Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Investing in Poland (part 3): a safe-and-steady macro play for the 2020s?

In 1989, there were hardly any experts who would bet any money on Poland's economic future. Poland was a basket case, and very few people expected it to succeed.

During my career, I've met two outstanding characters who believed in the newly independent Poland's future right from the start.

One of them was already a billionaire when the Eastern Bloc started to open up, and he needs to remain nameless. He decided to provide funding to a young Polish entrepreneur and became yet richer as a result. His discreet investment never made it into the public domain, but he loves telling his friends about it.

Another one was Jan Kulczyk, the entrepreneur on the receiving end of said investment. At the time, Kulczyk was a car dealer trying to get Volkswagen automobiles into the hands of his compatriots. From this humble origin, he rose to become one of Poland's most outstanding serial entrepreneurs. When he died at too young an age in 2015, he had become Poland's richest man with a net worth of USD 3bn.

The duo put investments to work in Poland when everyone told them it was nothing short of madness to bet on the country.

Which, in my experience, is one of the prerequisites of a successful long-term investment.

To achieve outstanding investment returns, you've got to go against the consensus. If no one is calling you crazy, you aren't contrarian enough ("Don't invest in it if they don’t call you crazy!").

That's why I revel in the fact that my Poland series has raised a lot of sceptical eyebrows and yielded below-average web metrics. In fact, I'd be worried if it were any different.

Part 1 and part 2 of this series have looked at the surprisingly diverse Polish stock exchange, the country's increasingly vibrant entrepreneurial landscape, and the growing interest of foreign venture capital financiers (ranging from Silicon Valley billionaires to Goldman Sachs).

In today's final instalment, I'm looking at the crucial remaining question: is Poland's macro-economic success likely to continue?

It is, and the positive macro outlook provides a fertile ground for investments to grown on.

If you'd like to get another (different!) perspective of investing in Poland, you've come to the right place. This article will tackle a few general questions, dig deeper into recent political and economic developments, and analyse where Poland is likely going to end up in 2030.

Let's dive right in!

Why are (some) countries so successful?

Poland's economic success has been in doubt for a long time, but it is now an objective fact:

- The country has risen to affluence faster than any nation except South Korea.

- It is now the EU's seventh largest economy (ahead of Sweden).

- Its economy has created a broad middle class of consumers instead of only benefitting a narrow elite.

The more difficult question is, how did Poland manage to get there?

Here is another fascinating figure that illustrates just how dazzling Poland's success is:

East Germany's 16m people received over EUR 1,000bn in transfers from West Germany.

Poland's 40m people received just over EUR 200bn in transfers from the EU.

Who was more successful in narrowing the gap to West Germany's level of affluence?

The Poles!

It leads back to the question: what makes a country rich, and what keeps a country poor?

Poland has turned itself into a case study that offers a plethora of fascinating figures, provided you make an effort to look closely.

The country's success is often cast aside rather condescendingly by saying: "Without EU funding, the Poles could never have turned the corner."

At the same time, even the EU's own data shows these widespread claims to be an exaggeration.

The European Commission estimated that its transfers to Poland were going to increase annual GDP growth by about 0.5% p.a.

Analysts at Erste, the Austrian bank, also placed the growth effect at 0.5% p.a.

Never mind that the transfers only started in 2004.

These annual contributions to the country's growth rate compare to an average yearly growth rate of 4.2% since 1992. The EU did add a boost, and these funds also helped to build institutions and create good governance. But it's not like Poland wouldn't have grown remarkably even without these transfers.

There is never a single explanation for a country's economic success, even if some like to claim much of the credit. Growth is multifaceted, and it's difficult to dissect its components. It's undisputed, though, that there are factors that tend to get more attention and others that have less of a lobby.

3 factors that will keep Poland rising

The following are the main factors why I believe that Poland is now well-positioned to keep its locomotive going for the foreseeable future.

1. A thriving middle class

Since 1950, only 28 of 180 developing countries around the world have managed to catch up with the US GDP by more than 10% .

According to a 2012 study by Justin Lin and David Rosenblatt, almost all of these countries had a common feature: they managed to build institutions that worked for the broad majority of the population rather than a small elite.

Poland had suffered under "extractive" elites from 1500 to 1939, followed by the Soviet domination.

Very few countries manage to rid themselves of an entrenched elite that is siphoning off their wealth. Moving to a more inclusive way of operating is a considerable challenge both politically and economically.

As part 1 of this series already showed, Poland is one of the model cases for having pulled it off. Since 1990 (while Western Europe and the US have suffered from a declining middle class), the incomes of ALL levels of Polish society have increased significantly.

Poland has become an economy with a domestic consumer sector that makes up 61% of GDP, which exceeds the EU average. Consumer spending has been growing strongly, and it now makes for a healthy backbone of the Polish economy. The country does have some reliance on exports, especially through its strong trading links with Germany. To the extent any country can ever stand on its own feet, however, the Polish economy has become more independent than anyone would have ever expected it.

The detail of how Poland succeeded in rejigging its system is a subject unto itself. It's a fascinating one, given how much bad press the country gets internationally – often from countries that should really clean up their own backyard.

What matters most is that it has created an environment where investments thrive.

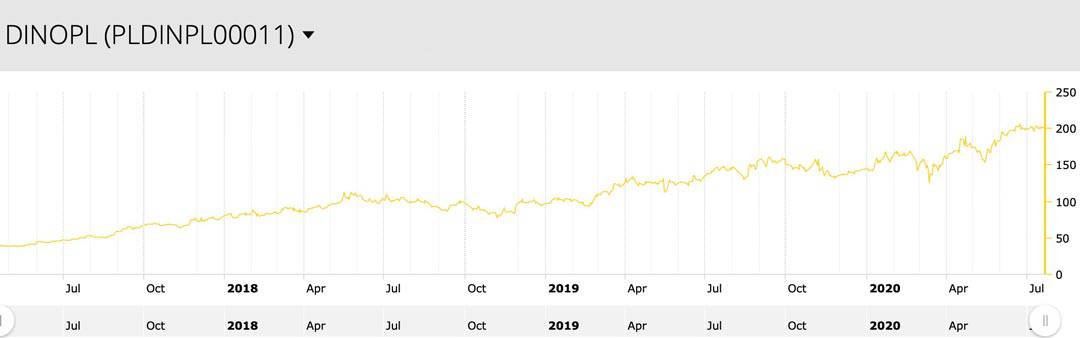

In Poland, even an investment in as unexciting a company as a national grocery chain could have made you heaps of money already. The stock of supermarket chain Dino Polska (ISIN PLDINPL00011) is up fivefold over the past four years. Rising spending from an upbeat population has continuously provided uplift for the stock.

A persistently thriving middle class is one of the most powerful secular economic forces for investors to benefit from. Out of such mass affluence also comes political stability. These factors create a virtuous circle for investments. It's what created many long-term success stories in Western Europe between the 1960s and 1980s, and the trend has now taken hold in Poland.

2. Hard work

We live in an age when a book about "The 4-Hour Workweek", by Timothy Ferriss, has become a perennial international bestseller.

I always believed this was baloney aimed at the gullible.

If you are down and out, or if you simply want to achieve something significant, you have to work your guts out for an extended period. That's one of the ways how the Poles manage to keep their economy moving at a faster pace than others.

In 2015, Poles worked an average of 1,963 hours per year. Number of hours worked doesn't equal productivity, but it's one relevant indicator to look at.

That's 300 hours and 600 hours more than the Western European and German average, respectively.

Nations that are already rich or that have achieved higher productivity can afford to cut themselves some slack. For example, the Germans have long been rich enough to not only work less, but to also throw trillions of euros at underperforming European regions, such as Greece, Italy, Spain, and East Germany. Godspeed to German efficiency and generosity! How all that will turn out, in the long run, remains to be seen.

In the meantime, I prefer to place my bet on folks who have a strong work ethic. They simply stand a higher chance of producing good results.

3. Population management and immigration

Demographics are the most powerful economic force, as the Poles can attest to.

During the early 2000s, the country's ascension to the EU saw a million young Poles elope to what were then greener pastures economically. The UK alone counted an influx of at least 600,000 Poles, many of them highly-qualified.

In 2018, the EU published a report that called Poland "the largest victim of brain drain in the EU". Whenever someone wants to cite an example of an Eastern European country losing population numbers, Poland is the go-to story.

Does the well-established narrative hold up to scrutiny, though?

An assessment of the economic and financial aspects of emigration needs to look beyond headline figures.

Here are some of the lesser-known facts:

- Poland's wave of emigration was actually no worse than that of other EU countries with weak economies. This holds true both in absolute terms and regarding the percentage of highly-educated. Also, having young, agile people temporarily move abroad (as opposed to a massive number of disenfranchised young unemployed in your own country) can be a good thing as it takes off a financial burden.

- Polish emigration has led to an explosion of remittances. In 2013, money sent back home from Polish emigrants stimulated an additional 1.1% of GDP growth (twice the effect of the fabled EU transfers).

- At the time the emigration took place, Poland had a vast labour surplus. Magically, when Poland's economy ran out of labour, the tide turned. In 2018, for the first time in nearly a decade, the number of Poles living abroad fell. As the Financial Times wrote: "Tide turns for Polish émigrés, lured home by booming economy".

"Brain drain" is a term coined by a sensationalist British newspaper in the early 1960s, when young British scientists were leaving the country. Such terms make for good headlines but do not necessarily reflect all underlying dynamics. There are cases such as the two Poles who went to the Netherlands to set up a venture capital firm, OTB Ventures, which now sends tens of millions in investments to Polish start-ups (see part 2 of this series). A more appropriate term would be "brain circulation". Trends can also reverse. Incidentally, Britain, too, eventually reversed the trend and became one of the leading science hubs in Europe.

Without a doubt, Poland does have demographic challenges, including a fertility rate that has stayed way below the replacement rate despite generous handouts for families. However, there are a variety of ways to counter such challenges, including:

- Squeezing the most value out of those young people that you do have, by giving them the best education and tools to succeed in life. Interestingly, today's 15-year old high school students in Poland are as well educated as their German peers, even though Germany spends 60% more on each student (adjusted for purchasing power). Over the past 20 years, more young Poles have studied at university level than in Germany. When they enter the workforce, they get to use the Internet that is faster and cheaper than in Germany. Through these measures, the lower birth rate is at least partially countered.

- A measured and effective immigration policy can also go a long way toward countering negative demographic trends. I already wrote about Poland's approach to taking in culturally compatible, economically integrable non-Polish immigrants in part 1 of my series. Based on what I have read and observed first-hand in the country, it does appear like the country is able to have a grown-up debate about immigration and population-management.

Which nicely leads over to…

Recent Polish politics and the country's international perception

Just about everyone I spoke to for the research of this article confirmed that Poland's international perception has been holding back its stock market.

The BBC, the New York Times, and Germany's SPIEGEL will all tell you how Poland is allegedly descending into extreme nationalism, illiberalism, and worse. Just as I was writing this article, The Times headlined: "Poland's 'Ivanka Trump' begs for unity but rulers march on to dictatorship".

Is Poland's reputation as bad boy country justified, and could it eventually even turn into the opposite?

Once you start to investigate the details, many of the well-established media narratives begin to appear in a different light.

Here are just a few examples:

1. Poland nationalising and "re-polonising" strategic industries

In late 2019, the Financial Times published a rather upset article about the risk of Poland wanting to keep control of some strategic assets.

The truth is, however, that protecting national champions is a distinctively Continental European habit, and far from unique to Poland.

Just look at France.

Like many other EU nations, France has laws that allow its government to thwart foreign purchases of "strategic" French companies. On the surface, these laws are aimed at bidders from outside the EU (not that this necessarily makes it any better). In reality, the French have no hesitation to use them against anyone and everyone. Just three years ago, Emmanuel Macron blocked an Italian company from buying the country's largest shipyard – and nationalised it instead.

Governments meddling in the economy is simply a way of life across much of Continental Europe. However, some countries are singled out for (well-deserved) criticism, whereas others get away with murder. One needs to keep a sense of proportion when reading such reports.

2. Polish state media doing the bidding of the incumbent government

I don't doubt that some Polish media give favourable treatment to government politicians.

What's new, though?

Look no further than Germany, where a heavily entrenched system of publicly funded media controls a 45% (!) market share of the TV market. Based on its annual budget, the German public broadcasting organisation, ARD, is the largest such organisation in the world. Their funding, ultimately, depends on the politicians that they report about on a daily basis. A fool who thinks these dependencies wouldn't influence the reporting.

Or look up the media conglomerate owned by Germany's Social Democratic Party, the Deutsche Druck- und Verlagsgesellschaft mbH. It owns stakes in 40 newspapers around the country. Nota bene, the party is part of the current government, and has a long history of using the legal system to prevent others from reporting about its involvement in the media.

That doesn't make it better, but Poland is far from being the worst offender in this regard. It's simply the way the cookie crumbles in many Continental European countries.

3. The government kicking out judges

Few other subjects have gathered so much attention abroad than the Polish government's long-standing efforts to replace some of the country's judges.

The EU has taken Poland to court over the matter, and it's an often-cited example for Poland allegedly entering some kind of dark age.

May there be another side to that coin, though?

In the UK, too, a discussion has started to take shape about the same subject. There is growing concern that some judges have become political activists who legislate from the court bench and can't be held accountable by voters. The UK's 2016 referendum, in particular, has brought the issue to the fore. Following the Brexit referendum, several political issues were decided by judges – in decisions that many criticised amounted to political activism by judges who had a well-documented political bias. So glaring were some of the cases that even the Brexit-opposing Prospect Magazine couldn't help but point the finger at the issue. In a January 2020 article, "Judges in the Dock", the left-leaning magazine wrote:

"It is not only populists who worry about top judges stepping too far into the glare; plenty of lawyers and judges we spoke to worry that the Supreme Court has strayed from its proper position in our constitutional landscape."

Courts undermining long-standing parliamentary practices is a serious issue. There is a lot to suggest that yet other countries in Europe will take a similarly critical look at their court systems. In Sweden, for example, jury members for court cases are appointed by political parties. Honi soy qui mal y pense.

Some of the Polish judges involved in recent controversy had been appointed back in the Communist era. Are they the right people to exert de facto legislative power? Also, the country's ruling party had disclosed these planned changes before it was voted into power in 2014. Voters have since reconfirmed the party's mandate.

Poland could simply be ahead of the pack in tackling an inconvenient issue that could undermine the indirect power of some special interest groups.

In any case, the issue has a lot more nuance to it than first meets the eye. Given how the Poles lifted themselves out of economic socialism, political totalitarianism and financial destitution, I think they deserve both respect and the benefit of the doubt. Maybe there is simply a genuine issue with some of these judges, and one that the majority of voters would like to see tackled.

Which leads me right to my final question and conclusion.

Poland as a trendsetter in a newly emerging asset class?

The investment industry likes to group investments into different classes and themes.

The best-known recent addition is, of course, that of so-called "ESG" investing (environmental, social, governance). But there are others, and similar groups will continue to emerge over time.

I have long toyed with the idea of doing some experimental research on the question. Could it yield superior investment returns if you focus your investments on countries that:

- Make it a non-negotiable priority to protect their national sovereignty.

- Pursue their national interest even if others act as if they are offended by it.

- Protect their cultural identity as a way of minimising internal conflict.

In a long-term study of such countries and their investment performance, I'd probably include Switzerland, South Korea, Israel, Norway, post-Brexit Britain, maybe Austria, and certainly Poland.

How do these countries fare in the long run, compared to countries that are visibly keen on shedding sovereignty and putting themselves under the governance of supra-national bodies? A benchmark within the comparative group would be Germany, of course.

I already tried to find literature on the subject to expose my thinking to new source from either side of the argument, but there is precious little.

Poland has been getting a bad rap as of late, and its international standing has been weighing on equity valuations. Eventually, though, political worries will give way to economic and financial results.

I wonder if there isn't a growing likelihood that this situation will turn into the opposite during the 2020s, simply because the financial results become apparent and overwhelmingly positive.

The country has a 30-year track record for doing things its own way, and being extraordinarily successful economically on the back of it.

Following this year's presidential elections, the Polish government can now count on a majority until 2023. This solid situation gives it plenty of time to finish the work started in 2015. Which other European countries had a full eight years of one party being firmly in control recently? So many other European countries are suffering under splinter-politics and frayed national assemblies. Based on election results and election participation, the Polish government has a much stronger democratic mandate than the government of Angela Merkel.

I decided to spend a fair bit of time writing about Poland because I sense an ongoing shift in the Zeitgeist. When I first travelled to Poland in 2018, not a single person would understand why I wanted to spend some time there. More recently, however, a growing number of my Western European friends and professional contacts seem to be growing envious of some of the features of Polish society. I've also had much more interest in my Poland investor trip (16-19 September 2020) than I had anticipated – another interesting indicator.

Many people have come to realise that much of the image that they were sold about Poland does not match the reality on the ground. Which, incidentally, counts for the Polish economy, too. And the next few years will likely accentuate this trend further.

Some of the projections that I have found for Poland as part of my research included:

- Poland's economy catching up with Spain by 2030 – before potentially setting its sight on Italy (although that currently appears to be a stretch-goal).

- Poland becoming a hub for pharma-related businesses and offshoring services, not the least because of the excellent education system and wages that are still four times lower than in Ireland.

- Poland managing to be the EU economy that's least affected by the COVID-19 pandemic.

At the same time, other countries that have long been the darling of international investors could go out of fashion. For example, I wonder if American money will eventually be repatriated from China – given the increasingly hostile situation between the two countries. Where could it be deployed instead? Poland is emerging as a strong political and military ally of the US, at least for now. There are over 10m Americans of Polish descent, making it the largest Polish diaspora in the world. Some of them will work in fund management. Given how small the Polish stock market is, even a relatively small amount of international investment could move the needle significantly.

The next few years are likely to see unprecedented change in the world. In the meantime, all projections are only that – projections.

However, Poland has long been vastly underestimated. Are there reasons to believe that Poland will continue to overperform?

Which opportunities can investors take advantage of?

Is the entire Polish stock market one of Europe's ultimate perception gaps?

This series will have given you some insights in this regard. You now have more information based on which you can do your own research and make up your own mind.

As always, I welcome reader feedback about this subject. Comments of any kind, pointers towards further research material, and critique of the points set out herein are all equally welcome. Not the least from my growing number of Polish readers – whose increasing presence on my website's membership roster may just be a sign of the Poles growing interested in equity investing?

It'll be interesting to watch how it all plays out in Poland.

In the meantime, I can point Undervalued-Shares.com Members to the ONE Polish stock they might want to own for the long term.

It's just one, and I'll briefly tell you why.

A brand new report for my Members – covering THE Polish stock to own

In the lead-up to this series, I had looked through a whole swathe of listed companies that Poland has to offer.

I wanted to make up for one of the more costly mistakes of my investing career, when I missed out on dirt-cheap prime residential real estate in the region. At the time, in the early and mid-1990s, I didn't invest because of my own prejudices against the former Eastern Bloc and the constant media fear-mongering.

Today, I am eager to form my own opinion based on the available evidence – which all points towards a continuation of Poland's growth story. I'm not going to make the same mistake twice (missing out once has hurt enough!), and I'm also not going to spend half of my living days managing a Polish portfolio.

So, if I could own just a single Polish stock and had to hold it for a decade, which one would it be?

I have found the one stock that ticks a lot of the "growth" boxes:

- Dominant market position in its sector (near-monopoly status for 30 years).

- High operating margins, low capital requirements, and plenty of room to grow.

- Benefitting from the key macro trends that are driving the Polish economy.

- Low valuation, both in absolute terms and relative to its international peers.

- Dividend yield of >5%, to make waiting more comfortable.

- Possibility of the share price multiplying over the years.

- A market cap of USD 500m and over 50% free-float, i.e. sufficiently liquid trading for private investors.

My interest has certainly been piqued!

If you, too, would like some exposure to the Polish growth story, that's the one investment I'd advise you to check out in more detail. The stock in question is disclosed in my latest research report – available for Undervalued-Shares.com Members as of today.

Blog series: Investing in Poland

There's more to "Investing in Poland" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Join me in Poland this September!

Poland has many surprises in store, and it’s about time we dig into those exciting opportunities (before everyone else does).

"We" - that is you and I! Join me on my investor trip to Poland for some hands-on, real life research.

20 investors have already signed up, and I can now offer a handful more spaces (Undervalued-Shares.com Members only).

Interested?