Oil made from olives is one of the world's oldest commodities.

Of late, it has made headlines for its surging value.

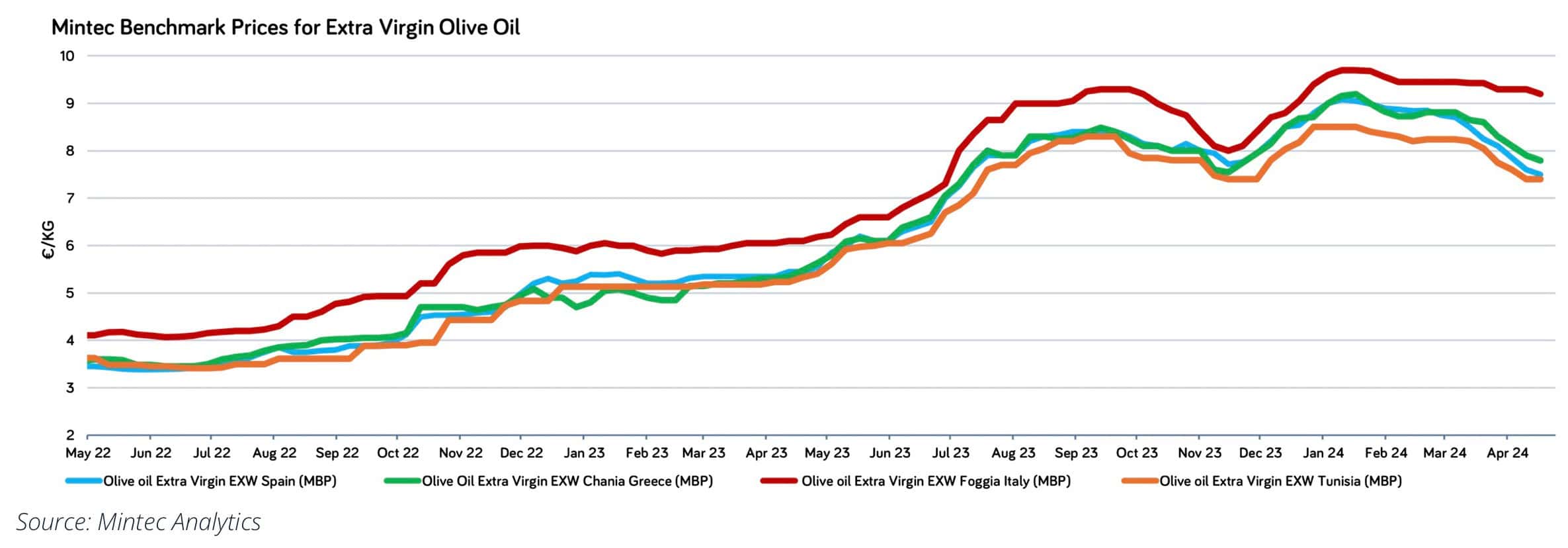

A kilogram of Spanish olive oil cost EUR 2 as recently as 2020, but as much as EUR 9.20 in early 2024. It's now around EUR 7.70 (see chart below).

Insufficient supplies of olive oil have led to skyrocketing prices in supermarkets, and the world could be facing an ongoing shortage.

Is there a way for private investors to make money out of this situation?

Source: Mintec Global (click on image to enlarge).

A beloved, niche-y product

Wild olives originated in what is Turkey today, with humans cultivating them for at least 6,000 years. Historically, olives were used for religious rituals, medicines, fuel in oil lamps, soap-making, and skincare application – and, of course, as a key ingredient of the famous Mediterranean diet.

Hippocrates called olives "the great healer", and Homer "liquid gold". They've played an important role in human history, and continue to be widely loved by gourmets.

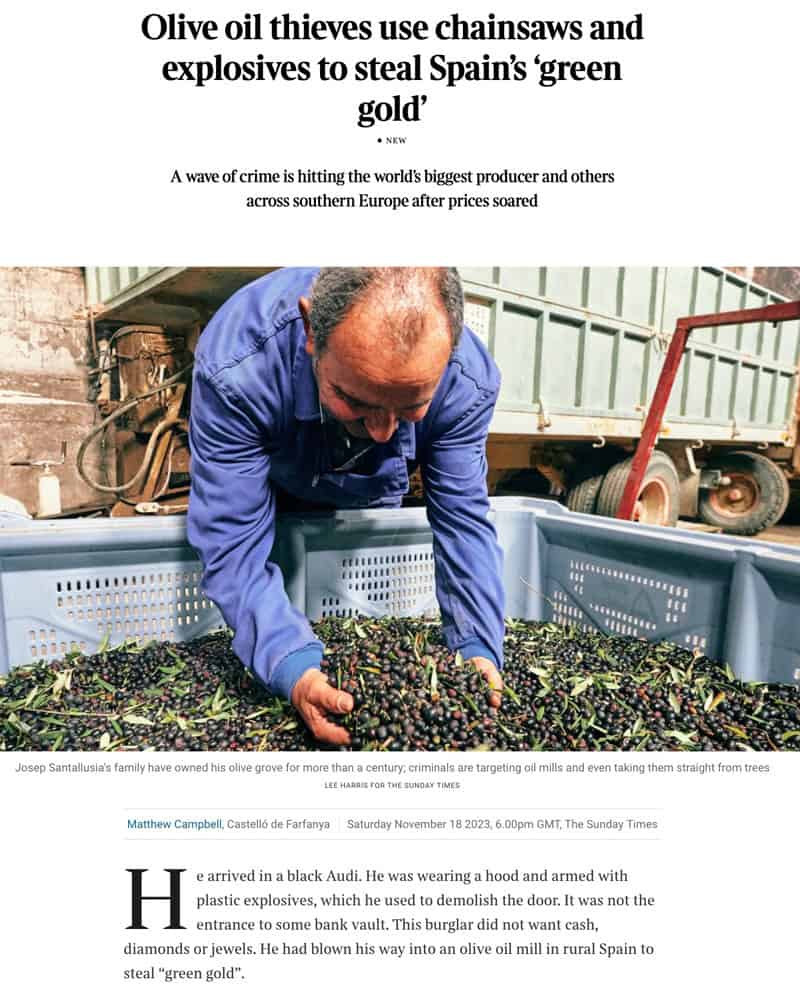

Between early 2020 and early 2024, the price of olive oil quadrupled. Spanish consumers had long been accustomed to paying less than EUR 5 for a litre bottle of high-quality, local extra virgin oil. When it suddenly cost EUR 15, gangs started to create a lucrative black market trade involving stolen bottles – and turned olives into the most stolen item in Spanish supermarkets in 2023.

Even the plant itself became a target of criminal gangs, when thieves started to move into olive oil groves to shake down olives at night. Branches were sawed off or entire trees felled. Some olive farmers resorted to hiring night guards for their properties.

Why the crazy rush?

40% of the world's olives are grown in Spain. To produce the juiciest olives, you need a year with moderate temperatures and a modest amount of regular rainfall. When Spain got hit by a two-year drought and a heatwave, the country's production came out way short.

Portugal and Greece, Europe's two other main producers of the fruit, also suffered adverse weather conditions. In addition, parts of Italy struggled with "Xylella fastidiosa", a bacterium that is also called olive leprosy or olive ebola. It's native to the Americas but made its way to Europe in 2013 and has since proven a costly pest.

Throw in rising costs for energy and labour, and it's been the perfect storm for the olive oil market.

Even though it has made lots of headlines, hardly anyone has ever asked if there are publicly listed companies that give you exposure to this market.

Source: The Times, 18 November 2023.

The top producers

Olive oil is a tiny market, barely worth USD 15bn worldwide. Compared to other oils used in cooking and food production, olive oil is a niche product, albeit a premium one.

It doesn't feature high on the list of equity investors because much of the world's olive oil production is in the hands of:

- Family-owned small businesses.

- Large corporations where it contributes a tiny percentage to the overall business, and which are often privately held anyway.

- Farming cooperatives.

Large publicly listed companies comprise Conagra Brands (ISIN US2058871029, NYSE:CAG) and Fresh Del Monte (ISIN KYG367381053, NYSE:FDP) while privately-held American companies among the world's top olive oil producers include Cargill, Pompeian, and California Olive Ranch. Italy's Salov S.p.A. was taken over by a Chinese state-owned group, Bright Food, a decade ago. Portugal's Sovena Group is family-owned. India's Modi Naturals (ISIN INE537F01012, BOM:519003) is publicly listed and has an informative investor relations website, but the company is also very engaged in other edible oils such as rice bran and biofuels. Besides, most investors find it difficult to trade stocks listed in India.

One publicly listed company that could be mistaken for being in the olive oil industry is Spain's Borges Agricultural & Industrial Nuts (ISIN ES0105271011, BME:BAIN), but it is merely the sister company of a large olive oil producer, Borges Edible Oils. Both companies belong to Borges International Group, a family-owned business.

Acesur and Migasa, both based in Spain, are 100% family-owned. Dcoop, a Spanish agricultural cooperative that produces lot of olive oil but also wine, is owned by its members.

Among the world's largest olive oil producers, this only leaves Spain's Deoleo (ISIN ES0110047919, BME:OLE), which is majority-owned by CVC. The private equity company bought an initial 29.99% stake in 2014, when Deoleo produced one-fifth of the world's bottled olive oil but suffered from a mountain of debt stemming from acquisitions in the 2000s. The purchase was highly contentious because Spain viewed Deoleo as a strategic national asset. The initial stake cost CVC EUR 0.38 per share, and the stock has since gone nowhere. Now trading at EUR 0.21, Deoleo has a market cap of just EUR 110m. CVC had to up its investment further because of ongoing funding needs, and currently owns 57%.

Source: Just Food, 6 June 2023.

You'd think that a highly fragmented market involving a commodity that is both a staple item and a premium product should get a private equity house excited to start an industry roll-up. However, CVC seems to have had enough. In June 2023, El Economista reported that CVC had hired Lazard to assist with the sale of its stake. Parties reportedly interested in a purchase include Acesur, Dcoop, and Borges (Acesur already got a foot in the door by acquiring 5% of Deoleo in 2020). In September 2023, however, CVC decided to pause the sales process because the sharp rise of the olive oil price put buyers off. Deoleo will probably be back on the market before too long. Given that Acesur didn't use the open market to up its stake further, it's doubtful the stock is much of a bargain right now. Quite probably, taking the time to delve deeper into Deoleo would prove a waste of time.

Olive oil, a market where public market investors have no viable, attractive option?

One little-known stock from Australia might yet change that.

A new player from down under

Much as Spain, Italy, and Greece are thought of as the world's leading olive oil destinations, there is the New World to consider, too.

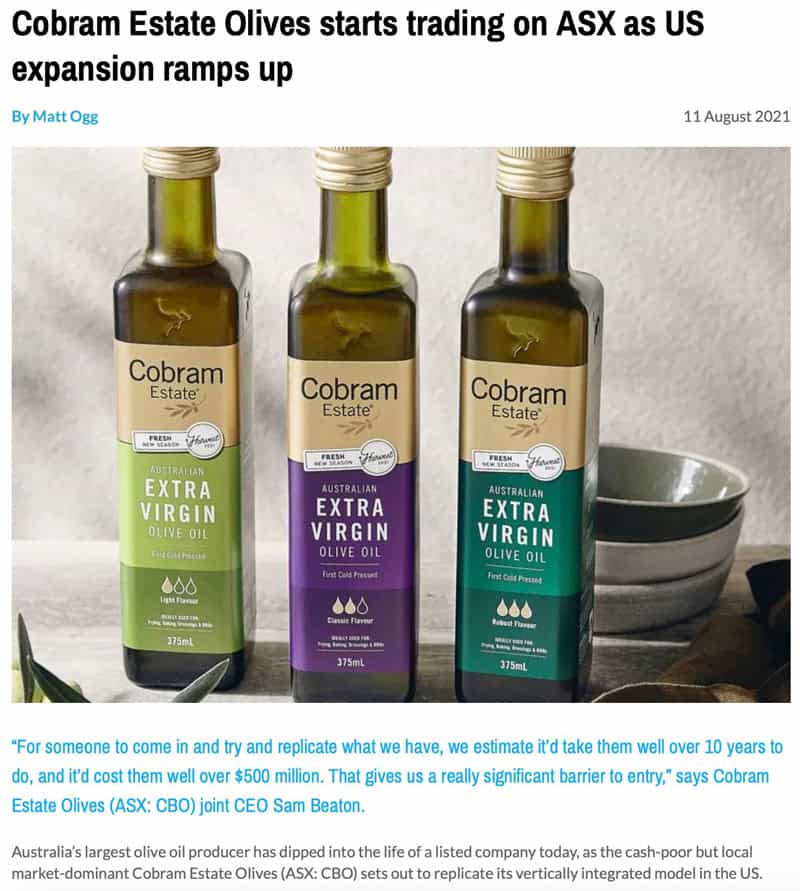

Australia's stock exchange comprises Cobram Estate Olives (ISIN AU0000167066, AU:CBO), a company specialised in nothing but olive oil and as such a "pure play". In Australia, it has a 35% market share in olive oil sold by supermarkets and reins as the undisputed #1 domestic player.

Cobram Estate Olives has also started to expand internationally. Over the last nine years, the company has built its US division into the ninth-largest olive oil brand of the US and the #2 among Californian olive oil brands. Cobram Estate Olives.

In 2023, it reached group sales of AUD 216.3m, up 50.8% compared to the previous year thanks to a combination of growing production and (primarily) higher prices.

Interestingly, despite what has happened in the olive oil market, the stock isn't up much. When it first started trading in 2021, it opened at AUD 1.87. It subsequently fell as low as AUD 1.09, and is now back at AUD 1.80.

Cobram Estate Olives.

Cobram Estate Olives is the rare case of a company going for a "silent" listing. It had planned to raise additional capital through an IPO, but pulled the plan at the last minute and instead listed its existing shares on a recognised stock exchange. Cobram Estate Olives went from from an unlisted public company with 705 shareholders to a company that is easy to trade via a public market, but which never benefited from the conventional media hype that comes with a public placement. Nearly 200 of the company's shareholders at the time of listing were employees who had been given free shares.

Such a quiet listing usually comes with an initial lack of attention and interest. As a result, Cobram Estate Olives hasn't attracted much third-party reporting online.

What is excellent, though, is the company's reporting to investors. Its presentations for shareholders are extremely informative, and it tries to educate investors what's required to make this business grow. Olives are an alternate bearing species and typically have a year of heavy fruit production followed by a year of lighter production. Who knew?

In 2023, Cobram Estate Olives achieved AUD 54.1m cash flow from operations, up 60% and compared to a current market of AUD 747m (based on 415m outstanding shares). Given the sharp fluctuations of the olive oil price, it's difficult to make a call whether the company is cheap, or not. A few interesting factors do stick out, though:

-

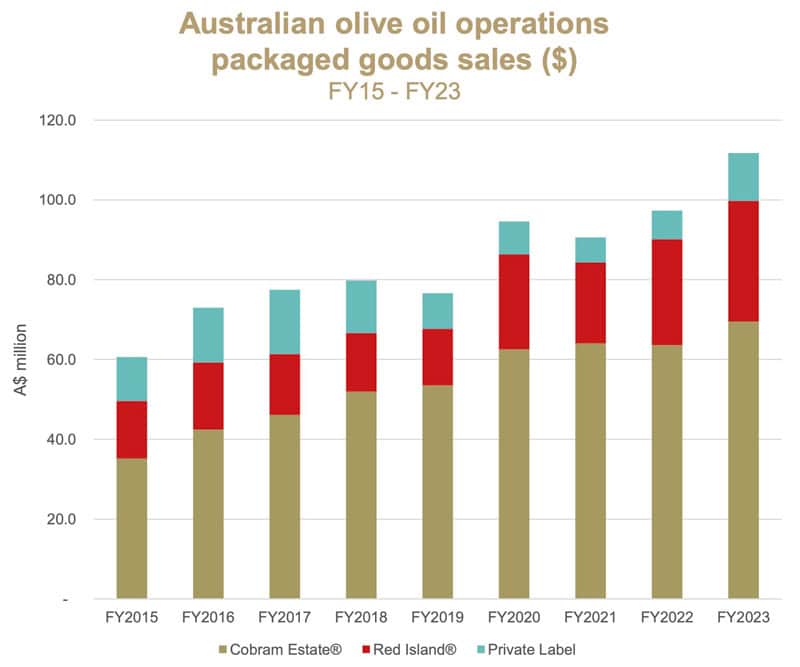

- Between 2015 and 2023, Cobram Estate Olives achieved 14.9% p.a. sales growth in its Australian division.

Source: Cobram Estate Olives.

- Even though it was only set up in 1998, its group production is now bigger than that of countries such as the US, France, and Israel.

- At last count, only 61% of its Australian groves were mature. A further 28% were immature, and 11% not yet productive. Over the coming decade, the company will experience significant growth in production purely through its trees reaching maturity.

- The company's expansion to the US seems very successful. It has now started to buy into Argentina, which could turn out a great move, too.

A little-known twist to the story is that olive oil could be a major long-term growth market. In Spain, Italy, and Greece, consumers guzzle down an incredible ten litres of olive oil per year. In the UK and the US, per capita consumption is currently just 1 litre per year.

In a world where healthy food options are a growing market, the oil that forms a major part of the "Mediterranean diet" should see significant long-term growth in per capita consumption in those countries that can afford it. Case in point, Cobram Estate Olives' home market. In Australia, per capita consumption has doubled to two litres per head over the last decade, probably in part driven by one company's successful marketing.

The US currently imports over 90% of its olive oil, and the management of Cobram Estate Olives sees an opportunity to pull off in the US what it has already achieved in Australia.

There are also some negative signs, though. The two co-CEOs recently sold millions worth of stock, reportedly because of rising interest rates on their debt-financed stakes. Still, in a world where there is growing awareness that "food is medicine", it could be worth keeping an eye on this niche, untransparent sector.

The stock of Cobram Estate Olives could be:

- An interesting hedge against food inflation.

- A bet on alternative forms of healthcare in the spirit of Hippocrates, or

- A well-managed long-term compounder based around hard assets and in a country with secure property rights.

What Cobram Estate Olives has built would take other investors at least a decade to replicate – or more, given how slow olive trees grow!

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Undervalued liquidation case

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report for Lifetime Members.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: