Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

3 British real estate companies that could receive a takeover bid

Image by Nadiia Gerbish / Shutterstock.com

"London is dead". Is it really?

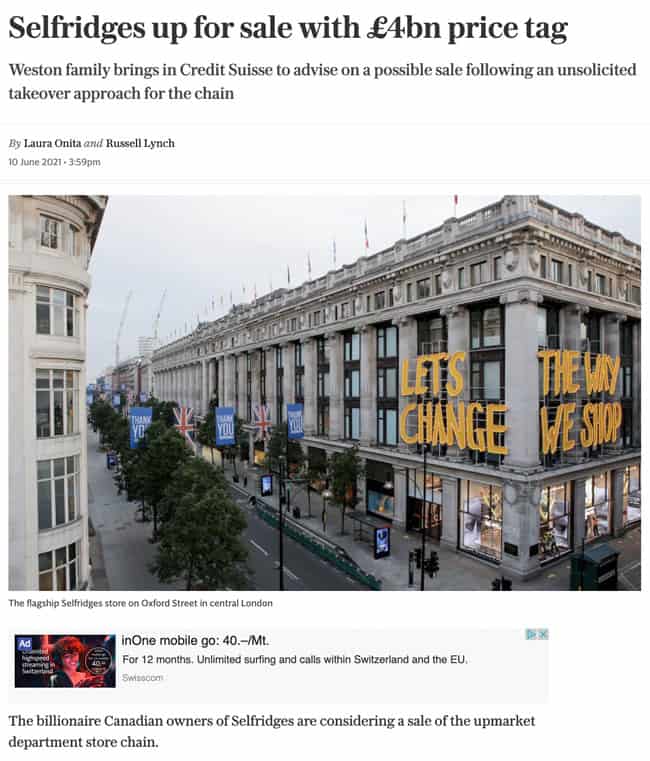

Many believe London as a whole and retail properties in particular are areas to stay well clear of. However, not everyone agrees. A few weeks ago, the owners of privately-owned retailer Selfridges received an unsolicited (!) bid for the company. The bid came in at a staggering GBP 4bn, or nearly USD 6bn. Of that, 50% is for the real estate itself of which the flagship store on Oxford Street makes up the biggest part.

The anonymous bidder is in good company. During the first half of this year alone, seven publicly-listed British real estate companies received a takeover bid. The majority of these bid targets focussed on London's real estate market. A further two bids for British real estate companies are currently underway. Compared to the last stock price before the bid became apparent, the premiums paid to shareholders amounted to an average 30%.

I've repeatedly reported on the takeover mania on London's stock market. It's bound to continue.

Today's Weekly Dispatch is going to introduce you to three likely bid targets.

Source: Daily Telegraph, 10 June 2021.

Why is London in such demand?

Work from home, the future of cities, and the fate of retail properties are controversial subjects. There is lots of extensive research available, such as Goldman Sachs' report "The post-pandemic future of work", Morgan Stanley's 84-page primer "A new workplace creates two cycles", and BofA Global Securities "The urban exodus – more myth than reality".

If you sift through all of this institutional research (as I do), you'll quickly realise that there are no absolutes.

Yes, some people may never return to their office. However, others are already back to the same rhythm as before the crisis. In between these two extremes, there is a lot of grey.

It's in the disruption, dislocation and uncertainty of real estate markets that sophisticated investors see an opportunity. As the example of Selfridges shows, there are investors willing and able to deploy large amounts of money to buy real estate, and they expect outsized returns.

Another opportunity from the British Isles

IWG and its entire investment case don't fit into any boxes. Yet, the flexible office space provider is gearing up for a large tax-free capital return, and it's currently trading at a third (or less) of its intrinsic value.

Get your initial investment back but keep your share in a growing business. Sounds too good to be true?

My exclusive research report has all the details.

Another opportunity from the British Isles

IWG and its entire investment case don't fit into any boxes. Yet, the flexible office space provider is gearing up for a large tax-free capital return, and it's currently trading at a third (or less) of its intrinsic value.

Get your initial investment back but keep your share in a growing business. Sounds too good to be true?

My exclusive research report has all the details.

For private equity investors, in particular, making bids for British companies currently is similar to shooting fish in a barrel. It's a target-rich environment.

Private investors, in turn, can benefit when a bid is made at a premium to the recent share price.

Which begs the question, what are the next likely targets?

Three candidates for a bid before year-end 2021

At least a dozen publicly-listed real estate firms in the UK currently qualify as a bid target. The following are three of the most promising, and each company comes with a very different angle.

Helical (ISIN GB00B0FYMT95) is focussed on developing and renting out office properties in London. Few of my readers will be familiar with the company since it has a market cap of just GBP 600m. Its attractiveness stems not so much from an undervalued portfolio, but its outstanding expertise and track record in developing properties. A bidder could use Helical as a vehicle to break into the London office market and with a team that will know how to make maximum use of the current market situation. 96% of the office properties in Helical's current portfolio are either newly built or recently refurbished, which means no problematic assets for a potential bidder. Last year, the company collected 93% of its rent, and its loan-to-value ratio is at a historic low of 22.6%, all of which is nicely summarised in its 21 May 2021 investor presentation. Before the pandemic, Helical had received not one, but several unsolicited bid approaches. The stock is currently trading 11% below its net asset value of GBp 533. In a bid situation, it should fetch a premium of at least 20-25% compared to the current price.

A chunkier target is Grainger (ISIN GB00B04V1276), the UK's largest institutional landlord of residential homes. The 109-year-old company currently has 8,850 homes under development, which will double the size of its existing rental portfolio of 9,000 homes. Grainger has a little-understood feature that makes it interesting for private equity bidders: a third of its homes are regulated tenancies, which the company can sell on the open market once the tenant dies. The death of the tenant usually makes for an immediate uplift in property value of 18-20%. The mechanics of such portfolios are under-appreciated by the market and not generally reflected in a company's value. Also, a private equity bidder could improve Grainger's returns by giving it access to more finance for finishing its construction projects faster. With a share price of GBp 312, the stock has already rallied past its most recent net asset value estimate of GBp 286 – however, this undervalues the regulated tenancies! Grainger currently counts as one of the City's more obvious bid targets which is why its upside is now relatively small, probably amounting to 15-20%. However, if the current market correction persists, there might be an opportunity to pick it up cheaper during a dip. Just as I put the finishing touches to this article, it leaked that Lloyds Banking Group (ISIN GB0008706128) is looking to build a portfolio of 50,000 residential homes in the UK, which could make Grainger a perfect fit to get the portfolio started. Put this one onto your watch list if you fancy a relatively conservative bid target.

Would you like something a bit more speculative but with higher upside? No company remains a clearer bid target than Capital & Counties (ISIN GB00B62G9D36), and it's my favourite bid target among British real estate companies. "Capco" controls much of the real estate around London's Covent Garden district, and it has bought a large stake in Shaftesbury (ISIN GB0007990962) which owns a cluster of five "villages" in Chinatown, Soho, Carnaby Street, Fitzrovia and Soho. These are London's most popular tourist and entertainment areas and as such heavily reliant on travelling, which is why Capital & Counties and Shaftesbury have taken a strong hit during the pandemic. However, both companies individually represent portfolios that would take decades to build. Taken together, they represent one of the most outstanding available acquisition targets for long-term investors such as sovereign wealth funds. Unsurprisingly, the Norwegian Sovereign Wealth Fund has already bought a large stake in both companies, further adding to the Norwegian's existing substantial holdings of London super-prime real estate. I published research about Capital & Counties before the pandemic and ahead of a bid approach by the Saudi's Sovereign Wealth Fund (which at the time didn't yield a bid). The pandemic hit the stock of Capco hard and the company had to write down assets values from GBP 293 per share to GBp 199. Right now, it is trading at GBp 176. Shareholders won't agree to sell for much less than the pre-pandemic valuation, given what a unique asset the company has assembled. There is probably 50% upside to Capital & Counties if a bid comes in.

Market figures speak a clear language

London has its issues, but for some, these issues represent opportunities.

From the perspective of these large-scale, professional long-term investors, the underlying numbers are simply too good to resist. The current yield spread between UK government bonds (1%) and UK property (5%) is about as large as it's ever been. British real estate companies as a whole trade in the lower half of their historical valuation range, when compared to their underlying asset value. The UK is a country with a very open capital market, which stands in stark contrast to Germany's never-ending discussions about potentially expropriating mega-landlords.

Blackstone (ISIN US09260D1072) alone is sitting on USD 130bn in capital they need to put to use, of which USD 36bn has to be allocated to real estate. KKR (ISIN US48251W1045) recently set up a new team to focus on nothing but acquiring UK companies (see my Weekly Dispatch from 16 July 2021). High-profile cases such as the bidding auction that will now be opened up for Selfridges will generate more momentum and force would-be acquirers to make long-delayed decisions.

The UK market has seen yet more bids for public companies since mid-July. Spirits (ISIN GB00BF5SDZ96) received a bid with a 44% premium, WM Morrison (ISIN GB0006043169) received the next-higher bid from its competing private equity suitors, and Elliott Management's newly-disclosed stake in SSE (ISIN GB0007908733, formerly Scottish and Southern Energy) is widely seen as a precursor to a takeover.

As The Times reported on 4 August 2021: "Bidding for UK firms at 14-year high".

Real estate firms are part of the rich pickings that investors – small and large – can find on the London Stock Exchange. By the time this year is over, I bet that two of the three names mentioned above are not going to be publicly listed anymore.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: