Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Piaggio & C. SpA – time to saddle up?

Image by Marcell Faber / Shutterstock.com

LVMH recently became the first European company to surpass a EUR 500bn market cap. Indeed, if there is any industry where Europe is the envy of the world and impossible to catch up with, it's luxury goods.

The success of the French conglomerate throws the spotlight onto smaller European companies that have most of their potential growth yet ahead.

Surprisingly, investors might want to keep a closer eye on a brand that is less known for luxury, and more for cheap transport and Italian-style "dolce vita". This perception could soon change, and it could make the company an interesting long-term investment.

Introducing Piaggio & C. SpA, the producer of the world-famous Vespa scooter brand.

Piaggio & C. SpA.

A success story that almost didn't happen

Vespa is the iconic scooter known for its stylish Italian design and unique look. It is one of the few products that has led to the creation of a new verb: "vespare", i.e. "going somewhere on a Vespa". By anyone's standard, this is a brand that has very strong lifestyle associations.

The concept was born in post-war Italy when Italian firms were looking to replace their wartime manufacturing with products for the recovering civilian market.

Innocenti, a machinery works at the time, was one of these firms. Looking to design a simple, robust and affordable vehicle, the company enlisted the help of Corradino D'Ascanio, an Italian aeronautical engineer who had designed the first production helicopter. D'Ascanio came up with a "step through" design so that women could also easily get onto the scooter, but Innocenti turned him down.

Along came Enrico Piaggio, the second-generation manager of the eponymous firm. Back in those days, Piaggio & C. SpA produced items for the aeronautical industry, but it had an ambition to help create a modern, affordable mode of transport for the Italian mass market.

Piaggio asked D'Ascanio to redesign some aspects of his scooter, so that it ticked all the boxes he thought were necessary to make it attractive to the mass market. The motorcycle had to be easy to drive for both men and women, be able to carry an extra passenger, and not get its driver's clothes dirty. The redesigned Vespa scooter had a steel body that combined, in a unified structural unit, a complete casing for the engine to protect the rider from dirt or grease. Its flat floorboard provided foot protection, and its prominent front ensured wind protection. Not only was it very practical, but it also looked damn good and different than anything else on the market.

The redesigned Vespa (Italian for "wasp") launched in 1946. Within ten years, the then unimaginable number of one million units had been sold.

The subsequent history of Piaggio wasn't always smooth riding, though. In the 1990s, the company suffered a near-fatal crash.

Near-bankruptcy and IPO

In 1959, Piaggio came under the ownership of Italy's Agnelli clan (Fiat). It thrived until the 1990s, when then CEO Gianni Agnelli could no longer live up to his managing responsibility due to ill health.

Following the death of the legendary Italian automobile entrepreneur in 1997, Piaggio and the Vespa brand ended up in the hands of Morgan Grenfell Private Equity. A failed Chinese joint venture later, Piaggio was on the brink of bankruptcy and without a clear strategy nor the management team to execute it. All the while, the owners had run up a suffocating level of debt.

Salvation came in the form of Roberto Colaninno, an Italian entrepreneur and businessperson who had previously been CEO or chairman of illustrious Italian firms such as Telecom Italia, Alitalia, and Olivetti.

Colaninno injected EUR 100m of fresh equity and took control of Piaggio's management and strategy. His newly appointed CEO redesigned the company's factory to Japanese principles so that every Piaggio scooter could be made on an assembly line.

A mere three years later, Piaggio was back on track, and the company IPOed on the Italian stock exchange. Colaninno has retained his majority ownership ever since, and the remainder of the share capital is mostly in free float. With a EUR 1.4bn market cap, Piaggio is a typical mid-cap stock. It's well-known on its domestic stock market, but has a fairly limited audience outside of Italy.

Within a year of going public in 2006 at a price of EUR 2.30, the stock traded at EUR 4. It subsequently fell as low as EUR 0.90 in 2009 and never came close to its initial record prices during the ensuing 17 years – until February 2023, when it reached EUR 4.25.

What was driving the rally, and is the stock finally about to reach new territory altogether?

The booming demand for European luxury stocks seems to have put renewed focus on the stock, as did its recent accelerating of growth rates.

Mass transport with a dash of luxury

More than once during its long-running history did Piaggio benefit from a dash of Hollywood glamour.

Unforgotten is the role the Vespa played in the 1953 movie "Roman Holiday" with Audrey Hepburn and Gregory Peck. More recently, a Vespa featured in Paolo Sorrentino's "The Hand of God", starring Toni Servillo. And in a testament to its mass market appeal, a Vespa scooter also featured in "Luca", the 2021 animation movie created by Disney and Pixar.

Nothing beats having your product appear in movies, often without even having to pay product placement fees. Vespas appeared in more than 1,400 movies – an extraordinary achievement which demonstrates the brand's strength.

Since 1946, nearly 20m Vespa scooters have been produced. Their faithful riders are "Vespisti", and quite a few of them even come together in massive fan congregations. The brand and the product's distinctiveness continue to do wonders for customer affinity.

Piaggio has even gained a foothold in the luxury goods markets, through special Vespa editions launched in collaboration with firms such as Emporio Armani or Christian Dior. The Vespa 946 came with a retail price tag of EUR 23,000 and included a Christian Dior-branded helmet and tote bag.

Vespa's own merchandise has also become a luxury accessory of sorts. Created in collaboration with Sean Wotherspoon, the American designer behind some of the most popular sneakers, Vespa products are nowadays bought alongside the scooter and are a branded, premium product rather than just a necessity item for safe mobility. Piaggio has also launched a capsule streetwear collection that showcases classic vintage style, designed with fashion lovers in mind.

It's a clever strategy, where a relatively affordable mode of transport leads customers to eventually purchase products in the luxury segment.

How is Piaggio doing out of all this?

Rather good, as its most recent figures indicate.

Tapping into the Asian growth markets

Piaggio has a lot more depth to it than you'd expect at first sight from a company that is famous for producing an iconic scooter.

Besides Vespa, the company also owns the motorcycle brands Aprilia and Moto Guzzi, which are both successful in their own right. It has a thriving and often overlooked division for light commercial vehicles, and even owns a US-based subsidiary for robotics. Piaggio also has a growing presence in Asia.

The company's global presence in very different market requires investors to distinguish between growth rates and margins in the large but mature European market, and the smaller but fast-growing Asian market.

There are many interesting nuances to it, such as Piaggio's history of breaking into the Vietnamese market. In 2009, when it opened its first factory in Vietnam, Vespas were three times (!) more expensive than the average scooter produced by Japanese competitors such as Honda or Yamaha. Thanks to its distinctive design and brand heritage, the premium price worked to its advantage. Owning a Vespa became a status symbol for Vietnamese consumers and sales quickly took off. This year, Vespa will expand its Vietnamese production facilities to increase capacity from 240,000 to 400,000 vehicles per year. Compared to group-level sales of 625,000 vehicles in 2022, this is a very noteworthy expansion of production capacity.

In China, Piaggio pursued a similar strategy by investing heavily into positioning the Vespa brand in the upper end of the market, e.g. by hosting events in collaboration with Bulgari Hotels, or incorporating the Vespa brand into displays at high-end department stores and eateries. All the while, it built local management teams to better tap into local opportunities.

The 139-year-old company is a market leader in Europe, with a market share of 14% of the two-wheeler category and 24% in the scooter category. In its home continent, Piaggio stands to benefit from the rapidly evolving transport landscape. Changing consumer attitudes caused by the pandemic, the interest in electrification, pressure on the cost of living, and big cities waging war against cars are providing multiple growth opportunities for the company.

Then there is Asia, where Piaggio has been on a tear for over a decade. Between 2018 and 2022, the company's Asia-Pacific sales increased by 30% p.a. The region now accounts for 15% of annual revenue, compared to Europe with just over 50%.

Over the past ten years, Piaggio on a group level has grown its sales by 72% and EBITDA by 102% while reducing its debt from 3.3x EBITDA to now just 1.2x. While this might count as a success to many, a mere doubling in revenue and earnings across a decade is not vastly impressive by luxury market standards. Why, then, did the share price rally so strongly over the past six months?

Modest valuation and accelerating growth rates

Without a doubt, the rallying stock price was partially due to Piaggio's blow-out performance during Q4/2023. Group-level revenues shot up 31.6%, EBITDA was up 29%, and net income increased 66%. In Asia-Pacific, sales grew a stunning 57%, despite continued muted demand from China.

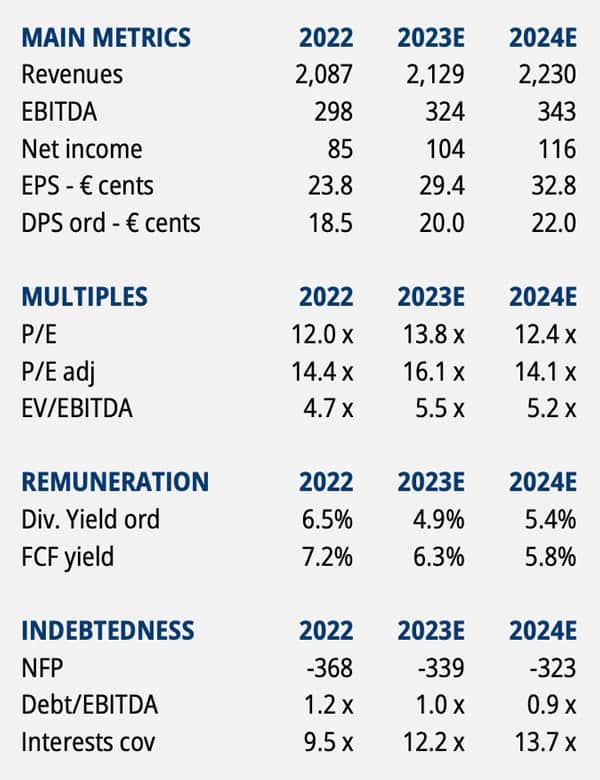

Piaggio generally does not provide any quantitative guidance for the upcoming year. The most recent projections were issued by leading independent Italian investment bank Equita in early March 2023. Equita's estimates assume a modest 2% sales growth, an 8% increase in EBITDA, and a 22% increase in net income. For 2024, the estimates point towards similar growth rates – steady, but not amazing. While Equita has justified concerns over the macroeconomic situation of the European home markets, it seems that on the whole, Piaggio could surpass the estimates on the back of its strong performance in Asia.

Source: Equita, 3 March 2023 (ratios based on a share price of then EUR 3.90).

Trading at a price/earnings ratio of ≈15 and about 5x EV/EBITDA, Piaggio stock is anything but expensive IF the company managed to keep growing at a faster pace than it did in the past. For the share to experience multiple expansion, the market needs to believe that Piaggio can now achieve consistently higher growth rates, rather than fall back to the relatively benign growth rates of the 2010s.

Is this going to happen, and is the stock about to finally break through its old 2007 high?

A plethora of opportunities

There are numerous areas and aspects that could help Piaggio accelerate its growth during the remainder of the 2020s:

- The Vespa brand has achieved an interesting market positioning in India, where a mode of transport that bridges the seemingly contradicting factors of affordability and luxury can address a huge audience. India is, obviously, a massive potential market by way of its 1.4bn population and rapidly growing middle class.

- In the Asian market in general, Piaggio seems to have an opportunity to become much more of a luxury good than it could ever achieve in Europe. Sales in the luxury segment tend to come with higher margins. Its heritage, the affiliation with an Italian lifestyle, and collaborations with other brands could do wonders for the company in Asia.

- Piaggio's division for light commercial vehicles makes up 17% of the company but gets almost completely overlooked. With changing traffic regulations and patterns in urban areas, this division could also yield surprising growth.

- There is no truly comparable brand in the world, but there are billions of emerging middle-class consumers that need and desire individual transport. With just 625,000 units produced per year currently, Piaggio seems to have only scratched the surface of the total addressable market. Why shouldn't the company be selling 1m or 2m Vespas a year?

Buy now – or watch first?

I've only done a relatively superficial analysis so far and am just watching the company from afar – but with a much deeper level of interest than before.

Maybe it's a buy right now. Maybe it'll be a buy during the next stock market rout. I don't know. But I find Piaggio terrifically interesting to follow, as it could well turn into a successful compounder of the kind that LVMH has been during the past decade(s).

Amid all the cyclicality of the transport market and short-term issues such as supply chain issues, wage inflation, and dampened demand for electric vehicles, Piaggio has shown remarkable resilience. Since 2016 alone, its Indian subsidiary has gone through a goods and services tax reform, an acceleration in the introduction of new emissions standards, and the mandatory requirement to register a vehicle when purchasing it. None of it stopped the subsidiary from doubling its two-wheeler sales between 2016 and 2021.

Piaggio could become known as one of these market leaders that you should have spotted at the outset, but didn't.

For anyone interested in learning more, I recommend the 20 April 2022 initiation report by Berenberg. Comprising 65 pages, it provides the single best overview of Piaggio that I managed to find. Email me if you'd like a copy.

A similar case with a doubling still ahead?

The share price of Piaggio has already doubled, but there's another well-known European company that is a potential luxury brand in disguise.

Its stock is currently "down and out", but there are clear signs for an imminent turnaround.

You'll be familiar with the brand and its product. It's truly iconic, and the weak share price should prove only temporary.

My latest in-depth research report, out next week, has all the details.

Become a Member (if you aren't already!) for the report to hit your inbox as soon as it's out.

A similar case with a doubling still ahead?

The share price of Piaggio has already doubled, but there's another well-known European company that is a potential luxury brand in disguise.

Its stock is currently "down and out", but there are clear signs for an imminent turnaround.

You'll be familiar with the brand and its product. It's truly iconic, and the weak share price should prove only temporary.

My latest in-depth research report, out next week, has all the details.

Become a Member (if you aren't already!) for the report to hit your inbox as soon as it's out.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: