Image by ermess / Shutterstock.com

Since the start of 2020, something extraordinary has happened on the Russian stock market: more than 8m Russians have opened a brokerage account, tripling the number of Russians investing in domestic stocks from 4m to 12m. These new investors have funnelled so much cash towards buying Russian stocks that in just 18 months, they've mopped up 3.2% of the Russian market's entire free float.

These are tremendous figures, and they show in the performance of individual stocks. Since late 2018, when I published a seminal report about Gazprom (ISIN US3682872078) and its new dividend strategy, the broader Russian market is up 54%, and Gazprom stock has nearly doubled (including dividend payments).

Why did so many Russians suddenly rush into the stock market?

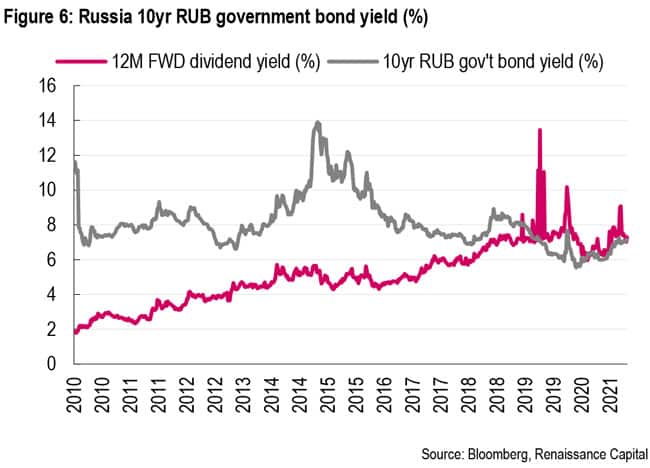

The average Russian stock yields ≈7.4% - a lot more than Russian banks offer on deposits, and roughly three times as much as the ≈2.5% yield of the global MSCI Index. Among investible markets, Russia provides the world's highest dividend yields.

What else is new in Russia, and is there still time to latch onto this trend?

Prejudices blown to smithereens

For many years, anyone asked about investing in Russian stocks would have answered one of the following:

- "Putin will steal all their money."

- "Boring, old economy companies."

- "Value traps."

Indeed, these views would have been spot on ten years ago. However, Russia has changed a lot over the past decade. E.g., in 2012, the Russian government started to encourage state-controlled public companies to pay out at least 25% of their profits to shareholders. In 2016, it upped the suggested payout ratio for dividends to 50%.

I highlighted as much in my report on Gazprom. Back then, in late 2018, just pointing out the facts was still quite contrarian, if not controversial. Most investors in the West allowed mainstream media to distract and unsettle them with their obsessive Russophobia.

In the meantime, reality has started to sink in with a broader circle of investors. Nothing speaks a clearer language than cash, and the shift in dividend payouts has made a massive difference for the Russian market as a whole. Since the beginning of this year, the market has gained another 18%, and it's now trading near a record high.

In amidst these headline trends, there are a few exciting details waiting to be discovered. E.g., the government decree to pay out at least 50% of profits only applied to state-controlled public companies, but many other Moscow-listed companies quietly started to follow the government's lead. A decade ago, privately-controlled Russian companies paid out less than 20% of their profits. Nowadays, it's closer to 40%, well above the average across emerging markets. In terms of its payout ratio, the Russian market went from the bottom of the international emerging market league to the top. What a difference a decade makes!

Something that is both a cause and an effect of this situation is the "March of the 12m", as Renaissance Capital called it in a June 2021 report. The leading Russian investment bank and brokerage firm pointed out that dividend yields were vital for attracting a growing number of Russian retail investors. Russia's public has started to buy into Russian stocks because people spotted an opportunity to make more money than if they kept cash in bank accounts or purchased government bonds.

Throw in the fact that technology has made access to the domestic stock market easier for ordinary Russians. Some Russian banks recently switched to offering stock trading through apps, Robinhood-style, where clients only have to fill out a short form to start trading right away.

Source: "The March of the 12m" (Renaissance Capital, 15 June 2021).

The Russians' new love affair with the stock market even sparked an interest in investing abroad. The lesser-known St. Petersburg Stock Exchange has made it a thriving business to offer trading in foreign stocks, similar to the OTC markets for foreign stocks in Germany (Auslandsfreiverkehr) and the US OTC market. Russians can now turn to the St. Petersburg Stock Exchange to trade the stocks of Facebook, Google and Amazon – and over 1,500 other companies from around the world. At times, trading volumes in St. Petersburg reached the same level as on the Moscow Stock Exchange.

Is this trend going to continue, and how can you benefit from it?

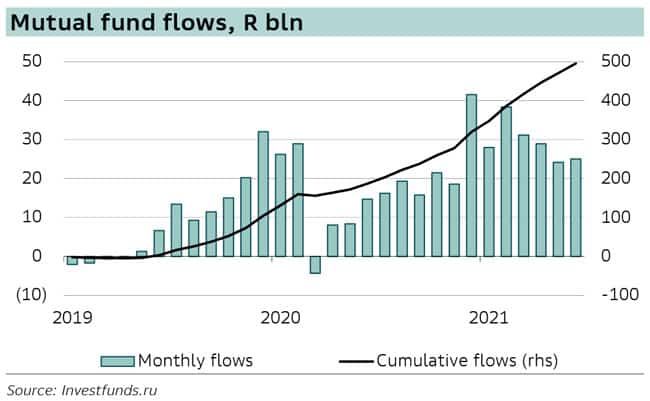

Things are taking a bit of a breather in Russia right now. In June 2021, "only" 500,000 new retail brokerage accounts were opened in Russia, the lowest monthly number in a year. That same month, Russian retail investors pumped USD 400m into the market, also merely the monthly average of the past 18 months.

However, there are some powerful underlying figures that make me believe the Russian market has a lot further to run over the coming two to three years.

A secular change to how Russians invest their savings

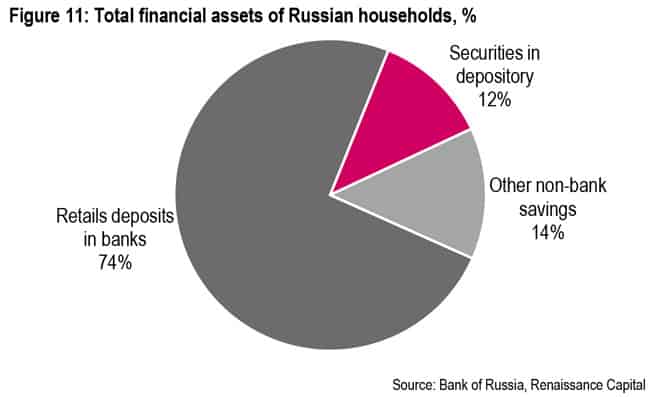

Even after the recent flurry of funnelling money into the stock market, Russian savers are still sitting on bank deposits of between USD 400bn and USD 500bn. For many years, Russians had become used to high nominal interest rates on deposits and government bonds. However, like everywhere else, rates have been falling rapidly in recent years, with local banks now offering less than 5% deposit interest p.a. When Russians see companies that are trusted household names pay a 7.4% dividend yield, it piques their interest.

Source: "The March of the 12m" (Renaissance Capital, 15 June 2021).

Source: "The March of the 12m" (Renaissance Capital, 15 June 2021).

Last month, Renaissance Capital published a report called: "Dividends in 2021-2022: Cashback", which analysed the top 40 Russian dividend stocks. No less than 12 companies paid a dividend yield of over 10%. Even the company ranked 40th was projected to pay a 6.2% dividend yield – still higher than anything a Russian could get from deposits or bonds. Many of the top 40 stocks are companies that ordinary Russians are familiar with, either because they are former state-owned enterprises or companies they interact with on a daily basis.

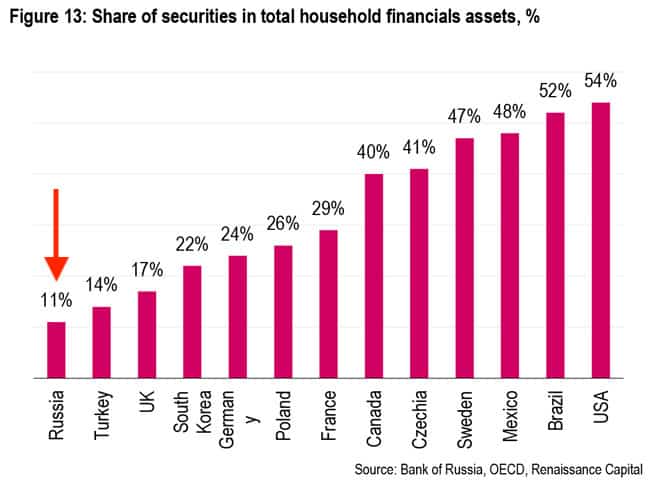

So far, Russians have invested just 11% of their financial assets in equities. Even in Poland – long known to be averse to equities – the local population has already put 26% of its savings into equities. In the Czech Republic, 41%. This compares to 54% in the US.

Source: "The March of the 12m" (Renaissance Capital, 15 June 2021).

Russian investors still have plenty of cash in the bank, they now have easy access to the market and company information, and they have gotten a taste of stock market investing. Combine that with a market that remains cheap by international standards and which also happens to pay the world's highest dividend yields – it makes for a powerful driver for Russian stocks.

The overall market cap of the Russian market is USD 720bn. Suppose Russian retail investors ploughed just another USD 50bn of their bank deposits into the market, it'd have a material effect on stock prices – and still leave investors with several hundred billion of firepower in the bank.

International investors are also returning

Several factors that used to be the Achilles heel of the Russian market are about to come to an end, which is helping to renew foreign interest. International investors have started to wake up to the Russian opportunity once again.

The Russian stock market used to be highly volatile due to a lack of domestic investors. Foreign institutional investors dominated the market, and during times of crisis, there were simply no other buyers. However, during the March 2020 sell-off, it was Russian retail investors that picked up shares and helped stabilise the market. Russian retail investors have since turned from a negligible factor to accounting for 30% of all Moscow trading. Foreign institutional investors are now less concerned about being stuck with Russian stocks the next time markets go south.

The increasing presence of domestic retail investors is putting more pressure on both the government and companies to enforce higher governance standards. Russians have also been putting more money into mutual funds, which equally adds pressure onto companies to up their governance standards.

Source: " Russian Investor Statistics" (Sberbank, 7 July 2021).

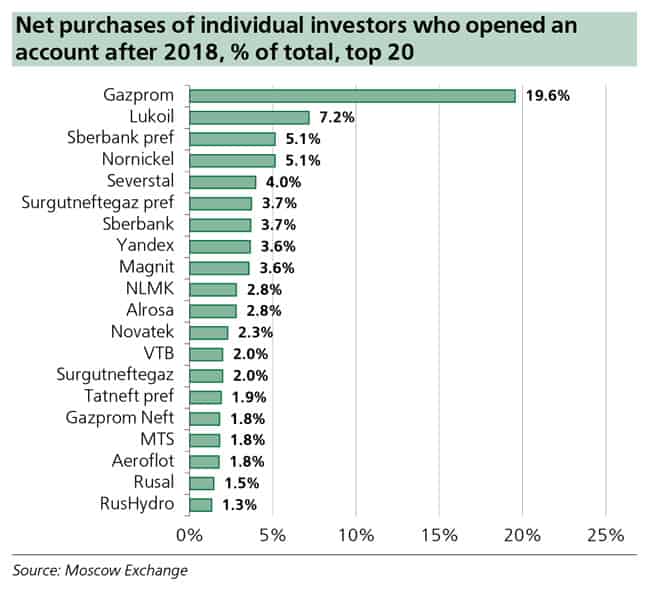

The market's many Old Economy companies used to be a drag. However, Russia's domestic retail investors like to invest in household names, with Gazprom, Norilsk Nickel and Sberbank topping the list, as well as utilities and industrial companies. These household names are likely to continue to attract interest, which suddenly turns the minus of having so many Old Economy giants into a factor that you can exploit for yourself.

Source: "Russia's Investor Base" (Sberbank, 7 February 2020).

Overall, the Russian market is becoming a lot more like other stock markets. To get a handle on how foreign investors perceive the market, I picked up the phone and rang Roman Fuzaylov, a fund manager at Prince Street Capital Management, the global emerging and pioneer market specialist based out of Singapore, Hong Kong and New York. Uzbekistan-born Roman, whose Prince Street Tamerlane Fund holds investments in Russia, gave me his assessment of the situation:

"The Russian stock market, like many emerging markets, has historically had some issues. But it's also been on the receiving end of a lot of negative press that's ignored the significant ways in which the market has transformed over the past decade. The flexible exchange rate policy has allowed for a dramatic reduction in interest rates, which in turn has driven millions of retail investors onto the exchange. At the same time, government efforts to improve corporate governance have driven higher dividends from state owned enterprises and led many private sector corporates to follow. Natural resource firms continue to receive the lion's share of media attention. But Russia also sports one of the most dynamic technology sectors in all of emerging markets, with a number of fast growing, well governed internet and technology firms increasingly looking to list their shares. While the country still faces some real challenges, higher dividends, improving governance, cheap valuations and increasing investor choice all make for an optimistic outlook in the years ahead."

Check out these Russian dividend stocks

With secular tailwinds like the ones described, the Russian market remains a compelling proposition even if you are only entering the fray today:

- Stocks are still way cheaper than elsewhere, but they now have a track record of gradually catching up with valuations paid elsewhere.

- While you wait for "multiple expansion" to unfold, you can pocket generous dividend payments.

- Last but not least, finding investment opportunities in Russia is almost like shooting fish in a barrel. EVERYTHING appears to be cheap in Russia (well, almost). Although, it's always better to be selective and invest in quality.

Out of the top 40 Russian dividend stocks featured by Renaissance Capital, here are two that stuck out to me:

- X5 Retail Group (ISIN US98387E2054) comes in at #15 on the list with a dividend yield of ≈9%, and its share price is estimated to offer an upside of 45%. Supermarkets are a much more interesting business than is commonly perceived, especially in developing countries because of growing consumer spending.

- Sberbank (ISIN US80585Y3080) is #24 on the list with a dividend yield of ≈9%. The bank is to Russian retail banking what Gazprom is to Russia's energy sector. It has been very successful with its digital transformation, which some say has turned the bank into a Fintech-style company.

I asked Prince Street Capital Management's Roman Fuzaylov about his view of Sberbank's progress, and he shared the following thoughts with me:

"The current management team has done a tremendous job in modernizing what has historically been a slow and sleepy state savings bank. The team understood years ago that the future competition would come not just from other local banks but also the biggest domestic tech firms, which have increasingly trained their sights on Sberbank's very profitable franchise. Sberbank management have proactively repositioned the bank accordingly and are now reaping the rewards, with the bank rebounding quickly from its COVID related troubles to post record profits in the first half of this year. Sberbank remains one of the best managed firms in Russia – and offers a compelling dividend yield to boot."

There are several other highlights among the top 40. I am not ready to divulge their names, though, because they might feature in one or the other upcoming report for Undervalued-Shares.com Members.

Speaking of which, you could do worse than pull out my past reports and updates about Gazprom. Based on current estimates, Gazprom will pay a dividend yield of ≈10% even at its now much-increased share price. I've always described Gazprom as a stock to own for many years, which is why these reports contain a lot of background information that remains relevant today.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Russia is good for more

Russia's stock market is too good an opportunity to miss. I have already gone to work and researched several Russian opportunities which are listed on a major Western European or American stock market (i.e. you won't need to have a brokerage account that can deal in Moscow).

At least two of those opportunities will feature in reports for Undervalued-Shares.com Members over the coming months. I am excited to prepare these reports for you and expect the first one to go out in a matter of weeks. On that note – stay tuned for more!