Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Why I set up a fund management firm

As you are about to learn, I am going to do something even better:

- Bring some of the world's best-performing but least-known portfolio managers to a broader market.

- Use my work with these exceptional, accomplished investors to create valuable, unique content – all aimed at helping private investors improve their skills.

- Help you meet some of these portfolio managers in person.

My plans have been three years in the making, and I am excited to share the news. This includes a very special, limited invite, which you'll find at the end of this article.

Bringing superior fund managers to a wider audience

Would you have liked your portfolio to grow by 25.8% p.a. for the past 23 years?

As it happens, I know someone who did achieve just that. In fact, I have known this person for over 15 years and personally followed his journey.

Chances are that you will not have heard of him before. He likes to keep very private, and he has been very focused on his work.

To achieve this performance, he didn't use leverage nor exotic derivatives.

All he did was to pick the right undervalued stocks, and often hold on to them for years. In one case, this strategy bagged him a 22-fold return over ten years on his then single biggest position.

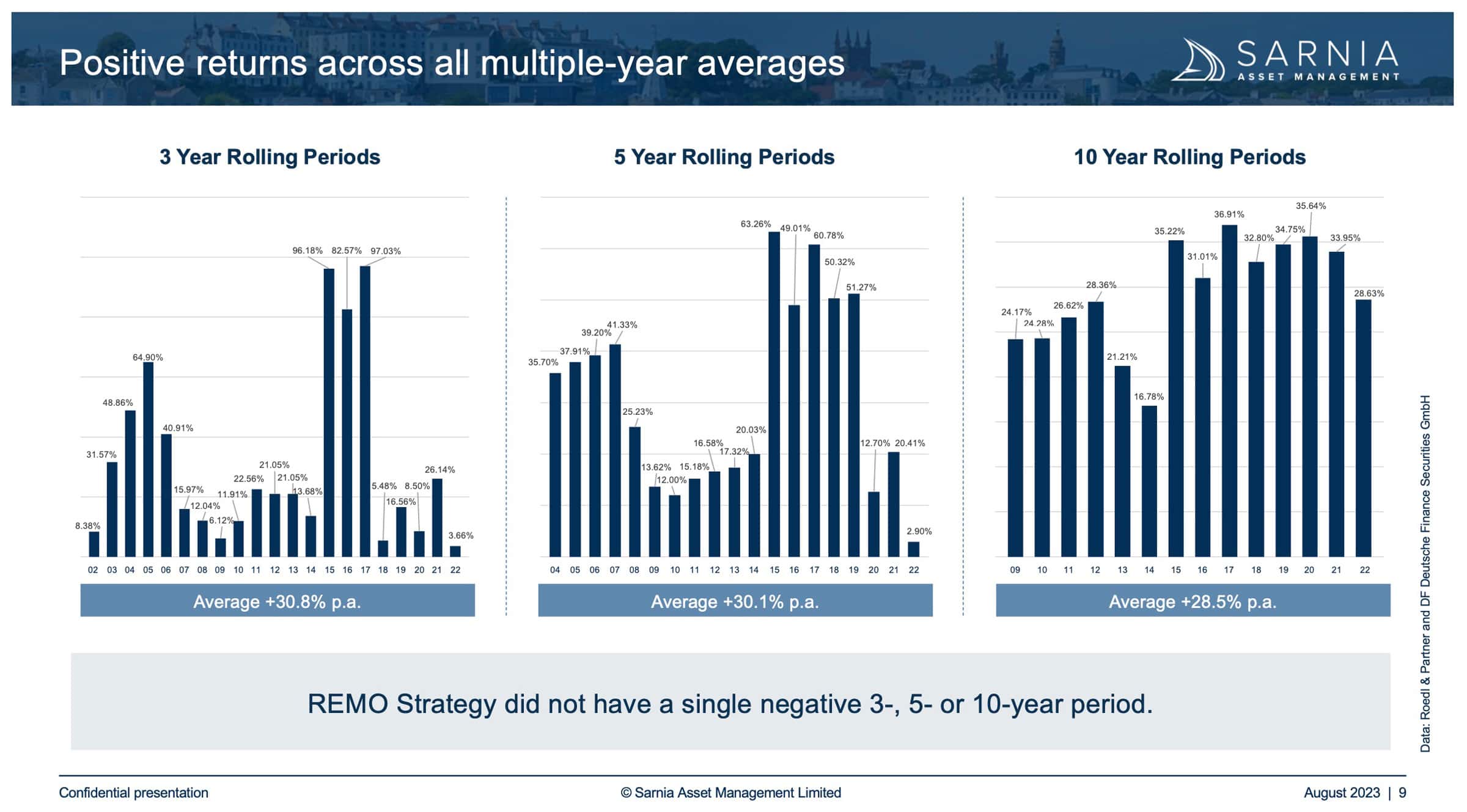

For the avoidance of doubt, his performance for the period 2000-2022 was achieved using real money, and checked by a major auditing firm. On average, the portfolio grew by a factor of 12x over a ten-year period. Even though it did experience quite a bit of volatility at times, there has never been a three-, five- or ten-year period during which it didn't produce a positive return.

Source: Sarnia Asset Management (click on image to enlarge).

Even if you took his 22-bagger out of the equation, his portfolio's 23-year performance would still come out at nearly 20% p.a. net.

Should someone like that manage a fund instead of just his personal portfolio? And if he did, would other investors likely be interested in such a fund?

I'd answer "Hell, yeah!" to both of these questions – but then add a major disclaimer.

Portfolio managers need to be empowered

Frankly, there are many reasons *not* to invest in funds – the fund management industry not being good enough at providing fund managers with the right framework is just one.

Large corporate fund management firms, for instance, have a long history of forcing diworsification diversification onto portfolio managers (and, by extension, their clients). E.g., they may ask their European clients to accept so-called UCITS funds, which, by law, aren't permitted to put more than 10% of their portfolio into a single stock. In the US, most funds are so-called diversified mutual funds, and they are not allowed to put more than 5% of the portfolio into securities of a single issuer at the time of entry into that position.

Compare this narrow limitation to how most famous investors have made their money – Buffett, Druckenmiller, Soros, you name them. None of them would have had the career they had – and produced the results they did – had they operated under the UCITS structure or the US diversified mutual fund regime.

In my view, giving a portfolio manager the option to occasionally weigh a single investment with up to 30% is absolutely vital. Every now and again, an opportunity arises that is too good not to make use of it with a higher weighting. A portfolio manager should be able to focus on their very best ideas. This will create additional volatility on occasion, but it tends to pay off with better results in the long run.

Luckily, there are viable alternatives that can be bought by almost anyone.

Let me tell you about other prerequisites for investment success first, though.

Small, owner-led and agile are key

According to a 2016 survey by the Financial Times, half (!) of fund managers in the US did not invest a single penny of their own money in their fund. Some firms stuck out even worse, usually the bigger ones: at the time just one of State Street's 33 US-domiciled funds had a portfolio manager who was invested in their own product.

There ARE fund managers who consistently beat the market and generate outstanding returns for their clients. However, these are usually found among smaller, owner-managed firms. According to a 2018 study conducted by US-based Affiliated Managers Group (AMG), such smaller investment managers outperformed larger firms and the indices over a 20-year period.

How come? The reasons are quite clear. The owners and managers of these firms tend to have real skin in the game, and they make extra efforts to allow their portfolio managers to:

- Focus on performance: pure and simple, enable the portfolio managers to dedicate their working hours to generating alpha. Make double sure they don't get distracted from their main tasks. For a large corporation, underperforming means a bad year. For a smaller fund manager, underperforming usually means going out of business!

- Pursue opportunities among small- and mid-caps: underresearched stocks are where most of the market inefficiencies are found. Stocks of smaller companies should be a focus rather than an afterthought. You can only do that if you manage a smaller pot of client money. It allows you to be agile even in less liquid markets.

- Flexibly shift among asset classes: during the Great Financial Crisis of 2008, corporate bonds were briefly so grossly mispriced that any rational investor had to switch from equities to the equivalent corporate bonds. Many portfolio managers at large fund managers had their hands tied and weren't able to take advantage of this. Circle back to the first point, a focus on investment performance instead of corporate processes.

If you create the right kind of work environment and legal structure for fund managers, their results will improve, and investors will benefit. The long-term performance of outstanding fund managers shows as much:

| Warren Buffett (20%, 60 years) | Seth Klaran (16.5% net, 25 years) | S. Druckenmiller (30%, 30 years) |

| Chandler bros. (37%, 20 years) | Steve Cohen (30%, 20 years) | Louis Bacon (18%, 30 years) |

| Charlie Munger (16% net, 60 years) | Carl Icahn (12% alpha, 20 years) | Tom Claugus (16% net, 21 years) |

| Jeffrey Ubben (20%, 18 years) | Ed Wachenheim (19%, 29 years) | Paul Tudor Jones (24% net, 26 years) |

| Leucadia (18%, 40 years) | John Griffin (15% net, 20 years) | George Steinhardt (24%, 33 years) |

| Glenn Greenberg (18%, 25 years) | Bruce Karsh (23% gross, 23 years) | George Soros (32%, 31 years) |

| Li Lu (16%, 21 years) | Max Heine (20%, 20 years) | Paul Singer (14% net, 36 years) |

| Allan Mecham (17% net, 17 years) | Shelby Davis (21%, 47 years) | Jim Rogers (45% net, 10 years) |

| Howard Marks (19%, 22 years) | Dan Loeb (16%, 21 years) | David Tepper (25%, 26 years) |

| Walter Schloss (16%, 49 years) | Dan Cloud (38% gross, 14 years) | Chase Coleman (21% net, 20 years) |

| Paul Isaac (7% alpha, 17 years) | Prem Watsa (19%, 30 years) | Ed Thorp (20%, 30 years) |

Source: Scott Reardon, Dakota Value Funds.

For private investors, the question remains: just how can you take advantage of such outstanding managers?

Access needs to be improved

Many of these truly outstanding funds come with tremendous entry hurdles. E.g., there is one particular European-focused fund I like to follow because it has produced a 20% p.a. performance across its lifetime. Sadly, its minimum investment is a staggering EUR 5m. For many of these outstanding portfolio managers, you won't even find a website, never mind trying to meet them in person or online to get a firsthand impression. Unless you have a portfolio of upwards of USD 30m to invest, these high-calibre fund managers will view you as retail investors.

Even relatively affluent investors – 19m investors globally with USD 1-5m in investible assets, and a further 2m with USD 5-30m – have become an underserved minority. They cannot get the financial products they want from their high street bank, nor can they join a multi-family office. They are stuck in No Man's Land.

For many of them, picking and monitoring stocks are a necessary evil, but one which they'd rather outsource if there was someone who combined a track record of superior returns with a willingness to take them on as clients.

I view these circumstances as an opportunity to help a large group of affluent investors to do better.

That's why I set up Sarnia Asset Management, a licensed fund management firm that will primarily serve the market of underserved private investors. The company will bring outstanding managers to the market, and allow clients to come onboard with a minimum investment of EUR/USD 100,000.

Instead of hiding its expertise from the public, the firm will actively share a lot of information on the Internet and through other media. Even for those who are not becoming a client (yet), the company will offer a lot of worthwhile insights.

The company's web platform already offers valuable content, primarily aimed at helping investors achieve better investment returns and protect their wealth. It carries articles about topics such as…

What everyone should demand from any fund manager

Before I take a call from ANY fund manager, I check if they fulfil the bare basics:

- A track record generated with REAL MONEY and FULLY AUDITED.

- An ability and willingness to put a serious chunk of their own money into their fund, the famous SKIN IN THE GAME.

- A level of personal success where they no longer need a conventional salary, i.e. a PROVEN ABILITY TO GENERATE SIGNIFICANT WEALTH.

Tough requirements?

If you are asking someone else to manage your money, these are just the very basic requirements I'd ask for. After all, would you take nutrition advice from an overweight, sickly-looking nutritionist? You get my point.

It's before I move on to also ask for genuinely ORIGINAL INVESTMENT IDEAS. The fund needs to add something to investors' portfolios that they cannot get elsewhere, instead of just copying what everyone else is doing. It also needs to be an investment strategy that appeals to COMMON SENSE. You'd want to be able to make a judgment if the strategy is likely to be effective.

Needless to say, this already filters out about 97% of all potential fund managers, if not more.

The remaining handful, however, are really worth looking at – if they are even willing to take you onboard as co-investor, that is.

Another problem of our time is that genius fund managers don't have it easy anymore to set up shop.

Spare a thought for the aspiring portfolio manager

Setting up a fund has never been easy. However, it's now more difficult than ever before.

The legal, regulatory and operational requirements to set up a fund are such that you shouldn't start if you don't have at least an initial EUR/USD 20 million to manage.

It's still possible to start with less, but starting smaller comes at a cost:

- Setting up in cheap, lower-quality jurisdictions saves costs, but it means many potential investors will stay clear of you because of where you are based.

- Not having dedicated staff for fundraising, marketing and communications also helps save costs in the short term, but it means the portfolio manager has to handle these jobs, which distracts from the task of generating alpha.

- Never mind the 101 other pitfalls any entrepreneurial venture has to avoid.

Even if someone overcomes all of these hurdles, they still have to compete in a field with >50,000 funds worldwide. To the casual observer, many of these funds will appear to have nearly identical strategies. How do you market your fund if there are dozens who offer a very similar product? Honestly, it takes a lunatic brave man to set up a fund nowadays. Read this outstanding blog post by Frederik Gieschen for a sobering summary of these realities.

Even if a portfolio manager does manage to navigate these hurdles, he (or she) will likely face another major challenge soon. Most portfolio managers naïvely believe that generating outstanding performance will make prospective investors bang on their door. The thing is, it won't.

The fund management industry is littered with portfolio managers who generate great returns but never seem to excel at finding clients.

Performance alone simply isn't enough.

You also need an audience. A following. A channel or a platform that you can use to make potential investors take notice of you and come your way. However, how do you build a following if you are busy generating alpha for your portfolio?

That's why I suggest to spare a sympathetic thought for genius portfolio managers who would like to manage money not just for themselves but also for others. It's an almost insurmountable task to get started.

Sarnia Asset Management will help them, too.

A new platform to connect all the dots

Undervalued-Shares.com is here to report on investment ideas from any sector, provided I spot an unusual opportunity and feel that my factual reporting helps you in making your own investment decisions.

However, Undervalued-Shares.com is not licensed to create investment products, and turning it into a licensed financial services company isn't an option.

To resolve the issues mentioned above and help my readers in other ways, I had to set up a separate firm.

My goal was to create a digital platform that uses valuable content to connect high-performing fund managers with a knowledgeable private investor audience, with as few geographic restrictions as possible.

With Sarnia Asset Management, I have created a fund manager that can accept investors from the UK, most EU nations, Switzerland/Liechtenstein, the US, Canada, Mexico, Australia, China, Hong Kong, India, South Africa, Japan, Singapore, Norway, and many other countries. My firm will be able to accept clients from the jurisdictions that represent 80% of the world's wealth. (Notable exceptions because of political quirks include Spain, Poland, and Kazakhstan – disculpas, przeprosiny, кешірім!)

To ensure that as many investors as possible will be able to take advantage of what I am building, I am doing all this work from a high-quality jurisdiction that is widely accepted by professional investors. Guernsey, one of the Channel Islands, has been on the OECD White List ever since that list was first created in 2009. In a 2016 global survey, it had the highest regulatory standard of 49 offshore and onshore jurisdictions assessed by the Financial Action Task Force (FATF). Getting this set up cost me three years of my life and added to the grey tone of my stubble beard, but it now gives me a powerful tool to get the job done.

To grow its content offering without neglecting my writing duties at Undervalued-Shares.com, I poached an old colleague who previously ran one of the UK's leading platforms for investment-related content. James Faulkner is a partner in the new firm and responsible for producing free content for Sarnia Asset Management's blog and LinkedIn page. When I relaunched Undervalued-Shares.com, I had vowed that all content you get to read will always be personally written by myself, and I'll continue to deliver on that.

The operations of Undervalued-Shares.com and Sarnia Asset Management are completely separate, and the usual strict compliance standards apply. Obviously, I am the two-legged link between the two, and I do want both operations to benefit from each other, but indirectly.

The first such benefit is yours for the taking right now.

Meet Michael Steindler – and ask him questions

The first fund that Sarnia Asset Management is launching is one that I am particularly proud of. Even though I am not the portfolio manager, it's the closest thing to having "my fund" – close to my heart and also very close to my line of thinking.

Michael Steindler is the chap who created the track record mentioned at the beginning of today's Weekly Dispatch. His so-called "REMO Strategy", which he used for his personal account, has earned 25.8% p.a. net from 2000 to 2022. REMO stands for Real Equity Multiple Opportunities, which relates to the "Equity Multiplier Risk Ratio", a metric that Michael likes to work with. REMO is a proprietary investment strategy developed by Michael – it's his mental model.

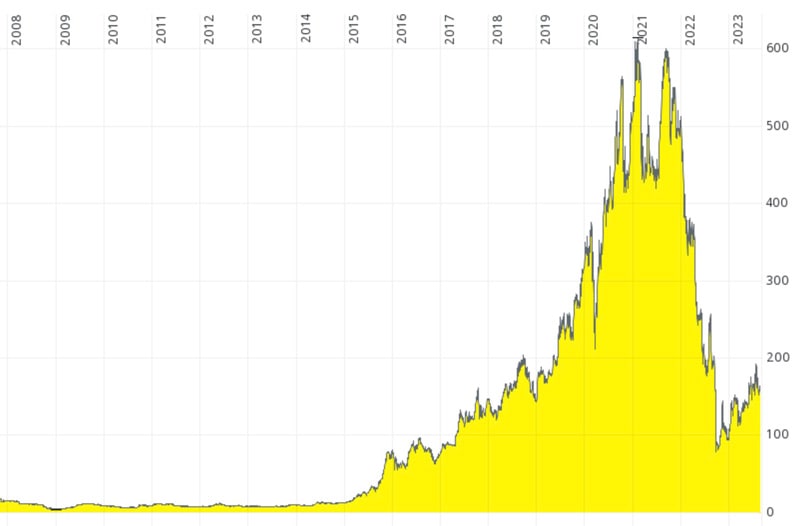

As it were, the biggest-ever gain that Michael landed in his investment career was a stock that he had read about on Undervalued-Shares.com – Hypoport AG (ISIN DE0005493365). I had published a research report on the company in 2010, when it was a small German software firm with a market capitalization of just EUR 50m. The stock was trading at EUR 7, and it was clearly underresearched and undervalued.

Hypoport.

I held Hypoport stock for a while, but then sold because I got impatient.

Michael, on the other hand, stuck to his guns. In the end, in his REMO strategy portfolio he ended up earning 22 times his money over ten years, and with a small part of the position he even temporarily almost reached the famous "100 bagger". At its peak in 2021, Hypoport stock traded at almost EUR 600, and the company had a market capitalization of EUR 3.8bn.

Just like myself, Michael likes to do very deep research on "underresearched" small caps, and his work is akin to a "treasure hunt". His approach to investing is unconstrained, i.e. he can invest anywhere in the world and will not be held back by unnecessary restrictions and box-ticking exercises. In his portfolio, Michael can weight an individual stock up to 30%, even though such a weighting will rarely ever happen, normally the result of a position growing to this size through gains. Michael's fund is about achieving a target return of at least 20% p.a.

You'll now understand why I'd rather have someone like Michael manage a fund that I also stick my name to, and why this fund is particularly close to my heart. Michael will be significantly invested in his own fund, which creates the necessary alignment. He can't guarantee future results of course, but you can invest alongside his personal investments. Michael is 49 and intends to continue his work for many years to come.

On this particular occasion, we opted for a dual structure that helps investors in two ways, both in Michael's home region and the rest of the globe:

- Anyone based in Germany, Austria or Switzerland can easily buy Michael's Liechtenstein-based fund. Michael is managing director of Munich-based Deutsche Finance Securities, which advises the fund.

- For investors the world over, I have created a feeder fund in Guernsey – accessible to investors anywhere Guernsey funds are allowed, and without charging a single penny (!) in additional fees (more about this at the bottom of this article).

I cannot and will not market individual funds on Undervalued-Shares.com, but what I can provide is a platform for investors to learn from the best – which is why I'm offering three opportunities for Undervalued-Shares.com readers to meet with Michael and pick his brain:

5 September: Munich (36 spaces total, 6 left)

25 September: Frankfurt (25 spaces total, 10 left)

26 September: Hamburg (24 spaces total, 9 left)

At each of these dinners in a private dining room, Michael will be one of the guests and speak about his work in general and which of his learnings other private investors should take onboard. He'll then answer any questions from the audience. How does he come up with new investment ideas? What advice does he have for other private investors? In which sectors or markets does he currently see opportunities? You'll be bound to get an answer.

Email me if you'd like to attend any of these events. Participation is EUR 100 to cover food, drinks, venue hire, and tips.

All I can say is, each time I get to spend a bit of time with Michael and listen to him, I go home buzzing with new ideas. Studying the success of other investors, picking apart their decision-making processes, and learning from their mental models is one of the most valuable things private investors can spend time on.

Funds tend to perform best when they are still small in size, because that has them at their most agile. If Michael continues to perform anywhere nearly as well as he has in the past, please do remember where you learned about him first!

Other reasons to attend

While most anyone will probably jostle to get near Michael and bombard him with questions, I'll be happy to speak to anyone who:

- May fit the criteria to launch a fund with Sarnia Asset Management. The company already has a pipeline of funds, but we are always eager to hear from others who may be a fit.

- Has prior experience in building or funding a fund manager to scale, and would consider becoming an active investor when Sarnia Asset Management does its next funding round. We have big, exciting plans but would love to have other, active investors onboard to help us not just with capital but also with active input.

- Is interested in collaborating in investment media, PR, and marketing. I love discussing how to work together in reaching and growing a high-quality investor audience in a non-salesy way.

Simply email me if you think we should discuss this further.

About Michael Steindler's fund: investors who would like to take a closer look at Michael's fund can do so with two entities. Private investors from the DACH region can look at the Deutsche Finance Global Opportunities Fund (ISIN LI1223645311), which is the Liechtenstein-based alternative investment fund that Michael and his team advise and which can be purchased through banks/brokerages in the DACH region. For investors outside of the DACH region and those who are looking to diversify wealth into the English-speaking world, Sarnia Asset Management has registered the Sarnia REMO Fund, a Guernsey-based alternative investment fund that acts as a feeder fund for Michael's Liechtenstein entity. Investors of the Sarnia REMO Fund do not incur a single penny of additional fees, and there are a few additional benefits such as an additional layer of monitoring by two highly experienced feeder fund board members and myself (feeder fund investors would be alerted by us if ever we concluded there was a reason to bail from the investment in the master fund). For legal and regulatory reasons, both of these funds require a minimum investment of EUR/USD 100,000. The REMO Fund section on the Sarnia Asset Management website provides further information, as does the Deutsche Finance Securities website.

Additional disclaimer: Undervalued-Shares.com does not give specific investment advice with regards to any of these funds. This article provides background information and does not aim to market a fund or any other investment nor does it intend to invite, induce or encourage any person to engage in any investment activities. Investors are asked to consult their professional advisor and consider that in any fund, capital will be at risk, including the risk that you will not recover the sum that you invested. The owner of Undervalued-Shares.com is CEO and a major shareholder of Sarnia Asset Management.

Hot off the press: new in-depth research report

My latest research report - released earlier today - features a "quick flip" bid target from Switzerland.

The company is among the global market leaders of its sector, and operates in a secular growth market which is undergoing a consolidation.

Compared to historical valuation multiples, a bid should come in at least 40% above the current level. The stock is highly liquid, and one of the lead investors has recently upped their stake through the market.

Is now the time to pay attention?

Hot off the press: new in-depth research report

My latest research report - released earlier today - features a "quick flip" bid target from Switzerland.

The company is among the global market leaders of its sector, and operates in a secular growth market which is undergoing a consolidation.

Compared to historical valuation multiples, a bid should come in at least 40% above the current level. The stock is highly liquid, and one of the lead investors has recently upped their stake through the market.

Is now the time to pay attention?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: