I am all set to fly to New York next week, which inspired me to pull out my folder with US stock ideas that I had long wanted to research.

First up, the world's most iconic motorcycle brand!

The stock of which, incidentally, is being bandied around as undervalued investment right now. My curiosity is peaked!

Does this investment case stand up to scrutiny?

As someone who doesn't drive and doesn't have any emotional connection to motorcycles, I set out to take a close, critical and purely financial look at the company.

In a class of its own

Harley Davidson is one of those rare companies whose name has become synonymous with an entire product class. E.g., some people refer to all soda as "Coke". When someone speaks of a "Harley", they don't necessarily refer to a motorcycle of that particular maker. It’s also quite simply a much-used synonym for powerful, chopper-style bikes in general.

During its 116-year existence, Harley Davidson has risen to become one of the world's most widely known all-American brands. It is about as American as McDonald's, the Statue of Liberty, or James Dean. The latter was, of course, a Harley owner.

There is even a social media account dedicated to photos of "Stars on Harleys".

In terms of brand value, Harley Davidson is right up there on Mount Olympus.

Immortalised in pop culture: Steppenwolf's "Born To Be Wild" became the cult song in "Easy Rider", the quintessential Harley Davidson enthusiast movie.

For shareholders, though, it's not been such a great ride recently.

During the past five years, the stock has lost roughly 50% of its value. In the same period, the S&P 500 Index rose by 50%. Shares in Harley Davidson are currently trading on the same level where they were back in the year 2000. Two decades with virtually no capital appreciation does not make for a roaring performance!

Owning a rare vintage Harley would have been a much better investment since the turn of the century than owning a part of the company.

One could be forgiven for expecting the company's iconic motorcycles to virtually sell themselves and Harley Davidson printing money off the back of a loyal, growing band of customers.

But it's not quite so.

Despite its brand name and heritage, the company has been struggling.

Harley never recovered from the Great Financial Crisis

Before the banking crash of 2008/09, the company was selling around 350,000 motorcycles per year.

Since the end of that recession, sales have mostly hovered around 250,000. The company never fully caught up with its pre-crisis heydays. It could end 2019 with as few as 215,000 sold motorcycles, depending on which estimate you choose to believe. Compare that to last week's article about Ferrari, a company that since 2007 has increased its annual unit production by almost 50%.

If you check the available research and publications on Harley Davidson, it emerges that three significant factors have been working against the company:

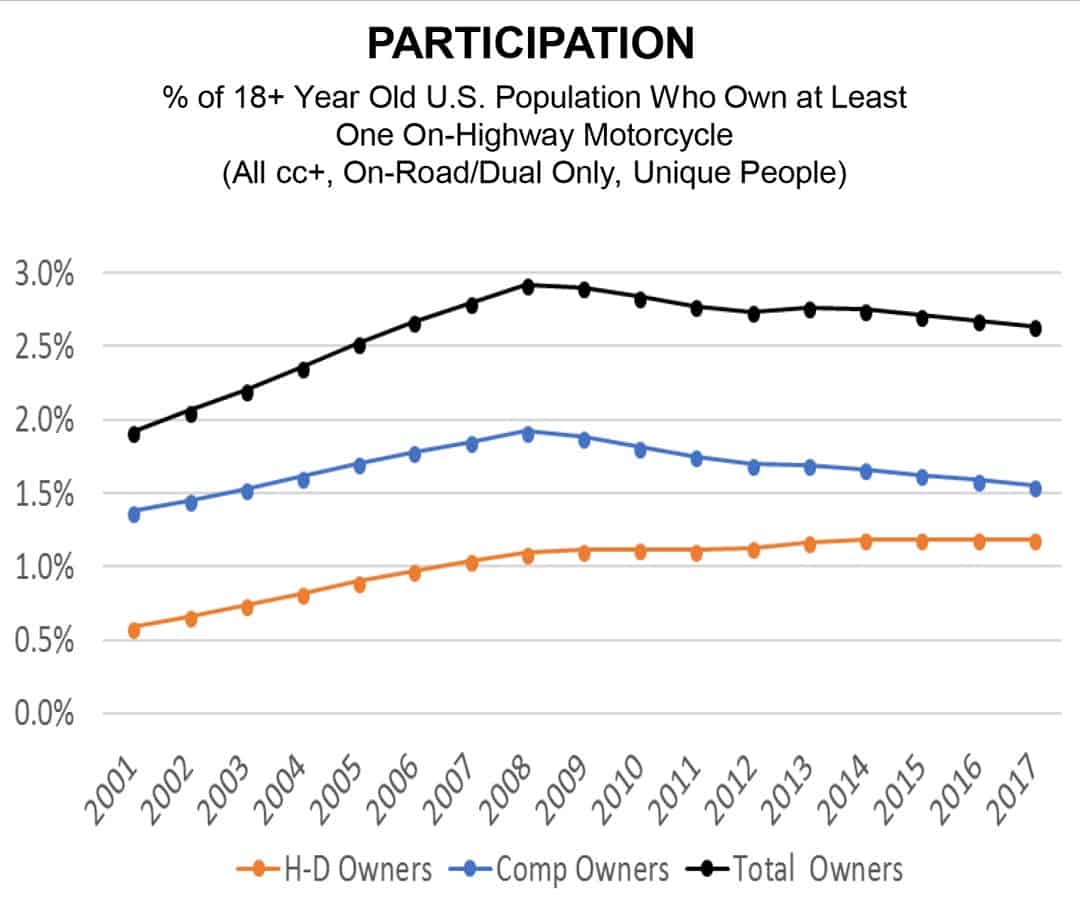

- Speaking very broadly, the Baby Boomer generation already owns all the Harleys it ever desired, and the younger generation hasn't latched on to the brand in quite the same way. Parts of the Millennial and Gen Z generations even outright despise the gas-guzzling, exhaust-spewing motorcycles. Harley Davidson isn't the only motorcycle producer facing the problem of struggling against a demographic shift. The sales of the entire industry never recovered after the 2008/09 crisis (see the following graph).

The US motorcycle industry has been in a decade-long, structural downturn.

- These bikes are a pure luxury item rather than a mode of transport, which provides an additional challenge during times of economic hardship. During the past decade, when many Americans experienced shrinking real purchasing power, they decided to use their money for more critical aspects in their lives.

- Harley owners will kill me for saying that, but in my impression, the company has lost some of its cool and bravado. The brand simply doesn't blow me away anymore. That's despite me trying hard to enthuse myself about it because I generally like classical American brands.

Add to it the fact that Harley recently got caught up in the middle of the US/Chinese arguments about trade policies. Parts of the company's production are nowadays located in China. The struggles about realigning tariffs have caused Harley Davidson both negative PR and tangible operational disadvantages.

How the company acted towards the investor community also didn't always help. E.g., the 2018 decision to bar journalists from its shareholders' meeting (!) was a break from the past and perceived badly.

Is anyone surprised the stock is down?

The question is, though, has it fallen far enough yet to be an attractive value investment and a prospective contrarian bet?

Oodles of cash flow and a healthy dividend yield

If Harley Davidson has done one thing well for its shareholders, it's its generous dividend policy. Despite all the challenges that life has thrown at the company, it has been increasing its dividend significantly. Between 2011 and 2018, it tripled its dividend per share from USD 0.48 to USD 1.48. During this period, the payout ratio increased from around 30% to now just under 50%.

Projections for 2019 foresee a dividend of about USD 1.50 per share once all four quarterly payments have been made.

For 2019 and 2020, earnings are projected to come out at USD 3.37 and USD 3.66 per share, respectively. The company can easily continue to pay out such a dividend.

At a share price of around USD 36, the dividend yield amounts to a nice 4.1%. It's trading at less than 11 times earnings.

Much as these are mere headline figures, one thing is clear. Just like the Baby Boomer generation itself, Harley Davidson does not lack reserves and cash flow. Also, its stock isn't trading at overly generous multiples. This COULD be a tempting value investment.

The question is, will the company ever show significant growth again?

The stock would be cheap indeed if there were significant growth prospects on the horizon. However, it would probably remain stuck around its current level until eternity if all it did was milk its existing customer base for cash flow.

That's why its management created the "More Roads for Harley" programme. Between 2018 and 2022, Harley Davidson aims to turn around its flagging fortunes and turn itself into a growth company once again. It wants to increase the operating income from its motorcycle division by about 50% and significantly improve just about any of its key metrics.

Outside of bog-standard management challenges such as reigning in operating costs, the company aims to:

- Win over the under-30 crowd by marketing an electric bike that is aimed at urban riders.

- Expand in new markets such as India, where an affordable Harley with an unusually small engine is on the cards.

- Make better use of digital channels to drive more customers to its enviable global network of bricks-and-mortar, themed dealerships.

Will it work?

Here is my verdict as someone who looked at it without knowledge of or bias for cool motorcycles.

It's not a safe enough investment case for this website

Turning around ailing brands is something I have long been a fan of. On a tiny scale, I once did this myself as CEO of an organisation that had a fantastic brand name but which was on the verge of bankruptcy when I took the post. Ever since I have been a believer that it is MUCH easier to turn around a sagging brand's fortunes than to succeed with building a start-up from scratch. An established brand, however tainted, gives you a head start. A start-up, on the other hand, requires you to start with nothing.

I salute Harley Davidson's presentation on "More Road for Harley", which anyone with a deeper interest in the company is well-advised to study. In terms of clarity and depth, you'd be hard-pressed to find a better investor relations brochure.

However, nagging doubts remain on my mind:

- Will the Harley Davidson brand transfer well from roaring choppers to purring electric engines?

- Did Harley Davidson make a wise move from a brand perception perspective when it recently launched a pedal bike for cyclists?

- How will a small-engine, low-budget motorcycle produced for emerging markets affect the brand's standing as a premium product?

I am afraid of Harley Davidson trying to be all things to all people. Such a strategy can scare off as many loyal enthusiasts as it will win over new fans – if the plan is successful at all in winning new fans.

It could work, but I remain unconvinced. Worst case, Harley Davidson will scare off its enthusiasts and not win any new customers. In which case, the stock could have further to fall.

For a value investment to be of interest to this website, I have set all sorts of criteria that act as a filter.

There needs to be as much certainty as there can ever be for anything in life that a company's strategy is going to succeed. That's the easiest to determine if a company wants to do more of the same, e.g. if it intends to sell more of its existing products. That still involves an element of risk because the company needs to develop new sales channels, but it’s a lower risk. Launching entirely new products AND developing new sales channels is relatively riskier.

With that in mind, I'll remain on the sidelines to watch the Harley Davidson story from afar. I'll keep admiring the history of the brand and I'll watch the management's performance with interest. But for investment purposes, I'd currently let that chopper roar past. Fun as it is to watch it!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year