Nothing beats doing research right where it all happens.

South Korean students, they say, are among the hardest-working anywhere on earth. 16 hours of studying on any typical day, three hours of sleep in the nights leading up to exams, and anyone who can afford adds private tutoring ("hagwon") on weekends.

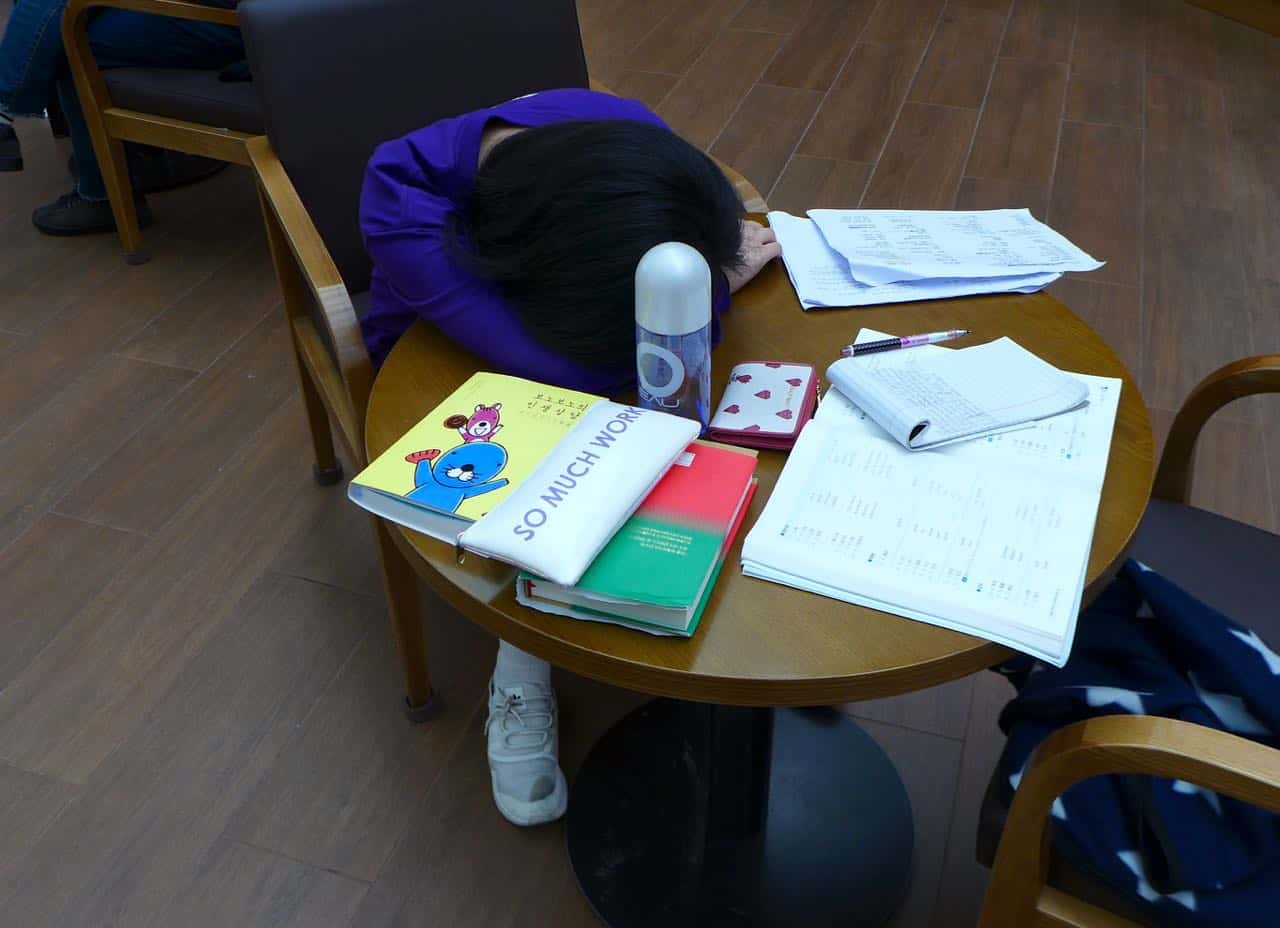

Those studious kids sharing my local cafe with me at 2am sure did look slightly stressed.

I had come to South Korea to study, too. Not to gain entry to one of their elite universities. But to try and make better sense of the country's economy as a whole, its publicly listed stocks and how they offer exposure to both the South and North Korean economies, as well as the prospect of investors making money out of the political and economic changes that may or may not come to the divided peninsula.

During two weeks of basing myself in Gangnam, the hippest and wealthiest district of South Korea's capital, those night-time encounters with bleary-eyed students became an almost nightly happening. The students did appear to be quite productive even late at night, though occasionally I also saw some of them nod off.

She has had it for a day

In amidst following American, European and Asian news outlets simultaneously and around the clock, I never adjusted to local time. Fueling up at the innumerable cafes dotted around the neighborhood, some of which were open 24/7, was the best way of coping with my body-clock being neither here nor there.

"Dear BBC, what about those bodyguards?"

I am writing about this experience with the benefit of three months having passed since it all happened.

My trip coincided precisely with the US - North Korean Summit in Singapore in mid-June 2018. I hadn't planned on this at all when I booked the trip a few months earlier, but the universe probably wanted me to witness the spectacle from this particular vantage point.

Revisiting my research material from the trip and combining it with the news about what has happened since then (including the developments during the past few days), did strike me as something I ought to turn into a mini-series.

Too much was there to learn from an event that held the world in thrall, but which was also perceived entirely differently depending on which part of the world you watched it from. The media spectacle I watched unfold around the clock offered lessons both for following world events in general, and how to find compelling investment opportunities in places that either aren't looking at yet or which are looked at after all but viewed through the prism of biased mainstream media.

A choice of June summit headlines in European and US media:

"Who are North Korea's running bodyguards" (BBC)

"What did Trump and Kim eat for lunch at North Korea summit?" (Newsweek)

"What chocolate biscuits tells us about Kim Jong-un's motivations" (ABC News)

Compare that to some of the headlines I collected from the local and Asian media at the time:

"How profitable will Inter-Korean business be?" (Korea Herald)

"Scenarios considered for North Korea economy" (Korea Times)

"South Korea's food-tech startup launches North Korea's best restaurant guide" (Jakarta Times)

Obviously, I am hand-picking examples to make a point.

However, that doesn't make the point any less valid. If you watched the North Korea - US Summit from a Korean or Asian vantage point, the gist you picked up was noticeably different than what most media consumers in Europe and Asia will have been primarily exposed to at the same time.

There, Trump bashing and skepticism.

Here, anticipating change and wanting to profit from it.

I did read the analysis of bodyguards, chocolate biscuits, and lunch-time preferences. However, what I was interested in the most, was how to make a buck out of all this. For that, I had to trawl through local sources.

Inter-Korean shares, lots of them

You won't hear me blowing a trumpet for investing in South Korean shares that offer exposure to the North Korean market. At least, not just yet.

What I do advise you, however, is to generally keep your eyes open for the sort of opportunity that your bank, broker or investment advisor is unlikely to put in front of you, but which you could easily get access to through your existing trading facilities and brokerage accounts.

Like those 166 shares of South Korean companies that in one shape or form give you a foothold in North Korea's economy.

Local newspapers often offer you a very different viewpoint

E.g., Busan Industrial (ISIN KR7011390002), a manufacturer of construction material. The company is relatively small, and whether its recent rise in share price is entirely justified or the result of ramping through tip sheets and gullible retail investors is entirely open to debate. Still, it's hard to sniff at a share price that's up over 400% during the past 5 months. It temporarily dipped following the initial rise but is now solidly back near its all-time high. Its ascent started one day before Kim Jong-un's historic step across the dividing line between both countries on April 26th. You could have jumped aboard even after the event took place.

It's also interesting to note how the markets anticipated an overall positive development on the Korean peninsula, at a time when so many media hacks were still trying to convince their readership just how futile, ineffective and naive the White House's efforts were.

Markets or media hacks, who has likely got the better handle?

Those who weren't only exposed to the common US/European mainstream media viewpoints, but who looked at it from different perspectives and formed their own view, were able to make a bundle with certain Korean shares.

Though I am the first to admit that this wasn't a risk-free trade (the biscuits could have been poisoned!), nor one that most private investors would have found to be easily accessible. Having the time to gather and analyze all the information and getting your bank or broker to trade Korean shares for you, were just two of the hurdles you would have had to overcome.

I, too, had missed that boat. I did have faith in Trump's negotiating strategy, or else I wouldn't have placed myself within 7 minutes striking distance of North Korean nukes at the time of the summit. But my prior knowledge of North Korea-related investment opportunities was limited to defaulted North Korean bonds, which are even more arcane to trade in than shares of South Korean companies.

At least, by now, I've got a better handle on things for the future.

Coming up: The no. 1 North Korea investment (so they say)

Being of a mid-1970s vintage and having grown up in Germany, I vividly remember the German unification and how it played out on the German stock market.

Initial euphoria and sky-rocketing stock prices across the board based on the prospect of 15m new consumers were followed by a period of realizing that it'll all require a lot of upfront investments and take years to materialize. Share prices came down again and went sideways for a while before those companies that were truly going to benefit from unification started a long-term ascent based on actual fundamentals and real progress.

Could something similar be in the offing for Korea?

If it were, would there be one or the other accessible, realistic opportunity to take advantage of among those 166 Inter-Korean shares?

In next week's edition of this e-letter, I'll take a closer look at one of the most interesting contenders in this field.

Check back next week for the 2nd part of this 3-part series about my research in Korea.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: