In theory, Europe is a unified market with 450m consumers and a GDP that is as gargantuan as that of the US and China. In practical reality, its fragmentation makes it a complex place to operate in.

Europe's lack of a truly unified market is one of the key reasons why its economies are lagging behind the more dynamic US and the fast-growing Asian markets: the Old Continent's percentage share of global GDP has been in secular decline for decades.

In 2000, 41 of the world's 100 most valuable companies were based in Europe. Today, only 15 are. The continent's share in global corporate profit has halved since the turn of the millennium.

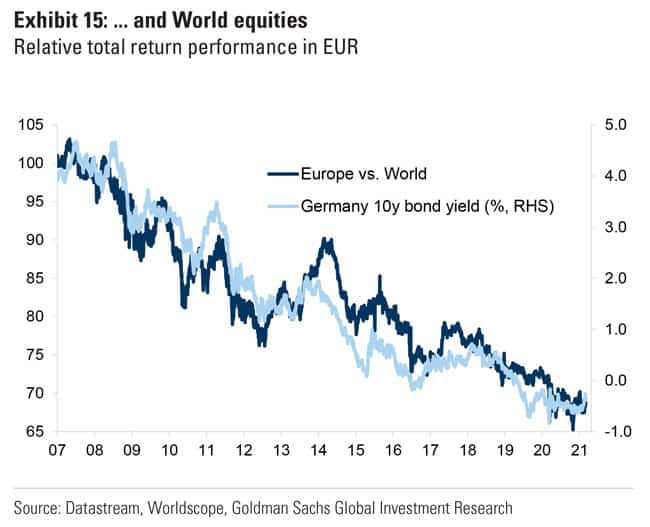

It fits the bill that during the 2010s, European stocks have underperformed US and global equities, as the following charts show.

Source: Goldman Sachs, "You're Up – Europe: the case for European equities" (4 March 2021).

Source: Goldman Sachs, "You're Up – Europe: the case for European equities" (4 March 2021).

On the surface of it, it's not a pretty picture. It's tempting to take the old saying "Europe is great for vacation, but not for business or investing" at face value.

Is that true, though? Do these numbers and truisms hold up to scrutiny?

The collection of little-known facts and figures in this article might surprise you. Quite probably, it will make you view the European investing opportunity in a new light altogether.

It takes a brave man to break a cudgel for the Old Continent, and that's exactly what I'm going to do today.

Are you ready?

Recent fear porn by The Economist – time for contrarians to take a closer look? (source: The Economist, 5 June 2021).

A whirlwind tour of lesser-known statistics

Which is Europe biggest industry: automobiles, machinery, banks? Or maybe energy?

Dead wrong. It's healthcare.

In the age of rampant viruses, ageing populations, and a growing global middle class, healthcare is one of the world's most profitable industries, and a growing one as well.

How come most people have never realised before how strong Europe is in healthcare?

Because they've looked at the "wrong" statistics. In terms of revenue or number of employees, there are, indeed, other European industries that are bigger than healthcare. However, for investment purposes, there is a much more useful measure (and the one I use in order to analyse the European markets): the market capitalisation that companies contribute to the STOXX Europe 600 index. Healthcare has much higher profit margins than other industries, which makes the industry so valuable.

The STOXX Europe 600 is the benchmark for looking at the European stock market as a whole. Crucially, it's not limited to the EU, and it also excludes countries that are too far out. The 23-year-old index includes the UK, Norway and Switzerland (all of which are not members of the EU), but not Turkey and Russia. It's a true representation of what is commonly known as Europe.

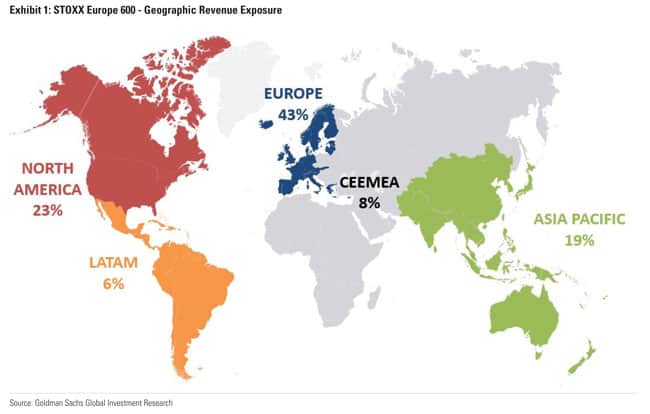

The data coming out of the STOXX Europe 600 makes for a few fascinating insights into the European economy, such as its truly global scope. The companies included in the STOXX Europe 600 generate 57% of their business outside of Europe. In contrast, the companies that make up the S&P 500 index make 70% of their sales within the US. Many European companies are great at succeeding on the world stage.

Source: Goldman Sachs, "European Portfolio Passport" (10 December 2020).

Case in point, European healthcare companies achieve 40% of their global sales in the US, a particularly competitive market. Would you have known?

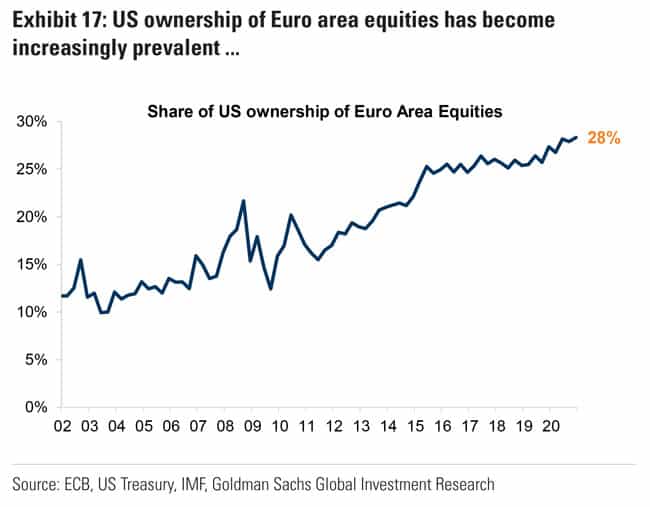

Sophisticated investors do know of these statistics, and they act accordingly. Far from ignoring Europe, US investors have become the dominant investors in European equity markets. In the 14 years since the Great Financial Crisis, American ownership of European equities has doubled, and US investors now own nearly 30% of all outstanding European equities.

Source: Goldman Sachs, "Europe in vogue" (28 June 2021).

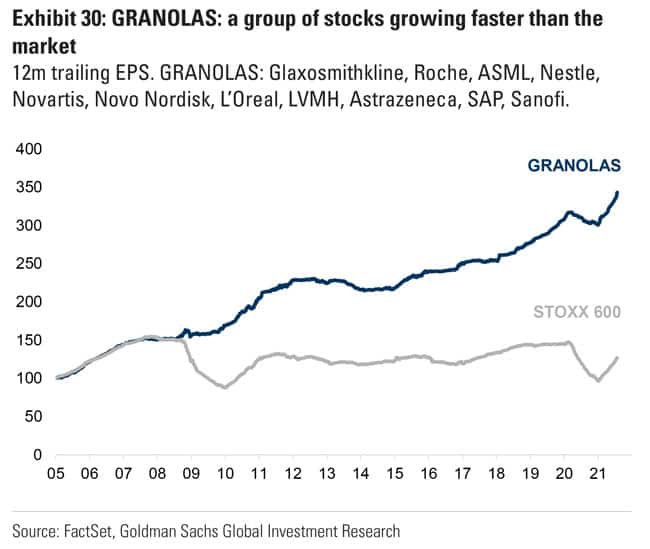

What was it that caught the attention of US investors? No doubt, the so-called "GRANOLAS" played a part.

Europe has its own set of stock market champions

Europe famously missed out on creating the kind of tech companies that have emerged from Silicon Valley over the past decades. However, it's not like the continent hasn't produced a good number of star performers after all.

Europe's strength traditionally laid in its large number of small and medium-sized manufacturing companies. An outcrop of this sector is LVMH (ISIN FR0000121014), the French luxury goods manufacturer that developed a formula for buying capital-starved European heritage brands and providing them with the growth capital to go global. Its major shareholder, Bernard Arnault, may not command media attention by firing penis-shaped rockets into orbit, but he still competes with Jeff Bezos for the title of world's richest man. The stock price of LVMH is up 15 times since 2008 alone, and Arnault's family controls 47% of a company that is now worth USD 400bn.

LVMH is represented by the "L" in "GRANOLAS", a term coined by Goldman Sachs in spring 2020. It's the following group of European companies:

- GSK (ISIN GB0009252882), the British pharma giant.

- Roche (ISIN CH0012032048), the Swiss pharmaceuticals and diagnostics giant.

- ASML (ISIN NL0010273215), the Dutch supplier to the semiconductor industry.

- Swiss-based Nestlé (ISIN CH0038863350), the world's biggest food company.

- Swiss-based global healthcare company Novartis (ISIN CH0012005267).

- Novo Nordisk (ISIN DK0060534915), the Danish multinational pharmaceutical firm.

- French cosmetics and personal care giant L'Oréal (ISIN FR0000120321).

- French luxury goods conglomerate LVMH (ISIN FR0000121014).

- British-Swedish big pharma company AstraZeneca (ISIN GB0009895292).

- French pharma heavyweight Sanofi (ISIN FR0000120578).

- German enterprise resource planning software giant SAP (ISIN DE0007164600).

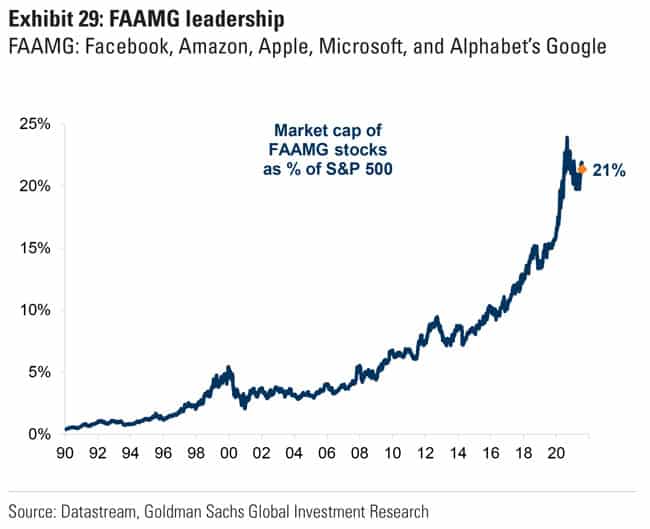

These are structurally strong, defensive growth companies which combine strong balance sheets, low volatility growth, and reliable dividend yields. Arguably, their growth rates are lower than those of the FAANG companies. However, while comparing the growth rates of the GRANOLAS to those of the FAANGs makes for great clickbait headlines in articles trashing Europe, it's also entirely irrelevant. It'd only be the right yardstick if you thought all investors should invest all their money in just five companies of the same sector.

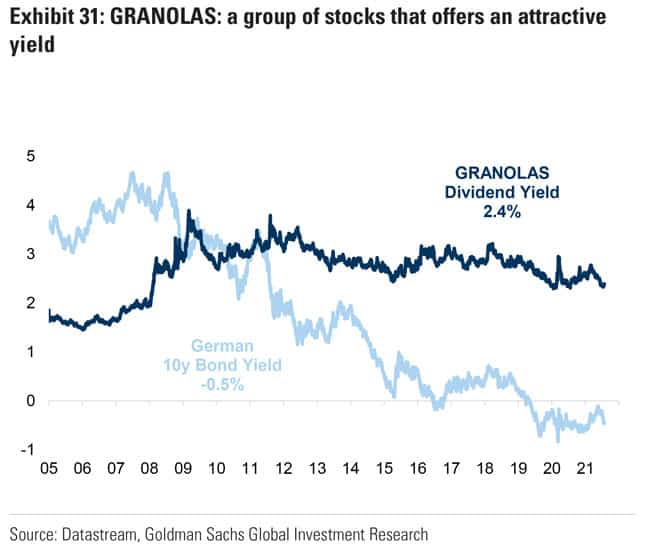

The stocks of the GRANOLAS don't primarily compete with the FAANGs but sovereign debt. Given the stability and reliability of their earnings and dividend growth as well as their strong balance sheets, these stocks appeal to investors that have to decide between buying sovereign bonds or large-cap stocks. The GRANOLAS come with an average dividend yield of 2.5%, which compares rather favourably to the non-existent or even negative yield offered by European sovereign bonds.

A groundfloor opportunity in gaming and esports

Introducing: the European entertainment champion which is looking to turn itself into a global giant - and could gain 125% by mid-2022.

Get in on this opportunity before everybody else becomes aware of it.

My latest research report has all the details. Exclusively available to Undervalued-Shares.com Lifetime Members.

A groundfloor opportunity in gaming and esports

Introducing: the European entertainment champion which is looking to turn itself into a global giant - and could gain 125% by mid-2022.

Get in on this opportunity before everybody else becomes aware of it.

My latest research report has all the details. Exclusively available to Undervalued-Shares.com Lifetime Members.

While Europe's stock markets as a whole have underperformed during the 2010s, earnings of the GRANOLAS have grown faster and their share prices have outperformed the broader market.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

The market cap of the GRANOLAS now makes up the same high percentage of the large European index as the FAANGs within the S&P 500 index.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

As the example of the GRANOLAS shows, when it comes to higher growth rates and returns, Europe offers more choice than is commonly perceived. The FAANG stocks and other players in the tech sector capture a disproportionate amount of media attention, but it's not like the Old Continent hasn't come up with its own growth companies.

Keeping up with Nasdaq (and then some)

Had you invested in Europe's renewable energy sector in 2015, you would have achieved the same spectacular return as with companies listed on the Nasdaq market. You can argue that this is a heavily state-subsidized sector that has yet to deliver evidence of its long-term economic value and societal benefit; however, for now, anyone who invested in it is looking pretty. And just for the record, Elon Musk's Tesla (ISIN US88160R1014) also benefitted from billions of subsidies handed out by a class of central government dirigistes.

Europe's digital economy is also much better than its reputation. It hasn't created Facebook (ISIN US30303M1027) or Alphabet (ISIN US02079K3059), but there are areas where it is leading in terms of growth. Goldman Sachs recently estimated that the UK's e-commerce penetration is now 50% ahead of that in the US. The stocks representing Europe's digital economy are up just as much since 2015 as the Nasdaq index, and Europe has since had more tech IPOs than the US.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

Europe does tend to move at a slower pace in many regards, but it does move eventually and investors are well-advised to look under the bonnet before drawing any premature conclusions. E.g., it's worth analysing how the relative underperformance of European markets was influenced by the composition of leading indices.

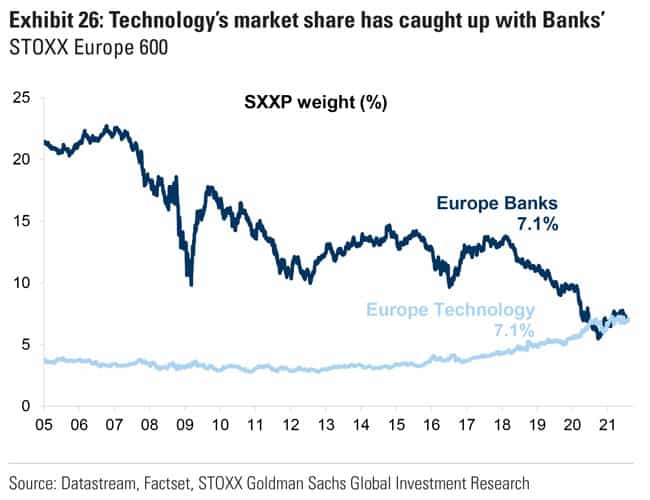

A significant amount of the past decade's underperformance was caused by the heavy index weighting of banks and traditional energy companies, which, in 2010, comprised 27% of the STOXX 600 Europe index. It's no wonder European indices lagged behind the performance of the more tech-orientated Nasdaq index. It also shows how comparing such indices can be akin to comparing apples and pears if you don't first check the underlying index composition.

Equally, it's important to keep an eye on how these underlying dynamics change. A widespread - but soon to be outdated - perception is that banking and traditional energy still make up the largest part of European equity markets. However, the digital economy now has a higher market cap share of the STOXX 600 Europe index than banks.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

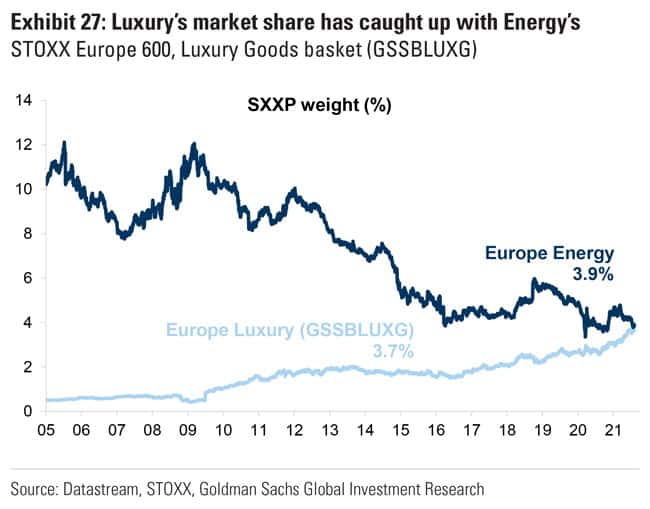

Likewise, Europe's luxury goods industry has recently overtaken the continent's energy sector, as far as index weighting by market cap is concerned.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

These changes in index weightings alone could lead to a significantly different performance of European equity markets during the 2020s. It looks, though, as if it still does not capture all that is afoot in some sectors and regions of Europe.

Global investors have discovered European growth companies

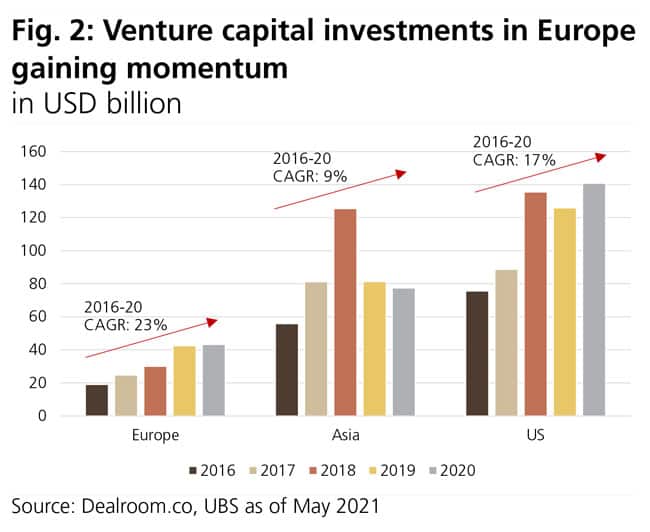

Venture capital funding for European companies has long lagged behind the US and Asia - a widely-known, commonly-accepted fact for as long as I can think back. However, the things, they are a-changin'. Risk-capital funding in Europe is growing at a much higher percentage rate than elsewhere.

Source: UBS, "Investing in Europe's digital leaders" (26 May 2021).

It's difficult to deny the impressive momentum in Europe's tech ecosystem right now. Europe currently contributes 65 "unicorn cities" to the global count of 170 cities that are home to a unicorn company. Incredibly, in 2020, Europe overtook China in producing unicorns. Since 1990, the continent has produced 296 unicorn companies, compared to China's 276. In 2021, Europe seems to be building on this lead, with 72 new unicorns created so far - over three times China's 22. The US is still leading by far with over 1,000 unicorns created since the early 1990s, but Europe's absolute number of unicorns makes it a serious player and gives investors plenty to choose from.

Inevitably, some of these companies become the target of M&A. Apple, Google, Microsoft and Facebook have all been on the prowl in Europe. During the last four years, Amazon alone has acquired or invested in 28 European companies, including companies in smart home tech, entertainment tech, and audio tech. M&A in the European tech sector was up 114% in 2020, with transactions totalling a respectable USD 55bn. That's enough to offer investors a multitude of opportunities to benefit from lucrative takeover bids.

Much of this growing interest in acquiring or investing in European companies is focussed on what the Old Continent does best: small and medium-sized companies that benefit from its highly-educated workforce and still-unrivalled approach to quality.

These developments also lead to new ventures popping up in surprising places. E.g., the Hong Kong-based family office, WWICL, recently teamed up with the investment vehicle of Italy's legendary Agnelli clan, EXOR (ISIN NL0012059018), to invest in fledgling Italian luxury brands. Problem-ridden as Italy as a country undoubtedly is, it is rich in medium-sized enterprises with strong expertise, enormous artistic creativity, and authentic heritage. Following on LVMH's stunning success in growing predominantly French luxury goods manufacturers to global stature, the duo of multi-generational entrepreneurial families will provide initial permanent capital of EUR 300m to help such companies pursue long-term, global growth ambitions.

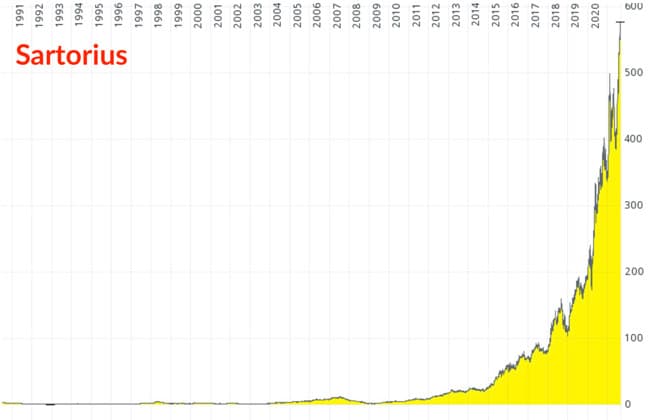

Without a doubt, some of these investments will have been inspired by other success stories that emerged from Europe's sector of small and medium-sized enterprises over the past decade. Take Sartorius (ISIN DE0007165631) as an example. A manufacturer of analytical laboratory instruments, the German company is the classic example of a family-controlled Mittelstand company. In 2010, it had a market cap of less than EUR 200m, i.e. a typical small-cap stock that would appear on few peoples' radar and not get any analyst coverage. Not paying attention to the company proved costly. Its stock is up over 100 times over the past 11 years alone. During this period, Sartorius outperformed all Nasdaq-listed companies except Tesla. If you go back 20 years, its stock is up 600 times.

"Who'd have possible known of Sartorius ten or twenty years ago?", you will ask.

Which is exactly the point. Europe's fragmented markets, its spaghetti ball of languages, and local peculiarities make for highly inefficient capital markets.

This is where the opportunity lies for equity investors who are willing to dig a bit deeper, as I'll now explain.

Complexity and opacity create opportunity

In the US, a shared language, unison legal system and national capital market put every single publicly-listed company within plain sight of every single equity analyst and investor.

Not so in Europe. Even today, an investor based in one European country may not even be able to a trade a stock in every other European country. That's true even for the continent's largest exchanges. I regularly get emails from British readers whose broker struggles to execute a trade in Frankfurt. Unfathomable in the year 2021, but true. And that's before we have even mentioned markets in Eastern Europe. Poland is now the European Union's sixth-largest economy (as described in my three-part blog series about investing in Poland), but its stock market remains difficult to access for most EU citizens.

A German company like Sartorius might get some coverage by German analysts nowadays. However, purely due to Germany's smaller absolute size (83m people) and lower equity ownership (7.6% of the population), there will be less eyeballs trained on analysing such a company than if it were located in the US (331m people and 52% equity ownership). These figures are always a bit lopsided because some German equities will be followed by analysts from other European countries, and equity ownership figures are famously distorted by differences between direct and indirect equity ownership (e.g. through pension funds and life insurance contracts). Still, it's crystal clear that the hunt for promising investments is less competitive in Europe than it is in the US.

There is a lot of outright market ignorance in Europe. If you engage in deep research, you stand a chance of making a better-informed decision and beat other investors. The range of opportunities span:

- Underappreciated business models (e.g., investors not realising a company's value).

- Corporate transformations (e.g., taking a European company to the global stage).

- Changes in ownership (e.g., a founder family selling out to a private equity giant).

Finding such stocks is one thing. Another crucial aspect is the "trigger". A cheap stock can stay cheap forever unless there is something that draws the market's attention and leads to a re-rating.

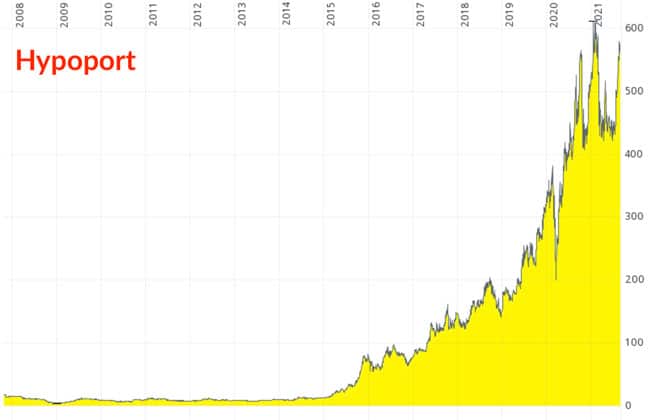

A perfect example that some of you will be familiar with is Hypoport (ISIN DE0005493365). The German company was the last stock that I featured on my "old" Undervalued-Shares.com site. At the time, in 2010, I published what was probably the first in-depth research report about the stock, which literally fell through the cracks of conventional equity analysis mechanisms:

- Hypoport had gone public through a direct listing instead of a traditional IPO, i.e. it opted for a low-profile stealth listing.

- Due to its market cap of then just EUR 50m, not a single analyst provided coverage.

- There was no comparable company in Germany, which made its growth plans harder to understand for anyone but a small number of investors who were familiar with its niche industry.

Fast-forward to today and Hypoport stock is up >100 times. Its annual earnings per share are higher than the price at which I first pointed out the stock. Anyone who bought back then now owns the fast-growing company at a p/e of <1. Incredibly, I do have at least one reader who bought back then and still holds some of the position!

It remains Undervalued-Shares.com's mission to find companies like Hypoport - or, as more recently, a Swedish company that hardly anyone will have ever heard of, even though one of its two divisions is world-leading. Europe's most successful activist fund as well as a renowned investor from the US have taken a stake, its stock price is cheap and its potential upside huge. Investors from elsewhere have simply not yet recognised the company's large potential now that it is working to expand globally.

This inefficiency of European capital markets persists even in the year 2021, and it's unlikely to change anytime soon. There is a plethora of opportunities out there for investors to make use of, at least for the remainder of the 2020s.This includes short- and medium-term opportunities, where you make use of inefficient markets to capture the value generated by a stock's re-rating over 6-24 months. It also includes longer-term opportunities, where you buy into an underappreciated growth company that has the potential to become the next Sartorius or Hypoport and then simply sit tight.

The European investment universe spans 10,000 to 20,000 publicly-listed companies. No one can even agree on the actual figure. Europe, too, has seen booming demand for passive investing (which is based on emulating indices rather than analysing individual companies), which further reduced the number of analysts working in these markets. Less eyes trained on analysing the opportunities, as I said before.

That's before even speaking about the ill-effects of the MiFID II regulation, which drastically reduced the amount of research available on European companies because it made the production of such research unprofitable. As even the European Commission admitted in mid-2020: "Research on small and mid-cap companies and on fixed-income instruments has experienced a decline in research coverage for several years."

Source: Institutional Investor, 23 July 2019.

European economies have made good headway in moving forward in some ways, but there are aspects of its capital markets that have moved backwards. The quantity and, importantly, quality of equity research in Europe has gone down. With less such research available, there will be more nuggets waiting to be uncovered. For anyone willing to invest in deep research and tracking down hard-to-find information, Europe continues to present a treasure chest of opportunities.

Where best to look, and how to do so as a private investor with limited time and resources?

Needless to say, I have a few practical suggestions for you.

Your choice of big funds, small funds, and specific stocks

The investment case for Europe is much more complex than could fit into a single article. Just as it's a diverse, fragmented continent, so are there many more aspects to the issue of investing in European equities.

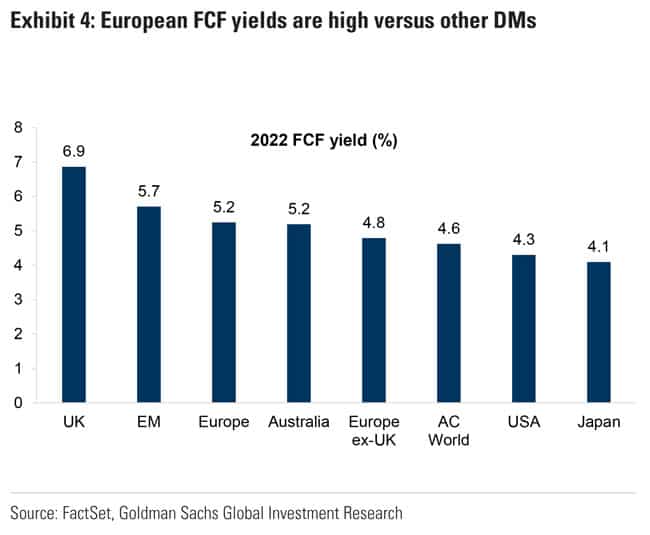

However, there is one overarching, objectively measurable and undeniable fact. On European equity markets, you can currently buy future cash flow at lower valuations than almost anywhere in the developed world. The bombed-out UK market, which I have written about repeatedly, is the standout case in that regard (and a prime example for Europe's huge national/regional variations). Only Australia and emerging markets are cheaper.

At the end of the day, investing boils down to purchasing future cash flow at too low a price. That's true whether you are a value investor, a growth investor, or anything else. Investors invest to get more cash back than they put in.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

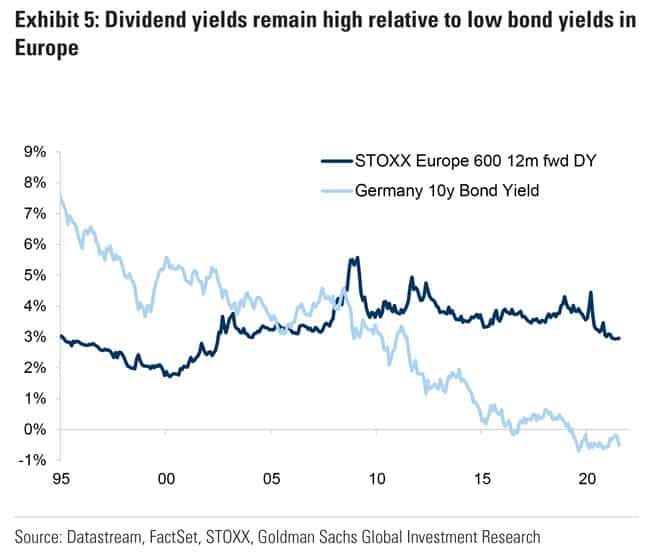

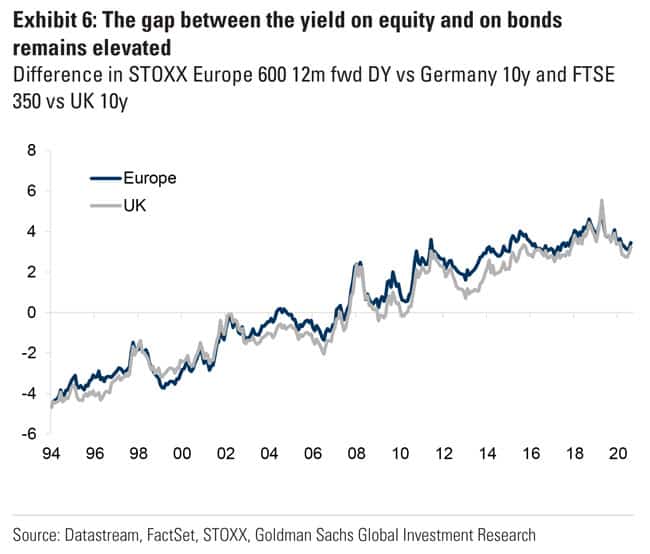

Assuming interest rates stay low, the situation on Europe's equity markets is likely to continue to attract more investors. Right now, European investors can "earn" a NEGATIVE 0.5% yield by buying German government bonds ("Bunds"), or they can treat themselves to a 2.5% dividend yield with a STOXX Europe 600 mutual fund. The difference between bond yields and dividend yields remains near the highest point it has been since the early 1990s. If only a small percentage of the trillions invested in negative-yielding debt was shifted to European equities, European markets would have a lot further to run.

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

Source: Goldman Sachs, "Europe - More to go" (10 August 2021).

During the past years, US investors were net buyers of European equities while European investors were net sellers. This was, among other reasons, due to the ongoing restructuring of European insurance companies and the widespread distrust of equities among European investors. Will it ever change?

Europe's ageing demographics could provide a crucial boost. Like everywhere else, retirees are pressed to achieve a yield on their savings. Even Europeans will increasingly realise that with central banks politically pressured to keep interest rates low at all costs, their savings will be ever more exposed to hidden inflation. One possible way out of the conundrum? Buy equities and benefit from companies' ability to deal with inflation by increasing prices and subsequently paying out attractive dividend yields. Putting money into a broad basket of leading European equities could well become fashionable as a means of hedging against hidden inflation.

You could simply buy index funds or a broad selection of mega-caps such as the GRANOLAS. However, this would leave you quite exposed to the ups and downs of the broader markets, and you would not get to capitalise on specific, higher-return opportunities. If you wanted to truly exploit the European equity markets for what they are worth, you'll need to either pick these opportunities yourself or get the help of people whose job it is to find the best opportunities among the large number of publicly-listed stocks available. Options to do so include (but are not limited to):

- Specialist funds: High-performing niche funds, such as German mutual fund Paladin ONE (ISIN DE000A1W1PH8), which I had featured in a research report in November 2019 and a Weekly Dispatch in August 2021, have made it their business to look for such opportunities. Paladin ONE's managers even had Hypoport in their fund's portfolio for at least some of the journey.

- Activist funds: The market for active fund management has shrunk relative to the size of the overall market. As a result, more opportunities are available for the remaining actors such as the European activist fund that has taken a major stake in the largely undiscovered Swedish stock, introduced to my Lifetime Members in August 2021. The fund in question has achieved a 283% return over the past six years, compared to the broader market's 52%. It's a somewhat unfortunate example, given that it requires a minimum investment of EUR 5m, but you could at least get your hand on the Swedish stock that has already caught the fund's attention.

- Undervalued-Shares.com: Last but certainly not least, those inclined towards specific opportunities can make use of Undervalued-Shares.com to find both information and inspiration.g., in January 2019, I featured Volkswagen (ISIN DE0007664039 preference shares) as one of THE European stocks to look at. Back then, Volkswagen was mired in the Dieselgate scandal and its stock was widely disliked. However, the stock's valuation was so low that I considered it a no-brainer investment opportunity if you had time to sit out the scandal. Volkswagen did subsequently take its time, largely due to the pandemic, but the company is widely seen as the #1 competitor to Tesla. It has turned into a model case of a sleepy European company taking its time but delivering quality results. You could call it a "Made in Germany" investment case, for lack of a better word.Incidentally, I am currently in the midst of preparing a similar in-depth research report for Undervalued-Shares.com Members. Once again, it'll feature a German company with a bombed-out share price and a multi-billion market cap, meaning the stock is liquid to trade. A low valuation, a decent dividend yield, and exciting prospects for 2022 and beyond are all part of the package. Keep your eyes open for "Volkswagen 2"!

Watch this space for further opportunities

As you can see, a broad scope of opportunities is available in Europe, and there are multiple ways to play the theme.

Just to have said it out aloud, not everything is golden in Europe – far from it. However, as an investor, you want to look for places where there's room for improvement. Europe offers such room in spades, and there is growing evidence that the continent will be a much better investment prospect during the 2020s than it has been during the 2010s.

As an introduction and high-level overview, I focussed much of today's Weekly Dispatch on a top-down view of European markets. There'd be plenty of specific aspects and opportunities to drill into, but I'll save them for another day.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: