Image by Dimitris Barletis / Shutterstock.com

I recently wondered which coronavirus vaccine I would pick for myself. That is, if or when I get vaccinated. So far, I am on the fence about the debate and figuring out which way to go. On the one hand, I am wary of medications of any kind. On the other hand, I am realistic enough to know that some situations warrant taking additional risks – if the powers to be even leave you any choice!

When I asked a trusted medical doctor for his advice about coronavirus vaccinations, he mentioned an option that I hadn't thought of yet: "If you aren't in a risk group and can wait, then wait for Novavax to hit the market in autumn 2021."

"Novavax" is both a vaccine and a company. The broader public isn't aware of it yet, but there are some metrics about the company that should make you pay attention:

- Novavax received USD 2bn in public support to launch its vaccine, more than any other American vaccine company.

- Countries around the world have already ordered 1.4 BILLION Novavax doses, which earlier this year made it the second-most ordered vaccine on record.

- Those countries with pending pre-orders aren't just developing nations but include the US (110m doses), the UK (60m), and Australia (51m).

Clearly, Novavax is a company that deserves to be taken seriously, all the more since quite a few credible observers have proclaimed it could be the "best" coronavirus vaccine of them all.

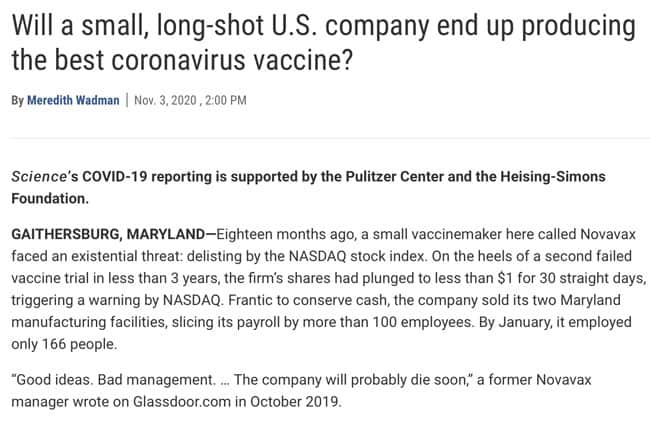

The "best" one, seriously? I am merely paraphrasing. See for yourself what Science Magazine had to say.

Source: Science Magazine, 3 November 2020.

Would you have known about these details and possibilities? If not, it's probably worth your time to read on.

Why Novavax (both the vaccine and the company) is worth paying attention to

Today's Weekly Dispatch might upset hardcore anti-vaxxers and vaccine triumphalists alike.

However, if you are about as middle-of-the-road and open-minded as I have tried to be about the subject, you might find these musings useful. Today's article includes an investment idea that could make 2.5-8 times your money over the coming 12-18 months.

How come I am neither racing to get vaccinated nor joining the anti-vaxxer crowd?

- I recognise some of the good that vaccinations have achieved in the past, but I also know of the unfortunate side effects and the politics of power and greed that are behind most medications. It's entirely possible that someone recognises both sides of the issue, even if many make it appear like there is only black and white.

- I am in favour of everyone having sovereignty over their body and their health-related choices. Equally, I am realistic enough to know that governments around the world are gearing up for mandatory vaccinations, if only by having corporations stop serving the unvaccinated. The writing is on the wall, much as I'd like to be wrong about it.

- I believe that food is the best medicine and that alternative, proven forms of healthcare should be given priority over experimental new medications. However, I live in a society where most people will jump at short-term solutions irrespective of the potential long-term costs, especially if resisting brings considerable social costs. If I want to continue to live in Western society (instead of taking to the woods), I'll probably have to come to an arrangement with these circumstances.

That's why I recently asked myself: "If, for whatever reason, I have no realistic choice but to take this stuff, which one will it be?"

Up to this point, I had no fixed idea what the answer would be. Embarking on a bit of in-depth research was in order. I do like to think that I approached my research with a genuinely open mind about the outcome.

To my own surprise, it led me to one particular vaccine that I could actually live with. Weighing the risks and looking at the big picture, I have decided to wait for Novavax to hit the market in the coming months. I'd still take it reluctantly, but I'd prefer that to going to the (physical or metaphorical) gulag of the unvaxxed.

My research of this controversial subject has made me realise there is a potential investment opportunity hiding in plain sight. If only half of what I concluded turns out to be right, Novavax stock has a realistic potential to go up in value by a factor of 2.5-8 over the coming 12-18 months.

Based on what is already known today, this company is gearing up to produce the coronavirus vaccine that:

- Scores very high in terms of efficacy (if not highest).

- Is equal or lower on side effects than other vaccines.

- Could have the longest-lasting immunity (outside of natural immunity, of course).

- Has minimal production costs.

- Can easily be distributed in developing countries.

- Is based on science that has been known for decades.

Does that sound like it was worth investigating?

Why I decided to turn this into an in-depth report

Much of the recent reporting about coronavirus vaccines puzzled me, which is why I was eager to do some research myself. During the past few weeks, I've spent several hours every day looking into the subject. What started out as personal interest and concern turned into investment-related research along the way.

I have been giddy with excitement about writing it all down and sharing it with my readers.

My initial idea was to write a Weekly Dispatch and share it all for free. After three days of intense writing, the first draft came out at over 10,000 words. Three test readers of the draft absolutely loved it. All three came from very different ends of the spectrum but their feedback was unanimous: What I had found was simply too interesting to just put it into a free column and have it disappear down peoples' newsfeeds. This story deserved to be featured in an in-depth research report for my Members.

As you will have gathered from what I set out above, Novavax could turn into an outlier for both investors and vaccine users. If either aspect interests you, then you should find today's report useful food for thought.

So confident am I about the details contained in this report, that I don't mind sharing the name of the company in this free Weekly Dispatch. It's a company with a USD 13.6bn market cap, i.e. there is no risk of my writing moving the stock price. Frankly, if you now dash out to buy this stock without having read the entire background, then it's you who is missing out.

Novavax has become a serious commercial enterprise, its product is near-certain to arrive later this year, and there is a chance that it turns into the unexpected blockbuster vaccine of 2022. The stock market does not yet seem to fully reflect that, and it could turn out to be undervalued to a degree where it might multiply once things work out.

In my report, you'll learn:

- How the stock's valuation compares to that of Moderna, its #1 competitor.

- Which world-class investors have taken large stakes in the company.

- Why this vaccine could be so appealing to vaccine sceptics (like myself).

Like every other investment, it has its risks and unknowns. However, the risk/reward ratio of the company (and its stock) struck me as such that I decided to write this report.

There are many reasons why following Novavax could be useful. Never mind the decision we all have to make on a personal level. Not that you should take my writing as medical advice. As ever, use my information to educate yourself, and seek licensed professional advice before making any decisions. However, the source material that I link through to in my report could help to inform your own conclusion.

Do you want to give it a shot? (No pun intended.)

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: