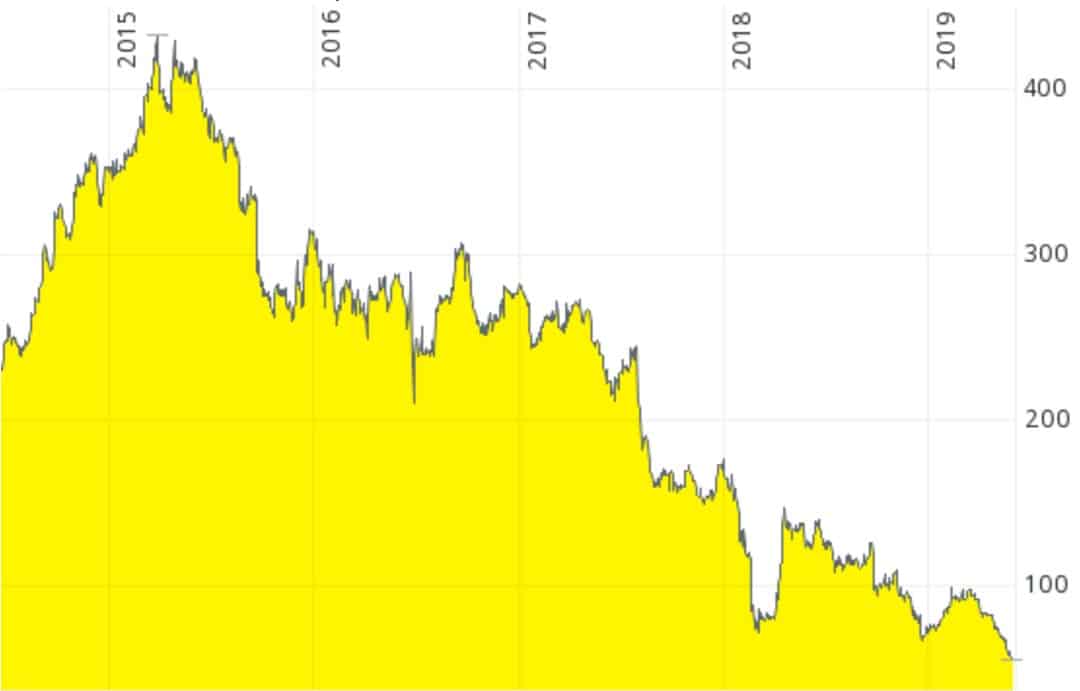

Since its high-profile IPO, shareholders of Britain's "Automobile Association" have gotten absolutely slaughtered. Following its 87% drop in value, I set out to look at the company from not just one, but several different angles. What led to the disaster, what lessons can be learned from the IPO failure, and is now the time to buy into the company at rock-bottom prices?

In case you didn't know already, "The AA PLC" (GB00BMSKPJ95) is the legal successor of Britain's Automobile Association, the organisation created in 1905 to provide rescue services to stranded drivers and all sorts of other services for motorists. Its American equivalent is the AAA Auto Club; Germany's local version is the ADAC, and similar organisation sprung up in most other Western countries around the same time.

As a nationally-known brand name, the 2014 IPO attracted significant attention among retail investors. The initial months saw the share price rise from GBP 2.50 to nearly GBP 4.50. Since then, the floor has fallen out and shares are now trading at less than GBP 0.60. Ouch!

Since I have a weakness for traditional British brands, I couldn't resist taking a closer look.

A survivor throughout decades of fast-paced change

It's impossible to get a grasp of the AA's current situation and future prospects without also taking a look at its history. This is an organisation that has witnessed massive changes in its sector over the past century, e.g. it put up all the road signs across Britain, before this responsibility was passed onto the government in 1931. In some ways, the AA literally created the industry that it is operating in.

The organisation also repeatedly adapted to new technologies. During the 1920s, it created a nationwide network of wooden telephone boxes along motorways, so that members could call for help. These boxes were in use until the 1960s. It's easy to imagine what a prominent position the AA had in the minds of Britons, given that anyone driving along a motorway couldn't help but notice its products.

Even today, it is one of the country's largest personal membership organisations, only outdone by three other British organisations. If corporate memberships are counted – the sort of packages that are sold to car dealers who then bundle an AA membership with the sale of a car – no less than 20% of the entire UK population are a member of the organisation. The combined personal and corporate membership rooster comes in at a staggering 13 million. This is a truly national brand if ever there was one.

The incredibly deep market penetration was only possible because the AA regularly adapted to the ever-changing requirements of motorists. The company stood the test of times.

Though nothing quite prepared the company for its recent period as a stock market listed entity!

Hitting a perfect storm of challenges

Originally owned by its members, the AA "demutualised" in 1999 (i.e., it changed its legal status to that of a company), and eventually went public in 2014. At the time of its IPO, it was one of the highest-profile new issues on the London Stock Exchange. Nota bene, this was at a time when UBER had only just started to expand outside of the US; talk of self-driving cars still appeared to be fiction; and electric vehicles, which have fewer parts than combustion engine vehicles and require less servicing, did not yet enjoy the attention they are currently getting.

After its going public, the company faced a perfect storm of challenges:

- Cars of any kind continued to become ever more reliable, making consumers question if they even needed an AA membership. Membership has been declining over the past few years, also on the back of widespread complains in the Internet that the membership is way too expensive compared to competing services. Because of services like UBER and the combined threat of self-driving fleets and electric vehicles, an ongoing membership decline has become shareholders' biggest fear. Last year, personal membership count was down 2%.

- Selling car insurance, one of the AA's biggest sidelines, became properly commoditised. Who doesn't simply check a price comparison website and buy the cheapest insurance available that has decent customer reviews?

- Issues in its management team, including a boardroom (!) punch-up (!!) involving the chairman (!!!). This made national headlines and is now forever ingrained in investors' memories.

Worst of all, its former private equity owners left AA with a substantial debt burden. The company has GBP 2.7bn in net debt, which is 2.7 times its annual revenue. What's more, the company had to refinance some of the debt and face higher interest rates when doing so. Oh, and did I mention the GBP 150m gap that turned up in its pension provisions?

The company's market cap has now shrunk to less than GBP 350m.

If it managed to once again adapt to the industry's changed circumstances, surely its shares could stage an impressive turnaround?

I spent a day reading up on the AA to form a view.

The market has not yet bought into the new story of "Technology Service Provider"

As someone who doesn't even have a driving license (though I did once own a car – a story for another day!), I've got neither a horse in this race nor any predefined ideas about the AA as a business. It simply struck me as a company that has such a strong brand name that I'd be inclined to believe someone, somehow will be able to get this company back on track.

Following the hiring of a new CEO in 2017 and other far-reaching management changes, a visible effort was made to rebrand the AA as a company that isn't threatened by technological changes, but utilises them to its advantage.

One of its big new ideas is to provide members with a black box-style system for their cars so that breakdowns can be anticipated. In a test involving AA members, this new technology predicted one third of breakdowns. Both the telematics device and an app called "CarGenie" are particularly aimed at younger people. AA's existing membership is dying off, and younger people are used to buying products off the web when they need them, instead of joining an annual membership scheme. An app is also a way to engage members, which in turn offers the opportunity to sell them additional products. Contrary to its decreasing personal membership count, its annual revenue from each personal member was up slightly last year.

To turn itself into a Technology Service Provider, the AA poached James Frost, a former Unilever director who had successfully grown the "Nectar" brand in the UK, one of the country's most successful loyalty schemes.

These were smart moves and carried out by a management that seems to sincerely want to turn around the ship.

The share price, however, recently yet again trended downwards. It's never been as low as it is now.

Is now the ultimate buying opportunity, or has the turnaround hit a bump in the road?

Valuable lessons that anyone can benefit from to avoid losses

The AA offers a few lessons for investors, which is one of the reasons why I decided to write about its story in some more detail.

Be wary when you spot any of the following.

1. Accounting figures that need explaining by "experts"

Many companies nowadays try to convince you that it's not simple old "Net Profit" that counts, but some other magic figure created by its accounting team.

The AA keeps insisting that "Trading EBITDA" is the key figure to look at if you want to judge the firm's financial success. I know what EBITDA is, but "Trading EBITDA"? As its most recent annual report sets out, this is a "non-GAAP measure explained on pages 28, 30, 106 and 107".

What this really says is: "We are not great at earning money, but we'd like you to believe we are which is why we have devised this really clever way of accounting to pull the wool over your eyes."

Last year, the company's Trading EBITDA declined to GBP 341m, a 13% decrease compared to the previous year's GBP 391m. Not exactly an improvement, but not a catastrophe either. Why, then, did the share price crash by about half in the months after the figures were published?

It crashed because the market isn't stupid. In amidst all the long-winded explanations in its press release on the annual figures, it's not until the bottom of page 3 that the company reveals its actual bottom line. The AA's net profit plunged to just GBP 42m, a 62% drop compared to the previous year's GBP 111m. At the end of the day, net profit is the figure that matters. That's after-tax, in case you wondered. I take an entirely unapologetic approach to never accepting any "one-off items" as an excuse to look at a figure other than net profit. Every business has one-off items all the time.

The relative supremacy of net profit also shines through in the company's dividend. For its last fiscal year, the payout was reduced to 2 pence per share, a 60% decrease compared to the previous year's 5 pence per share. For all those retail investors who bought into the company to earn dividends, the "Trading EBIDTA" won't be much of a consolation.

When you analyse a company, focus on net profit (or cash flow, which I'll cover in a future Weekly Dispatch). Don't let the accountants take you for fools.

2. When Private Equity sells, hide your money in the safe!

The AA was acquired by two giant private equity companies, CVC and Permira, in 2004.

These then milked the AA for its cash flow, loaded enormous amounts of debt onto the company, and subsequently sold all (!) their shares in the 2014 IPO at a price of GBP 2.50 per share.

It's really quite simple. Private equity companies are masters at marketing investments to an unsophisticated audience and selling off at the highest possible price. When they sell, you never get a bargain. Just check Aston Martin, about which I wrote back in November 2018. Since being taken public by its private equity owners, Aston Martin shares have lost 50% of their value.

There are exceptions, but this is a game heavily stacked to your disfavour. When they sell, it's usually not your time to buy.

3. Excessive debt can quickly make you lose 100% of your investment

High debt-leverage can propel you to incredible heights in a short time, or wipe you out altogether in an equally short time.

As one market commentator put it: "At the AA, the bondholders are now in charge."

The company would need its "Trading EBITDA" to rise well above GBP 400m per year to make meaningful progress in reducing its debt load of GBP 2.7bn. Until such time, the equity holders will see relatively little in terms of dividend. What's more, if the company makes one big misstep, most of the remaining equity value of currently just GBP 350m could be wiped out in a short time.

Will the AA succeed in eventually lightening its debt load?

Quite possible, but I would not yet want to bet on it.

Here are the reasons why.

What I would like to see in a turnaround candidate

I love turnaround companies, not the least because I had a hand in turning around several operations myself (as CEO and as a non-executive director).

Much as I am not an expert in the AA's particular industry, the company is currently lacking a few key components that I'd like to see in an attractive turnaround situation. I want to see either

• a decent business that has grown complacent; or

• a business that has been caught out by the cyclicality of its industry; or

• a business that extended its brand into the wrong sectors and which needs pruning back.

The AA doesn't fall into any of these categories. It appears to be a business that is under pressure to reinvent itself to a large extent. As such, I'd view it almost as a kind of start-up, even though it's built on the back of an existing operation. This is a risky situation that depends on a lot of "ifs". Add the debt load! That's enough to put me off altogether because it carries the risk of my investment getting wiped out entirely. That's despite me giving them a lot of slack over the self-driving car issues because I am not convinced that these will appear en masse quite as quickly as the Silicon Valley hype machine will want you to believe.

Much as I take my hat off to the AA's new management for facing the challenges and doing the best they can, I do not yet see a compelling investment case to jump right into AA shares. Not even after the 87% drop in value since mid-2015.

There is simply too high a risk that the company's equity investors will end up as a wreck by the roadside. If it came to that, bondholders would probably take control of the business, repackage it, and sell it on to private equity. Guess what would happen next? A going-private, followed by a period as a private company, before it's relaunched as IPO with private equity companies once again cashing out…

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year

P.S.: Check out my latest in-depth report about an investment opportunity you won’t get to read about elsewhere (yet!). Available for Members only so sign up now to get immediate access.