Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

IWG and WeWork – a match made in heaven?

If ever there was a moment for IWG and WeWork to merge, it would probably be now.

WeWork is on its knees financially, but it retains an incredibly strong brand name.

Its arch rival, IWG, is relatively strong financially, but its brand never amounted to much.

Could recent changes announced at IWG be a prelude to a merger of the two former competitors?

IWG.

WeWork vs IWG

Which brand embodies shared office space and flexible working arrangements like no other? Of course, it's WeWork!

Even though it was only set up in 2010, WeWork (OTC market: WEWKQ) became the category-defining company in its space. IWG, in comparison, was set up in 1989 already, and it literally invented the concept of shared office space. However, the company's brand and public perception are miles behind – including that of its long-running sub brand, Regus.

As we know now, WeWork's rapid ascent was driven by unique circumstances and came with its own set of problems. The company's growth would not have been possible without cheap money chasing overpriced venture capital deals. Its business model meant it was losing money even when overall circumstances were favourable. Its governance was so bad that a Bloomberg journalist called parts of the IPO prospectus "the most bananas thing I have ever read."

In the end, it all came crashing down for WeWork. In 2019, the USD 47bn IPO was called off, and instead SoftBank had to throw USD 9.5bn at a financial rescue package.

Two years later, an IPO finally did happen through a SPAC transaction. The flotation yielded a valuation of just USD 9bn, less than the costs of the bailout package.

Another two years later, WeWork had no other choice but to file for Chapter 11 bankruptcy protection. In November 2023, the company admitted that it needed to renegotiate debts to avoid closing down altogether. The stock of the SPAC is down 98%.

SoftBank committed over USD 16bn to WeWork since first investing in 2017. The Japanese venture capital holding currently owns about 71% of the share capital as well as a portion of the firm's outstanding debt of about USD 19bn (more than 70% of which will be owed to owners of office buildings for long-term leaseholds).

At last count, SoftBank valued its equity stake in WeWork at a paltry USD 41m.

Compare that to some of the recent news from IWG (ISIN JE00BYVQYS01, UK:IWG):

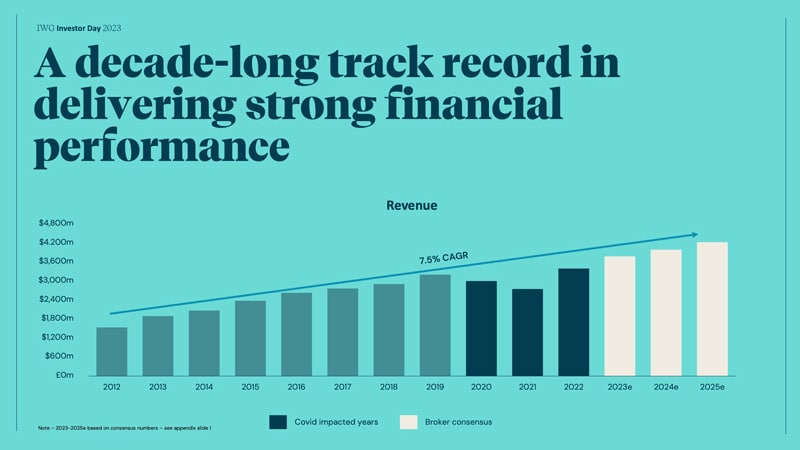

- Record revenues for the first half of 2023, up 14%.

- Almost as many lease agreements signed between January and June 2023 as in the entire previous year, thanks to the growing shift to hybrid working.

- 400 new locations signed up around the world, taking the total number to around 3,500 locations across 120 countries.

- Operating profit of GBP 94m, more than double the GBP 37m made a year earlier.

Source: The Guardian, 8 August 2023.

IWG also had to fight for survival during the pandemic, and its business is not without its own set of issues and weaknesses. E.g., investors never really took to IWG's stock, and the company's valuation remains fairly depressed. Even though IWG is an amazing entrepreneurial success story driven by a founder who remains the company's CEO and largest shareholder, it never quite sparked the public's imagination.

Source: IWG Capital Markets Day presentation (December 2023).

Still, it's clear that the future global champion of shared office space and hybrid working will not be WeWork but IWG. With its global network of around 3,500 offices, IWG is bigger than WeWork by a factor of seven. The next-largest competitor, Industrious, has just 160 offices.

If only there was a way to make the market recognise IWG's success.

Well, maybe there is...

A window of opportunity for a deal?

SoftBank is going to have one almighty struggle on its hands with making WeWork work. Even if the Chapter 11 process leads to a renegotiation of WeWork's debt and expensive property leases, it will still be an uphill battle to turn it into a viable, valuable company.

Given WeWork's long-standing financial instability, new clients will be hesitant to sign long-term agreements. This will especially be true for large corporations, where decision-makers will not want to be seen as taking undue risks.

Landlords will be hesitant to lease their buildings to WeWork. IWG had similar issues in the early 2000s, following its near-death during the dotcom bust. It took IWG years to overcome this reputation among landlords.

With SoftBank as a committed financial investor and applying the tools provided by the Chapter 11 process, it's possible to fix WeWork's balance sheet issues. The remaining company, however, will still face strong headwinds in the market space, due to everything that has happened in the past.

Why not find a better way and put to use the ONE truly valuable asset that WeWork still has – its brand!

Owning the category-defining brand name is the company's last remaining ace up its sleeve. WeWork was uniquely innovative, customer-friendly, and technology-driven. There must be considerable value left in its brand name, if someone finds a way to put it to good use.

While neither WeWork nor IWG have indicated that any such move was afoot, it's an interesting thought experiment to consider, for the following reasons:

- WeWork's remaining office portfolio will probably retain some value after the Chapter 11 process is completed, and it would further bolster IWG's existing portfolio.

- Eliminating the largest competitor from the sector would give IWG more pricing power and increase margins. The costs caused by competing with WeWork for corporate, multi-location contracts would disappear overnight.

- IWG would capture the valuable WeWork brand name. There'd be numerous possibilities for putting it to use, ranging from reviving the WeWork franchise business to changing the brand of existing IWG properties. As one idea that might seem wild but isn't entirely implausible, IWG PLC, the main holding company, could even be renamed into WeWork and listed on the New York Stock Exchange (rather than continue trading in London, where it's been languishing for a long time).

Is this a real possibility?

Plenty of possible outcomes

For full disclosure, I have an awful track record predicting anything relating to IWG.

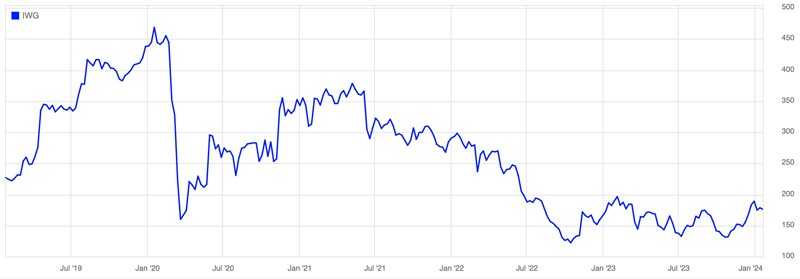

My June 2021 research report on IWG predicted that the company would continue to sell off further national franchises, thereby unlocking large amounts of liquidity that could be used to pay special dividends. This hasn't happened yet. Instead, the stock fell from 300 pence when I first wrote about it to 130 pence in June 2023 when I decided to pull the plug. To add insult to injury, the stock recovered to 190 pence at the end of 2023.

The November 2023 bankruptcy of WeWork could change everything, with some tantalising aspects fuelling such speculation:

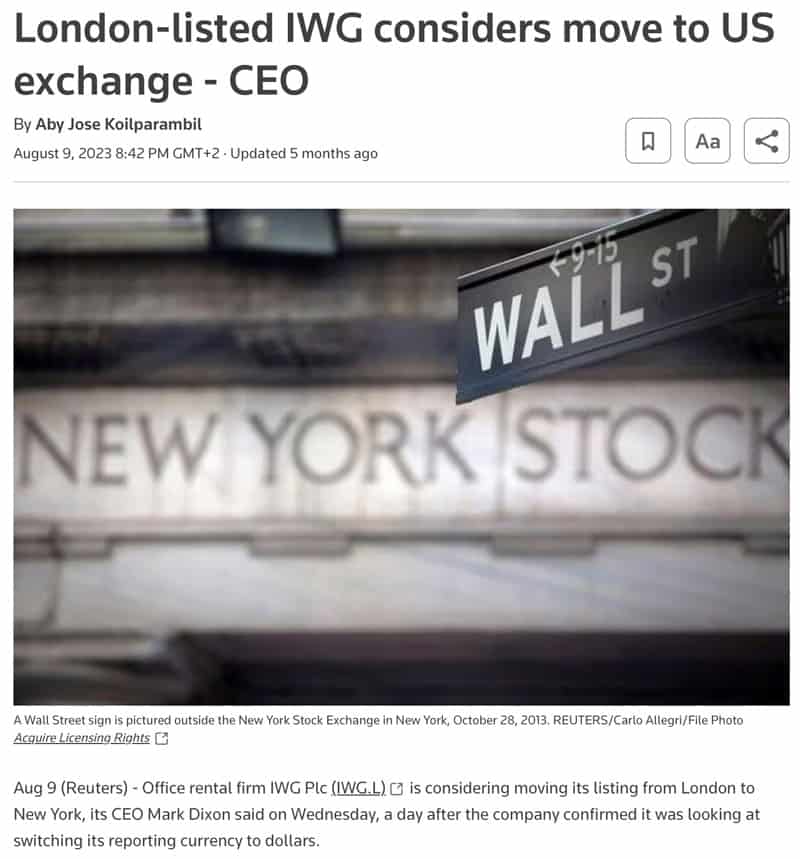

- IWG is changing its reporting currency from pound sterling to US dollars.

- The company is also considering to change its accounting from IFRS to US GAAP.

- IWG is even considering to move its primary listing from London to New York, according to Reuters reporting in August 2023.

Source: Reuters, 9 August 2023.

There'd be many good and entirely innocuous reasons for these steps. E.g., thanks to clients like Microsoft and Disney, a large part of IWG's revenue is tied to the US dollar. Many other British companies have also been considering to move their primary listing to the US.

Then again, there are reasons to speculate that WeWork's Chapter 11 process could facilitate a bold move. SoftBank already values its remaining equity stake in WeWork at just a few tens of millions, so it must be looking for a face-saving way to salvage some value from its investment.

Maybe it does all come at the right time. IWG's founder, CEO and major shareholder, Mark Dixon, is now 63 years old.

Might he want to make a bold move to deliver a parting shot ahead of sailing off into retirement?

Speculation of one kind or another isn't anything new for IWG.

In January 2018, Canada's Brookfield Asset Management considered a GBP 2.5bn bid for IWG. According to the Financial Times, the potential bid valued IWG at 280 pence per share, and "IWG's largest shareholder and founder Mark Dixon was inclined to sell the company".

Several possible transactions could be done now. SoftBank could facilitate a transaction between WeWork and IWG, and leave it at that. However, other private equity players could also be coming in. A WeWork/IWG merger could be combined with buying out some existing shareholders, and/or new investors putting in additional growth capital.

Other possibilities include IWG selling 50% of its digital business, Worka, and using the proceeds to make an outright bid for what is left of WeWork. The counter-argument is that revenue generated by Worka might be so closely tied to the rest of IWG's business that separating the two may not be realistic after all.

Where does it leave us all?

It takes us back to one important rule in investing, for which IWG currently is a model case.

"Is IWG a buy in its own right?"

When evaluating a speculative outcome like the one described above, always ask yourself the following question:

=> Would I still like to own the business, even if this potential development didn't come to fruition?

If IWG is a business that you'd like to be invested in regardless, then something like a potential merger with WeWork or the potential use of the WeWork brand name is merely the cherry on top.

If the merger is all you'd want to speculate on, then stay well away from the stock – it's too speculative, and too big a risk that no such scenario ever materialises. Other bidders could make a move on WeWork, and SoftBank may still believe that it can turn the ship around itself. We don't have any substantial insights into the likelihood of any of these scenarios.

That said, now could actually be a good time to look at IWG once again:

- The pressure on IWG's margins should subside, given that WeWork is no longer exerting such pressure on pricing. WeWork's collapse may be all that was necessary for IWG to thrive – no merger or other fancy developments required!

- The move towards hybrid working arrangements is more likely than not a decade-long mega-trend. The number of flexible office space centres across the world are estimated to double from 40,000 to 80,000 within five years. Shared workspaces used to make up just a few percent of the overall market, but should grow to 20-30% in the future. IWG is by far the largest operator in this space and as such will continue to benefit from this trend.

- A lot could be done to further enhance the value of IWG's global office network, e.g. a move towards dynamic pricing as used in the airline industry. This could also help to create a perception of IWG being more of a tech company than a real estate business – similar to Uber not owning cars and operating a software platform that does not require owning the physical assets.

- The "capital-light" model described in my June 2021 research report on IWG is as relevant for IWG shareholders as it has ever been. According to this model, IWG only provides building management for landlords, and gets a cut of the revenue – similar to Hilton Worldwide Holdings (ISIN US43300A2033, NYSE:HLT) and Marriott International (ISIN US5719032022, Nasdaq:MAR) in the hotel and hospitality industry (see my recent Weekly Dispatch on Hilton for details). IWG recently hosted an investor day in New York (notably, not London!) to announce its aim of reaching USD 1bn of EBITDA by 2028, compared to the current run rate of GBP 400-500m. The company attributed most of the upside to the growth of its capital-light business. Compared to its current Enterprise Value of GBP 2.4bn, generating such earnings would be huge. (The presentation of the Capital Markets Day is only available from IWG on request, and the company was not willing to send Undervalued-Shares.com a copy. The copy that Undervalued-Shares.com procured elsewhere – thanks to this website's network of amazing readers – did make for interesting reading!)

Plus, private equity could still become interested in buying out Dixon and making an offer to all shareholders. After all, IWG is built to generate recurring, subscription-style revenues – something that private equity will always be interested in.

WeWork's Chapter 11 process is complex and almost impossible to follow unless you are a major creditor, but it is scheduled to be completed by March 2024. If SoftBank wanted to facilitate a deal with IWG, it would have to take place in the foreseeable future.

Other writers in the blogosphere – such as Insider Ideas and Yaron Naymark – recently contributed to this debate. As WeWork's Chapter 11 process rolls on, we may yet see other reporting about IWG and WeWork. Their potential merger is an enticing possibility – albeit, so far, an elusive one.

Time to take another look at IWG

If you haven't read my June 2021 research report on IWG yet, now would be a good opportunity:

WeWork's collapse may be all that was necessary for IWG to finally thrive.

As the largest operator in the shared office space (by far!), IWG will continue to benefit from the ongoing growth of flexible office space centres across the world.

There are many possibilities to further enhance the value of IWG's global office network.

The company's "capital-light" model is as relevant for IWG shareholders as ever.

IWG's recurring, subscription-style revenue business is of interest to public equity.

If IWG is a business that you'd like to be invested in regardless, a potential merger with WeWork or the potential use of the WeWork brand name is merely the cherry on top.

Time to take another look at IWG

If you haven't read my June 2021 research report on IWG yet, now would be a good opportunity:

WeWork's collapse may be all that was necessary for IWG to finally thrive.

As the largest operator in the shared office space (by far!), IWG will continue to benefit from the ongoing growth of flexible office space centres across the world.

There are many possibilities to further enhance the value of IWG's global office network.

The company's "capital-light" model is as relevant for IWG shareholders as ever.

IWG's recurring, subscription-style revenue business is of interest to public equity.

If IWG is a business that you'd like to be invested in regardless, a potential merger with WeWork or the potential use of the WeWork brand name is merely the cherry on top.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: