Image by Milan Sommer / Shutterstock.com

This is already my third Weekly Dispatch about Getlink (ISIN FR0010533075), the French company that owns and operates the Eurotunnel underneath the English Channel.

For those of you who like to sharpen their investment skills, there is a useful lesson to be learned from the stock's recent movements.

What's more, in the aftermath of the coronavirus crash, it could be an interesting investment for some of you right now. The company might not survive as an independent entity for much longer, and could be gobbled up by a cash-rich bidder. Among the shareholders who could soon demand corporate action is one of Europe's hedge fund kings – who invested hundreds of millions to amass a 12.5% stake!

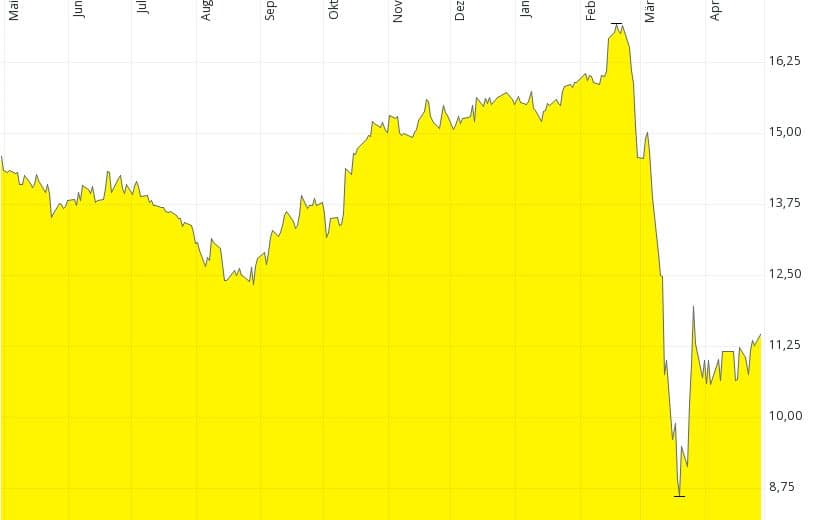

The coronavirus crash wiped out four years of gains.

A brief recap

Here are my two previous articles about Getlink:

- Significantly undervalued? Eurotunnel – and what its share price says about Brexit (October 2018)

- Eurotunnel: the 'Brexit share' is rallying – do markets know more? (March 2019)

As the headlines indicate, I had viewed the company as a thermometer for measuring the ongoing Brexit situation.

I thought it odd that despite the prospect of impending doom (as predicted by much of the media at the time), the stock of Getlink was performing rather nicely. After all, as the owner of the tunnel underneath the English Channel, one would have assumed the company was going to suffer mightily.

As the Brexit situation heated up, the stock kept rising. How was that even possible? The situation seemed counter-intuitive, at least at first sight.

By the time the UK left the EU, the stock had rallied 45%. It had reached its highest level since 2007 and kept rising in the weeks after 31 January 2020 (the date when the UK left the EU). The fact that the world didn't end after all presumably contributed to the stock's success.

Not surprisingly, though, it subsequently crashed when the coronavirus crisis struck. It lost half of its value, which is in line with the losses suffered by other tourism and infrastructure companies in Europe.

My first article about the company in October 2018 had called it "cheap, but not cheap enough". As part of my overall strategy of finding outrageous bargains, I gave out the motto to wait for an opportunity to get it even cheaper. As such, my readers missed out on the run-up before the Brexit date.

It's now back to a level where it deserves a second look.

The company IS suffering (like everybody else)

Needless to say, the coronavirus crisis has real ramifications for the company's business.

As a brief reminder, Getlink:

- Owns the Eurotunnel, under a concession that won't expire until 2086.

- Operates the "Le Shuttle" service to transport trucks and cars through the tunnel.

- Collects usage fees from the (separate) company that operates the "Eurostar" passenger trains.

Getlink loads cars, caravans and trucks onto special train carriages (Image: RogerMechan / Shutterstock.com).

With borders closed and tourism at a standstill, Getlink's business will suffer significantly in fiscal 2020. The majority of freight traffic going through the Channel tunnel is deemed "essential", which provides a level of stability during these difficult times. However, the number of passenger trains has been reduced from 50 to just two per day, which is in line with the collapse of air travelling.

Is this situation already reflected in the current share price?

Could the crisis actually turn into an opportunity for Getlink shareholders?

Is there a risk of Getlink going bankrupt yet again?

I've had a good look through all the recent analyst research.

Worrisome developments

If you want to put yourself off a potential investment, look no further than Goldman Sachs' research note of 23 April 2020.

Getlink's funding includes EUR 5.5bn of net debt, roughly ten times its EBITDA (earnings before interest, taxes, depreciation and amortization) until recently. While this is a fairly high level of financial leverage, it is far from outrageous, given that it was structured to be paid down over several decades. However, with trains stopped and EBITDA estimates for 2020 under severe pressure, the situation suddenly looks different.

As Goldman Sachs put it (slightly edited for context):

"On our revised 2020 EBITDA estimate of €357mn (€560mn in 2019), we calculate a debt service coverage ratio (DSCR) of circa 1.2x (2.2x last year), close to the main term loan covenant of 1.1x. … The DSCR is measured … at the end of June and end of December. … A DSCR <1.25x could also restrict Getlink's ability to distribute dividends next year (this year’s dividend has already been cancelled). We thus model no dividend payments for fiscal 2020 and 2021."

Breaching a debt covenant is no laughing matter. It could bring both the company and its share price under severe pressure.

Analysts at Citi Research are pointing towards another problem in Getlink's portfolio.

In 2012, Getlink started ElecLink, a project to put a gigantic electricity cable through the tunnel. Electricity in France was a lot cheaper than in the UK, and Getlink thought it had spotted an opportunity to make money off energy arbitrage between the two countries. The 51 kilometre (32 mile) cable with its ancillary facilities will cost EUR 750, and it was scheduled to finally go live in 2022.

It turns out that a lot can change in ten years. The electricity price spread between the UK and France has narrowed, and it is likely to narrow further. By the time ElecLink goes live, much of the opportunity will have vanished. Bank of America Research already estimates that 25% of the project costs are a write-off.

Getlink should have been a reliable dividend investment with a growing payout from its core business and an ElecLink dividend bonus from 2022 onwards. As of now, it looks like shareholders are at risk of two years without any dividends, as well as a high-profile disappointment when ElecLink is launched.

Why, for heaven's sake, should anyone pay attention to the stock?

Here are some thoughts that I don't believe the market has factored in yet.

Shake it up and auction it off

Chris Hohn is one of the UK's wealthiest money managers and most feared investors in Europe. His company, The Children's Investment Fund (TCI), is best known for audacious activist attacks on major companies around the world, including Deutsche Boerse (ISIN DE0005810055), ABN Amro (ISIN NL0011540547), and Japan's Electric Power Development Company, aka J-Power (ISIN JP3551200003).

Hohn believes in taking concentrated bets. He puts a few eggs into his basket (his fund is usually invested in only about 15 companies), and then carefully looks after it. I recommend you check out this blog post, an in-depth, fascinating profile of Hohn's success.

At the end of 2019, Hohn was managing EUR 30bn in client money. Between 2004 and 2019, his fund had made money every single year except 2008. In 2019, Hohn made 41% for his investors, beating the average hedge fund return of 10.35% by far.

Even a successful and experienced investor such as Hohn, however, occasionally ends up on the wrong side of the market. During the first quarter of 2020, TCI took one hell of a beating, with losses amounting to 23%. March 2020 was the fund's worst-ever single month with a loss of 19%.

TCI has had a difficult few months (source: Bloomberg).

TCI owns a 12.5% stake in Getlink, which makes it the company's second largest shareholder (not too far off the biggest shareholder with 15.5%). Even at today's reduced market price, the stake is worth a rather significant EUR 775m. It's also a fairly illiquid position, not the kind of stake you could quickly sell if you changed your opinion.

Hohn's fund has already been a significant shareholder since the turn of 2017/18, and the fund will have likely paid prices between EUR 10 and EUR 11. If my sources in the fund management scene are right, Hohn primarily bought into Getlink because he felt Brexit was going to turn out much more benign than the image painted by Brexit opponents. He allegedly also sees value hidden in the company, waiting to be unlocked through suitable changes implemented by management. So far, TCI has not signalled any intention of going activist on Getlink.

That may soon change, though.

ElecLink is near-certain to turn out a dud, debt covenants are dangerously close, and dividend cheques are going to stop for two years. This combination is likely to set off alarm bells in TCI's head office. At a time when the fund is under pressure to make up for its recent losses, it's fair to ask if Hohn will once again roll up his sleeves to intervene. Else, he might be stuck with an underperforming investment for a few more years.

There'd certainly be a lot for him to get his teeth into.

The crisis brings Getlink's weaknesses into focus

It's fair to say that relative to most long-term infrastructure plays listed on the world's stock markets, Getlink's stock is undervalued based on some measures. The extraordinary length of the concession, the sky-high replacement value of the tunnel, and the growing appeal of rail travel all add to the company's attractiveness. Insight Investment Research sees the company's underlying value at EUR 24 per share, despite the coronavirus crisis. That'd be well over double the current share price.

However, the stock has been undervalued for years. At some stage, shareholders will need to ask difficult questions.

Some of the questions are obvious:

- Any amateur observer will notice that Getlink had long been too lazy to pursue properly segmented pricing. Until recently, you were able to get a Range Rover onto the Le Shuttle at the same price than a compact car. Where else is Getlink missing a few tricks?

- Tying in with the previous point, there are compelling statistics that the company's management has missed out on the opportunities of the past decade. Since 2011, while the Eurotunnel division achieved 20% volume growth, 30% Le Shuttle pricing growth, and 20% Eurostar passenger growth, the EBITDA margin has remained flat. To add insult to injury, the management has explicitly promised higher margins for years. Why didn't the board act in light of the repeated failure to deliver on promises?

- Rather than fixing its reputation in capital markets, Getlink has gone backwards. A laser-sharp focus on its stable infrastructure income would have been the right strategy to maximise shareholder value. A division for arbitrage transactions in the electricity market increases earnings volatility, it doesn't make it more predictable. Has anyone been held accountable yet for the misallocation of capital?

An experienced activist with deep insights into the company could undoubtedly find other issues. When share prices are under pressure, such questions are much more likely to come to the fore.

Is Getlink soon going to face the wrath of Chris Hohn?

The next six months should yield clarity whether TCI is going to simply let matters linger on. I have no insight into TCI's current thinking, and I am merely thinking out aloud after looking at the evidence. There is also a new CEO joining the company later this year, which could also change the dynamics.

What I do believe is near-certain, though, is that Getlink will eventually fall into the hands of a bidder. It's just waiting to happen.

Getlink's size and character are ideal for a particular type of investor

Infrastructure investments do have their very own appeal.

More often than not, they are characterised by:

- Steady, reliable income.

- A monopoly or similarly strong market position.

- Significant overall size, allowing institutional investors to deploy large amounts of money in one fell swoop.

If managed properly, Getlink could offer an appealing proposition for the world's major infrastructure investors that goes well beyond financial aspects.

Public pension funds and other investment vehicles are currently under pressure to implement so-called "green" investing. The problem is, there is only a limited number of large-scale investments that qualify. What better asset to buy than a tunnel that gets people onto railway tracks rather than into jet planes?

A more proactive management team might also be able to tackle the company's persistently low average utilisation rate. In 2019, the Eurotunnel was operated at just 53% of its capacity. If Getlink succeeded in making better use of the capacity, there could be significant additional earnings. For a business that is as heavy on fixed costs as Getlink, each extra percentage of utilisation can make for an outsize addition to earnings. (In fairness, the recent addition of a London-Amsterdam route is a step in the right direction. Why did it take them so long, though?)

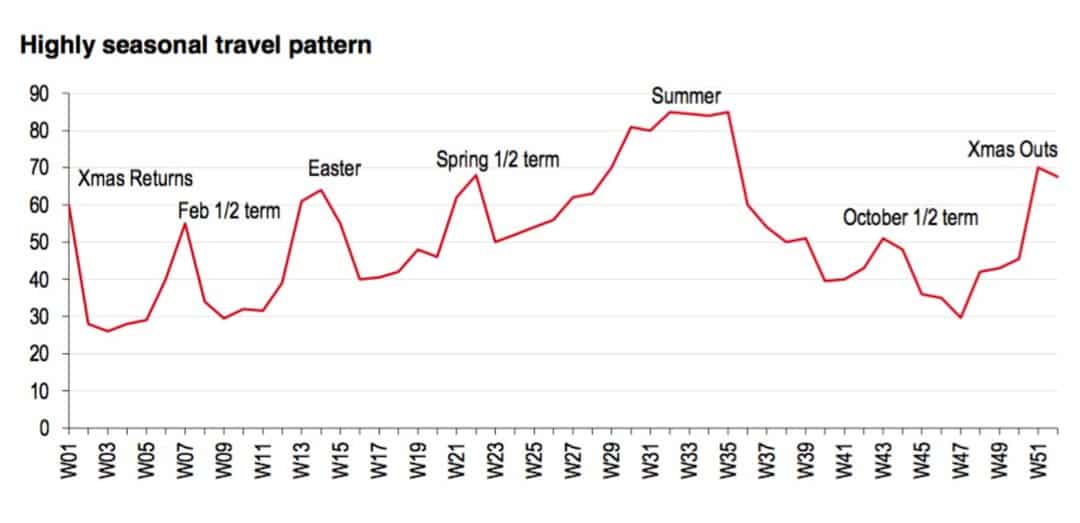

Across the year, the Eurotunnel operates at just 53% of its capacity.

Eurotunnel is one of the few publicly listed European railway plays (from Paris, Brussels and Amsterdam onwards, Eurostar passengers need to travel with trains operated by other service providers).

There could even be potential for disruptive moves. Some have speculated that the Eurotunnel's capacity would be much better utilised if the Eurostar monopoly was brought to an end, allowing a low-cost competitor to use the London-Paris and London-Brussel routes. More competition increases the overall market size and capacity utilisation, similar to what happened in the airline industry in the 1990s. Why not use these two routes to have someone invent the Ryanair-equivalent of European long-haul railway travel?

In any case, a new owner could achieve a reliable base income and potentially improve margins or add new sources of income. It's entirely reasonable to argue that Getlink needs a strategic shakeup. As a reasonably frequent user of the Eurostar, I can attest that the train is run like a state-run airline of the 1980s. If someone came along and bought 100% of the company, it would be much easier to implement large-scale changes.

Who are the candidates for such a move?

Atlantia SpA (ISIN IT0003506190), one of Europe's largest investors in toll roads, airport infrastructure and transportation services, has already positioned itself as Getlink's largest investor. With a 15.5% stake acquired for EUR 1.1bn (about EUR 12.90 per share) from a Goldman Sachs-managed fund, the Italians have a meaningful commitment and a guaranteed seat at the table.

Eiffage (ISIN FR0000130452), a major French civil engineering company and third largest investor in Getlink, acquired a 5% stake in late 2018.

Atlantia probably wouldn't be able to raise the funds to buy the entire company. It had to deal with the fallout of one of its bridges collapsing in Genoa, and is already highly leveraged.

Eiffage is too small and certainly doesn't have the firepower to pull off a bid.

However, other players could get the job done. Vinci (ISIN FR0000125486), a French investor in concessions and infrastructure projects, is just one example for a company that could have an interest and would be able to muster such a bid. With a market cap of EUR 45bn even after the recent stock market crash, Getlink would be the right size bid target for a company like Vinci. It would also be on the company's home turf. Vinci has a strong balance sheet and could pull off a bid without too much ado.

You can add any large pension fund or private equity company as a potential bidder. Getlink is a large-scale, long-term asset that investors of this calibre would be licking their finger for.

Maybe Hohn will go activist with the aim to put the company up for sale?

Stranger things have happened, and Getlink shareholders can't be happy about the status quo.

The value of a "shopping list"

Getlink also provides an exemplary lesson on how useful and financially valuable it is to keep a shopping list.

I follow an entire swathe of companies that I would be interested in if only the stock were available at the right price.

When I first reported about Getlink in October 2018, I pointed out that it was cheap, but not yet cheap enough to convince me that it was a buy.

As I said back then:

"I wouldn’t quite jump at it at current share prices (EUR 11.10). However, if there are some Brexit ripples after all or if world markets take a 2008-style dive, it could be worth keeping Getlink on your radar. Maybe it’ll dip significantly below EUR 10 for one reason or another. If or when it does, the share will be quite cheap, based on the currently available figures."

Low and behold, we did get another 2008-style dive. The stock fell to EUR 8.60 in February/March 2020, a level not seen since the immediate aftermath of the Brexit referendum.

It has bounced back a bit (for now), mostly trading between EUR 10 and EUR 11.

Will the stock test its recent lows once more?

If the markets took another turn for the worse and the stock tested its recent lows, it would probably be worth buying. Not only will Getlink be cheap relative to its underlying assets and potential, but there are several large investors who are currently stuck with their investment. At prices significantly below EUR 10, one or the other of them would probably start to add to their position.

Anything below EUR 9 would be a bargain, allowing you to simply stash the investment away. Even if the company breached its debt covenants and had to carry out a small rights issue to fix the problem, you'd own the asset for less than half of what it would likely fetch in an auction. If there wasn't going to be a bid, you'd eventually see dividends return.

The quick, but short-lived drop to EUR 8.60 teaches a useful lesson. It pays to have a shopping list of companies, so that you can strike quickly (and without the need for extensive research) when the market temporarily gets out of kilter. Now that you have read this Weekly Dispatch, you can prepare and be ready if or when the stock drops below EUR 9.

The most exciting aspect is, of course, any potential move by Hohn. The lower the share price, the more pressure for him to act.

You could probably do worse than keep a close eye on this situation.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year