Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

5 promising takeover candidates in Britain

Over the last 12 months, the pound sterling has lost 10% of its value against the dollar. The FTSE 250 Index is down 17% compared to September 2021. UK shares are trading slightly below their historical averages, at a time when US stocks are still trading 50% above these averages.

British bid targets have always been a lucrative sector for special situation investors, particularly cash-rich private equity companies from the US. With prices now even more affordable than last year, the stars are aligning for another round of bids for British companies.

Read on for a handful of specific targets.

Undervalued-Shares.com has long been onto this trend

For several years now, I've been going on about the wave of takeovers on the British market – and rightly so.

In October 2020, a Weekly Dispatch looked at Pearson (ISIN GB0006776081, PSON), the GBP 4bn market cap education and publishing group. The company had just come into the crosshairs of an activist investor, and I described the stock as "a situation worth following" because of its crass undervaluation. In March 2022, private equity giant Apollo Global Management (ISIN US03769M1062, APO) launched a GBP 7bn bid for the company. Even though the offer was rejected by management as too low, the stock is up from 500 pence to now 760 pence. Bidders could yet return with a higher offer.

In January 2021, a Brexit-themed Weekly Dispatch pointed at M&C Saatchi (ISIN GB00B01F7T14, SAA) as a possible target for a management buyout. In May 2022, one of the company's directors launched an unsolicited bid. A second bidder emerged and made a higher bid, which is now likely to succeed. The stock has gone up from 81 pence to currently 206 pence.

In March 2022, another Brexit-themed Weekly Dispatch predicted that Playtech (ISIN IM00B7S9G985, PTEC) "could see a renewed bid". In May 2022, the company confirmed that it was in continued talks with an Asian suitor whose first bid had been rejected as too low.

Why do I keep droning on about takeover targets in Britain?

Because there are unusually attractive bid premia to be earned, which makes for a truly unique situation among all the world's developed countries.

Bid premia you couldn't easily find elsewhere

As I wrote in my 16 July 2021 Weekly Dispatch, these takeovers involved "much higher average bid premiums than would have been paid historically". This has been due to the low valuation of the London stock market or, to be more precise, of old economy companies listed in the UK.

Indeed, there is still a notable number of extraordinarily high bid premia among the plethora of bids in the UK recently:

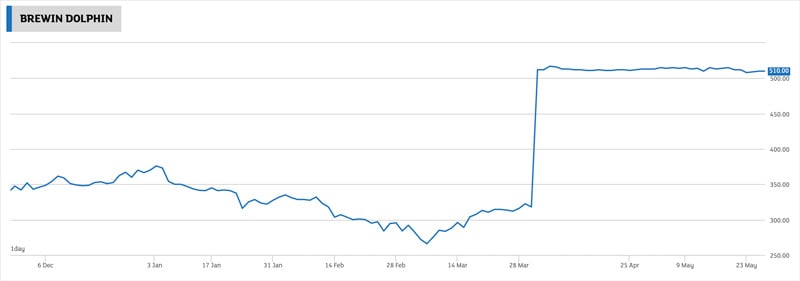

- When Brewin Dolphin (ISIN GB0001765816, BRW) agreed to a GBP 1.6bn takeover offer from Royal Bank of Canada in April 2022, the bid came in 62% higher than the undisturbed share price before the bidding started. The stock has gained over 100% during a time when markets crashed.

Brewin Dolphin.

- THG (ISIN GB00BMTV7393, THG) received a GBP 2bn bid approach from property tycoon Nick Candy, which was equivalent to a 48% premium. The bombed-out stock has since attracted additional interest, with a potentially epic takeover battle in the making.

- Homeserve (ISIN GB00BYYTFB60, HSV) agreed to a GBP 4.1bn cash bid by a Canadian private equity firm. The offer price represented a 71% premium to the closing price of the stock on 23 March 2022, the day before the market got wind of a possible bid.

Bids with very high premia remain a regular occurrence in Britain these days. As these examples show, they are by no means limited to illiquid small-cap stocks.

Where could bidders strike next?

5 targets worth keeping an eye on

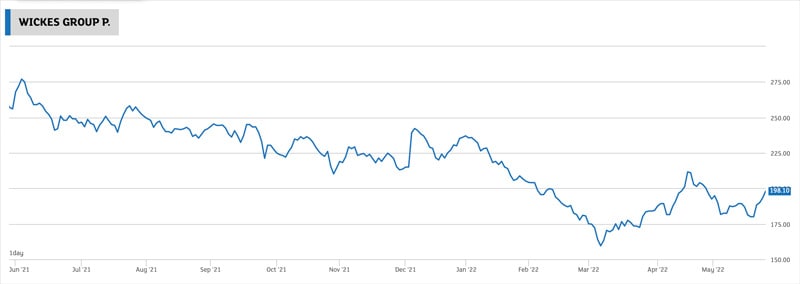

Wickes Group (ISIN GB00BL6C2002, WIX) is the UK's second largest DIY and home improvement retailer, with 232 stores turning over GPB 1.5bn annually. Since the company's demerger from its former parent company in April 2021, the stock has lost about 20% of its value.

I first got wind of Wickes Group when Christian Ryther of Curreen Capital featured the company at the 2021 Cyprus Value Investor Conference. It has since been featured in an extensive, free analysis published by Value Situations on 23 March 2022. As the article noted:

"WIX is trading at just 2.3x EBITDA; this compares to recent comparable private market transactions completed in the 6x - 7x range, and WIX's listed peers who trade at an average ~7x multiple. I estimate WIX is worth ~£3.44/share or 98% above the current market price on a stabilised basis."

With a free cash flow yield of ≈10% and no dominant shareholder, Wickes Group is an obvious target for financial bidders.

Wickes Group.

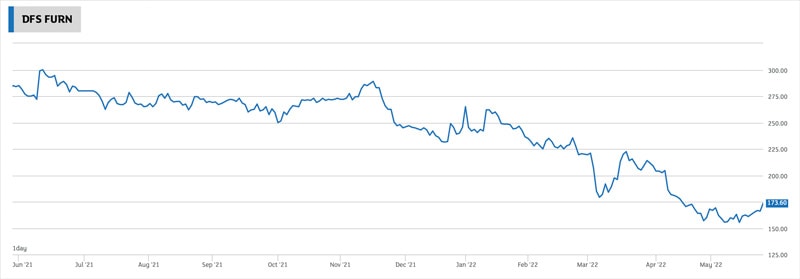

Another old economy company that fits right into the usual buying patterns of private equity is DFS Furniture (ISIN GB00BTC0LB89, DFS). The company is the UK's leading upholstery retailer and focusses on making and selling high quality sofas. With a price/earnings ratio of ≈5, a cash flow yield approaching 20%, and a low net debt/EBITDA multiple (excluding leases) of <1, it's a match made in heaven for a private equity bidder. The stock has recently become yet cheaper; DFS Furniture is effectively a sitting duck.

DFS Furniture.

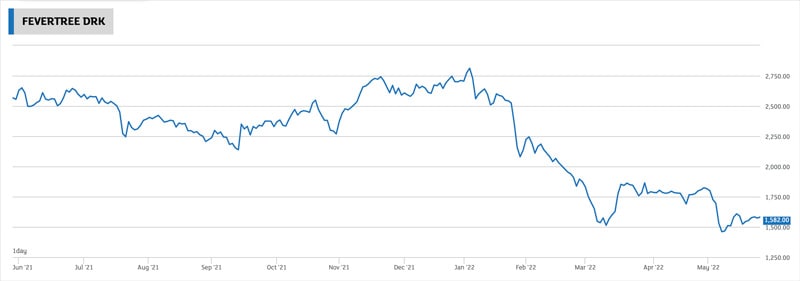

Those who prefer growth companies with a bid angle should look at Fevertree Drinks (ISIN GB00BRJ9BJ26, FEVR). The producer of premium drink mixers isn't a new bid target as it's been the subject of rumours for years. The company has racked up an impressive track record of growing revenue at a rate of 25% p.a. during recent years, and it is expected to continue growing at double-digit rates (well ahead of the single-digit rates that are typical in this industry). A larger player could bring significant synergies and improve margins. Fevertree Drinks has zero debt, GBP 160m in cash and could easily handle 1.5 times net/EBITDA. The 44% drop in share price since January 2022 has now left the company vulnerable to unsolicited bids, which could be launched by the likes of PepsiCo, Coca-Cola or Keurig Dr Pepper.

Fevertree Drinks.

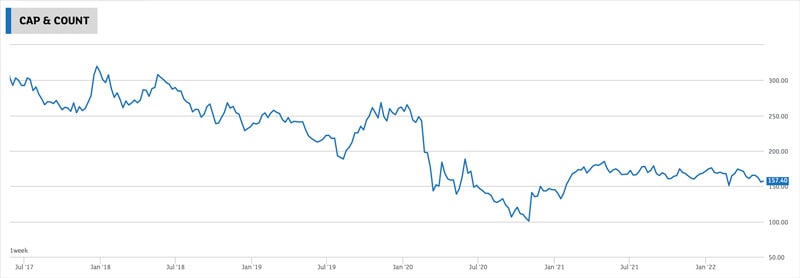

Undervalued-Shares.com Members are already familiar with Capital & Counties (ISIN GB00B62G9D36), a real estate holding that owns the world-famous Covent Garden estate in Central London. As predicted in my original research report, "CAPCO" is now trying to take over Shaftesbury (ISIN GB0007990962, SHB), the owner of the almost equally famous Carnaby Street estate in London's Soho district. The combined group would be a truly unique target for ultra-long-term investors such as sovereign wealth funds or pension funds. Indeed, Norwegian wealth fund Norges Bank has already become the largest individual shareholder of both companies. Once the two firms are combined, a cash bid is probably just a matter of time – and it should come out about 60% higher than the current share price.

Capital & Counties.

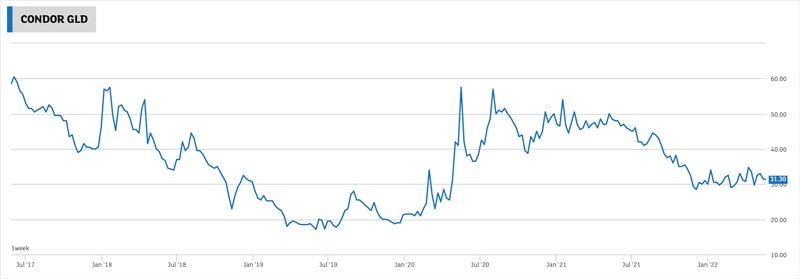

A microcap company that I recently stuck my neck out for is Condor Gold (ISIN GB00B8225591, CND), a GBP 46m gold explorer focussed on Nicaragua. My research report for Undervalued-Shares.com Lifetime Members dubbed the company Britain's next high-conviction bid target. There are indications that potential bidders have already started to sniff around, and the major shareholders are unlikely to sell for anything less than 100 pence – more than three times the current share price. The current market volatility might require investors to average down if the share price takes another hit. That said, after following Condor Gold for 15 years, it's a company that I believe is destined to be taken out through a cash bid sooner or later.

Condor Gold.

This trend will pick up more steam

The UK remains an active hunting ground for foreign buyers searching for cheap takeover deals. Increasingly, others come to this conclusion, too.

As Bloomberg reported in its 20 May 2022 article "Private Equity Can Lap Up British Businesses Again":

Graham Simpson, analyst at Canaccord Genuity Quest, recently identified 255 London-listed stocks with a market capitalization under £1.5 billion that were generating extremely attractive levels of free cash flow relative to their market enterprise value."

…

The question is whether shareholders will be willing to sell what private equity wants to buy. Right now, resistance is probably falling.

…

Last year, investors started to say no to bids – or demand higher offers – in spite of recommendations by the target company's board to take the private equity lucre.

The difference this time is that stock markets are much weaker. Bids are going to be increasingly attractive to asset managers as the year-end approaches and they're seeking to boost their annual returns. For private equity, still sitting on a lot of cash and incentivized to put it to work, it's going to be tempting to test the waters."

That's a fertile hunting ground indeed, and American private equity companies are increasing their staff in the UK to prepare the groundwork for more bids.

As This is Money pointed out on 24 May 2022:

"Vindi Banga, partner in the London office of Morrisons owner Clayton Dubilier & Rice (CD&R), said private equity firms which have bought companies from the AA to Asda in recent years would sustain their vociferous hunting in the UK.

…

Looking at the UK, Banga argued that many businesses listed on the stock market were still ripe for picking by private equity because their current price did not reflect their 'intrinsic value'.

This meant they were much more focused on investing in companies that churned out safe dividends, he said, rather than helping to fund riskier high-growth businesses.

Peter Orszag, chief executive of the financial advisory arm of investment bank Lazard, said that although rising interest rates would make it more expensive for private equity firms to borrow the money they needed to complete their deals, 'rates are still not dramatically high. I still think there's a lot of momentum behind mergers and acquisitions'."

The biggest bonanza of bids for British companies since the 1980s is likely to continue, and with bid premia that outdo the offers made during that golden decade. It's a truly one-off period, and investors should do their homework to take advantage of it.

Solution in sight to the ADR problem (German-language video)

The Russia-Ukraine war continues to pose significant challenges for investors, but there might be some light at the end of the tunnel.

What's the macroeconomic outlook for Russia, and what are the perspectives for holders of Russian ADRs such as Gazprom? What other macrotrends should investors be looking at more closely?

Join me and Stephan Wolf of Fokusinvestor for a discussion that couldn't be more timely!

Solution in sight to the ADR problem (German-language video)

The Russia-Ukraine war continues to pose significant challenges for investors, but there might be some light at the end of the tunnel.

What's the macroeconomic outlook for Russia, and what are the perspectives for holders of Russian ADRs such as Gazprom? What other macrotrends should investors be looking at more closely?

Join me and Stephan Wolf of Fokusinvestor for a discussion that couldn't be more timely!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: