Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

250th Weekly Dispatch – celebrating my readers

With few exceptions, I have published a free Weekly Dispatch every single Friday since September 2018.

It has become quite an archive of articles to rummage through and every week attracts readers from around the world. Undervalued-Shares.com has paying Members in 96 countries and the free Weekly Dispatches are being read in over 210 countries worldwide.

Such a milestone makes for a good moment to take a quick breather and focus on the factor without which Undervalued-Shares.com wouldn't exist – you, my dear reader.

And I dare say, you are quite something!

An unexpected parcel

One case that illustrates quite how special a readership I have is a painting that a couple from Germany created for me.

He loves my articles.

She wanted him to be able to have a chat with me, which he had long wished for.

So she painted her own interpretation of the cover image of my 2007 book. Yours truly on horseback in Nicaragua, to which she added bull and bear to symbolise how the subject of investing in stocks is following me around the world.

This turned up as a surprise on my doorstep in Sark, together with a lovely handwritten letter.

I arranged a video call with the couple to thank them in person for this special gift.

Needless to say, their painting found a place on a wall at my home.

Better than Xmas

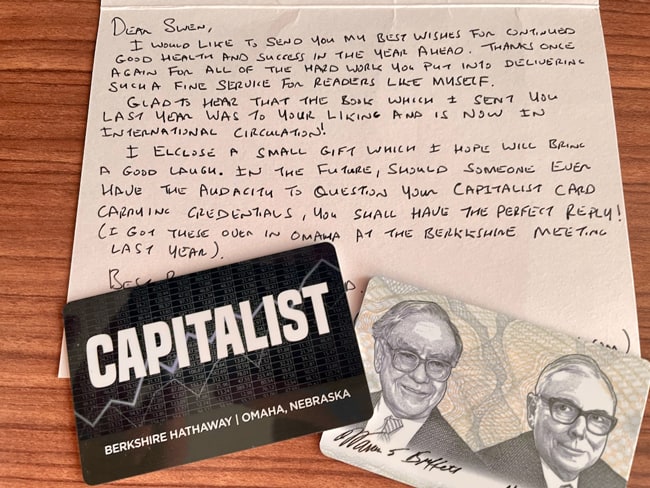

One reader from Ireland seems to have developed an annual habit of sending me a thoughtful gift accompanied by a lovely note.

The first time, this gift comprised a book that he felt I absolutely needed to read to help inspire and inform my work.

Most recently, it included an ID document to use "should someone ever have the audacity to question your card carrying capitalist credentials".

Since I had long wanted to attend the AGM of Berkshire Hathaway but never quite found the time, this gift was also particularly appreciated.

These are just two examples of many.

Even more importantly, my readers are….

A global brain pool to tap into

Readers take time to send me short notes and carefully crafted feedback on the articles and research reports that I have published – or are yet to publish. This feedback loop is highly valuable to me and, in turn, it benefits everyone.

As I have said from the beginning, my Weekly Dispatches are my laboratory. Since they are for free, I take the liberty of using them to help answer the following:

- Is this subject something that anyone would want to read about?

- Can some of my readers help me out with intel on a particular industry?

- Are my investment theses sound?

Whether it's someone calling me out on something that I got wrong or pointing me towards a stock that I should know about, having this growing community on the other side of my laptop screen is a fantastic asset.

My "office" during a research trip to Puerto Rico.

Collecting feedback – virtually and in person

In February 2022, I asked my readers how to improve the Weekly Dispatches and other parts of this website. While some of these findings have already been implemented, others are going to get done further down the road. Undervalued-Shares.com is essentially a lifelong project, and I believe it will be around for a few more decades (which makes the Undervalued-Shares.com Lifetime Membership quite a good investment!). Assuming I don't get eaten by a crocodile somewhere along the way, I have the time to make evolutionary changes instead of rushing things.

One aspect that I'll certainly continue to use more of is to meet readers in person.

I have met readers at gatherings in London, Munich, and Zurich. There has been a joint trip with readers to Poland where we investigated investment opportunities, and I have another such trip coming up to Istanbul (no more spaces available, I'm afraid). Another highlight were reader trips to the Galapagos Islands, which I am taking a break from in 2023 but may yet organise again.I also meet with my blogger colleagues, such as the fantastic Lyn Alden whom I tracked down at an event in Philadelphia, and Harris "Kuppy" Kupperman whom I visited in Puerto Rico a few months ago (hoping he'll reciprocate with a visit to Sark later this year). Another reader, my fellow libertarian and small state afficionado Titus Gebel, just invited me to a gala dinner in Monaco which, without a doubt, will yield valuable insights that feed back to the research you get to read on here. There are too many other occasions and people to mention.

Weekly brain fodder for you and I

To let you into a secret, the weekly publishing schedule of this column was also supposed to be a challenge for myself.

Seven days pass damn quickly, and my readers have pretty high expectations of the Friday read. I went into this challenge with my eyes wide open, and always wanted the accountability that only a public commitment gives you.

It forces me to educate myself on at least ONE subject every week. This can be digging out one stock that I know nothing about, or a more complex subject. On occasion, it veers off into another direction, such as giving away information about how I work.

Each week, I have to challenge myself a bit to produce this column. As a result, each week I learn something new and grow as a person. I'd like to think that this has quite an effect on compounding knowledge.

If I wrote this column bi-weekly or monthly, it would not have the same effect.

At the going rate, I'll reach the 500th issue sometime in spring 2028.

The 1,000th issue is due probably in early 2037.

Without a doubt, my life will bring many more adventures and explorations until then. Thank you for sharing them with me, and for all the great input and energy you contribute to Undervalued-Shares.com.

I'll do my best to stay clear of those crocodiles…

Latest report for Lifetime Members: telco stock with quintuple catalyst

As you'll have learned from today's Weekly Dispatch, an Undervalued-Shares.com Lifetime Membership is quite a good investment.

Not the least because you'll get to read reports such as my latest one, which is exclusively reserved for Lifetime Members.

It introduces you to a European telecoms company with not just one or two, but up to FIVE catalysts on the horizon for a revaluation to take place.

In times where the tide may be turning on European telco M&A as early as June 2023, having this stock on your radar isn't a bad idea.

Latest report for Lifetime Members: telco stock with quintuple catalyst

As you'll have learned from today's Weekly Dispatch, an Undervalued-Shares.com Lifetime Membership is quite a good investment.

Not the least because you'll get to read reports such as my latest one, which is exclusively reserved for Lifetime Members.

It introduces you to a European telecoms company with not just one or two, but up to FIVE catalysts on the horizon for a revaluation to take place.

In times where the tide may be turning on European telco M&A as early as June 2023, having this stock on your radar isn't a bad idea.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: