Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

This French family is squirreling away millions each year – now is the opportunity to share some of their spoils

Image by Radu Razvan / Shutterstock.com

The best companies usually aren't for sale. Imagine you owned a company that has grown consistently for decades, dominates its market, and throws off large amounts of cash every year. You probably wouldn't even consider selling it, would you? If you did, where else would you invest the money from the sale?

This is why Warren Buffett is struggling to find a home for the $112bn in cash reserves that his holding company has accumulated. What is for sale usually either doesn't fit his criteria or is offered to him at too high a price.

You, on the other hand, have it much easier than Buffett's Berkshire Hathaway Holding.

The stock market regularly gets the pricing of companies wrong, at least for a while. Buying (and selling) small amounts of company stocks is so much easier than to try and buy entire companies. You can more easily slip in and out, so to speak.

What's more, you can do so based on powerful, clear signals that key shareholders of that company may be sending you. These signals can help you improve your investment success, and occasionally land a home-run.

If the majority owners of a company are spending millions (or tens of millions) on buying more of their own company's stock, then there is a pretty good chance that the stock is currently too cheap and represents a good investment.

Enter Société BIC, a company whose brands you most definitely have heard of or even bought. I guess, though, that you have never heard of BIC in an investment context!

Not one or two, but three world-leading product categories

If you buy a gas lighter, there is a 50% chance it was produced by BIC. The company sells over 2bn of them each year, way ahead of the 450m sold annually by its biggest competitor.

For any ballpoint pen you have ever used in your life, there is an almost 1-in-5 chance that it was manufactured by BIC.

The same holds true for razor blades, where BIC also holds a 20% global market share.

All of these products are seemingly cheap and simple. However, they aren't that simple after all. BIC has thrived because the company repeatedly figured out innovative ways how to produce these products in such a way that they are of high quality and reliability. E.g., back in the 1950s when ballpoint pens were a new invention, BIC invested in precision metal cutting tools to improve the tiny metal spheres for the ballpoint, which was pivotal for its success. Its crystal pen is so widely used that it has become part of global pop culture.

If you want to get an entertaining lesson in how a company that produces seemingly simple products achieves and defends a dominant market position, I recommend you read the investor presentation that is available on BIC's investor relations website; an excellent example for a publicly listed company communicating what they do, how they do it, and why they will probably continue to be successful.

You'll then also stumble across a raft of other well-known brands the company owns, e.g., legendary Tipp-Ex! There is also plenty to be learned about innovations that you probably didn't even knew existed, e.g., the BIC Body Marker, a pen that allows children to draw temporary tattoos onto their skin without the risk posed by harmful chemicals. (Whether kids should be encouraged to glorify tramp-stamps is another subject entirely.)

By sticking to its core range of products, the family that majority-owns BIC has become rather rich indeed since its founding in 1945. At a current share price of EUR 77, the company is worth EUR 3.6bn. The 44.8% stake owned by the BIC family is worth a cool EUR 1.6bn. Because of a special share category with additional voting rights, the family controls over 60% of the votes. They clearly wouldn't need any more shares to exercise full control over the company. Nevertheless, they seem eager to own an even bigger stake in the company.

BIC is recycling some of its profits to buy back shares

For decades, BIC has had a fairly generous dividend policy. Since 2005, it has always paid out at least 37% of its annual earnings as a dividend, and at least 51% for every year since 2013.

The dividend payment for 2017 amounted to EUR 158m, which put EUR 71m into the pockets of the family shareholders. BIC has no long-term debt and always keeps a triple-digit million cash reserve.

Some of that cash reserve has recently been used to buy back shares. Companies that feel their stock is undervalued can get their shareholders' permission to buy back shares. These are then either held by the company ("treasury shares"), or they are cancelled (which increases the percentage stake of the remaining shareholders).

In a company that is majority-controlled by a family, a share buy-back is nothing more than an indirect way for family members to buy more shares and increase their percentage stake. It's an insider purchase in disguise.

BIC's buy-back programme has increased a lot since 2015, probably a direct result of the share price's weakness ever since. The family must view the current share price as too low, and with its majority voting power, it authorised putting some of the excess cash to good use by buying back shares. During 2018, EUR 54m went towards share buy-backs, which will have been equivalent to roughly 1.5% of the entire share capital, or 2.8% of the remaining free-float. The share buy-back programme amounted to one third the amount of money the company paid out as a dividend that year.

The buy-back programme continues. In March 2019 alone, the company bought back over EUR 10m of its own shares (to be precise, it has done so during the first 12 days of the month). That's 0.28% of the company, or 0.5% of the remaining free-float.

This is a significant, clear signal from family shareholders if there ever was one. They'd have every opportunity to invest their money elsewhere, but they chose to up their exposure to BIC.

It is also quite reasonable to assume that on the current level the company is going to continue to buy back shares. For 2019, earnings are estimated to come out at around EUR 5.40 per share. This should allow for another dividend payment of EUR 3.45, based on which the comes with a pretty decent 4.4% yield.

A once-in-a-decade buying opportunity?

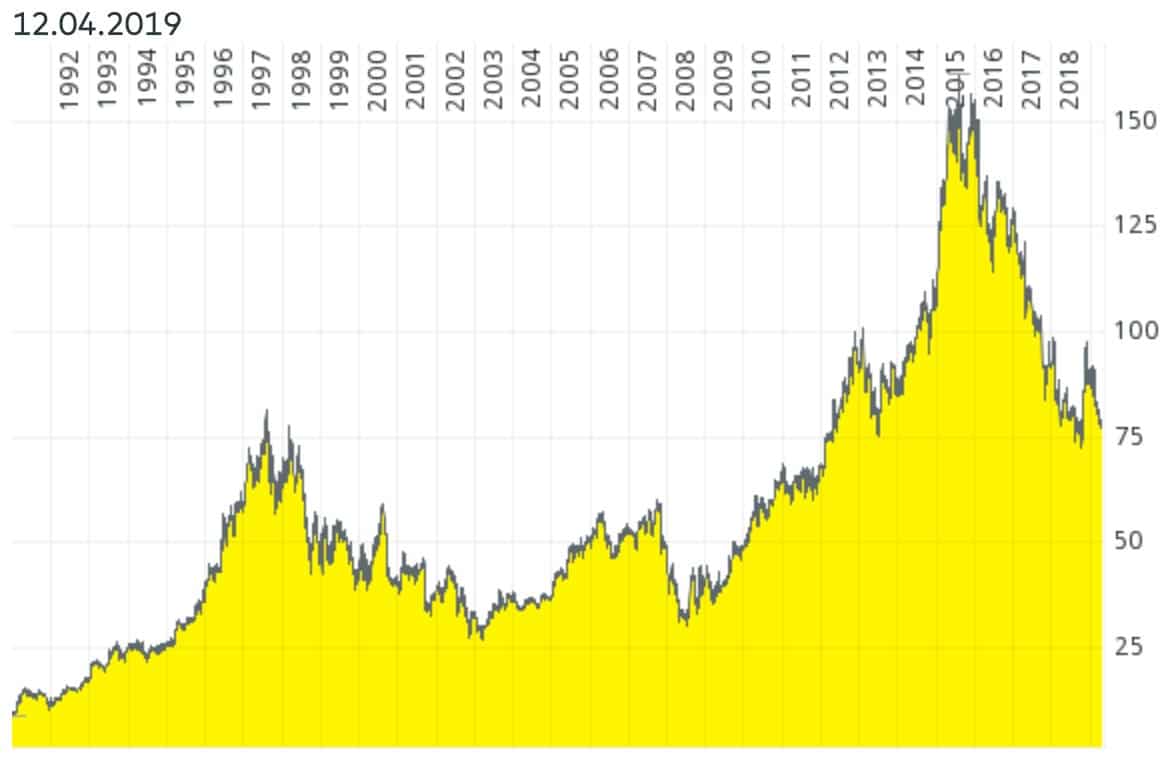

Had you bought BIC shares as a long-term investment back in 1991, you would have seen your investment grow 17-fold over the ensuing 24 years. During the same period, the Dow Jones Index only rose 6-fold.

However, since 2015, things haven't been going well for BIC shareholders. After a peak of EUR 150 in mid-2015, the share has fallen in value by half. It's last been trading at EUR 77, and last year had been as low as EUR 72.

What happened?

The market seems to have grown concerned about the company's ability to grow and keep its profit margins. Even these seemingly simple, low-value products are affected by changing consumer preferences and market disruptions. E.g., cigarette consumption trends are down in parts of the world, and Internet-based subscription services such as the Dollar Shave Club have created new challenges for the razor blade division. Indeed, during the past three years, growth rates did slow down compared to previous years.

Will the BIC family shareholders see their money fountain diminished?

Not if you believe their management's presentations and plans. Their "BIC 2022" strategy sets out how the company – once again – plans to adapt to changing markets and utilise these new trends to its advantage.

The family knows that its range of products is – ultimately – fairly resistant to changing consumer demands. E.g., despite the growth of electronics over the past 20 years the market for ballpoint pens has only ever kept growing. Factor in a growing world population that may well reach 10bn by 2050, and you can easily figure out why the family wants to increase its share rather than sell the company (for which there would be plenty of interest if it were ever put up for sale).

I am no expert on gas lighters, ballpoint pens, nor razor blades… However, I do trust the founder family to know a fair bit about these markets, and I did take note that they are putting their money where their mouth is. The massive ongoing share buy-back programme is the family's vote of confidence in BIC's long-term prospects. They seem to think that BIC merely hit a temporary lull, and that its growth rates will accelerate again.

Their additional investment makes it more likely than not that the share price's weakness since 2015 will turn out to be a temporary setback. If they are right, then buying now could prove as lucrative a decision as it would have been back in 1991.

The world is your oyster (and you can get a free, extensive BIC report from a friend)

There is a lot of research showing that in the long run, family-owned companies deliver a better share price performance than companies that are not controlled by a family. Most recently, Credit Suisse produced some seminal research on this.

As it happens, I've recently featured two other family-owned companies on my website, i.e., Volkswagen and one company of which I only reveal the name to Members of my site.

The case of BIC fits right into this same category. Though this time, I can't take credit for finding this stock. It was pointed out to me by a colleague, Tim Staermose, a globe-trotting investor, activist, and investment author who (just like myself) likes to invest his money in deep-value opportunities that he finds all across the globe. Tim has written a 14-page report on BIC, which would normally only be available to subscribers of his website, but which he kindly agreed to send to any of my readers who contact him on [email protected].

BIC is a company with a multi-decade track record of delivering superior value to shareholders; it's a multi-billion Euro company with a stock market listing on a major exchange and a liquid stock; and its excellent corporate website makes it very easy for private investors to read up on its prospects and decide for themselves if this share fits their investment criteria.

My website will continue to feature such companies in a variety of shapes and forms, and sometimes in collaboration with other investment writers from around the globe. There are SO many opportunities to be uncovered, in all corners of the world. Headline valuations of equity markets are generally quite high right now, but if you know where to look, you can find extraordinarily good value!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Tap into some more family-owned companies!

Volkswagen is one of those companies which features in my recent research reports - plus a "secret" company (only revealed to Members). Sign up now to get immediate access.

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year