Britain offers many unloved, undervalued stocks. Opportunities come from takeover candidates, changing politics, and special situations.

The craziest (unknown) European banking stock

In November 2023, I told Undervalued-Shares.com Lifetime Members about an unpopular Austrian bank.

Since then, the share price has doubled.

At yesterday's Weird Shit Investing conference in Hong Kong, I explained to participants why it can rise another 200% from its current level.

"Weird… what?"

Once a year, I host the Weird Shit Investing conference.

It took place in Hong Kong yesterday, followed by London and New York next week.

This small, exclusive event is an ideas contest that brings together a highly curated audience of fund managers, private investors and family offices. Participants have to make a 20-minute pitch for an investment idea that is unusual, original, or even "weird".

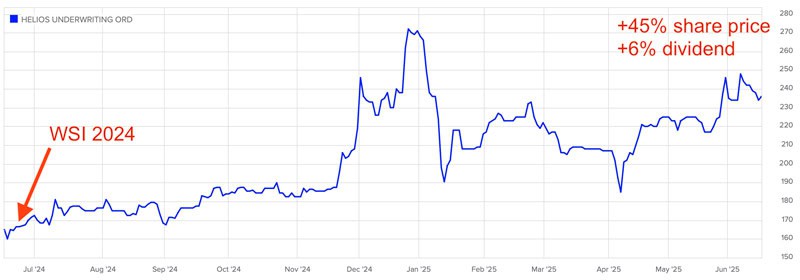

Last year saw me present the quirky case of Helios Underwriting (ISIN GB00B23XLS45, UK:HUW), a truly unique insurance vehicle listed in London. The stock is up 45% since then and has paid a substantial dividend. It probably has more upside even now.

Helios Underwriting.

I thought long and hard about which stock to present this year. After all, the event host has to show some idea leadership.

I had the perfect idea in mind – undervalued, overlooked, and VERY quirky.

However, 48h before the Hong Kong event I changed my mind and churned out an entirely new presentation – on Raiffeisen Bank International (ISIN AT0000606306, VIE:RBI), the Vienna-listed Austrian bank with a market cap of over EUR 8bn.

Some of my more active readers already had multiple touchpoints with the bank.

In October 2023, 15 readers met with the bank's investor relations staff during my investor trip to Budapest, where we gathered valuable intel (and had lots of fun!).

Visiting Raiffeisen Bank International at the 2023 investor trip to Budapest.

The following month, I published a research report on the bank for Undervalued-Shares.com Lifetime Members. Since then, the stock has doubled.

The story doesn't appear to be new, the stock has already doubled, and it's difficult to gain an edge in an investment that is already covered by several investment bank analysts.

So... Why now my rush to pitch the bank's stock at my ideas contest?

Quite simply, I believe it will at least double again from its current level.

With a bit of luck, it could even triple.

The reasons why the stock has this potential are complex, overlooked, and difficult to explain at a time when the concept of "profiting from Russia" is not what corporate equity analysts could possibly be associated with.

Here is the stock's new and expanded angle in a nutshell.

Why Raiffeisen Bank International can rise another 200%

Raiffeisen Bank International is a corporate and retail bank founded in Austria.

Somewhat unusually, 58% of its share capital is owned by a group of regional Austrian coop banks, while the remainder is listed on the Vienna stock exchange. Despite being a truly European bank, Raiffeisen Bank International is anything but limited to the small Austrian market. It is also a major player across Central and Eastern Europe, Ukraine, Belarus, and Russia.

In the early 2000s, Raiffeisen Bank International invested early and aggressively into Russia.

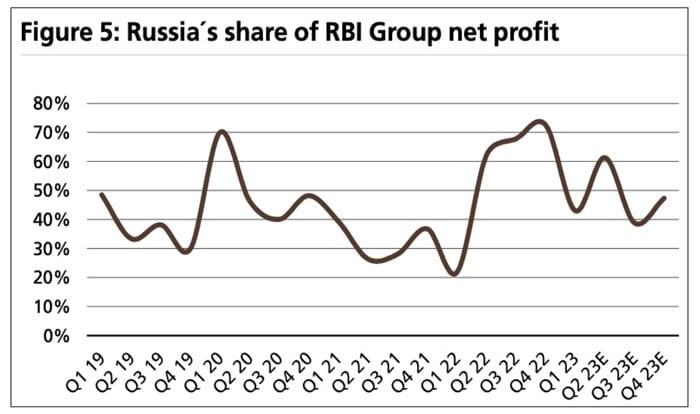

The bank's Russian business started off as a money pit – but eventually became famously profitable. In 2019, the Russian subsidiary generated 70% of Raiffeisen Bank International's total group profits. For much of the 2010s, it contributed between 25-50%.

For obvious reasons, this major money-producing asset became a problem after Russia's full-scale invasion of Ukraine.

Since then:

- Raiffeisen Bank International has been unable to repatriate profits from Russia.

- European regulators have pressured the bank to exit the Russian market.

- Russian authorities have made any potential sale financially punitive through heavy taxation.

In the wake of the invasion, Raiffeisen Bank International's stock has lost 65% of its value.

Raiffeisen Bank International.

Selling a Russian subsidiary is anything but easy. There is a very limited pool of potential buyers for a bank – and even fewer for a bank deemed systemically important.

However, the investor trip to Budapest yielded unusually valuable, concrete indications that something was afoot. And indeed, one month after my research report, Raiffeisen Bank International did release that it had found a potential partial solution for its conundrum.

Here is the set-up.

Russian oligarch Oleg Deripaska owned 24.1% of Strabag (ISIN AT000000STR1, VIE:STR), one of Austria's leading construction firms. His assets were frozen due to sanctions while Raiffeisen Bank International had billions of cash trapped in Moscow – accumulated profits from its Russian subsidiary.

The two parties agreed a swap. Deripaska would get some of the cash Raiffeisen Bank International had stuck in Russia, and in return, Raiffeisen Bank International would get the Strabag shares held by Deripaska's investment vehicle, Rasperia.

It was a brilliantly creative idea to begin unwinding the Russian situation, which European authorities were pressing for. Most of the relevant authorities appeared willing to approve the deal.

Sadly, the Americans didn't. Ultimately, the transaction had to be canned.

Even so, the stock remained about twice as high as when I first wrote about it.

Raiffeisen Bank International.

In recent years, European bank stocks have experienced a renewed wave of investor interest (see my previous articles here, here, and here).

So why, then, is Raiffeisen Bank International now on the verge of possibly doubling – or even tripling – once more?

Here is the thesis in a nutshell.

A cheap bank even if Russia is worth zero

As a major European bank, Raiffeisen Bank International is closely tracked by analysts at major investment banks, such as UBS. However, most conventional analysts now assign zero value to its Russian subsidiary.

Instead, they focus on what's referred to as "RBI core" – "RBI excluding Russia".

The consensus 2026 estimate for "RBI core" gives the stock a P/E of 6. This compares to a P/E of 8.8 for the average European bank.

"RBI core", however, is a normal European bank – and as such, it should trade at the same average as its European peers. That's 45% upside.

In addition, Raiffeisen Bank International's management believes it can raise its return on tangible equity (ROTE) from an estimated 9% in 2025 to 13% in the medium term. That'd be another 45% upside on top of the first 45%. Along the way, the bank also achieves some growth because it operates in markets that are generally growing at a healthier rate than those in Western Europe.

Catching up with other European banks should lead to a share price of ≈EUR 55-60, compared to currently EUR 25.

Notably, this assumes the Russian subsidiary is worth zero – a cautious but slightly silly assumption.

Russia adds a lot of upside

Raiffeisen Bank International's Russian subsidiary currently has equity of EUR 4bn, and it continues to produce profits at a clip of over EUR 1bn per year.

Meanwhile, a complex legal case has unfolded. A Russian court ruled in favour of Deripaska, who argued that cancelling the Strabag transaction breached existing contracts and laws. The Russian central bank subsequently seized EUR 1.9bn in cash from Raiffeisen Bank International's Russian subsidiary – which seems like bad news.

However, the court also ruled that Raiffeisen Bank International is entitled to ownership of the Strabag shares.

As it were, Strabag shares began to rise immediately following the court's decision and have since doubled. This was aided by the renaissance of European shares, and the prospects of Strabag benefitting from European spending packages or even a potential reconstruction of Ukraine.

Strabag.

The Strabag shares in question are now worth EUR 2.25bn. Notably, the Russian subsidiary's equity of EUR 4bn is after deducting the EUR 1.9bn confiscated by the Russian central bank.

The legal case now being fought by Raiffeisen Bank International is complex, and it involves courts as well as sanctions regulation in multiple jurisdictions. Deripaska recently added another claim for damages to the mix. It'd take a brave person to predict the outcome.

What's entirely possible, however, is to conclude the following:

- Given the stock's current valuation, anything coming out of Russia is currently priced at zero. It's really only one way from here – up.

- There are three obvious potential scenarios, which I summarise in my Weird Shit Investing conference presentation.

- These different scenarios could generate an additional value of EUR 3-25 per Raiffeisen Bank International share.

In other words, just catching up with other European bank stocks should see Raiffeisen Bank International double from EUR 25 to about EUR 55 over the next two years.

With a bit of luck, the pending matters in Russia could add another EUR 25 and see the stock rise to EUR 80.

Most likely, this will take 18-48 months to unfold. Only a broad political agreement with Russia could accelerate developments.

In the meantime, Raiffeisen Bank International offers a dividend yield of 6% p.a., which is projected to rise to 8% p.a. as the bank's operation is improved further.

It's quite the set-up, and it's been hiding in plain sight.

Want to learn more?

The above is a very superficial description.

You can learn more about it by downloading my November 2023 report on Raiffeisen Bank International (note: exclusively available to Undervalued-Shares.com Lifetime Members).

Alternatively, you can get in touch with Roemer Capital, a brokerage firm located in Cyprus which continues to track Russia-related opportunities. While it does not provide research coverage on Raiffeisen Bank International, it recently circulated a brief opinion piece on the bank to its clients. If you are interested in exploring this further, you can reach out to Alexander Kantarovich at Roemer Capital. Please note that the firm serves institutional and high-net-worth investors only.

Credit for piecing this together goes to Alexander; conference participants were fascinated by how these different dots connect!

Cases like this are the reason why the world needs a network of truly independent thinkers. There is real value in generating original investment ideas and analysing opportunities that some may be reluctant to talk about. It's why I will keep organising the Weird Shit Investing conference.

In this instance, the "weird" investment case involved a fairly liquid stock. With a EUR 8bn market cap and 42% of shares in free float, Raiffeisen Bank International is accessible enough even for medium-sized funds to build a position through a major Western exchange.

Weird not necessarily means illiquid or impossible to access.

Undervalued-Shares.com Lifetime Members were the biggest winners in this story, having discovered Raiffeisen Bank International when its stock traded at EUR 13. If it does reach EUR 80, their investment will be up more than 5x.

Even better, thanks to their low entry price, they are currently earning a dividend yield of 12% p.a. – projected to rise to 16% p.a. – which alone should make up for the USD 999 Lifetime Membership fee!

Coming soon: "Weird Shit Investing 2025 – The Manual"

Weird Shit Investing Hong Kong has already delivered some truly original and offbeat investment ideas – and with London and New York just around the corner, even more quirky, high-conviction opportunities are on the way.

As a Weekly Dispatches subscriber, you won't miss a thing.

You'll automatically receive a copy of "Weird Shit Investing 2025 – The Manual", featuring all 40+ investment ideas presented across all three events.

Due out on 4 July 2025, and not to miss!

Coming soon: "Weird Shit Investing 2025 – The Manual"

Weird Shit Investing Hong Kong has already delivered some truly original and offbeat investment ideas – and with London and New York just around the corner, even more quirky, high-conviction opportunities are on the way.

As a Weekly Dispatches subscriber, you won't miss a thing.

You'll automatically receive a copy of "Weird Shit Investing 2025 – The Manual", featuring all 40+ investment ideas presented across all three events.

Due out on 4 July 2025, and not to miss!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: