Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Tadawul – the booming Saudi Arabian stock exchange

"Powering growth – where capital growth connects" is the motto of Saudi Arabia's biggest ever Capital Market Forum, held in three weeks' time.

Indeed, the Saudi market has been powering ahead. In 2023, Saudi stocks gained an average of 14%, thanks to investors flocking towards names that embody the kingdom's bold vision projects.

Tadawul is not only the national stock exchange but also a publicly listed company.

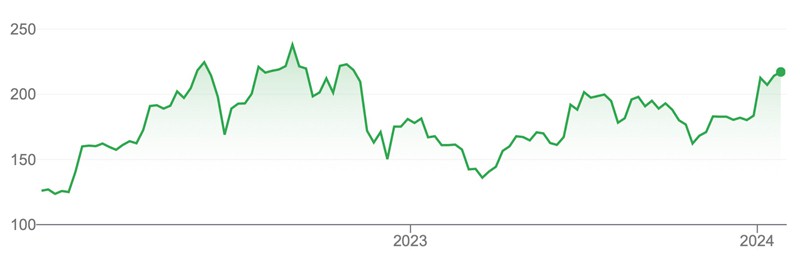

Judging from its chart, its stock price is about to embark to higher ground.

Saudi Tadawul Group Holding Company SJSC.

The unbelievable transformation of Saudi Arabia

"Saudi Arabia, the Aramco IPO, and why you must visit" must be one of the best such articles I have ever written. Published in November 2019, the Weekly Dispatch shone a light on a highly relevant but mostly overlooked subject. It proved timely, and it also included some entertaining travel advice. Last but not least, it was highly polarising.

The article triggered the first serious hate mail ever received from Undervalued-Shares.com readers. It appeared a year after Saudi Arabia dismembered the journalist Jamal Khashoggi, which came on top of the country's controversial practice of beheading, its limited rights for women, and its death penalty for homosexuality. The idea of investing in Saudi Arabia struck some as outrageous.

Fast-forward four years, and interest in Saudi Arabia is unprecedented.

The Wall Street Journal summarised recent developments on 7 September 2023:

"Flush with cash from an energy boom, Saudi Arabia and other Gulf monarchies have a moment on the world's financial stage.

Five years ago, Saudi officials watched a wave of American finance executives pull out of a free investment confab in Riyadh after the murder of a dissident journalist made the kingdom a toxic place to do business.

This year, the conference, nicknamed 'Davos in the Desert,' is expecting so much demand it is charging executives $15,000 a person.

Now, everybody wants to go to the Middle East – it's like the gold rush in the U.S. once upon a time."

What has changed?

Saudi Arabia's royal rulers decided to pursue "Vision 2030", a combination of bold economic and social reforms. Originally launched in 2016, it's taken a few years to get the programme off the ground, with the murder of Kashoggi temporarily slowing down developments. Today, Vision 2030 is progressing fast.

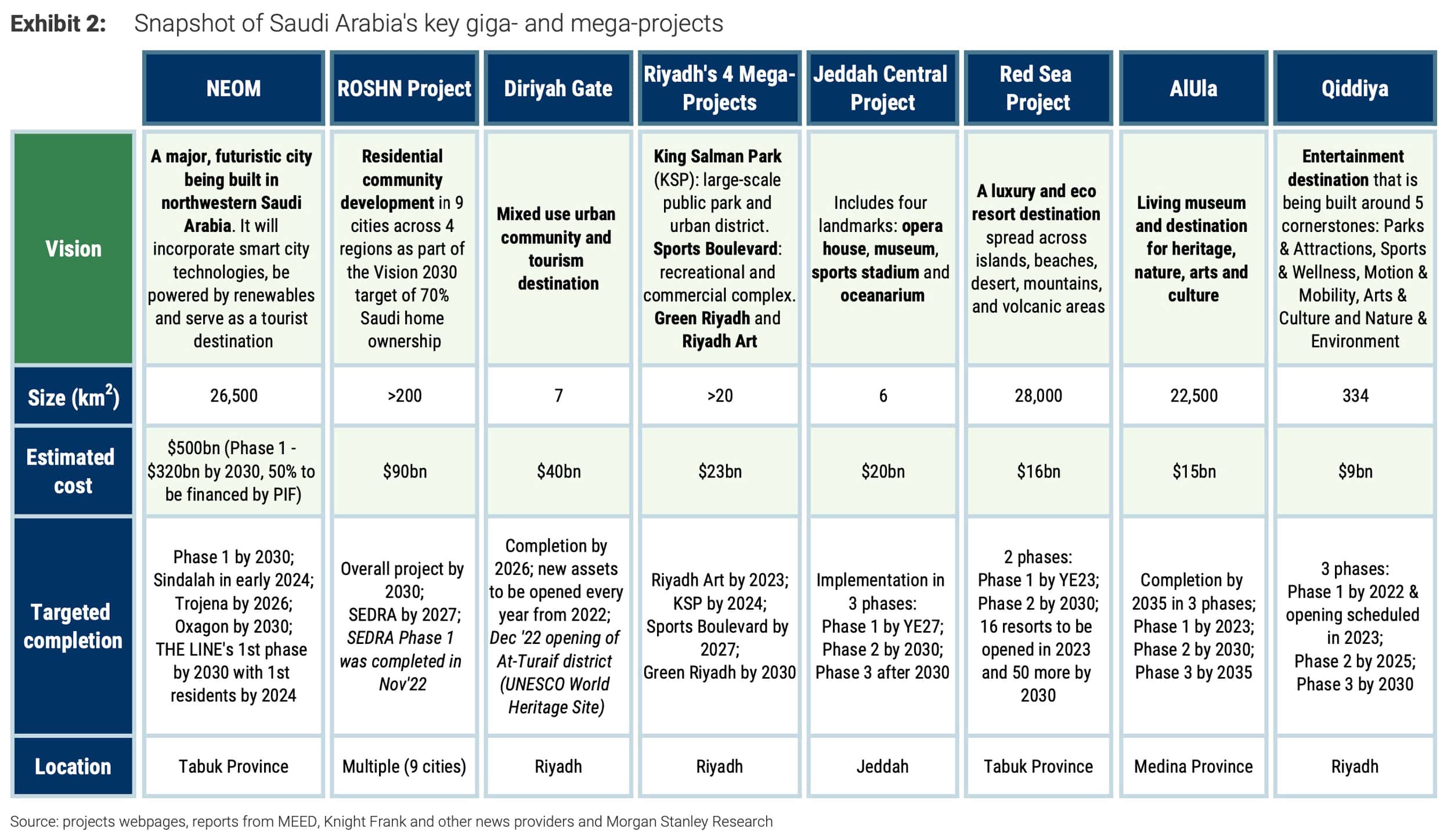

Best known internationally are the so-called "Giga Projects" that the country is planning. Saudi Arabia has set aside investments of USD 900bn for new cities, resort destinations, entertainment complexes, museums, and similar facilities.

Source: Morgan Stanley, "Saudi Arabia: Emerging at 'Giga'speed" (December 2022) (click on image to enlarge).

Some of the plans peddled in the media may never happen – and may, in fact, have been outright PR stunts.

However, it's now become impossible to deny that Saudi Arabia isn't just changing in ways that many didn't think possible, but at a breathtaking pace.

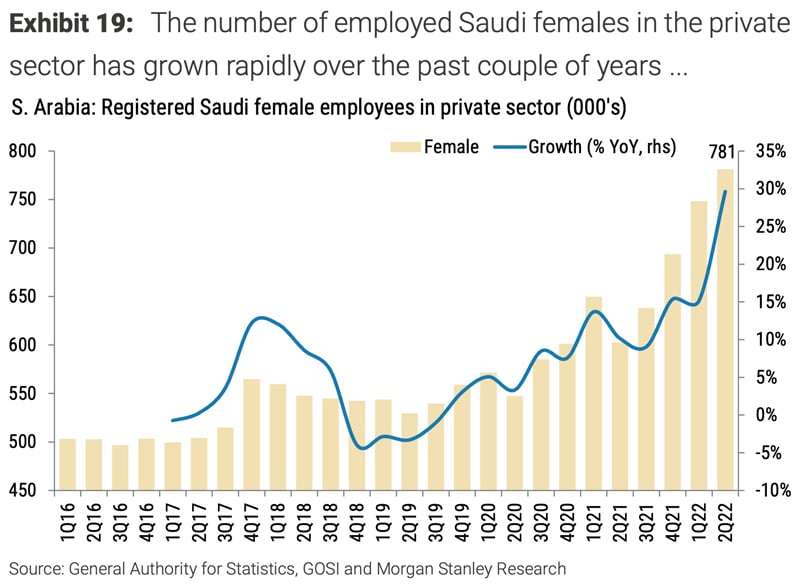

Case in point, the rights of women and their participation in the labour force.

Once famous for prohibiting women from getting a driving license and putting them under a stifling system of male guardianship, Saudi Arabian women are now allowed to travel abroad, obtain passports, work, and start a business without requiring permission from a male guardian. Restaurants are no longer required to have separate entrances for men and women.

In less than five years, the participation of Saudi women in the labour force has risen from almost 0% to now 35%.

Source: Morgan Stanley, "Saudi Arabia: Emerging at 'Giga'speed" (December 2022).

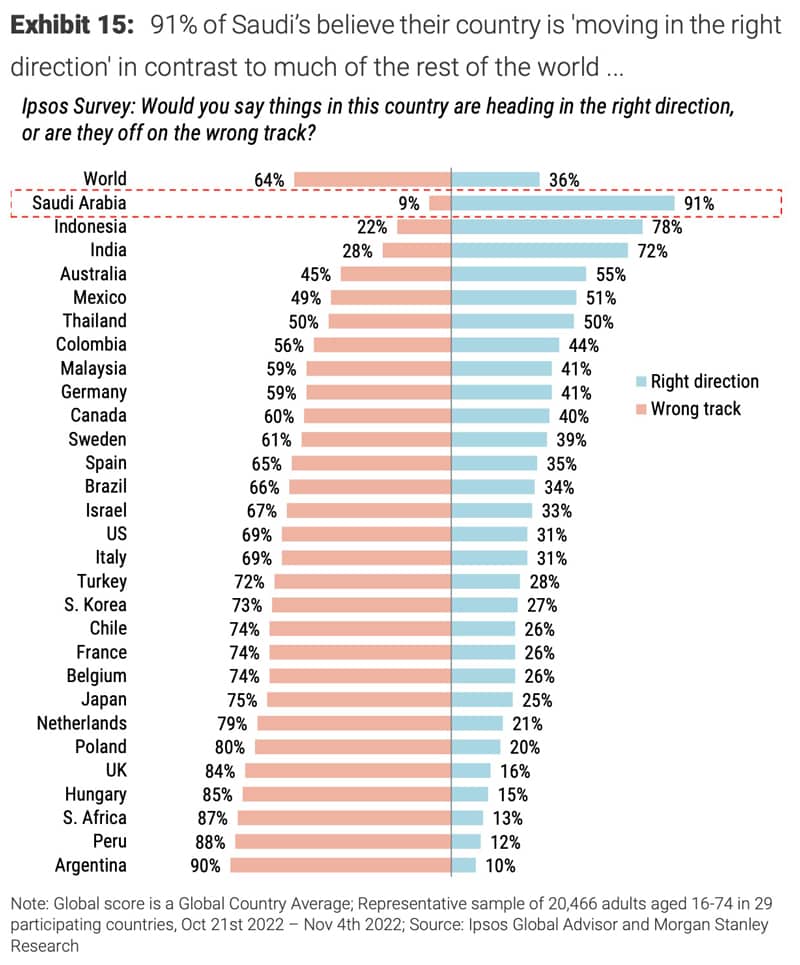

Saudi Arabia is still far from "normal" in a Western sense, but it has been gripped by an infectious wave of enthusiasm and optimism. According to a 2022 survey, 91% of Saudis believe their country was moving in the right direction. Compare that to other countries using the table below.

Source: Morgan Stanley, "Saudi Arabia: Emerging at 'Giga'speed" (December 2022).

I had noticed as much during my trip to Saudi Arabia in 2018, when Saudi newspapers already reported extensively about the ongoing "Saudisation" of the economy. After relying on massive welfare statements for decades, the Saudi population was weaned off state support and asked to go and work (replacing many guest workers, who were asked to leave).

The result is summarised in the 2023 annual investor letter of regional fund manager Ajeej Capital:

"With the cutback of allowances, ….. Riyadh's population of sleepy shisha smokers and desperate midnight car-racing drifters transformed into an army of hustlers working long hours in buzzing co-ed coworking spaces and coffee shops. … The Saudi creatives who traditionally fled to New York or London, the financiers who preferred Dubai, and the families who escaped Riyadh to Kuwait City and Doha at the weekends now firmly prefer Riyadh, with its Season, its burgeoning art and music scene, and the muscular dealmaking that underlies Vision 2030."

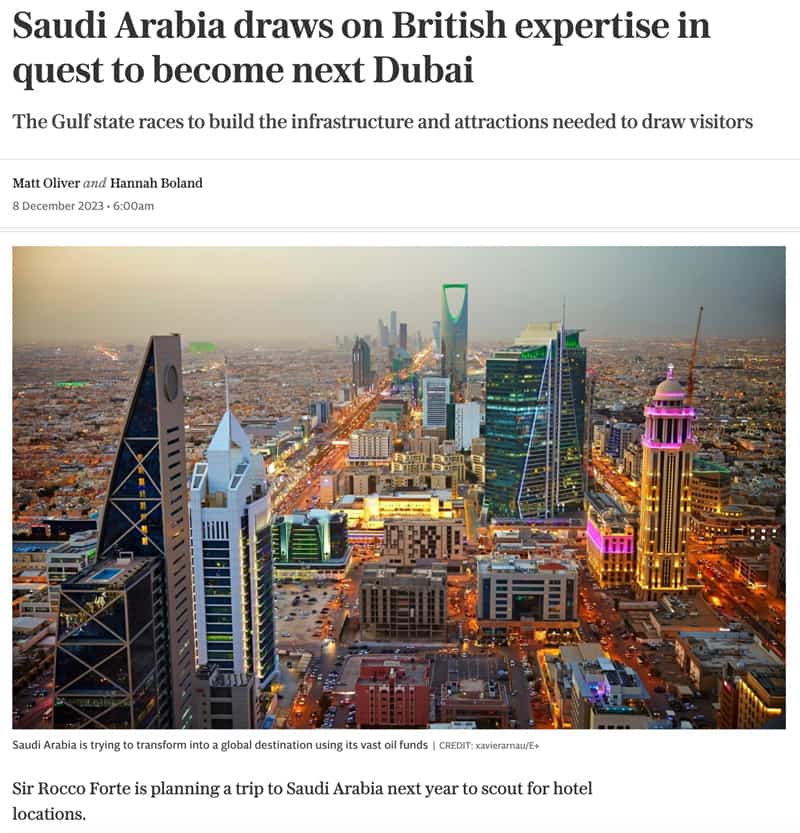

You can even visit nowadays. Tourist visas were finally introduced in 2019, and today, citizens of 49 countries can apply for an e-visa. Saudi Arabia's tourism industry is rapidly developing, and the liberalisation of social norms extends to visitors, too. Foreign men and women are now permitted to rent hotel rooms together without proof of being related.

As I wrote back in 2019, visiting Saudi Arabia was one of the best travel experiences I've had in my entire life. Friends equally came back from a recent visit with their mind blown and their perceptions changed. As the Ajeej Capital letter stated: "'I took my family on a 10-day trip to Saudi Arabia, and it was the trip of a lifetime.' A sentence I couldn't have imagined writing 3 years ago, yet alone 5 years ago."

Source: Daily Telegraph, 8 December 2023.

If, in the meantime, you'd like to fall down a rabbit hole and blow your mind with a seemingly never-ending set of amazing metrics about Saudi Arabia, take a peek at Morgan Stanley's seminal 127-page report "Saudi Arabia: Emerging at 'Giga'speed". Even though it was published in December 2022, it still stands out as one of the best source materials about the country's ongoing transformation.

Source: LinkedIn.

For more recent publications, download any of the following free reports:

- KTrade: "Saudi Arabia: The Vision Driving a Renaissance" (May 2023)

- Goldman Sachs: "Saudi Arabia Capex Super-Cycle: Diversifying, Decarbonizing, Digitalizing" (September 2023)

- MUFG: "Middle East 2024 outlook: Balancing geopolitical shocks with the region's global outlier status" (January 2024)

Unsurprisingly (or maybe surprisingly), Saudi Arabian equities also play an increasingly important role in these changes.

It's all driven by "Tadawul", which literally means Saudi stock exchange. Tadawul is currently gearing up to host the global investor community at a conference that is bound to generate more interest among both fund managers and the media.

Are Saudi stocks the next hype?

A country having a stock exchange is one thing (even Venezuela does).

A country having a stock exchange and turning it into a publicly listed company is quite another thing. It is often a sign that the country has reached a certain level of maturity and ambition.

For Saudi Arabia, that moment had come in 2021. After launching a set of restructuring measures in 2017, Tadawul, as both the company and the stock market are called, went public. The IPO seemed even more notable and consequential than the 2019 IPO of national oil company Saudi Aramco (ISIN SA14TG012N13, TADAWUL:2222), which had stirred up a lot of international media attention.

Formerly 100% owned by Saudi Arabia's sovereign wealth fund, Tadawul was opened up to public market investors in an effort to open up the country to foreign investment. It has already succeeded to a higher degree than you might think.

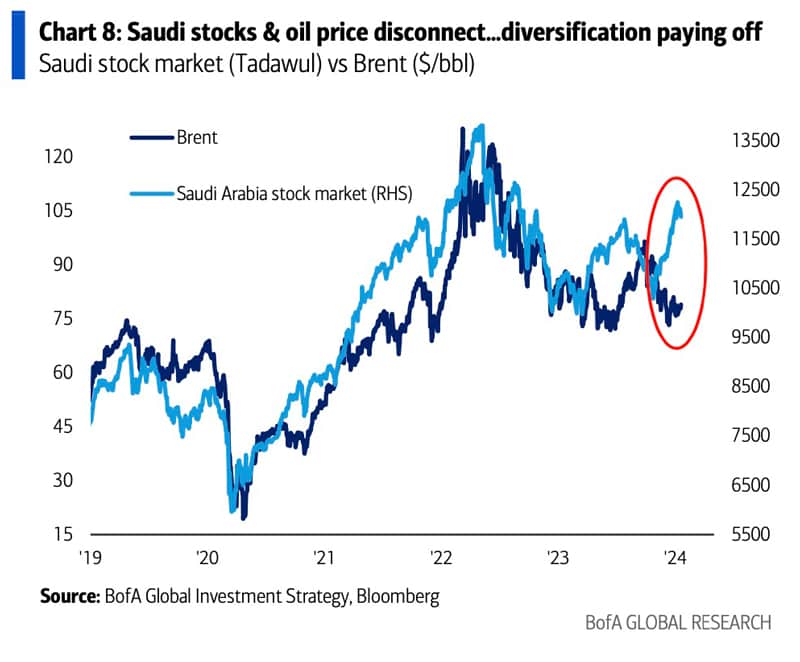

Notably, the performance of Saudi stocks recently started to disconnect from the oil price. Even though oil and Saudi Aramco still play a large role in Saudi Arabia, the underlying investment thesis is no longer just about the black gold.

Source: BofA, 6 November 2023.

Saudi Arabia has been discovered by equity investors, as this recent endorsement by a notable fund manager demonstrates:

"Fund manager Rajiv Jain takes $2.8bn bet on Middle Eastern stocks

Fund manager GQG has amassed a $2.8bn holding in companies in the Middle East and expects to raise this further, while it has cut its position in China to around half that level.

The Florida-based asset manager founded by Rajiv Jain, previously a star fund manager at Vontobel Asset Management, has built up the bet over the past 18 months, spurred on by the 'business friendly' approaches of governments in the region and their plans to diversify away from a reliance on oil.

'There are massive privatisation hopes which by definition will open up the economy,' said Jain, whose firm manages $105bn in assets and is well known for a large contrarian bet it took last year on Indian conglomerate Adani. 'There's a real intention to open up and transition away from oil.'

GQG’s new interest in the Middle East means its funds now have more money invested there than in China, the world's largest emerging market. That marks a major change of position from five years ago, when the world’s second-largest economy accounted for 40 per cent of the firm's emerging markets portfolio."

The metrics that illustrate these ongoing changes at the Saudi stock exchange are equally mind-boggling.

When I first looked at the exchange six years ago, Saudi Arabia was still rated as a so-called "stand-alone market", i.e. a stock market that was excluded from the MSCI international indices. In 2019, MSCI upgraded Saudi Arabia to its Emerging Markets Index, but the changes have taken a while to take hold. Even in 2022, 63% of all global emerging market funds owned zero Saudi stocks, which made them the biggest underweight of any major emerging market. These are remarkable figures, given that even at the time, Saudi Arabia was already the world's 20th largest economy, on par with Turkey.

Today, the country is the largest (!) constituent of the MSCI Emerging Markets EMEA Index, with a 32.7% weighting (ahead of South Africa's 24.15%, Qatar's 9.9%, and Poland's 7.6%). The exclusion of Russia from the index further accentuates these figures. Of the ten largest companies included in the index, five are from Saudi Arabia.

Based on the number of IPOs carried out recently or still in the pipeline, the country's index weighting could increase further. In 2023, Saudi Arabia's stock exchange saw 39 IPOs, double the number of 2022. According to the EY Global IPO Trends 2023 report, a further 27 Saudi companies have already announced their intention to float. To put this into perspective, the US – a country with ten times the population of Saudi Arabia – had 105 IPOs in 2023. It's also a multiple of the growth of the past era, when Tadawul had just 29 listings in the six-year period from 2015 to 2021. In absolute numbers, Saudi Arabia was the world's ninth most active IPO market in 2023.

Which begs the question, is it worth getting in on the act?

And if so, how?

The bad news first

If you are looking for bargain-priced stocks, Saudi Arabia is not going to be for you. Saudi stocks are already trading at a premium to the rest of the region, and they aren't cheap in absolute terms either. Anyone taking the effort to manually look through the exchange's 290 publicly listed companies will mostly find stocks with price/earnings ratios in the 20s, 30s.

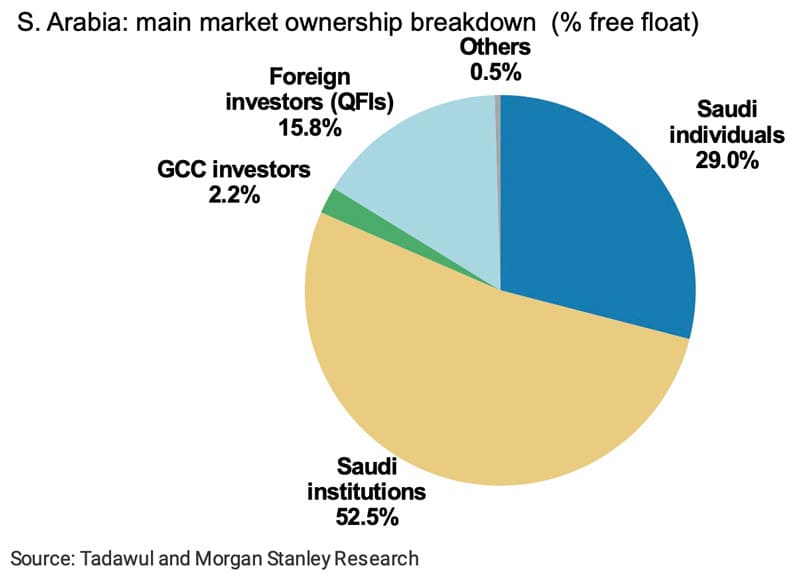

Local retail investors were among the first to discover Saudi stocks. Since 2020, the trading volume caused by local individual investors has exploded. According to Tadawul's 2022 statistics, individual investors make up 29% of Saudi equity free float. A significant portion of this group is retail investors. This influx of money has driven up valuations.

Source: Morgan Stanley, March 2022.

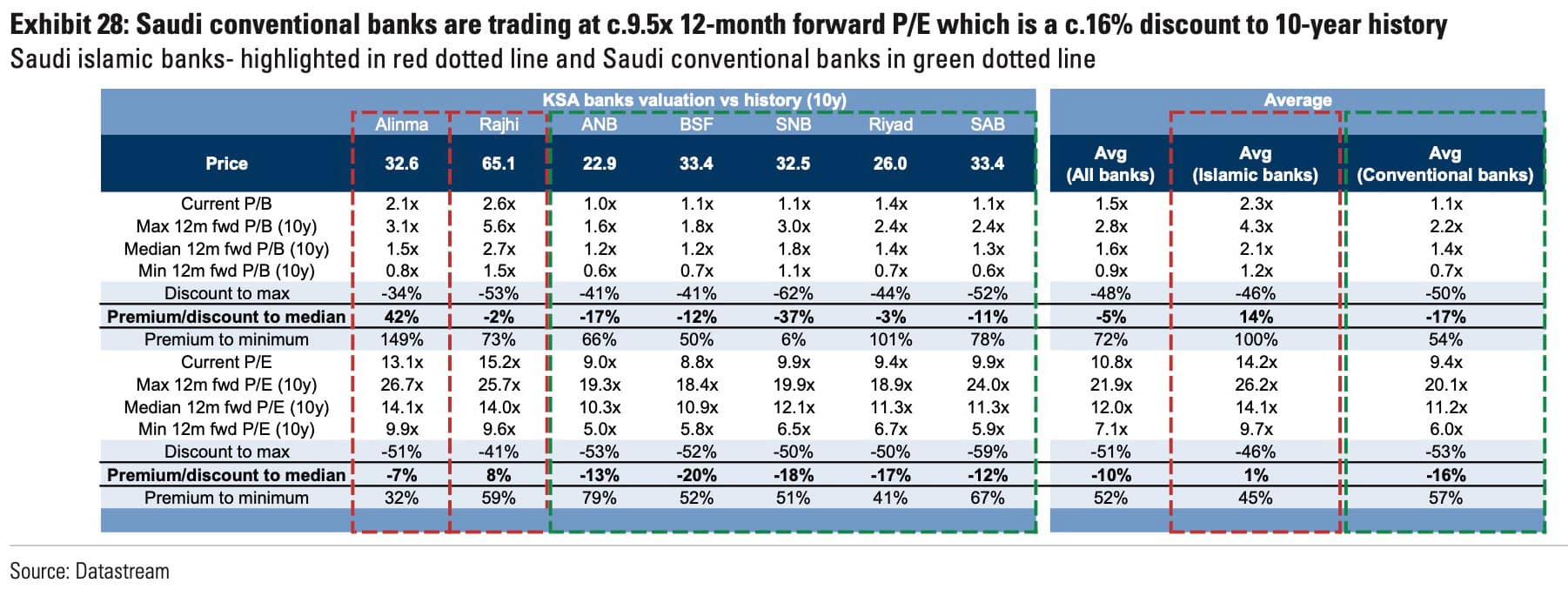

Case in point, the Saudi Arabian banking sector. Even though there is a 49% limit on foreign ownership and a cohort of Islamic banks with restricted business models, the sector trades at a forward price/earnings ratio of 9.5, which is high compared to most European banks (trading for half that multiple).

Source: Goldman Sachs "Financing the US$1 trillion project pipeline", 10 October 2023 (click on image to enlarge).

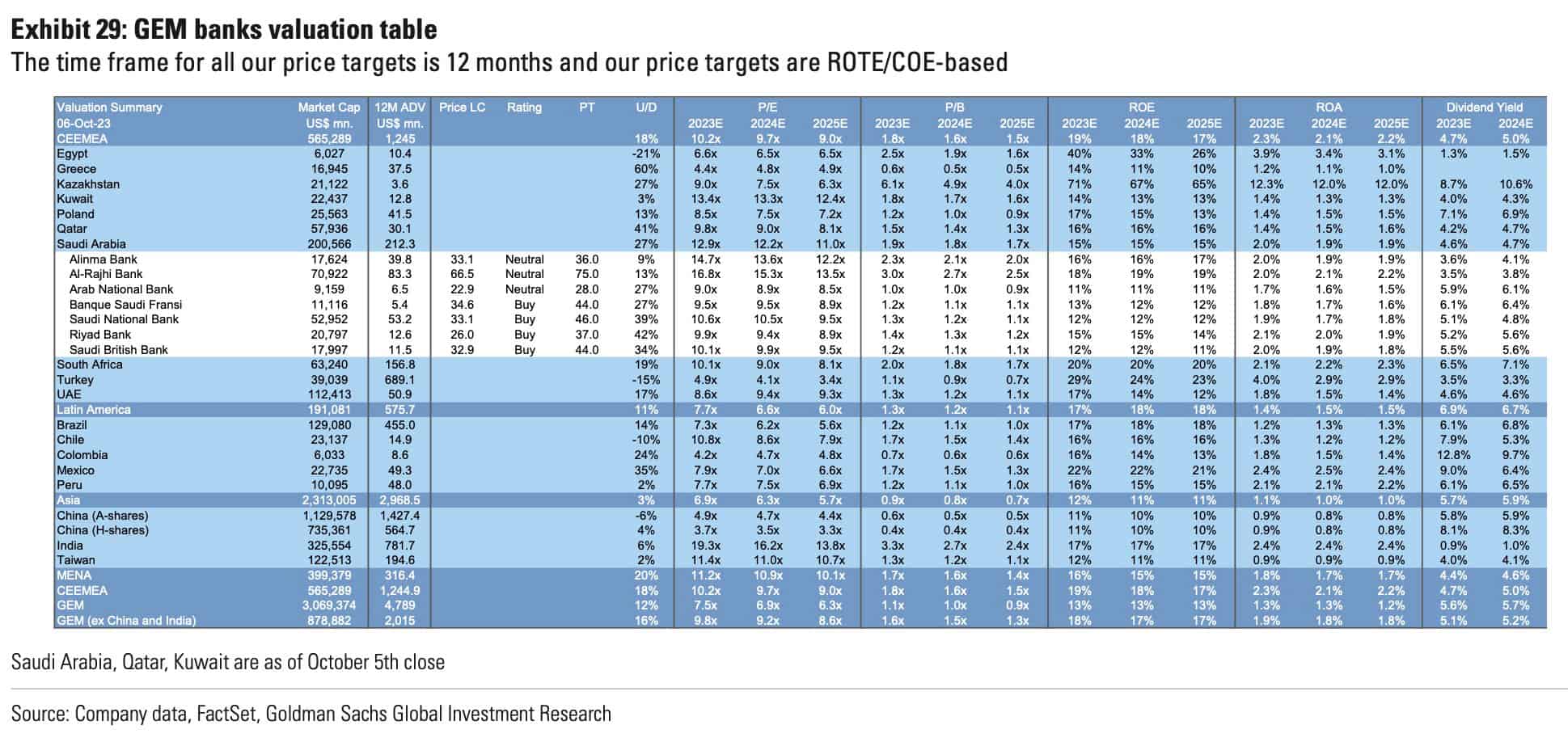

It's a premium also compared to other global emerging market banks, which tend to be valued at price/earnings ratios of 4-7.

Source: Goldman Sachs "Financing the US$1 trillion project pipeline", 10 October 2023 (click on image to enlarge).

Have Saudi stocks already run their course?

Rajiv Jain doesn't seem to think so, and he is probably keeping an eye on foreign capital flows.

Tadawul will benefit from index-driven money flows

Given the practical and legal hurdles that existed for foreign investors, the percentage of Saudi stocks owned by foreigners was less than 5% in 2017.

Of late, foreign ownership of the free float of Saudi Arabian stocks has increased to around 15%. Saudi Arabia aims to get this percentage to 17.5% before the end of 2025. (This particular metric is measured based on free float rather than overall market cap to eliminate the distracting noise caused by Saudi Aramco, which has a USD 2tr market cap but less than 2% free float.)

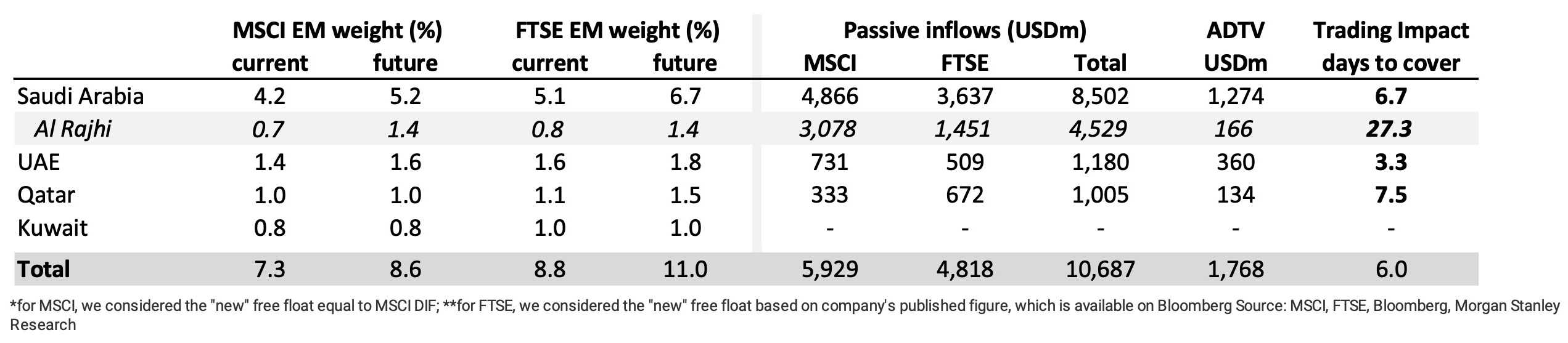

As Morgan Stanley figured out in a March 2022 analysis: "A full removal of foreign ownership limits in the Middle East would drive further passive in flows and higher benchmark weights, particularly for Saudi Arabia."

Source: Morgan Stanley "A new EEMA", March 2022 (click on image to enlarge).

The upcoming Saudi Capital Market Forum on 19-20 February 2024 could provide a significant boost. Saudi Arabia is actively inviting participants from around the world, and the event is likely to generate a fair bit of international media attention.

Will the likes of Goldman Sachs, Morgan Stanley or J.P. Morgan use the occasion to publish another set of seminal research reports that outline Saudi Arabia's progress? I'd bet on that.

The spider that sits at the centre of this entire web of developments is Saudi Tadawul Group Holding (ISIN SA15DHKGHBH4, TADAWUL:1111). The company that operates the Saudi Arabian stock exchange is bound to be a winner in more ways than one:

- More IPOs mean more trading volume, as does increasing foreign interest. Both the number of IPOs and foreign interest will also benefit from a new class of domestic entrepreneurs that is emerging in Saudi Arabia. To cater to smaller firms, Tadawul has already launched NOMU, a less regulated growth equity segment.

- Tadawul is bound to add additional services and products, such as high-margin information products. In January 2024, the company launched its own index, whose data it can sell to investors, database operators, and the media.

- Tadawul aims to have foreign companies list in Saudi Arabia as a way for them to tap into the country's enormous fundraising potential. This could become a two-way street: in September 2023, Hong Kong Exchanges & Clearing (ISIN HK0388045442, HK:0388) granted Tadawul the status of Recognised Stock Exchange, which makes it possible to dual-list Saudi companies in Hong Kong.

- Tadawul might just act as a consolidator of smaller bourses in the region, similar to Deutsche Börse (ISIN DE0005810055, DE:DB!) in Europe and Intercontinental Exchange (ISIN US45866F1049, NYSE:ICE) in the US. Just a few days ago, Tadawul acquired a strategic stake in the Dubai Mercantile Exchange, aimed at creating the Gulf Mercantile Exchange.

Source: Gulf Business, 19 January 2024.

Tadawul includes four subsidiary companies – the exchange itself, a securities depository center (Edaa), a securities clearing center (Muqassa), and a technology services company (Wamid). With an underlying market cap of around USD 2.5tr, Tadawul is not just the largest exchange of the region, but one of the ten largest exchanges in the world. Its management, and the country's ruler, aim to get the Saudi stock exchange into the top five by 2030.

Buying the stock of a stock exchange is a good way to capture the kind of macro tailwind that is driving a country like Saudi Arabia.

Tadawul is probably one of the smartest ways to play the Saudi stock market, and its chart looks like the stock could be about to reach higher territory altogether. However, it does require you to believe that massive economic growth, Saudi Arabia's abundant capital, and growing international interest will continue to drive this exchange yet higher. It's not a cheap stock, either. Based on 2024 earnings estimates, it is currently trading at a price/earnings ratio of around 60.

Source: Arqaam Capital, 23 January 2024.

It wouldn't be the first time for the Saudi stock market to move higher than you'd expect based on valuation metrics. Back in the mid-2000s, the market already experienced an incredible run-up driven by excess liquidity. When the oil price increased from USD 20 in 2003 to USD 135 in 2008, the Saudi stock market index exploded from 3,000 to 20,000. The subsequent 68% crash gave it the #8 spot in the annals of the ten worst crashes of all time, but it did for a time rally like there was no tomorrow.

Source: BofA, 6 November 2023.

How far will current trends take the market?

It's a question that I would have loved to research in more detail on the ground, but recently decided otherwise (for now).

How to benefit from Saudi Arabia – without actually going there

Like myself, Undervalued-Shares.com readers love learning about the world, which includes taking excursions to some of the lesser followed markets such as Turkey and Hungary.

For spring 2024, I had Saudi Arabia on my list as the #1 candidate for another investor trip.

Alas, I decided to hold off for now. Saudi Arabia is still difficult to access for most investors. Unless you reside in the region or are wealthy enough to hold an account with the likes of Goldman Sachs or Morgan Stanley, you'll find it nigh on impossible to trade any of the country's stocks.

Even though I closely follow developments in Saudi Arabia, I have not yet been able to find out when stocks traded on Tadawul will become more easily accessible. As a result, I have now chosen another country for our first reader trip of 2024 (watch this space!).

When it comes to benefitting from what is happening in Saudi Arabia I have concluded that – at least for now – it's best to play this market indirectly.

There are many non-Saudi, global companies that stand to benefit from the country's developments:

- South Korean contractors are heavily involved in construction, with several listed on a stock market.

- French luxury goods companies will have another fast-growing market to speak to.

- Ferrari (ISIN NL0011585146, NYSE:RACE) and Aston Martin Lagonda (ISIN GB00BN7CG237, UK:AML) will benefit from Saudi Arabia's improved infrastructure and long, open roads – ideal for taking a sports car out for a spin! Saudi Arabia's sovereign wealth fund is one of Aston Martin's largest shareholders.

- Certain Hong Kong banks have positioned themselves to benefit from growing Chinese co-financing of Saudi projects.

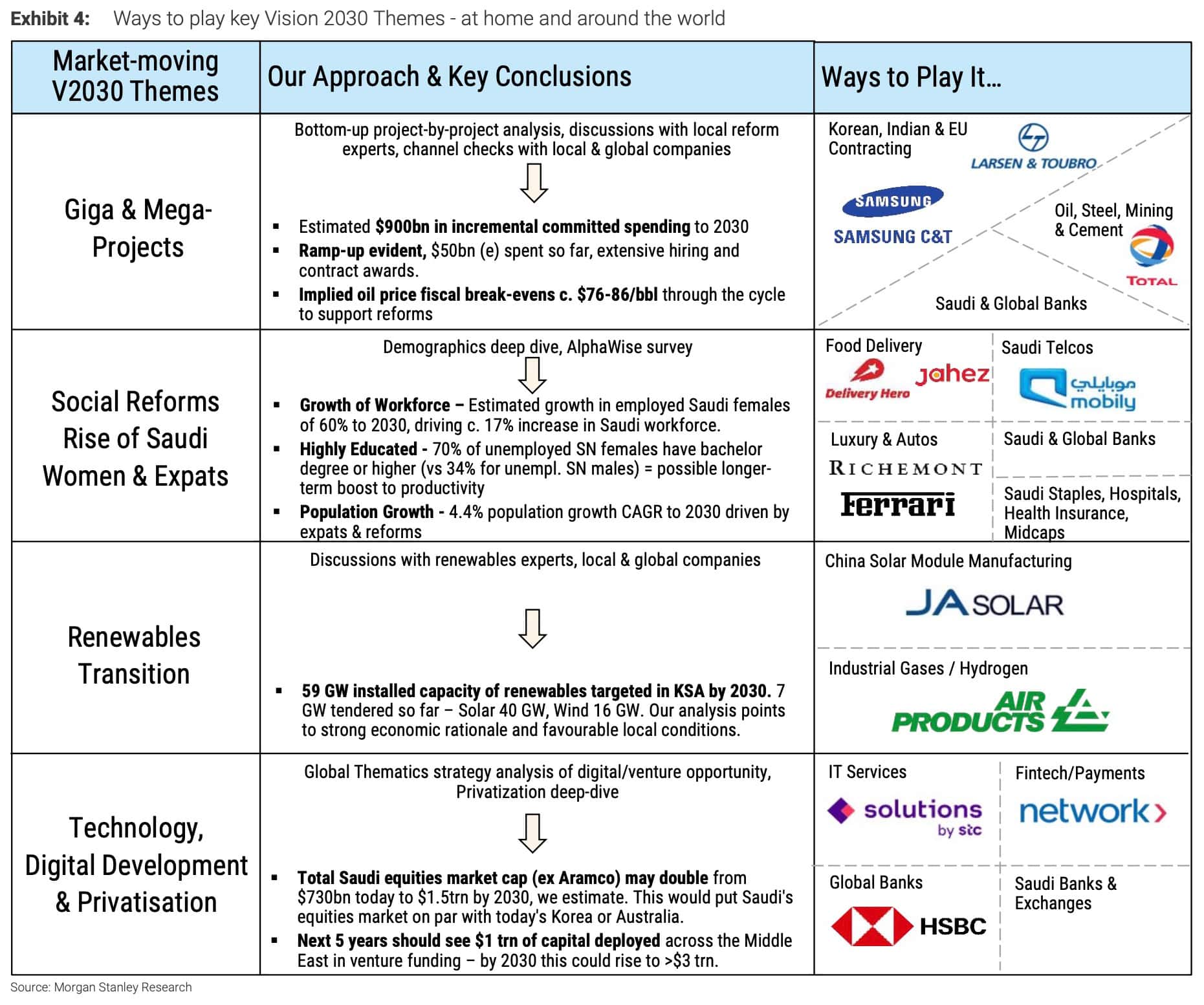

Morgan Stanley created the following list of publicly listed companies that it believes are specifically going to benefit from the money that is being pumped into Saudi's Vision 2030.

Source: Morgan Stanley, "Saudi Arabia: Emerging at 'Giga'speed" (December 2022) (click on image to enlarge).

Barron's also recently published "Inside Saudi Arabia's $3 Trillion Plan to Move Past Oil", an extensive feature that tries to answer the question of "how investors can ride along" by providing a list of names of multinationals that will expand in the country.

There are many ways – and reasons – to consider investing in Saudi Arabia. The West's misguided energy and ESG policies have artificially constrained investment in the fossil fuel sector, which has led to higher energy prices in many Western countries (especially Europe). The result is one of the largest transfers of wealth in the history of mankind, benefitting primarily oil- and gas-rich countries such as Saudi Arabia. If you are feeling the pinch financially because of the broader effects of higher energy prices, adding a dose of Saudi might just be the right hedge for you.

In the crosshairs of private equity

What do you call a publicly listed company where ALL large shareholders agree that the company should be sold?

A prime takeover target.

My latest research report features one such target from the British Isles.

It is the market leader in its region, with a strong balance sheet and a valuable brand name.

A bid for this company will likely have to be at least 50-75% above the current share price.

In the crosshairs of private equity

What do you call a publicly listed company where ALL large shareholders agree that the company should be sold?

A prime takeover target.

My latest research report features one such target from the British Isles.

It is the market leader in its region, with a strong balance sheet and a valuable brand name.

A bid for this company will likely have to be at least 50-75% above the current share price.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: