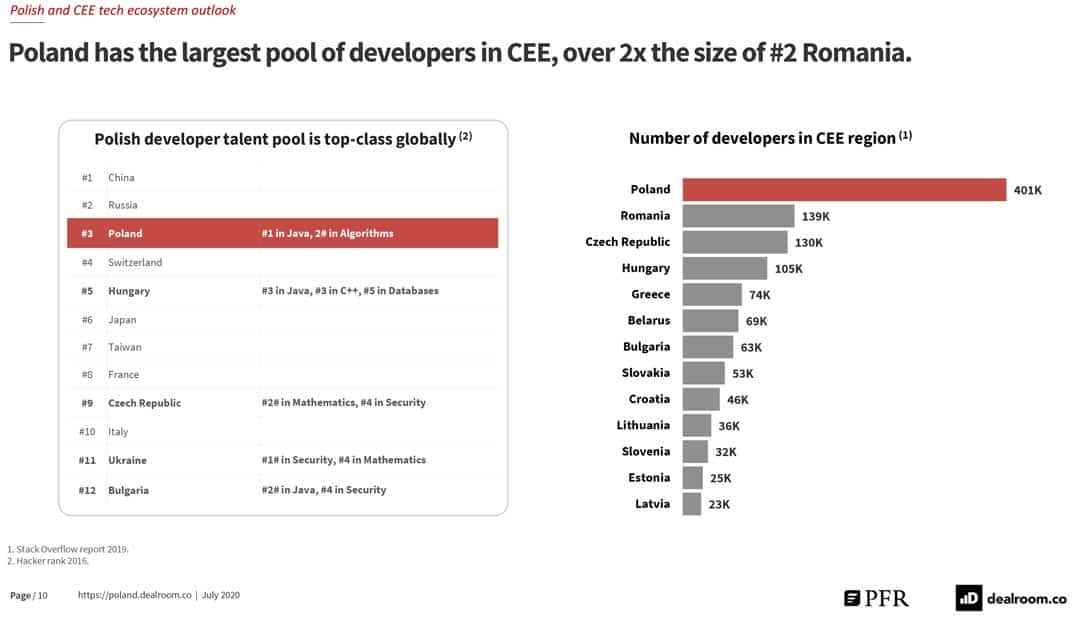

The country's large, highly educated population puts it at an advantage (just by way of example, its number of software developers is far higher than that of other CEE nations).

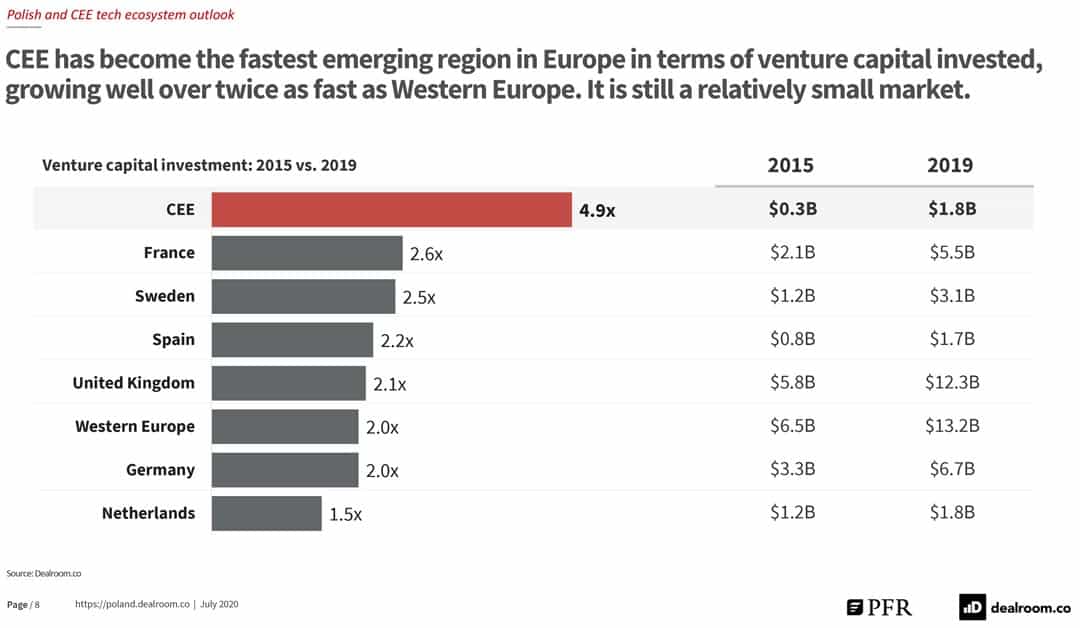

In absolute terms, venture capital investments in the CEE region are still lagging behind Western Europe. This isn't unusual, given that the region started much later and only has 50% of the population of Western Europe. However, it's growing fast.

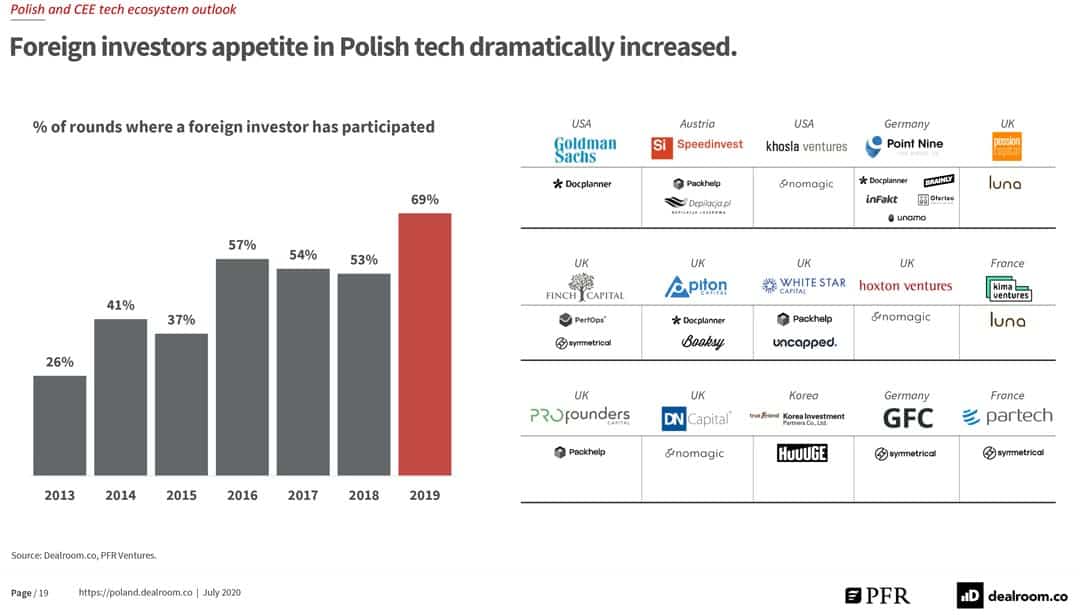

Foreign interest in Polish venture capital investment has increased significantly.

Investors who were early-early have already benefitted from the first group of successful exits.

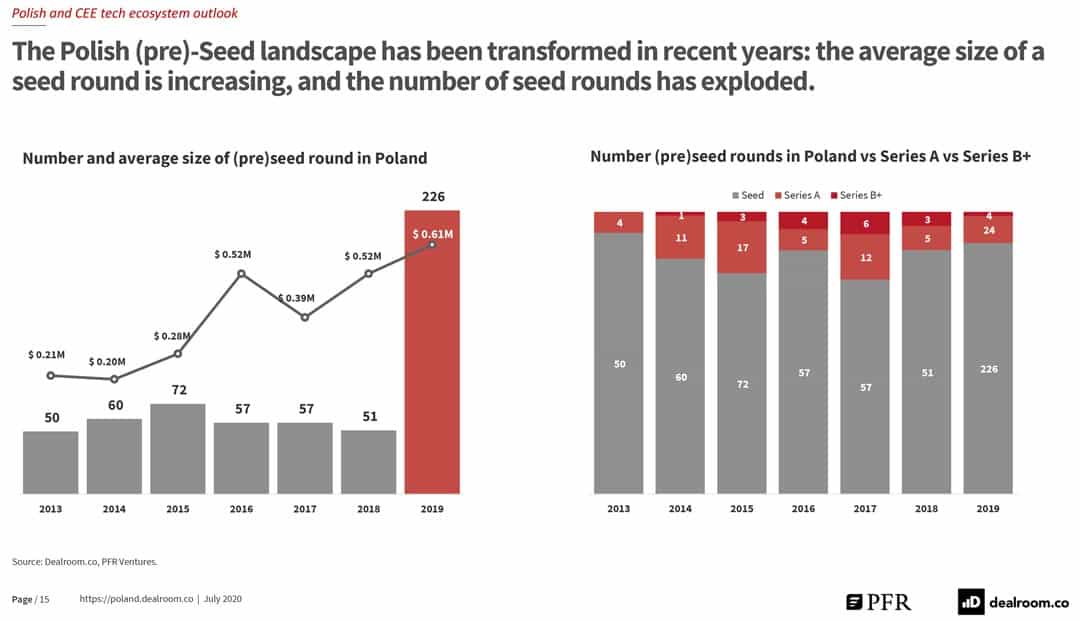

And more is likely to come further down the road. Not only has the number of seed funding rounds in Poland exploded, but also their amount: the average seed funding round is now USD 0.6m, compared to USD 0.2m a few years ago. It's indicative of the growing amount of local entrepreneurial talent.

Investing in venture capital is difficult for most private investors, and seed funding is truly only for specialised investors.

It begs the question: how can private investors get in on the act?

Large amounts of early-stage investing eventually lead to more IPOs, which then makes these listed companies more accessible to private investors.

Interestingly, even today there are already more high-growth companies listed on the Warsaw Stock Exchange than is commonly known. Earlier success in seed funding and venture capital has increased the range of stocks that investors can choose from in Poland. It's this sector of publicly-listed companies that is worth checking out.

You do need to make a bit of an effort to research these companies - which is where this website comes into play. Finding opportunities in places where not too many others are looking (yet) is what Undervalued-Shares.com is all about.

The gaming sector is where all the action is right now

Gaming companies are one area where Poland has already started to make a name for itself. Investors have tried to latch onto the sector, following the incredible success of CD Projekt (ISIN PLOPTTC00011; see last week's issue), or also Creepy Jar (ISIN PLCRPJR00035), a game developer that did a pre-IPO round at PLN 65 in 2018. The stock recently skyrocketed to PLN 1,380.

There are other examples:

- German investors will probably be familiar with 11 bit studios (ISIN PL11BTS00015), a company that was recently featured by a well-known German YouTuber. I have already received about 20 emails from German readers asking for my view on 11 bit studios. Speak of people starting to latch onto Poland!

- Another well-known play on the Polish gaming sector is PlayWay (ISIN PLPLAYW00015), which has a market cap of EUR 842m / 960m following its tenfold rise since early 2017.

- Ten Square Games (ISIN PLTSQGM00016), currently worth EUR 900m / USD 1bn, is up eight times over the past two years.

Notably, most of these Polish gaming companies are already traded on the German OTC market. This listing makes them easier to access (if you can trade in Frankfurt, you can trade these Polish stocks), and also indicates a growing international interest.

If you have a knack for gaming stocks, you can start researching these companies through the Warsaw Stock Exchange website. It is painfully slow and cumbersome, but available in English for the most part.

For a deeper dive into these companies, you need to get access to Polish brokerage firms and other boutique research providers. Their reports are usually difficult to get hold of for private investors, but there are exceptions. One extensive research document that is available publicly is the handbook of Polish companies featured by the Polish brokerage firm, IPOPEMA, at its recent GPW Innovation Day.

Alternatively, check out the video that East Value Research provided of the recent Polish Capital Market Days (Day 1 and Day 2). These video sessions featured a line-up of companies not just from the gaming sector but also from other high-growth industries.

Once you start digging, you realise that there is a lot more to the Warsaw Stock Exchange than meets the eye.

IT, biotech, and more

The combination of a highly educated population and comparatively low labour costs has made Poland a country where entrepreneurs can realise their dream of setting up a company. It's therefore no surprise that you'll find fast-growing companies across the entire swathe of growth industries – and more than you'd think are already listed on the Warsaw Stock Exchange.

Notable examples that investors can easily buy into include:

- LiveChat (ISIN PLLVTSF00010), an online customer service software that is now used by 27,000 paying customers in 150 countries. The company has a market cap of EUR 450m / USD 510m. Since early 2019, its stock price is up by a factor of three. Back in late 2020, you could have invested at a price that also gave you a 7% p.a. dividend yield. Growth stocks rarely come with a high dividend, which made this so remarkable. The stock has since doubled. Why, oh why, did I miss this one back then?

- Selvita (ISIN PLSLVCR00029), a research company that offers drug discovery services and bioinformatics solutions to the pharmaceutical and biotechnology industries. In essence, Selvita helps other companies to become more successful. It was spun off from another listed Polish company last year, which is why few investors have heard of it yet. Its market cap of EUR 200m / USD 225m still leaves it a small-cap, but for private investors, it's an entirely sufficient size to invest. I have not yet researched Selvita in any detail, but it's the kind of company that piques my interest: too small to attract professional investors, but large enough already to be a serious, professional outfit. It's in that space that you can find the best investment opportunities.

- Polski Bank Komórek Macierzystych (ISIN PLPBKM000012), a company that I had recently featured in a report for my Lifetime Members. "PBKM" is Europe's leading stem cell bank (a subscription-based business providing compounding growth), and it also develops stem cell-based drugs (which make for blue-sky potential if just one of them works out). The company is currently plotting a semi-hostile takeover and merger with Europe's #2, Germany's Vita 34 (ISIN DE000A0BL849). I had anticipated this move in my report, which was published on the very day the entire mélange became public. Following the likely merger, the company will probably seek a new listing on the Frankfurt Stock Exchange to attract new investors. To think, Europe's leading stem cell company will come from Poland!

For some of these investment cases, research is readily available if you know where to look or who to speak to. Yet other opportunities remain so well-hidden that only local contacts will enable you to take a look at them. For example, I have a connection in Warsaw who is currently sifting through pre-IPO candidates among gaming stocks. Will he find the next Creepy Jar before it takes off?

All of this is going to provide fuel for the Warsaw Stock Exchange to become better known internationally.

As I mentioned in last week's column, the Polish market also features a segment for smaller growth companies. "New Connect" has about 350 companies, and much of the reporting about these companies is currently available in Polish only.

A lack of transparency always bears opportunity. It is one of the reasons why it might just be possible to invest in Poland on more advantageous terms than elsewhere.

It's long been known that valuations of growth companies decrease as you travel East.

Growth companies are granted the highest valuations in the US.

It gets a bit cheaper once you shift your attention to the UK, which is by far the largest European destination for venture capital and similar investments.

Move over to the Western part of Continental Europe, and valuations get cheaper still.

Then look at Eastern Europe, and you get by far the most value for your money.

Like any other fast-growing market, the "New Connect" segment has seen its fair share of bankruptcies and outright scandals. That comes with the territory. However, I have no doubt that plenty of opportunities are hidden among these companies.

Which is exactly the opportunity that Draper spotted, too.

Watch this space for my findings on Polish stocks

Poland is an opportunity that is so near, yet so far.

Geographically, it's just around the corner (if you live in Europe). However, as someone recently told me: "Germans will know more about Thailand than their neighbouring country, Poland." As someone who has spent the past three years travelling to Poland regularly and telling friends about their new-found enthusiasm for the country, I couldn't agree more with that statement.

Language is an obvious issue, though one you can overcome.

The sheer lack of research material outside of Poland itself is flabbergasting. Try finding books and research reports about the country. There is not that much out there, besides Ivan Kushnir's outstanding 2019 book "Economy of Poland".

The dearth of research made me realise that I needed to involve locals and other experts to get my head around the Polish market.

One of the benefits of operating a website is that you come across many smart people. One observant reader sent me some additional information about Allegro, the Polish online platform that I mentioned in last week's issue. As my reader pointed out, Allegro once formed part of QXL Ricardo, a company which in the early 2000s was listed on the London Stock Exchange. Compared to the 2003 low of QXL Ricardo stock, the planned IPO valuation of Allegro will represent a 10,000-times (!!!) increase in value.

Not a bad return for those who had the foresight of believing in the Poles.

There are already over 800 publicly-listed Polish companies, and many more are likely to go public over the coming years. As you can read between the lines, I am determined to locate the country's best opportunities for you.

Join my investor trip to Poland (minimal availability)

As you will have learned from this week's edition, it's high time to learn more about Polish opportunities.

To support my readers in doing so, I'm organising an investor trip to Poland. From 16 to 19 September, I will be leading a group of investors to meet with companies and decision-makers in Warsaw. Speak of hands-on, real-life research!

Lifetime Members got first picking in signing up to the trip, and 15+ participants are already confirmed.

I can now offer a few more spaces*:

- 5 spaces for fund managers and other finance professionals.

- 5 spaces for private investors.

* for Undervalued-Shares.com Members only

Detailed information about the trip, including a 12-page brochure, is available in my Events section. The brochure does not include many names of companies that we will meet, because I want to keep this information exclusive to those who go on the trip.

Those of you who can't participate will get to read about the findings. I might also produce a short video (investment vloggers who would like to collaborate – please drop me an email).

Coming up next week: a longer-term perspective on Poland and my view of current political developments. The Poland investment opportunity is at its very beginning, and you will have read it here first.

Blog series: Investing in Poland

There's more to "Investing in Poland" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Missed my report on Polski Bank Komórek Macierzystych?

You can still catch up – provided you are a Lifetime Member.

My research report on Europe's leading stem cell bank is one of four additional investment opportunities that I make available to my Lifetime Members every year. And it's one that I'm particularly excited about!

It's yours for the taking, and it takes only two minutes to sign up.