You will have come across so-called "perception gaps" in different parts of life. They describe, for example, the way we see ourselves and how others actually perceive us; or cases where you meant to communicate one thing, and your audience understood something entirely different.

Perception gaps are a result of human flaws, and they also exist in the investing business.

My mission is to find perception gaps that relate to publicly listed companies, and figure out how to make money off them.

In an ideal case, such as perception gap consists of the following:

- A widely-known company is perceived negatively by the investing public for a variety of reasons. Because of this negative perception, the stock is trading at a cheap valuation.

- My research leads me to conclude that the reasons for the company being perceived so negatively are already outdated. This needs to be backed up either by hard, substantial evidence or by intelligence that I gather from industry experts.

- There are reasons on the horizon why the wider public's perception of the company will soon change.

Let's take a look at a concrete example of how such a perception gap looked like in the case of one specific company, and how the initial phase of this gap closing has unfolded.

This example will make it clear to you how to profit off such perception gaps, and also explain in a bit more detail what kind of research I carry out and write about.

A widely-known company that many people had an opinion about

Most people will have heard of Gazprom, the Russian gas company: Europeans, because it is their prime gas supplier; Americans, because some American politicians and media outlets regularly mention the company in the context of US-Russian relations and geopolitics.

At the end of last year, had you asked any random selection of investors about Gazprom, they would have said the following:

- "I know the stock is cheap, but I am concerned about Putin's corrupt cronies siphoning off all the money instead of shareholders benefitting from it."

- "The individual companies that Gazprom is made up of are probably worth a lot more than the current share price, but Gazprom will always remain a convoluted, intransparent behemoth."

- "Gazprom is already such a dominant supplier in Europa that it has run out of room to grow."

These widely-held notions about Gazprom kept most investors from buying into the stock. It had a very low price-earnings ratio of 4 and an attractive dividend yield of 6%. Its pipeline network alone was worth several times its market capitalisation, valuing the entire rest of the business at zero. But none of these analytical figures mattered, because of the company's overall perception.

Fast-forward a few months, and that perception gap has changed.

One single announcement changed the equation

A week ago, Gazprom announced that its dividend payment for 2018 will be doubled.

This came as a surprise to those who had thought that Gazprom's increasing profit was never going to benefit the shareholders. It also led to Gazprom stock suddenly featuring a ridiculously high dividend yield of 10%.

Kleptocrats stealing the company's money had up to then been the no. 1 concern of the investing public, by a mile. With one single announcement, this concern started to appear like an outdated fear.

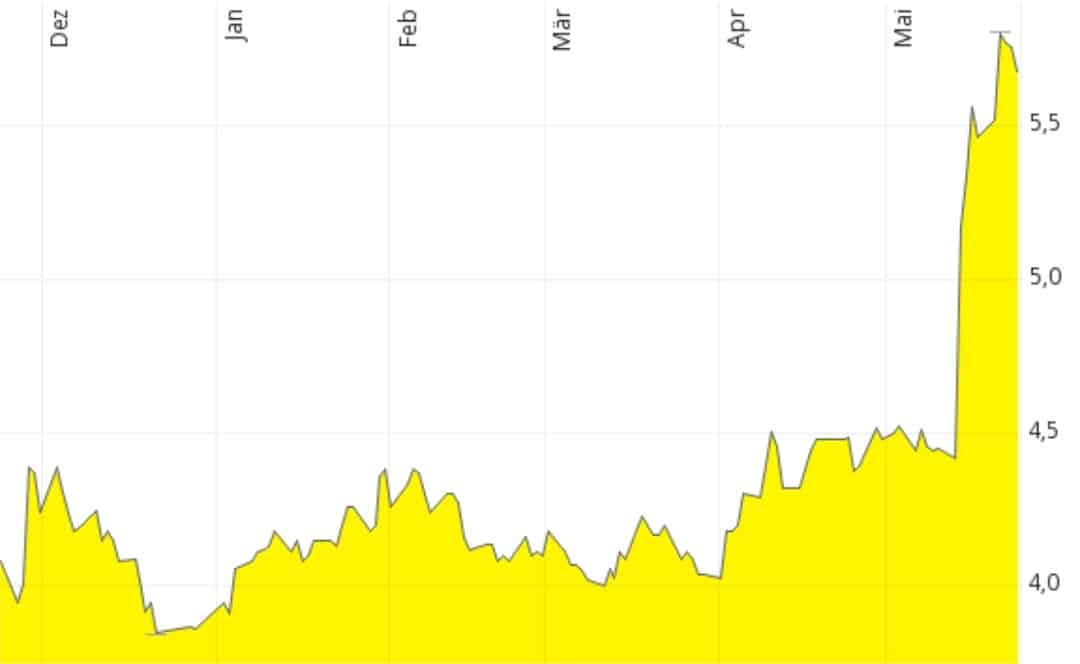

That day, Gazprom shares leaped 20% and recorded the single biggest one-day gain in over a decade. That's a massive jump for the stock price of a country's biggest company.

Curiously, it had already been apparent last year that a development of this nature was likely to happen. Anyone who had studied the extensive information that Gazprom regularly publishes about its own business could have figured out that:

- Gazprom was about to experience a massive increase in free cash flow and net profit, because of the part of the investment cycle it was in.

- Gazprom's management had become extremely keen to demonstrate to the investing public that it had upped the ante for its corporate governance. Why else would it have gone on a global roadshow to present its governance policies to investors?

- The state of Russia, which holds the majority of Gazprom shares, was bound to support a change in dividend policies. After all, it had already done the same at a number of other state-dominated companies.

That's why I refer to this case as a "perception gap". The perception was one thing, while the evidence and the situation on the ground were already strongly pointing towards another thing.

Eventually, the market caught up, and the share price rallied.

Further such changes appear to be "in the pipeline" (no pun intended)

Curiously, it's already pretty clear what could cause the next such jump in share price.

Gazprom has always been perceived – quite rightly – as a company that is too big and too complex for anyone to make sense of. This is a company that single-handedly makes up 8% of the entire Russian economy, and it employs almost as many staff as the US Postal Service. If you go through its list of subsidiaries, you will have to look at hundreds of different companies.

It's difficult to assess what hides inside the depth of the company's balance sheet, which creates uncertainty. Investors don't like uncertainty, which is why this was another reason for investors to stay away from Gazprom.

Lo and behold, this perception gap might start to close, too.

Earlier this week, it was reported that Gazprom is currently considering to pursue a separate stock market listing for one of its principal subsidiaries. The press hasn’t reported about it yet, but anyone with a Bloomberg terminal can look up this report (see screenshot below).

Gazprom has a whole range of significant subsidiaries that should be spun off, or sold. This will make the company easier to analyse and increase investors' confidence.

For now, this issue remains a "perception gap in the making". Once the first company is spun off, everyone who clings on to the view that Gazprom will forever remain intransparent because of sheer size and complexity will have an outdated view.

This is an excellent example for how most developments don't just happen entirely out of the blue, but instead, there are some advance hints for those who pay attention to detail and make an effort to follow a large number of news sources.

Finding and analysing such perception gaps in the making isn't easy, but it's not rocket science or black magic. All you need to do is read a lot and connect the dots. Though, obviously, this is a time-consuming business.

Only one source has reported about this yet, but others are bound to spread the message soon.

Most people suffer from having a static view

Another widely-held notion about Gazprom is the concern that it has basically run out of room to grow.

- In Russia, it already supplies most of the domestic market with gas. Add to this the fact that the Russian population is declining.

- In Europe, Gazprom has had an anti-trust lawsuit thrown at it by the EU because of its high market share of around 35%. The company subsequently committed to not increase its market share too much beyond the current level.

- According to bank analysts, Gazprom's massive new pipeline to China was going to be a loss-making venture. Surely this rules out further expansion in this important part of Asia, right?

Curiously, with all of these concerns, there are at least indications that they will be overtaken by events, or are focussing on the wrong aspect.

Here are just some of the reasons why this could well be the case:

- In the domestic Russian market, Gazprom's situation doesn't so much depend on market share, but on pricing and ancillary factors. The company is currently selling gas to Russian consumers for an artificially low price. It is also forced to take on clients with a bad payment history. What if these factors were to gradually change?

- In the European market, the limitation to increasing its market share further is primarily caused by one single factor. Gazprom currently has a monopoly on pipelines leading from Russia to Europe, which brings it into conflict with the EU's energy market directives. If these pipelines were opened to other Russian gas producers – in exchange for a pipeline usage fee – then there'd be very little the EU could do to stop Gazprom's expansion in Europe, e.g., by extending its pipeline network deeper into Europe's West.

- The company has been holding its cards close to its chest when it comes to the economics of the pipeline to China. However, recent and repeated hints suggest that Gazprom is considering to build a second pipeline to China. If the first one was loss-making, why would the company's management now be considering building another one?

These are factors that are on "perception gap watch". There isn't a clear perception gap yet, because these factors relate to future aspects and at least for now, some of these concerns are entirely valid. But there are strong indications that something could change in a significant way. When it does, the market is likely to react in a similar fashion to how it reacted to news about the new dividend strategy.

Just like when driving a car, when you pick investments, you have to keep an eye on what's appearing further down the road.

Gazprom turned into a textbook example in the space of just a few months

I admit that I have picked the particular example of Gazprom because it also provides me with an opportunity for shameless self-laudation.

Back in December 2018, I published a 91-page report that was basically a summary of all the perception gaps that existed about the company at that time:

- Profits not getting to the shareholders? I wrote about a new era of increased dividends being likely to start in 2019.

- Convoluted giant? I told my readers that spin-offs of companies, including potential listings on Asian stock exchanges, were likely in the making.

- Lack of room to grow? I described why there is plenty of room for Gazprom to increase both revenues and profits, subject to strategic moves being made.

This was a classic perception gap if ever there was one: The evidence was already quite clear, but the market stubbornly refused to take note.

I was confident that the public perception was eventually going to change. Why? Because the company is so big and so widely-known, eventually the media will pick up on the real situation. This was a situation that was different from small-cap companies, which can remain hidden from the public's sight for a very long time because hardly anyone reports about them. When you focus on large companies (as I do), you can count on the message eventually getting out there because of journalists writing about it and spreading the message.

Since December, Members of my website have received a couple of other reports that identify and analyse such perception gaps. Yet more will follow over the coming months.

Hopefully, the example of Gazprom will have made it clearer to you why these require a fair amount of work, and why having a clear-cut analysis of them can be worth a fair bit of money to investors.

On that note, I am back to reading and researching, which is what I spend about 90% of my time on these days!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year

P.S.: Check out my latest in-depth report about an investment opportunity you won’t get to read about elsewhere (yet!). Available for Members only so sign up now to get immediate access.