Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Yoma Strategic – betting on peace in Myanmar

Myanmar is a world-famous tourist destination, but its internal conflict has also made it one of the world's "forgotten wars".

Of late, rebels have reportedly been gaining ground on the military junta.

Yoma Strategic Holdings is an easy play on Myanmar. Its stock is listed on the Singapore Stock Exchange and reasonably liquid.

It has doubled over the past two months but remains way off its pre-war high.

Yoma Strategic Holdings.

A quick primer on Myanmar

More mature readers will remember Myanmar as Burma, and for its seemingly never-ending military rule.

Formerly a British colony, what was then Burma gained independence in 1947. A coup d'état in 1962 brought it under military rule, which has continued in some shape or form until today.

With a population of 55m people and the largest landmass of any country in mainland Southeast Asia, Myanmar could be of note both economically and politically. The country has long suffered from a plethora of issues, though, including being made up of a myriad of ethnic groups. Economically, it barely moves the region's needle.

Even though Myanmar switched to a multi-party system in 1988, the military initially didn't cede its power and only paid lip service to democracy. This seemed to change at long last in 2010, when the military allowed general elections to take place. In 2011, the military junta was officially dissolved. Over the following decade, the world-famous human rights campaigner Aung San Suu Kyi was released from 15 years of prison, and Myanmar's international relations improved. However, in 2020, the military seized power again, not accepting the result of another general election. Some claim that the military always remained a government on top of the government.

It seems that after three generations of military rule and at a time when the population can easily follow the rest of the world using the Internet, the populace finally had enough. Following the latest military coup, rebel groups formed in various parts of the country to take on the junta with military means. Myanmar descended into civil war.

Economically, this was a disaster. Myanmar's economy had never made the kind of progress that other countries in the region had achieved. Following decades of cronyism under military rule, Myanmar already had one of the widest income gaps in the world, and it lagged in overall development. After a brief burst of economic progress during the 2010s, the civil war made matters worse again.

Statistics about the economy nowadays come from two different sources – the military junta and the shadow government comprised of opposition members. Naturally, their respective numbers usually don't match. The overall trend is clear, though. In 2021, Myanmar's economy shrank by about 20%. The national currency, the kyat, has plunged about 70% since 2021.

In a sign of how bad things are, the military recently arrested dozens of money changers and gold shop owners as well as real estate promoters who offered property investments in Thailand. Their activities were seen as further destabilising the country's currency. The official exchange rate of the kyat to the US dollar is 2,100, but the blackmarket price is 4,500.

As an outsider, it is difficult to get your head around Myanmar's situation. Not only is Myanmar a large, complex country, but information is scarce and most of it that does make it to the outside world will have been influenced by the interests of the warring factions.

What's easier to assess, though, is a depressed stock trading at a fraction of its former valuation.

A leading Myanmarese conglomerate

Yoma Strategic Holdings (ISIN SG1T74931364, SG:Z59) has been listed in its current form in Singapore since 2006. With a market cap of around USD 145m, it is reasonably accessible for private investors.

Yoma is one of Myanmar's leading conglomerates, with activities in real estate, mobile financial services, leasing, food and beverages, automotive and heavy equipment.

In a country where cronyism and corruption has been rife, it's worth nothing what Yoma is NOT. The company isn't state-controlled, and its major shareholder is reportedly not a part of the military junta. In fact, Serge Pun is widely seen as a "good guy".

A Burmese-Chinese national who left the country for China three years after the initial military coup of 1962, Pun moved to Hong Kong in 1973 where he built his business interests. Now 71 years old, he is based out of Singapore. During better times, his 28.1% stake in Yoma gave him a net worth of USD 500m and a place on Singapore's Rich List.

Photo: Serge and Melvyn Pun, father/Chairman and son/CEO team.

Pun's wealth got crushed during the past few years, at least as far as his visible stake in Yoma is concerned. Yoma's stock price was trading as high as SGD 1 in 2013 when Myanmar was riding a wave of investor interest. In April 2024, it was trading for less than SGD 0.04.

The price has since soared to as high as SGD 0.10, with heavy trading accompanying the rise. It was trading at SGD 0.087 when this Weekly Dispatch got published.

Yoma Strategic Holdings.

Over the past months, headlines about a potential political turn in Myanmar have created an interesting picture:

Rebels take key Myanmar city after government troops lay down weapons

Sky News, 5 January 2024

Myanmar's junta loses key base to rebel forces

Financial Times, 4 April 2024

Could Myanmar's Rebels Actually Win? (video)

TLDR News Global, 5 June 2024

This comes combined with a seemingly significant undervaluation of Yoma's stock, which has a book value of over SGD 0.22 (USD 0.16), i.e. it was trading at 0.19x book value before the surge and even now trades at 0.45x book value.

How has Yoma fared during the years of conflict?

Turning crisis into opportunity

The double whammy of the pandemic and the coup made Yoma's management put extra effort into strengthening its balance sheet.

Between September 2021 and March 2024, the company reduced net debt from USD 326m to now just USD 36m. It sold properties, shrunk the food and beverage operation, reduced headcount, and sold some non-core investments.

Every crisis brings some opportunity. Even in civil-war countries, life has to go on, and buying property is seen by many as a way to protect their savings against the consequences of war. With inflation running at 20% p.a. (even based on official figures) and the currency's value in freefall, there is demand for investing in hard assets. Of late, Yoma focused more strongly on developing real estate, where it shifted its strategy to building more affordable housing, and built a brand name for project quality and completion. Buyers need to come up with a reasonable 20-30% equity and Yoma helps with arranging mortgages. Last year, real estate generated two-thirds of the group's revenue.

Yoma-built housing (source: Yoma annual report 2023).

Yoma's second most important business line are electronic money transfers. In a country where four out of five people don't have a bank account, carrying out transfers through mobile phones and apps is a vital service for the population as well as a continuously growing market. Yoma's "Wave Money" has an incredible 80% market share in Myanmar for so-called over-the-counter money transfers, and it has built a network of 50,000 agents across the country. The company earns a commission from the transfer and interest income from the digital wallet float. The disruption of the Internet during the civil war and additional regulation by the government had caused short-term problems for this operation. However, in a scenario where Myanmar goes back to some kind of growth, controlling such a digital platform could prove an incredible money-spinner for Yoma. The company used the crisis to buy out another shareholder, and it now has a 65% stake in Wave Money. Speak of using a crisis to shape your future opportunities.

The digital money transfer business contributes about 18% of group revenue. Real estate and money transfers make up about 85% of the company's revenue, meaning all the other business divisions are currently also-rans.

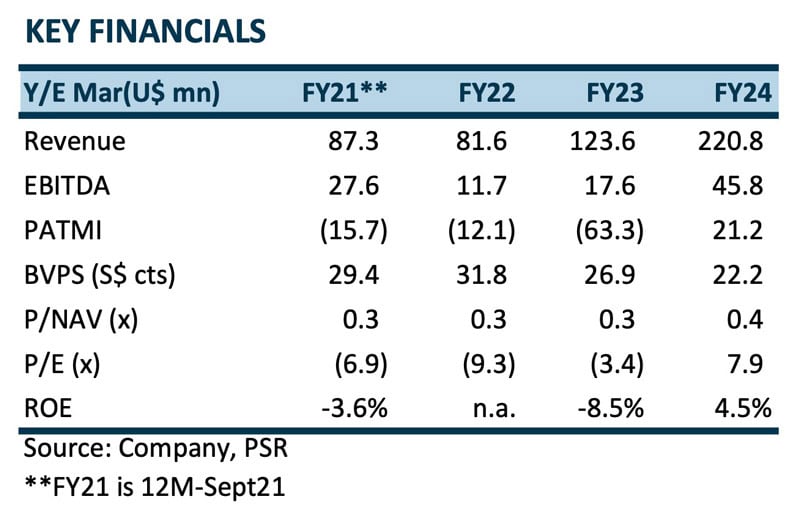

For its fiscal year 2023/24, Yoma recently reported 80% revenue growth to USD 221m and EBITDA jumping 160% to USD 46m. More details are spelled out in the company's latest investor presentation.

PhillipCapital in Singapore covers the stock with research, and issued its most recent report on 3 June 2024 containing the following estimates.

Source: PhillipCapital, 3 June 2024 (share price then: SGD 0.085).

Still a buy?

When wars end, there is usually a rush of money flooding in to benefit from a country's recovery.

Myanmar's military and political situation is difficult to judge. Investors who believe that better times may lay ahead for the country should look towards Yoma. The company comes with a listing in Singapore, a good track record in governance, a highly credible major shareholder, and interesting valuation metrics. On the other hand, wars tend to drag on for longer than anyone thinks. Myanmar also has some major other issues, e.g. the country recently became the world's #1 producer of opium poppy (taking over from Afghanistan after the Taliban closed down the trade), and it has become a global centre for cyber scams (Nigeria, watch out!). How do you weigh such factors to form an opinion and make a decision?

I used my global reader network to reach out to someone with a better understanding of the situation on the ground: Thomas Hugger, CEO of Asia Frontier Capital (AFC) in Hong Kong. AFC manages an Iraq Fund that I pointed out in my 11 June 2021 Weekly Dispatch "How to invest in frontier countries (part 3): Iraq". The fund gained 110.4% in 2023 based in US dollars and it's up further since. Could Myanmar provide a similar ground-floor opportunity that you need to get in on when others are still too scared?

I emailed Thomas for his current assessment of Yoma and investing in Myanmar:

"With residents and investors in Myanmar looking for hard assets due to the devaluation of the Myanmar kyat and high inflation, Yoma's key real estate business should continue doing well in the near term due to its upcoming projects and large land bank.

The ground situation in Myanmar remains very fluid at this point in time and therefore it is very difficult to predict in which direction the political situation and the country will move but we believe that a change is 'around the corner' and will be most likely positive for the general population, country, economy and especially Yoma. We have seen that with assets like Yoma which have been trading at extremely discounted valuations and still trade at rock bottom valuations, any long-term incremental positives in Myanmar will benefit Yoma since it has exposure to key areas of the economy like real estate, consumption and financial services. Bear also in mind that Yoma is one of the top quality conglomerates in Myanmar and currently the only way to get exposure to Myanmar for foreign investors through a listed and non-sanctioned entity. Hence, for investors who can adapt to some amount of volatility, the Yoma stock could offer a multi-bagger."

It's easy to see why there would always be a degree of speculative interest in a company like Yoma. Myanmar is a country that has long attracted Western tourists because of its world-famous pagodas. Millions of visitors guarantee that there will always be a fair amount of curiosity about stocks that give you exposure to the country.

Besides, Yoma stock is arguably rather cheap. While companies trading at less than 50% of book value can also be found in other parts of the world (especially Europe), Myanmar is a country with large potential to eventually catch up with its Asian counterparts. It may, in effect, offer a similar ground-floor opportunity as Vietnam in the early 2000s. If Yoma managed to combine good stewardship of capital with the benefits of growing local incomes, the company could be in for a very long growth spurt – and its stock would eventually see multiple expansion.

Some investors might of course prefer to cover such an opportunity through a fund, such as the AFC Asia Frontier Fund offered by AFC. It is the only long-only fund globally which offers investors access to listed equities in Asian frontier countries. The fund is currently invested in 14 different Asian frontier countries, such as Bangladesh, Iraq, Kazakhstan, Mongolia, Pakistan, Sri Lanka, Uzbekistan, and Vietnam. It returned +27.1% in 2023 in USD terms, and year to date as of 31 May 2024 it is up around +10% in USD terms. The AFC Asia Frontier Fund currently trades at a p/e ratio of 7.2x.

There are many "dark", undercovered corners in the world…

Another one is the Falkland Islands, which few investors have on their radar – but which is likely going to see a resurgence of public interest.

The Falklands are British-affiliated territory, and one where British oil exploration companies have long had a presence.

If a "Falkland Islands Oil Boom 2.0" were to happen, this Falkland-focused firm looks worth investing in the short term.

There are many "dark", undercovered corners in the world…

Another one is the Falkland Islands, which few investors have on their radar – but which is likely going to see a resurgence of public interest.

The Falklands are British-affiliated territory, and one where British oil exploration companies have long had a presence.

If a "Falkland Islands Oil Boom 2.0" were to happen, this Falkland-focused firm looks worth investing in the short term.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: