Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The great escape (part 2): Investing in Dubai

Dubai, one of the seven emirates that make up the United Arab Emirates, is one of the most polarising jurisdictions on earth.

For some, it's a crass, plastic-fantastic destination that symbolises everything that's gone wrong with a rapid, unsustainable urban development. An indoor skiing slope in the desert? You have got to be kidding me!

For others, it's the model case of a government that prioritises infrastructure investments in order to make life better for its residents. So great is the attraction of living in this unique city that Dubai's foreign-born population now outnumbers the locals by a factor of nine.

It certainly managed to change rather rapidly. Compare the following two images of downtown Dubai. One was shot in 2000, the other one a mere 20 years later.

Dubai in 2000 and 2020 (source: Dubai then and now).

You may not like the place, but Dubai has gone from remote desert outpost to global metropolis in a shorter time than any other city before. Throw in the world's largest land reclamation projects, the highest tower, and all the other superlatives that Dubai has claimed over the years. Who would argue that this is one of the great man-made wonders of the world?

Dubai's quest for never-ending growth and ambitious infrastructure projects has made headlines for decades. Recently, Dubai made waves as a destination to get away from the global pandemic. The city-state of 3.3m people reopened its businesses and borders sooner than most other jurisdictions, thanks in no small part to one of the fastest vaccination drives in the world (using China's Sinovac). During the lockdown winter of 2020/21, Dubai became the playground of choice for anyone who managed to go away from their locked-down home countries. The ensuing stream of celebrities and social media influencers lounging on the beach, while others were stuck at home, made Dubai celebrated and despised at the same time, depending on who you asked. As I said, it's a polarising place.

Dubai is also famous for its tax regime. Residents pay no income tax, and companies benefit from Economic Free Zones, where they can get 50-year tax holidays. There's currently an influx of new residents seeking to protect their income and wealth against the increasingly confiscatory levels of taxation elsewhere. Property prices are on the up, and there is a lot of talk in the media and online forums about Dubai as THE place to move to.

Does it stack up, and how can stock market investors make money off it?

Following last week's article about Monaco as a "great escape" destination, Dubai deserved to be featured in more detail.

What's driving demand in Dubai?

Just like other so-called "tax havens", Dubai has put in place a few attention-grabbing regulations to market itself as a favourable place to base yourself.

Income tax? 0%.

Corporate tax? That's probably also 0% for you, unless you are an oil company or a branch of an international bank.

However, just like other "tax havens", Dubai does actually levy taxes. For example, in Monaco, residents pay a value-added tax of 20% on all purchases (which doesn't require a vast bureaucracy to collect and allows residents to keep personal admin to a minimum). In Dubai, the government funds itself through taxes on hotel rooms, alcohol, and rental income.

The mainstream media usually refer to "the rich" allegedly paying no taxes at all in places like Monaco, Dubai or (in my case) Sark. In reality, however, the facts are quite a bit more nuanced. In Dubai, for example, residents do pay lower taxes overall but they also receive less in return. E.g., foreign residents are responsible for their healthcare and pensions, and road users need to pay tolls. It's not a model of zero taxes but one where the government plays a smaller role and, instead, the onus is on the individual to pay for things privately. Instead of calling them "tax havens", they should really be called "liberty havens".

Overall, this leaner role of government makes for a much better deal for anyone who is productive and creates significant amounts of wealth. This is one of the reasons why jurisdictions like Dubai attract an unusually high number of entrepreneurs, rather than those seeking to live off welfare. Right now, entrepreneurs and other wealth-creators are flocking to Dubai in numbers not seen in years.

As the title of this three-part blog series alludes to, the Western world is currently on the cusp of an unprecedented migration of the wealthy. In North America and Europe, the past five decades have witnessed an ever-growing role of government in society, with at least half of the economic output going towards the government in some shape and form. It's now widely accepted that the 2020s will see higher levels of taxation throughout the Western world, also driven by the economic costs of the pandemic. There'll be a growing class of "tax refugees", as a new form of economic migrants that flock to countries where they are treated more favourably than in their home countries.

Dubai is one of the places to benefit from this situation. As the Financial Times put it in a 23 June 2021 article: "A new generation of wealthy people are basing themselves in Dubai".

Indeed, the sale of luxury properties, in particular, is way up:

- In 2020, 19 properties worth more than USD 10m were sold, compared with 22 such properties during the first five months of 2021 alone. These high-end properties are merely the bellwether of the market, and sales as well as prices are up across the board.

- Property prices have finally turned around, following their decline or stagnation since 2014. Depending on which part of the market you are looking at, prices are up between 8% and 25% since the beginning of 2021.

- Stories abound on social media of property speculators queuing up for over 24h to buy off-plan real estate – and flipping it with a 25% profit the following day!

As Bloomberg reported on 18 May 2021: "Morgan Stanley Sees Dubai Property Rally Lasting for Years":

"The rally in Dubai’s residential property prices isn’t stopping anytime soon, according to Morgan Stanley.

'Robust demand, peaking supply growth and long lead times for new projects could lead to a tighter-than-expected market over the next several years,' analysts Katherine Carpenter and Nida Iqbal wrote in a report."

Will the current boom continue?

There is one aspect where Dubai has an almost unbeatable competitive advantage. It's not necessarily the taxes, the sunshine, or its location at the crossroads of several key economic regions.

The unbeatable affordability of Dubai

Dubai originally became famous as a place for beach holidays, shopping bargains, and good airline connections. It's now much more than that. Increasingly, it's an economic hub not just for the Middle East but for companies from all over the world, even including Australia. It's among the world's greatest and most important cities in finance, media, and other important sectors. I am saying this even though I've never been Dubai's biggest fan. Given recent developments, even I need to acknowledge that Dubai is about to reach the next level.

Unlike New York, London, Hong Kong, Singapore, or Tokyo, Dubai doesn't suffer from restricted space and sky-high construction costs. It has a nearly unlimited amount of empty space to play with, and it even created habitable space in the sea. The planning laws created by its absolute ruler are geared towards rapid development, and the country has zero scruples when it comes to importing cheap foreign labour to get the job done in record time. Whereas London has spent a staggering 74 years (!) discussing a potential third runway for Heathrow, Dubai just goes ahead and builds stuff.

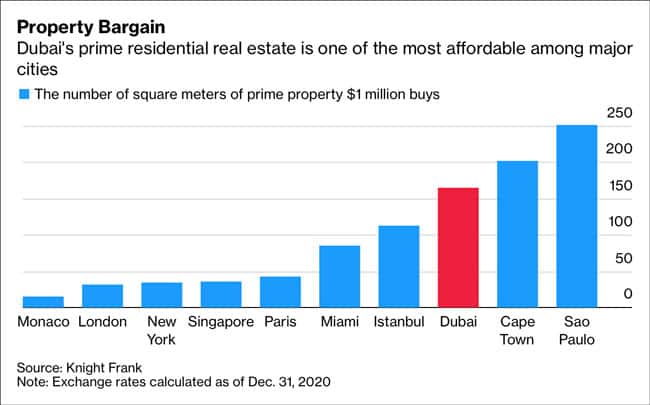

As a result, today's Dubai is one of the most affordable global cities to base yourself in. Dubai's residential real estate is 80% cheaper than New York, 82% cheaper than London, and 91% cheaper than Monaco. Put another way, in Dubai, you get five times more for your money than in New York and over ten times more than in Monaco.

Its relative affordability comes with lax visa requirements for new residents, a welcoming attitude towards new business, and that unbeatable combination of reliable sunshine and plentiful beaches. Dubai also benefits from its increasingly global set of residents, which makes it a viable alternative even for those living in the likes of London and New York. Dubai is not for everyone, but it's the right place for a growing number of people.

At a time when it's ever easier to relocate staff or even entire companies, Dubai has turned into a magnet for new residents from across the world. Demand for Dubai real estate is likely to stay strong, which has also started to show in the prices of publicly-listed real estate companies.

Dubai's equivalent of Monaco's SBM

Outside of buying apartments or villas, one way to latch onto Dubai's increasing property prices is the stocks of local property developers. The most prominent among these companies is Emaar Properties (ISIN AE0005802576), which is widely credited as the company that created modern-day Dubai.

Set up in the 1990s as a state-owned enterprise, Emaar Properties carried out its IPO in 2000 and became the first company listed on the Dubai Financial Market. It subsequently realised many of Dubai's best-known property projects, including Downtown Dubai, Dubai Marina, Dubai Mall, Mall of the Emirates (which features the skiing slope), and the Burj Khalifa.

Emaar Properties is Dubai, and Dubai is Emaar Properties. The company is to the emirate what Société des Bains de Mer et du Cercle des Etrangers à Monaco (SBM) is to Monaco. Over the years, Emaar Properties has expanded to 36 other countries around the world. The bulk of its business remains in Dubai, though. It owns a massive land bank in the city and could continue developing large-scale real estate projects for decades to come.

As Dubai's #1 real estate firm, how have its shareholders fared so far?

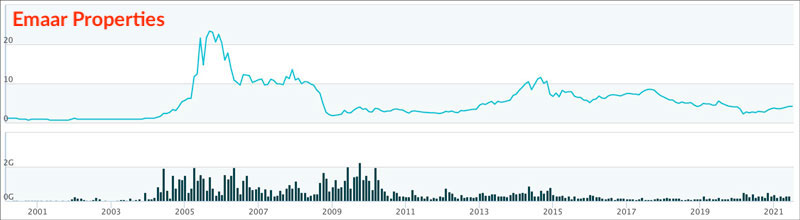

The stock's long-term performance has not been nearly as glamorous as Dubai's ascent among global cities. During the initial boom in the mid-2000s, it has risen by a factor of 25 in just a few years, only to lose over 90% of its value during the Great Financial Crisis. It rallied by a factor of six during the subsequent recovery.

Since 2014, falling property prices in Dubai caused by a supply glut have seen the stock fall from AED 11 to currently AED 4 (1 Arab Emirati Dirham = USD 0.27).

At the current level, Emaar Properties views its shares as a bargain. As the company's May 2021 investor presentation points out, the stock is currently trading with a 50% discount to its book value and a 73% discount to its net asset value.

Is the stock a bargain worth investing in, or will it turn out to be a value trap?

In a notable change to the past few years, a few bullish voices are finally emerging. HSBC recently upgraded the stock from "Hold" to "Buy" with a price target of AED 5.20. HSBC pointed out that, historically, Emaar Properties stock offered a 90% correlation to local real estate prices. When prices rise in Dubai, Emaar Properties stock does well.

At first glance, this should be the ideal stock to bet on an ongoing boom in Dubai:

- Liquid with a USD 8bn market cap.

- Transparent, as the investor relations section of its website shows.

- A cornerstone of regional indices, i.e. a go-to stock for institutional investors.

However, the investment case may not be quite so straightforward.

Like many property developers in Dubai, the company has a relatively weak balance sheet. In July 2020, S&P downgraded Emaar Properties' debt to junk. In the days leading up to this article, the credit rating agency revised its outlook for the company from "negative" to "stable". Given the strong state-backing and with markets looking up, there is no risk of Emaar Properties going to the wall financially. Still, this is a company that has grown aggressively and its balance sheet needs shoring up to make investors more comfortable.

Also, Emaar Properties stock is currently only trading on the Dubai Financial Market, which international brokerage firms cannot access. If you want to trade on Dubai's stock market, you need to register with the government and open a local brokerage account (here are the instructions how to do this).

It's mind-boggling. Here is a city-state that tries to position itself as a global hub for trading and finance, yet its stock market is virtually inaccessible to anyone without banking facilities in the region.

This is a common problem in the Middle Eastern region. Access to markets around the world has become easier than ever even for retail investors, thanks to firms such as Interactive Brokers which offers trading in 135 markets globally and has 2m brokerage clients in 200 countries. However, the Middle East largely remains off-limits to stock market investors from outside of the region.

Most likely, access to Dubai's stock market will become easier sometime during the 2020s, simply because markets are becoming ever-more connected. When it does, foreign money is bound to flow in. Just think of several million foreign-born residents of the emirate looking to invest some of their savings into local, familiar companies. The inevitable additional demand will lift valuations and initially focus on the region's blue chips.

Emaar Properties is worth keeping an eye on for several reasons, but it's also worth keeping in mind that the current situation could persist for years to come. If you decide that Emaar Properties is a stock you'd like to be invested in, it's well possible that you'll need a lot of staying power.

It should be worth it after all, though. Dubai has the right kind of leadership, and the city-state is undoubtedly turning into one of THE places in the world where to base your business and enjoy a great lifestyle. Buying a property developer stock could even turn out to be a smarter bet than buying physical real estate. While researching this article, I rang up my friend Ladislas Maurice, author of The Wandering Investor blog, which is specialised in real estate investments. As Ladislas told me:

"Dubai is full of opportunities, but keep in mind that its property market is quite different from other markets. Investor demand tends to be focussed on the latest developments. If you own an apartment that is five or ten years old, you'll find many prospective buyers giving you the cold shoulder and instead chasing the latest 'hot' apartment building. Dubai property can be a disappointing investment for landlords. The place has seen many years of oversupply of rental properties, and investors should plan for high depreciation rates because real estate ages fast. The opportunity is bigger for developers, because they shift their real estate and move on to the next project."

Buying a place in Dubai to live in is a different proposition altogether, because you need a roof over your head and a base that allows you to get a visa. For longer-term investment purposes, the stocks of developers could yet turn out the better bet. Unless you can queue overnight and flip off-plan investments for a quick profit, that is.

In any case, Dubai is a fast-moving situation that offers multiple ways to benefit financially.

Another visit is overdue – any readers down there?

I first visited Dubai in 2006 and went back a few times (for business, primarily). The experience was great back then, and it's greater by a magnitude today. I am in the camp of those for whom Dubai is a bit too plastic-fantastic to decide to live there permanently, but I've followed its ascent with fascination and respect. It IS becoming another Monaco of sorts, albeit for a younger, more entrepreneurial clientele and with a lot more space to work with – and that's a huge plus. There is no other place like it on earth.

Another visit is due to do more research, not the least because a growing number of my friends are moving to Dubai. Even among my network, Dubai's attraction is clearly visible.

Given the unbeatable affordability of its real estate and the way the world is going, I'd rate Dubai a place where one should be invested during this decade. If you can overcome the hurdles to get in, I believe you are bound to do quite well over the years to come. And of course, you can always count on me to report back once those hurdles begin to fall!

Blog series: The great escape

There's more to "The great escape" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

The future of coworking: should you invest? (German-language video)

The pandemic has made one thing clear: coworking is here to stay.

What does this mean for flexible office space providers such as IWG? What differentiates the global market leader from its competitors, and what makes it so attractive for investors? Jens Rabe and I set out to investigate.