E-commerce giants used to originate almost exclusively from Silicon Valley, but not so anymore. During the past few years, the world has increasingly seen the emergence of national e-commerce champions hailing from elsewhere.

China has Tencent, India has Jio, and Russia has Ozon – to name just a few.

Quite a few of these new e-commerce champions have made their shareholders rich. For example, I pointed out MercadoLibre (ISIN US58733R1023) in a Weekly Dispatch in January 2019. At the time, I was asking if this could become South America's equivalent to Amazon.

A mere two years later, the stock is up 400% and MercadoLibre has become a globally-known blue-chip company that is worth USD 80bn.

However, a short 24 months ago, most investors would have shrugged their shoulders at the mentioning of the company:

- “MercadoLibre? Never heard of it.”

- “Argentina? Good lord, there is so much corruption.”

- “Why would anyone need another e-commerce company if there is Amazon?”

During these ensuing two years, the stock market has begun to recognise that not all technology champions originate in California. A growing number of investors have already latched onto the idea of national (and regional) e-commerce and tech giants emerging in surprising locations.

It makes sense. The world is a big place, and many localities require approaches that are quite different from the American way of operating.

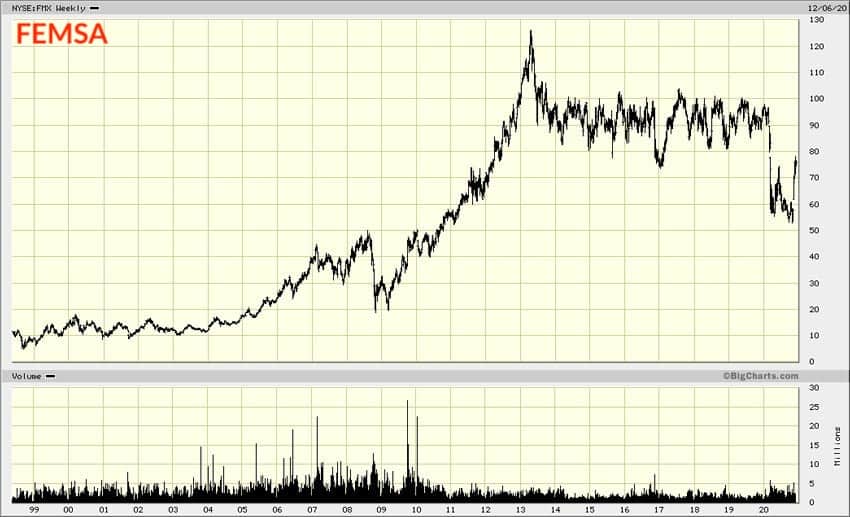

That's why the equity story of Mexico's FEMSA (ISIN US3444191064) is worth taking a look at.

It's not a new story per se, but one that the wider public has not yet heard about.

The Weekly Dispatches aim to broaden your investment horizon, and I'll introduce you to a company that you might want to add to your watchlist.

Underbanked, underserved – and with all the more growth potential

Mexico is the world's 15th largest economy with 130m consumers, but it is not a country that you'd commonly associate with e-commerce (yet).

Two thirds of its population don't have a bank account, meaning they cannot easily pay for online transactions.

It gets worse. Without a reliable postal service, deliveries are difficult and expensive.

Never mind classic emerging market factors, such as a lack of Internet bandwidth, the low purchasing power of significant parts of the population, and bureaucracy making any form of innovation difficult.

However, problems and barriers are, ultimately, opportunities in disguise.

The entrepreneurs who are able to solve and overcome these issues will reap ample rewards.

That's why emerging market investors with knowledge of Latin America have long had an eye on FEMSA, or Fomento Económico Mexicano, S.A.B. de C.V. as the company is officially called.

The family-controlled company is Mexico's third largest publicly-listed company by market capitalisation, currently worth USD 25bn. It has a 130-year history of dealing with Mexico's peculiar challenges and repeated crises, and during multiple generations of family ownership has proven resilient. Each time the country was struck down by yet another crisis, FEMSA eventually came back even stronger than before.

In recent decades, the company was mostly known for producing beer and operating the largest Coca-Cola bottling operation outside of the US. For most of the recent past, investors would have valued it as a conventional play on the Mexican consumer economy.

However, it could soon become known as an emerging e-commerce and fintech giant. Such a new chapter in the life of FEMSA could turn out to be extraordinarily lucrative for shareholders, if the investment thesis currently bandied about holds water.

Here is what you need to know in a nutshell.

Using retail infrastructure to push into digital services

Since 1978, FEMSA has invested in building a national chain of convenience stores, OXXO, which is similar to the 7-Eleven chain in the US. The 100 sq m / 1,100 sq ft shops sell over 3,000 fast-moving items that fit into consumers' daily lives, ranging from soft drinks to cigarettes and toiletry. As a place where consumers purchase products "on the go", prices tend to be higher than in supermarkets. Retail may seem like a boring business, but FEMSA has been earning healthy revenue margins.

The company's original plan had been to use these outlets for selling beer and Coca-Cola produced by its existing businesses. However, the shops have now become a vital asset for potentially achieving a dominant role in Mexico's e-commerce and fintech sector.

How so?

Mexican consumers mostly rely on corner stores to purchase digital services. Without a bank account and debit card, they have to go to a physical store where they can pay for digital services in cash. OXXO offers a digital wallet, which consumers can pay cash into at the counters of its stores. Millions of Mexicans use the service to load cash onto their digital wallets, which they can then use to pay for services such as Netflix or Spotify.

In an unbanked, cash-orientated society such as Mexico, having such a physical interface between consumers and web services is vital for getting e-commerce going.

Every day, 14m Mexicans pass through the 19,500 OXXO stores. The company has been earning a 30% return on its equity invested in the retail chain, and it keeps investing in opening more stores. Every day, three new stores are added. It is estimated that Mexico is big enough to let FEMSA expand to 30,000 OXXO stores.

As a place where to capture consumers and make them sign up to an app, the OXXO store network is an incredibly valuable asset that no other company in Mexico can even remotely compete with. To give you an idea of the size of the chain, FEMSA alone has more outlets than the country's entire banking sector – they only have 13,500 branches. Measured by the total number of stores, OXXO is the largest retail chain in the Americas.

A company that successfully markets such a digital wallet service is in a powerful position. Consumers that pay through digital wallets inadvertently provide information about their shopping preferences, which enables targeted marketing. A company that controls a country's leading digital wallet can use its market position as a stepping stone towards offering other digital services. Eventually, a network effect sets in. The most widely used digital wallet becomes a focus of attention that attracts ever more users and which leaves smaller operators by the roadside.

In industry lingo, the digital wallet can turn into that country's "super app".

In China, hundreds of millions of consumers operate their life through WeChat, the super app owned by Tencent. Through WeChat, Tencent came to dominate the Chinese e-commerce market.

In India, something similar may be about to happen through Jio, the app that Reliance Industries recently raised USD 20bn for. Reliance Industries has been using its retail chain, Reliance Retail, to spread use of the app. It has been successful in marketing a digital wallet in a country that is known for being chronically underbanked. Does that sound familiar by now? Check out the stock price of Reliance Industries.

A bit nearer to FEMSA's home country, MercadoLibre also provided a case study for using a digital wallet to successful establish an e-commerce operation.

There are plenty of examples how it's done, and FEMSA seems to own all the right assets to be the next in line.

Will the company be able to replicate what companies elsewhere have already achieved?

The jury is out, but a successful roll-out could be extremely beneficial for FEMSA shareholders.

Valuable financial assets and a low valuation

Right now, FEMSA is mostly known for its two major legacy assets.

FEMSA's origins were in brewing beer, and the company's biggest asset is a 15% stake in Heineken (ISIN NL0000009165), the publicly-listed Dutch beer conglomerate that today is Europe's largest brewer. In 2010, FEMSA sold its entire Mexican brewery operation to Heineken in exchange for a 20% stake in the Dutch company (which has since then been diluted to 15%).

FEMSA also owns a 47.2% stake in Coca-Cola Femsa (ISIN MX01KO000002 and US1912411089), a publicly-listed Coca-Cola bottling operation.

Being invested across beer, soft drinks, convenience stores and a few other sectors, FEMSA is a mixed conglomerate. A hotchpotch of completely divergent businesses usually trades at a significant discount to its underlying asset value, and FEMSA is no exception.

Enter the year of COVID-19, and you have a stock that is currently undervalued by many a measure.

If you deduct the value of the stake in Heineken and Coca-Cola Femsa, the remaining core business of FEMSA is now the cheapest you have been able to buy it for since 2010.

Unusually, the company isn't just undervalued relative to its existing assets. It's also undervalued relative to its growth potential, if you believe that it will turn itself from a conventional consumer goods and retail company into an e-commerce operation.

The question is, will there be a catalyst that leads to a higher valuation and a corporate transformation?

Enter a potential sale of the Heineken stake, and the rise of OXXO as Mexico's potential e-commerce, fintech and digital services giant.

Catalysts to get the stock price going

FEMSA has already been free to sell the stake Heineken since 2015. So far, it had held on to it. However, with a 15% stake, FEMSA has no say over Heineken's strategy and the stake is primarily a financial asset. For the future of the Mexican group, it's probably more important to sell the stake at an attractive price and reinvest the money elsewhere, than to hold on to it for eternity.

Following a steep decline during the Corona crash of spring 2020, the stock price of Heineken is now back to where it was trading at the beginning of the year. It is also near the highest point its traded at since 2000.

Will FEMSA's management soon pull the trigger and sell the stake?

It would certainly go a long way towards raising cash for investments in growth sectors. Mexico has a young population with an average age of just 28 years, and putting the money to use at home seems like a better option than holding out for the dividend of a global brewery company. Coincidentally, a ten-year agreement that FEMSA had stuck with Heineken in 2010 is about to expire. The writing seems to be on the wall for FEMSA's stake in Heineken. A sale would yield around USD 9bn, or about a third of FEMSA's current market cap. That'd be plenty of cash to fund a digital transformation of the remaining business.

FEMSA has a number of steps available to itself for rectifying the problem of its low share price, including:

- Selling its stake in Coca-Cola Femsa (or distributing the stock to its own shareholders).

- Inviting strategic investors to take a stake in OXXO, just as Reliance Industries allowed Facebook to invest USD 5.7bn in Jio.

- An IPO of OXXO.

There are possibilities galore.

The question is, will the management make it happen?

The right people in charge

Given the company is controlled by a family rather than corporate bureaucrats, it seems likely they will eventually pull the trigger for yet again transforming FEMSA. Getting the company ready for a new era is something the family has done repeatedly over the generations.

Did I mention that Bill Gates is invested, too? His investment vehicles hold 9% of FEMSA, and among his board representatives is one of the brains behind Warren Buffett's operation.

As a value investment with potential catalysts for a revaluation, FEMSA ticks a lot of boxes. You can read a lot more about it in this in-depth analysis published by Packy McCormick's Not Boring blog, which is one of the best summaries of the opportunity.

Following a difficult year, which involved FEMSA having to deal with Mexico getting hit particularly hard by the pandemic, FEMSA's longer-term fortune could be looking up.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Who in their right mind would touch Twitter right now?

I would!

I've dug deep into the ugly duckling of the world’s publicly-listed social networks. There is plenty going on behind the scenes, and Twitter could indeed become a high-growth story once again (in fact, as soon as 2021!).

How come?

Find out in my latest research report - now available for Undervalued-Shares.com Members.