Since listing in London in 2011, the stock of Zambia's largest integrated agribusiness and food chain is down a whopping 90%.

A cursory look indicates Zambeef stock might be trading at a price/earnings ratio of less than 3.

On 16 September 2024, a long-scheduled event will end an eight-year period of uncertainty, where the stock has gone nowhere but sideways.

Is now the time to take a closer look at this asset-rich play on African agriculture?

Zambeef Products.

For-profit funding to feed Africa

Zambeef Products (ISIN ZM0000000201, UK:ZAM) is Zambia's largest integrated agribusiness and food chain. As the name suggests, its origin lies in producing beef. The company is the largest processor of beef in Zambia, with five abattoirs that have capacity to slaughter up to 230,000 head of cattle a year. However, Zambeef has long expanded into ancillary areas as well; it has capacity to breed up to 25m chickens annually and can process the meat of up to 100,000 pigs per year.

The operation nowadays also includes 237 retail outlets, of which Zambeef owns 196 outright, with the remainder operated through concessions. The retail chain is complemented by its fleet of 252 trucks, which gives the company control over its logistics and distribution. Under the brand name "Master Meats", Zambeef recently started to expand its retail activities to Ghana and Nigeria.

Zambeef's corporate motto is "Expanding horizons, feeding the nation", and the company has come a long way in this regard. Since it was set up as a beef-focused operation in 1993, it now ranks not just as one of the largest companies in Zambia but across Southern Africa.

How did Zambeef get there?

Funding from the UK played a major part, and repeatedly so. After going public on the domestic Lusaka Stock Exchange in 2003, Zambeef pursued a dual-listing in London in 2011 which helped raise an additional USD 55m of growth equity from investors. The London listing won an award as 2012's "Deal of the Year" in Africa for equities, because "it marked the first time a company from the southern African country had listed internationally and was one of the few overseas African IPOs from outside the natural resources sector. … It got the attention of some of London's biggest investors."

Raising equity is never a bad thing, but it does occasionally bring with it its own set of problems.

In the case of Zambeef, a follow-on equity raise created a level of complexity and uncertainty that has been haunting the company ever since.

UK government funding – with a twist

In 2016, Zambeef raised a further USD 65m using its access to funding sources in London.

This involved an obscure but well-funded British investment agency, which even most Brits won't have heard of: the Commonwealth Development Corporation (CDC), a multi-billion investment agency operated by the UK government to make for-profit investments in emerging markets. Basically, this was development aid done through equity investments, with a focus on South Asia and Africa.

The agency agreed to a funding package for Zambeef, which led to it owning an equity stake of 17.5%. However, besides its ownership of ordinary shares, CDC also subscribed to convertible redeemable preference shares, which among other things, give it multiple voting rights. With 17.5% of the equity capital and 34.8% of the overall votes, the agency today is not just the largest owner of equity but also the largest holder of voting rights.

Having an organisation like CDC among your largest shareholders is a matter in itself. With its origin dating back to the Labour government of 1948 and post-WW II colonial policies, this agency has undergone multiple changes driven by the politics of the day. Along the way, it has not been without controversy.

E.g., in 2004, CDC spun out a private equity fund manager for emerging markets, Actis Capital. The agency sold 60% of the company to the management of Actis and continued to invest its resources in Actis funds. A subsequent investigation by Britain's Private Eye magazine accused CDC of selling its stake in Actis at an "implausibly low valuation". The magazine claimed that CDC had moved away from financing beneficial international development towards seeking large profits from schemes that enriched CDC's managers while bringing little or no benefit to the world's poor.

A government enquiry followed, and CDC changed its way of operating.

In 2022, further change followed, and CDC renamed itself British International Investment (BII). It currently manages GBP 8bn in investments and aims to increase the size of its portfolio to GBP 9bn by 2026.

As part of that, BII will have to decide on its convertible redeemable preference shares in Zambeef and its overall position with regards to the company.

For Zambeef shareholders, 16 September 2024 will be a crucial date. That day, the conditions for the convertible redeemable preference shares held by BII will change.

These preference shares came with a 12% preferred return. They made up about USD 55m of BII's total funding package at the time, and it would take Zambeef about USD 137m to repay the money in September 2024.

The company doesn't have that much cash at its disposal. As Zambeef said in its 2023 annual report: "The likelihood of such a repayment by the Company in this new financial year, or in the medium term, is currently considered by the Board to be extremely unlikely."

For lack of viable alternatives, BII will choose its option to convert these convertible redeemable preference shares into ordinary shares.

Zambeef currently has a share capital of 305.5m shares. When converting its preference shares, BII will receive 300.15m shares. Together with its existing stake of 52.6m shares, BII will then own 352.75m shares (or 58%) of a total share capital of 605.65m shares.

How is that going to affect existing shareholders, and could this be a catalyst for Zambeef's wrecked share to gain some ground?

Ignore the market cap – look at Enterprise Value instead

What triggered my curiosity in the first place was Zambeef's seemingly low market cap of just GBP 17m combined with decent-looking earnings estimates.

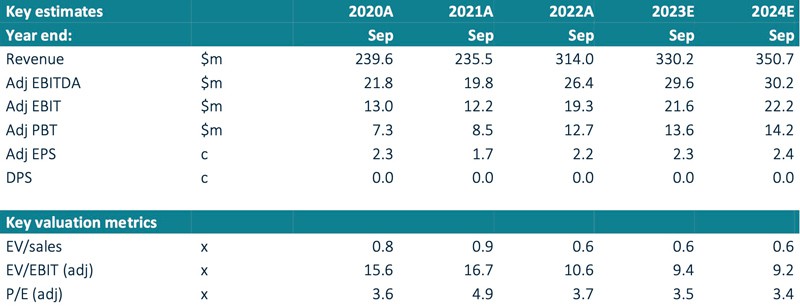

In its 7 November 2023 update, London brokerage firm Cavendish estimated 2023 and 2024 earnings per share of 2.3 cents and 2.4 cents, respectively. These dollar estimates make for earnings of 1.8 pence and 1.9 pence, respectively. Trading at 5.5 pence, this would make for a price/earnings ratio of not even 3.

Source: Cavendish, 7 November 2023 (multiples based on a share price of then 6.6 pence).

However, valuing this business is more complicated than that.

For once, Zambeef's share capital will likely finish the year 2024 with more than double the current number of shares outstanding. Besides, the company has other debt outstanding.

Cavendish calculates Zambeef's Enterprise Value to be around USD 210m (GBP 164m). That's nearly ten times the market cap that the company appears to have if you trust the market cap figure provided on the London Stock Exchange website.

Much as this makes the firm's valuation appear in a very different light, it could still be an interesting stock to follow.

Pay for the land – get everything else for free?

Zambeef is rich in assets, including 55,000 hectares of farm land. What's farmland in Zambia worth? In 2019, Zambeef sold a small farm with 2,500 hectares for USD 10m in cash. Bigger farms are more profitable overall, and the remaining land receives more rainfall. The remaining land holdings alone could be worth somewhere between USD 200-300m, which means that the value of the land alone would cover the company's valuation.

On top of that, Zambeef owns a swathe of other valuable assets, such as:

- 196 retail outlets.

- Eight abattoirs and meat-processing plants.

- Large farming operations with equipment to match.

- Biological assets such as 14,000 feedstock cattle and 220,000 chickens.

What's such an operation worth?

Zambeef generates annual sales of about USD 330m. Cavendish estimates its 2024 EBITDA to come out at about 30m, which would see the stock valued at 7x EV/EBITDA. That's not particularly expensive, but it's also not particularly cheap when considering how many European companies trade at multiples of 4-7x.

A hopeless case then?

Zambeef stock's biggest attraction may yet lay in a change of majority ownership and someone coming in to unlock what appears to be significantly growth potential.

Will BII exit?

Zambia has tremendous unexploited potential in agriculture. Of its 42m hectares of arable land, less than 10% are under cultivation. Zambia benefits from abundant water resources, and its climate follows a similar pattern to that of most Southern African countries. It has transport infrastructure and cheap labour, too. This is a country that was made for agriculture, if you can mobilise the investment needed to make it happen.

Given the world's growing population and changing diet patterns as more people reach middle-class income levels, a large-scale agricultural operation in a stable African country will have significant long-term growth potential. Setting it up from scratch would be nigh-impossible, which makes a firm like Zambeef a potentially sought-after asset. A larger African player or private equity could come in and use Zambeef as their platform from which to develop a massive agriculture operation in Zambia, and possibly beyond.

The question is, will BII stick to its investment, or will it step aside?

Once BII owns over 50% of a company outright, it will make Zambeef a de facto UK government-owned company located in Africa. Is this what the British development agency intends?

BII does exit investments when changed circumstances call for it. E.g., in November 2023, BII partially exited an Indian warehouse operator to make way for a strategic investor to take the company to the next level. The stake was bought by Exor (ISIN NL0012059018, Euronext:EXOR), the highly successful long-term investment fund of the Agnelli clan.

A few months earlier, BII had once again been under public scrutiny, with the UK Parliament's International Development Committee concluding that BII did not always live up to its priority of fostering development where it's most urgently needed.

Zambeef has grown into a profitable company with access to international growth capital. Does BII really need to tie up a large amount of money in such a company when there are so many pressing financing needs in other poverty-stricken countries and cash-starved sectors? Like any government agency, BII's funding priorities will change along with the political zeitgeist of the time; the scrutiny committee already pointed towards the rebuilding of Ukraine as an upcoming urgent priority.

On balance, after September 2024, it'll probably be difficult for BII to argue that it should hold on to its majority stake in Zambeef. The next logical step would be to bring in a strategic investor who can take the company forward. Quite possibly, such a step could already be under negotiation as part of converting the preference shares.

Change coming for Zambeef?

We have already seen some movement among shareholdings recently.

In October 2023, London brokerage company First Equity disclosed having bought 8.5% of Zambeef on behalf of Armstrong Investments Limited, an investment holding in the Isle of Man. Armstrong Investments has a history of turning up with large stakes in British small- and micro-cap companies. First Equity, in turn, has a group of directors who are well known in the wheeler-dealer circles of Britain's AIM market. Throwing over a million pound at a totally illiquid micro-cap is not what one would usually do if there wasn't a truly compelling reason.

"What's cooking?", is the question I would ask.

A development and poverty-alleviation agency like BII controlling the actual voting majority of a profitable, large conglomerate strikes me as an anachronism that cannot (and will not) stand. Holding on to this stake would set up the agency for further public criticism.

Zambeef's London listing isn't actively used, and Zambia's growth potential remains unexploited.

Change is probably afoot, one way or another.

Is this a situation where small-cap investors could make a buck?

Based on current prices, Zambeef's minority shareholders could be a nuisance to anyone who comes in and buys out BII. A new majority owner could make a lucrative offer to take Zambeef private.

Just as much, a new strategic investor might see the company's London listing as a major asset. Ever since BII entered the fold, Zambeef's share price has not gone anywhere. Once the long-standing uncertainty of the preference shares vanishes and with a clear growth plan in place, Zambeef could attract renewed attention from investors.

Come September 2024, Zambeef shareholders should know more.

Until then, the company serves as model case for the diversity of stocks listed in London and why it's worth keeping a long-term diary of upcoming events that affect little-followed equities.

More immediate potential for an x-fold return

For a more advanced case with more immediate potential for an x-fold return, dig out one of my latest reports for Undervalued-Shares.com Lifetime Members.

It features a stock that is valued at an EV/EBITDA multiple of 0.3 (not a typo!) based on 2025 estimates.

There is a catch – but one that should be resolved sometime after next month already!

Until then, it's worth considering to buy into this opportunity while no one is paying attention.

More immediate potential for an x-fold return

For a more advanced case with more immediate potential for an x-fold return, dig out one of my latest reports for Undervalued-Shares.com Lifetime Members.

It features a stock that is valued at an EV/EBITDA multiple of 0.3 (not a typo!) based on 2025 estimates.

There is a catch – but one that should be resolved sometime after next month already!

Until then, it's worth considering to buy into this opportunity while no one is paying attention.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: