aGermany and Denmark are model cases for the increased use of so-called renewable energy, but their approach is mostly about wind and solar. Japan and South Korea, on the other hand, are pushing into hydrogen.

Hydrogen is a lot less talked about than solar and wind. However, for some countries, it's a strategic priority to develop the chemical element as an energy resource.

Geopolitics play into it. China supplies 80% of the world's solar panels, and neither Japan nor South Korea want their energy supply to depend on an authoritarian, communist country.

Is there more to it than politics, and should investors pay closer attention?

As a hydrogen newbie, I recently started to dig into this subject. Here is a short primer on investing in the hydrogen economy.

The miracle energy that has been known for centuries

Hydrogen is the "H" in water ("H2O") and in methane (CH4). It makes up 75% of the mass in the universe, which makes it the most abundant element of all.

It's also extremely energy dense. Burning a kilogram of hydrogen provides 2.6 times more energy than burning a kilogram of natural gas. This is one of the reasons why it's long been used as rocket fuel, starting with the Apollo moon programme in the 1960s.

The idea of using hydrogen as an energy source started a lot earlier, though. The first fuel cell to convert the chemical energy of hydrogen into electricity was invented in 1853. Jules Verne predicted in 1875 that hydrogen would one day constitute "an inexhaustible source of heat and light".

Yet, here we are in the year 2022, and hydrogen makes up a paltry 1.5% of the world's energy supply - not more than a rounding error.

What has gone wrong?

Many false dawns

There has been no shortage of attempts to turn hydrogen into a viable, widely used source of energy.

In the 1930s, it was used in zeppelins, before the Hindenburg disaster put a stop to it.

That same decade, General Motors built the first-ever hydrogen-powered car. Hydrogen-powered cars don't produce exhaust fumes but just water vapor and warm air – which has always struck everyone as a miracle of sorts. However, the technology wasn't ready and the GM Electrovan ended up in a museum.

Another high-profile attempt to use hydrogen in cars was the hydrogen-powered Hummer, also produced by General Motors. The "H2H" (H2 Hummer) became known as "Arnold's Hummer", because Arnold Schwarzenegger used it during his time as governor of California to promote the concept of so-called renewable energy. It never took off for a number of reasons, including cost and the lack of a refuelling station network.

Because of all these failed attempts, the industry joke is that hydrogen is the fuel of the future — and it always will be!

Why, then, do successful countries and companies keep investing in it?

Besides Japan and South Korea as countries, three standout examples of companies that currently invest in hydrogen technologies are Toyota Motor (ISIN JP3633400001), Hyundai Motor (ISIN USY384721251), and BMW (ISIN DE0005190003). Toyota produces the hydrogen-powered Mirai, Hyundai's hydrogen car is the Nexo, and BMW introduced its SUV iX5 Hydrogen just last year. These aren't niche manufacturers, but three of the world's largest and most successful car manufacturers.

Aren't battery-powered electric vehicles supposed to take over the world?

Didn't Elon Musk tweet that plans to build hydrogen-powered cars were "extremely silly"?

I was surprised to hear that between now and 2030, both public and private investment in the hydrogen sector is predicted to amount to USD 500bn. There are 350 major projects underway around the world, comprising clean hydrogen production, hydrogen distribution facilities, and industrial plants that are going to use hydrogen for processes which now use fossil fuels.

It made me wonder who (besides myself) doesn't even know the basics of how hydrogen as an energy form works and where this industry might be going?

Choose your colour hydrogen

Unlike oil or coal, hydrogen is not a primary source of energy. It is best described as an energy carrier (akin to electricity) and as a means of storage (like a battery).

Hydrogen has to be manufactured using some other form of energy to separate water (H2O) into its constituents of oxygen (O) and hydrogen (H2). Depending on which energy form is used for the separation process, the resulting hydrogen is described with a different term:

- Coal: black hydrogen

- Natural gas: grey hydrogen

- Coal or natural gas with carbon capture storage: blue hydrogen

- Solar or wind: green hydrogen

- Nuclear power: pink hydrogen.

Cost is an obvious issue. At this point in time, producing hydrogen is inefficient and, therefore, expensive. There are some areas, though, where hydrogen is irreplaceable, despite its current cost.

E.g., hydrogen is important for producing fertilisers. It is used for the production of almost all the world's industrial ammonia, which is the main ingredient of artificial fertilisers. Without ammonia, the world's agricultural productivity would plummet, and hundreds of millions would face starvation.

It's also used for refining petroleum and treating metals.

Globally, the production of hydrogen generates revenue of approximately USD 150bn annually, which is about the size of an Exxon Mobil (ISIN US30231G1022).

It's a niche business, but one that the Japanese, more than anyone else, are pushing hard to give a different stature altogether.

The Japanese efforts to use hydrogen

As CBS News put it in a 29 October 2021 report, "no country in the world is more gung-ho about hydrogen as an energy source than Japan".

Japan has the ambition to become the world's first "hydrogen economy". This could be ignored as a national folly if Japan wasn't the world's third largest economy and one that has repeatedly created large-scale technological innovations that the world eventually adopted. This particular country deciding to go down the route of hydrogen is a big deal.

A confluence of factors led to the ambitious plans:

- Japan has been investing in hydrogen since the 1970s, so it has both a head start and an existing financial investment.

- Since the Fukushima disaster of 2011, Japan has a difficult relationship with nuclear power.

- As a nation that is extremely keen on protecting its national sovereignty, Japan doesn't want its energy industry to become dependent on China's production of cheap solar panels and wind mills.

The publicly visible flagship project (and most widely cited example) of Japan's hydrogen efforts is the Toyota Mirai, which means "Future". Used as a PR prop during the Tokyo 2020 Summer Olympics, the car has a fuel cell under the bonnet and hydrogen tanks under the back seat.

The Mirai is too expensive to become a conventional success, but both Toyota and the Japanese government see it as part of a strategic, long-term initiative. To make it all happen, the country is pumping a lot of money into developing hydrogen as an energy source that it feels will be "renewable".

In 2021, Japan teamed up with Australia to turn lignite coal into hydrogen. The resulting hydrogen is liquified at minus 253 degrees Celsius before it is piped to a specially built ship which carries it to Japan. At a later stage, Japan and Australia are hoping to capture the emitted carbon and bury it underneath the seafloor off the Australian coast.

As the BBC reported, "climate change campaigners are horrified by this plan".

Toyota, however, sees hydrogen "as a powerful and important energy" that is required for "realising carbon neutrality". Much as a cost-efficient, environmentally friendly use of hydrogen is still further into the future, some Japanese companies view it as the more viable way forward. Another company with a bet on hydrogen is Mitsui (ISIN JP3893600001), one of Japan's largest mixed conglomerates.

Different countries have different interpretations of what constitutes so-called "renewable energy" or "green energy". The European Union is currently trying to rebrand nuclear power a green form of energy, to the dismay of the Germans who are just now switching off their nuclear power plants to become their own version of green. As these examples show, what constitutes the best form of renewable energy is anything but settled.

For now, though, the single biggest problem with popularising the use of hydrogen remains its cost.

It's all down to price – and Morgan Stanley predicts a massive shift

If Japan switched the generation of its electricity to hydrogen, it would currently have to pay around eight times more than for electricity generated from natural gas or solar, and nine times more than for electricity generated from coal.

From Japan's perspective, achieving better cost efficiency is merely a matter of time. An October 2020 research report about the hydrogen economy by AB Bernstein estimated that the cost for blue hydrogen would reach parity with solar and wind sometime during the first half of the 2030s. As the example of Japan shows, some countries may be willing to pay a bit more for hydrogen because of political aspects – which makes cost parity just one of several factors to consider.

Interestingly, the falling costs for solar and wind can contribute to the eventual adoption of hydrogen. After all, cheaper solar or wind-based energy can be used to produce hydrogen. Also, hydrogen may be able to score well when it comes to storing energy for later use. Solar and wind both need battery storage to provide more than intermittent energy, but batteries are limited in the amount of energy they can store and they suffer from battery drainage as they age. A single major hydrogen storage facility in Texas can store about 1,000 times as much electricity as the world’s largest lithium-ion battery complex in South Australia. Whether battery technology will ever catch up with the sheer scale at which the hydrogen industry can store energy remains subject to debate.

Cheaper solar and wind could help produce hydrogen efficiently.

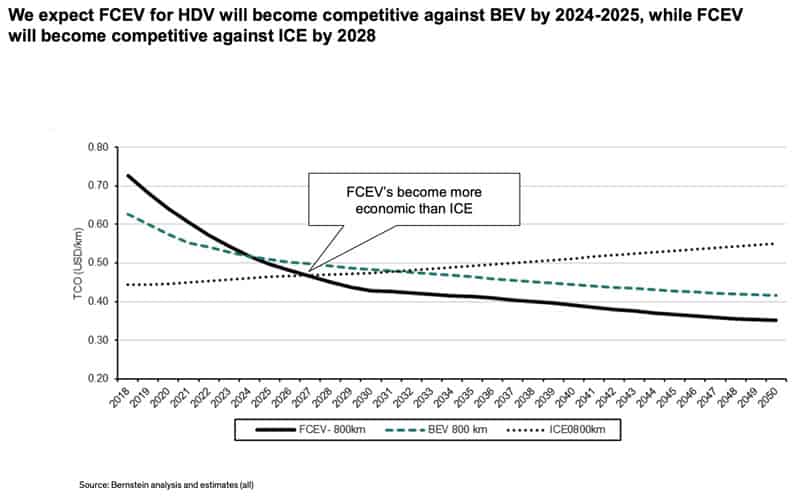

Each of these different energy forms has its proponents who believe that technological innovation will put it at the forefront. Only time will tell who will ultimately win the race, but the bets placed by Toyota, BMW and Hyundai may be smarter than they appear at first. The AB Bernstein report estimated that hydrogen fuel cell-based heavy-duty vehicles would become competitive against battery-based electric heavy-duty vehicles by 2024-2025. By 2028, they are predicted to become competitive against internal combustion engine-based heavy-duty vehicles. I first took notice of hydrogen when I read that Toyota planned to essentially sit out the battery-powered electric vehicle hype and focus on hydrogen-powered vehicles instead. I now understand why the world's largest car manufacturer took this position.

FCEV = Fuel Cell Electric Vehicle; HDV = Heavy-duty Vehicle; BEV = Battery Electric Vehicle; ICE = Internal Combustion Engine (source: AB Bernstein "Hydrogen Economy", 20 October 2020).

If the ambitions of countries like Japan work out, hydrogen will be able to do a lot more than just power cars, busses, trains, trucks and ships. It would also be able to provide energy for steel mills and other industrial plants, all of which now have few alternatives to today's polluting processes and are major energy consumers.

Right now, most of the major hydrogen projects underway strongly rely on direct government funding or on companies viewing them as a loss-making strategic investment. The question is, how fast will the costs for hydrogen-based energy solutions fall?

There is a wide range of estimates. Currently, green hydrogen costs between USD 3-6.50 per kg compared to USD 1.80 per kg for grey hydrogen. BloombergNEF, a research provider covering global commodity markets, predicts it will take until 2030 for the price of green hydrogen to fall to USD 2 per kg. Morgan Stanley put out a much more aggressive forecast whereby green hydrogen could be produced for just USD 1 per kg in just two to three years. To add another perspective, in 2010, it still cost USD 10-15 per kg for green hydrogen.

Opinions about the likely future course over the next few years are divided, and it's from such hugely divergent forecasts that opportunities stem for investors.

An up-to-date primer: "The Hydrogen Revolution", published in August 2021.

A broad but complex industry to invest in

Hydrogen is an investment theme that attracts a hype every few years. When hydrogen-related stocks last gained a lot of investor attention - between November 2019 and February 2021 - some of the leading stocks of the sector rallied between 300% and 800%. During subsequent busts, the bloodletting is horrific.

There is a wide range of companies that are focussed on or involved with hydrogen, including:

- France's Air Liquide (ISIN FR0000120073) and Germany's Linde (ISIN IE00BZ12WP82), two market leaders that cover the entire value chain of the hydrogen industry.

- Britain's ITM Power (ISIN GB00B0130H42) which designs and manufactures world-class hydrogen energy solutions.

- Canada's Ballard Power (ISIN CA0585861085), a world market leader for powering busses, trains, and ships using hydrogen. It's teamed up with China's Weichai Power (ISIN CNE1000004L9) which wants to popularise hydrogen-powered transport solutions in China.

- Sweden's PowerCell (ISIN SE0006425815), another company at the forefront of fuel cell technology.

And the list goes on… The selection of hydrogen-related investments available to investors around the world is larger than most would think. There are also hydrogen-focussed ETFs. One of which, the Global X Hydrogen ETF (ISIN US37954Y1525), has published an excellent technical guide about the hydrogen economy.

That's before counting the potential indirect investment opportunities. E.g., hydrogen-powered vehicles will require a lot of platinum, at least based on current available technologies. Platinum could make for an investment that benefits from the hydrogen economy.

Also, a growing global hydrogen economy could alter the economics of entire countries. Sunny and windy places that lack transmission links could become able to export clean energy as hydrogen. Candidates include (but are not limited to) Australia, Chile, Morocco, and Namibia (see below). These countries could "ship sunshine" to the world and greatly benefit from the resulting income.

Will the desert become valuable? The Wall Street Journal reported about Namibia's green hydrogen ambitions on 18 December 2021.

Will pioneers like Japan blaze a trail for hydrogen and help make hydrogen become an energy source that catches up with other forms of energy?

I don't know, but throughout my initial research of the sector I have come to realise several interesting conclusions:

- This sector is more complex than I thought, but also much closer to a potential quantum leap forward from its current paltry 1.5% market share of the global energy market. A firm like Morgan Stanley sticking out its neck with an aggressive projection about the costs of hydrogen-based energy is something to pay note to. There could be surprise developments further down the road.

- The sector still lacks transparency. I usually have access to a broad range of research, but it proved difficult even for me to procure up-to-date research about the hydrogen economy and its main players. I like a lack of transparency, because it enables me to find trends and stocks that the public hasn't caught onto yet. Maybe this sector is similar to investing in wind and solar plays five or ten years ago when the industry still faced a lot more doubt?

- The volatility of the stocks in this sector is considerable. With a technology like hydrogen, it can be lucrative to pick up stocks during a trough of disillusionment and focus on the best companies of the sector.

Industry bellwether Ballard Power shows the extreme cyclicality of hydrogen stocks.

Do I feel strongly that hydrogen will be a winner?

I'd expect the reality to lie somewhere in between the extreme projections peddled by the competing interest groups.

Battery-powered vehicles are powering ahead (no pun intended), and they might turn into the long-term winner simply because they came first and conquered the public's imagination. As everyone knows, VHS video tapes won over Betamax even though they weren't the superior system. Sometimes, the superior technology doesn't win.

I do pay attention, though, when the Japanese are onto something. Few remember it nowadays, but the Japanese played a pivotal role in creating the Liquid Natural Gas industry in the 1970s. When Japan focusses its national attention on a task that it considers a national priority, it's worth keeping an eye on. Japan has the know-how and the capital to make things happen on a large scale.

The subsequent outcomes will probably sit somewhere in between the opposing predictions. Maybe Volkswagen boss Herbert Diess was right when he said: "Green hydrogen should not end up in cars. It is needed for steel, chemical, aero." This could still leave room for hydrogen to grow into a significant new industry, because of the sheer amount of energy required in these sectors.

At the very least, a growing number of countries has recently started to ask the same question. While in 2019, only three countries had a national strategy for hydrogen, more than 20 governments in 2021 publicly announced they were working to develop such a strategy. After many false dawns, this *could* now be the final breakthrough for the industry.

With all that in mind, it's an industry that I do think investors should pay attention to. Some hydrogen-related stocks have come down again, and I am laying in ambush to find the best ones at the best possible price. It could well be a fair bit into the future for me to present my recommended pick in this area, but I've now got my sight set on the sector.

In the meantime, I'd advise you to pay attention to an energy source that is already providing an investment opportunity right now – and one that has significant upside.

A stock with a likely 30% dividend yield in 2022 alone

Hydrogen currently makes up just 1.5% of global energy consumption.

Fossil fuels contribute 81.3% of the world's energy needs.

Among them, oil reigns supreme. Despite all the hype about so-called renewables, oil still contributes 31.2% of the energy consumed around the world. Its role as backbone of the world's energy industry will remain well into the 2050s.

However, oil has also become an outcast as far as investing is concerned - which has created opportunities for those who subscribe to energy realism. While the West decreases its investment in oil exploration and production for the sake of virtue signalling and politicking, other nations are doing just the opposite. These countries know that for decades to come, the oil they are pumping from the ground will be needed.

Chief among them, Brazil and its national oil champion, Petrobras (ISIN BRPETRACNPR6).

The figures underlying this stock are staggering. Between 2022 and 2025 alone, the company is expected to pay dividends totalling over 100% of the current share price.

How is that even possible?

My recent research report on Petrobras has the answer (available to Undervalued-Shares.com Members only).

Petrobras: time to love oil again

Not owning fossil fuel energy stocks in 2022/23 could turn out to be the biggest drag on your portfolio.

Introducing: Petrobras aka “Gazprom #2”. Such an extraordinary opportunity that I dedicated an entire research report to it!

Why has Goldman Sachs just raised its expectation for Petrobras' 2022 and 2023 dividends to 30% each?

What's the potential political surprise that could lead to Brazilian equities going through the roof in 2022?

How secure are the dividend payments in times of fluctuating oil prices and currency exchange rates?

How does Petrobras' valuation stack up against its international peers, especially Russian energy stocks?

My report gives the answers to all those questions, and more.

Petrobras: time to love oil again

Not owning fossil fuel energy stocks in 2022/23 could turn out to be the biggest drag on your portfolio.

Introducing: Petrobras aka “Gazprom #2”. Such an extraordinary opportunity that I dedicated an entire research report to it!

- Why has Goldman Sachs just raised its expectation for Petrobras' 2022 and 2023 dividends to 30% each?

- What's the potential political surprise that could lead to Brazilian equities going through the roof in 2022?

- How secure are the dividend payments in times of fluctuating oil prices and currency exchange rates?

- How does Petrobras' valuation stack up against its international peers, especially Russian energy stocks?

My report gives the answers to all those questions, and more.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: