Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

The great escape (part 1): Investing in Monaco

All over the world, governments have used the pandemic as an excuse for upping their spending to record levels. Never since the Second World War have governments increased their spending at quite such a pace, often by piling debt on top of existing debt.

The spending spree was difficult to argue with, because… You know, the pandemic.

Eventually, someone has to foot the bill. The signs are there for taxes to rise significantly and remain high throughout the 2020s:

- The G7 nations are pushing for a global minimum tax on corporate profits.

- Countless national governments around the world are preparing to tighten the screws on their taxpayers.

- In Germany, ALL major parties running in the federal election in September have some form of wealth tax in their manifesto.

- In the UK, the writing is on the wall for a 50% income tax rate from 2022.

There are not many places left to get away from it, though some options do remain. E.g., Monaco is destined to remain a low-tax destination, given that its appealing tax system is at the heart of the country's business model. It doesn't take much to see the wealthy fleeing to the sunny, glamorous low-tax jurisdiction at the edge of the Med. Case in point, the tiny country recently once again won the crown of "World's Most Expensive Property Market".

Monaco remains in a league of its own (source: Hello Monaco, 14 April 2021).

One country's loss is another country's gain. If the wealthy flee some countries, there'll be other countries that gain from these new residents.

My new three-part Weekly Dispatches series "The great escape" will cover three jurisdictions where investors benefit from an increased influx of the wealthy. As the queen of tax havens, Monaco deserves to be featured first.

No worries, I won't suggest you buy an apartment in Monaco as an investment. For all three of the "great escapes", I am going to feature at least one publicly-listed company whose stock you can buy and sell through a brokerage firm.

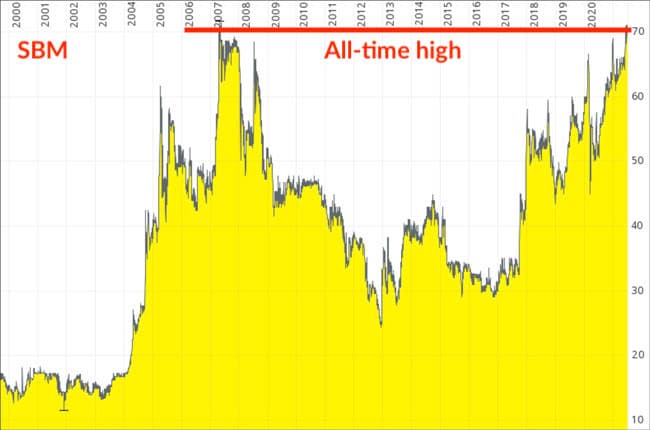

Enter the Société des Bains de Mer et du Cercle des Etrangers à Monaco S.A. ("SBM", ISIN MC0000031187), whose stock price might just be about to reach new record levels.

An oldie but a goldie – a quick recap for new readers

(Note to my "older" readers: This section is to get new readers up to speed about SBM. If you have followed my blog for a while just skip to the next section.)

SBM is the publicly-listed holding company of the Grimaldi family. The Grimaldi's current patriarch, Prince Albert II, is the reigning monarch of the Principality of Monaco. The family owns 64.21% of SBM's share capital, and the stock trades on the Euronext/Paris Stock Exchange.

SBM owns a large number of trophy assets in Monaco, including the Hôtel de Paris Monte-Carlo, Hôtel Hermitage Monte-Carlo, Café de Paris Monte-Carlo, Monte-Carlo Bay Hotel & Resort, as well as the newly launched residential neighbourhood, One Monte-Carlo. It also owns real estate in nearby France, e.g., the Monte-Carlo Beach and Villa La Vigie. SBM is the exclusive operator of casinos in Monte Carlo under a license agreement with the government which expires in 2027.

In 2004, I published an investigative report about the vast treasure trove that is SBM's balance sheet. The report went viral and proved highly popular. I vividly remember some random guy in Hong Kong asking me about it when he realised that I was the author. I even ended up in the vaults of the Hôtel de Paris Monte-Carlo with a bunch of my readers, a real treat in itself.

When I first reported about SBM, the stock was essentially trading for the equivalent of the debt-free company's cash reserves. All real estate and operative businesses were thrown in for free. Speak of a value investment! The stock soared from EUR 19 to EUR 71 within a few years, and the story culminated in Qatar's (unsuccessful) attempt to launch a takeover offer at EUR 72.50 per share.

The period from 2009 to 2017 wasn't a particularly exciting time to be an SBM shareholder, all the more when you compare it to rallying world markets during the same period. Since 2017, however, the stock has been trending upwards again.

It recently crept up to its historic high. Could the stock price break out soon and reach new territory altogether?

I set out to investigate.

Monaco has emerged stronger from every crisis

Like everywhere else, the pandemic has left a mark on SBM:

- Hotels and casinos temporarily shut down.

- International tourism stopped arriving in Monaco.

- The Principality's property market slowed down.

The company's most recent financial update of 27 May 2021 makes for dire reading. During the fiscal year 2020/21, revenue from its legendary casinos and hotels was down 48% and 62%, respectively. The company's profit of EUR 26.1m turned into a loss of EUR 79.1m.

Somewhat counter-intuitively, the stock RALLIED 10% when the figures were released. The market was already looking to the future and took heart from some of the other developments mentioned in the annual report:

- SBM finally had a good reason to close down the Sun Casino, which for a long time had been one of the less successful casinos in Monaco.

- The company made a voluntary redundancy offer to staff. Such offers are usually accepted by employees who have lost interest anyway, and as such are a good tool to clear out dead wood. Over 200 employees took SBM up on it.

- Income from rental properties increased by 11%, primarily driven by increasing occupancy in the new One Monaco residential development.

The market seems to anticipate that in the post-pandemic era, a place that combines low taxes, societal stability and good weather is destined to thrive yet again. After all, Monaco survived the Second World War, various recessions, and even a 1960s blockade by the French government. After each crisis, the micro-state reached a new zenith.

The first hallmarks of the recovery

The effects of the pandemic also hit the cushioned residents of Monaco. Given that residential space is scarce, living in Monaco during the pandemic mostly involved being stuck in an apartment. Many buildings closed down their gyms and spas. The media reported an increase in extramarital affairs and addictions.

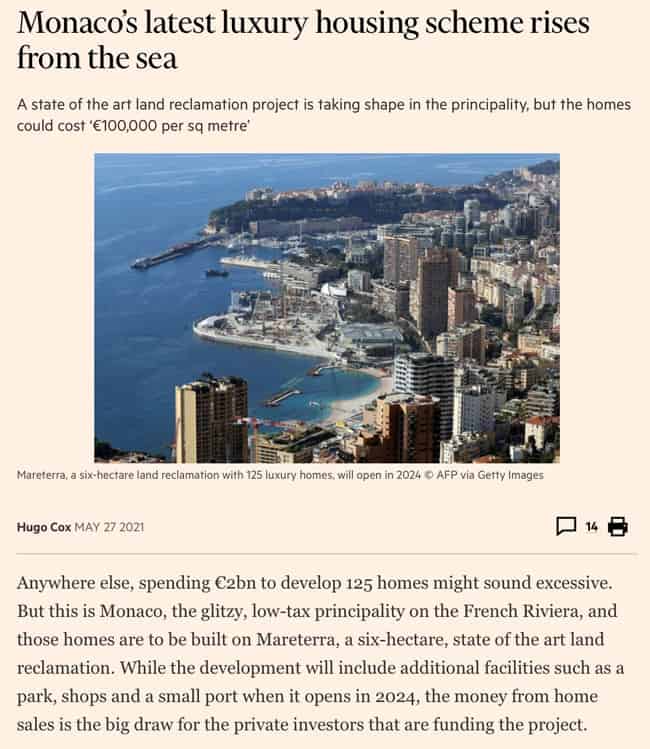

Some couldn't take it and left. Rental prices for property in Monaco fell by a whopping 23%, while sale prices only dropped a marginal 1.1%. Over the past few months, demand has started to come back. One of the key drivers behind it is Anse du Portier, or Mareterra as it's now called following a recent rebranding. It's Monaco's latest expansion into the sea and one of the world's most unusual land reclamation projects.

Monaco's coast falls off rather steeply, which is why conventional land reclamation is difficult. Instead, the Principality decided to invest a staggering EUR 2bn in developing what is essentially a floating mini-city. My stock market colleague and friend Jens Rabe recently visited Monaco for the Grand Prix, and sent me this photo of the construction site.

Mareterra is going to push the boundaries, even by Monaco standards. Residential real estate in the Principality costs an average EUR 47,000 per square metre (EUR 4,300 per square foot). In Mareterra, prices will be around EUR 100,000 per square metre (EUR 9,000 per square foot). This is in line with the prices paid for newly-built apartments in Monaco's Golden Square in front of the casino.

The project is funded by private investors and SBM isn't involved per se. However, anything that's good for Monaco's growth also benefits SBM, given the broad range of assets the company owns in Monaco. Mareterra is going to increase the overall desirability of Monaco as a place to live or visit, which pushes up the value of all real estate and brings new clients to town for SBM's various businesses.

Mareterra is already making headlines (source: Financial Times, 27 May 2021).

Could Mareterra's success rub off on SBM? How much further might the stock have to run?

Trophy real estate worth several times the current stock price

SBM stock is incredibly difficult to value:

- On the one hand, the company's trophy real estate would command sky-high prices if it were ever sold off.

- On the other hand, the company has long had challenges with its profitability. SBM has always been rumoured to give well-paid jobs to well-connected locals, and its casino business has seen a lot of competition from Asia and online operators.

I could easily make a credible case that at its current share price, SBM's assets are undervalued by a multiple based on the underlying value of its real estate. SBM could be worth EUR 200 to EUR 300 per share compared to its current price of EUR 70.

SBM owns everything that you can see in this photo (image credit: Drozdin Vladimir / Shutterstock.com).

Equally, I could credibly argue that SBM stock is anything but a bargain. The company simply doesn't have a reliable track record of generating earnings from its vast assets.

For this peculiar company, beauty is truly in the eye of the beholder.

What's my gut feeling? I believe the stock will continue to do well. I had already said as much in my 76-page research report that I published in August 2019. SBM's share has since risen from EUR 60 to currently EUR 71. I wouldn't be surprised to see a triple-digit stock price before too long.

Over the next few years, jurisdictions that don't fleece their citizenry and aren't in deep debt will not only do well – they should become favoured as safe havens for investments. Owning assets in Monaco has got to count as one of the safest ways for stashing away some wealth.

Given the likely ongoing influx of new residents with deep pockets, property prices in Monaco will probably only have one way to go. Rising property prices are probably the #1 argument in favour of SBM's stock continuing to appreciate. Since the end of the Second World War, property prices in Monaco have risen faster than anywhere else in the Western world. Given that the rich do tend to get richer (and faster than everyone else), it doesn't take much to figure out the overall direction of travel.

Also, there is a strong emotive aspect to this investment. Who wouldn't want to own a slice of Monaco? Thanks to SBM stock trading on the Paris/Euronext stock exchange, you can join this illustrious circle for just EUR 70 per share.

You can read (and see) a lot more about SBM's unique portfolio of assets in my August 2019 report. Having just checked back to my own writing of two years ago, this report remains the single most comprehensive summary of all things SBM you will find anywhere on the Internet.

It's worth checking it out for:

- "6 facts you didn't know about Monaco"

- "SBM explained in 7 easy steps"

- "5 tantalising possibilities for the future of SBM"

Alternatively, stay tuned for the next two parts of "The great escape". I'll be looking at another world-famous low-tax country that some call "the next Monaco", and at a lesser-known jurisdiction that is currently experiencing its biggest boom in decades.

The great escape of the wealthy is on, and Undervalued-Shares.com will help you to make money off it.

Blog series: The great escape

There's more to "The great escape" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Volkswagen’s hidden potential (German-language video)

The share of Volkswagen has seen an impressive revaluation over the past year: from its low of just under EUR 90, it climbed to over EUR 240 at the beginning of 2021.

What does the future hold for the German carmaker, and what’s in it for the share price? Get the answers in my video interview with Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V.